In 2016, California authorized a statute to extend the minimal wage yearly beginning in 2017. This Senate Invoice (SB) deliberate for the hourly charge to achieve $15 in 2023, with inflation changes as much as a most of three.5%. This era has now handed and the California minimal wage charge is at $15.50.

Nevertheless, the price of dwelling has additionally elevated, and a $15.50 hourly charge doesn’t permit folks to cowl all of their bills. Based on a Zillow examine, an individual making minimal wage would wish 2.7 full-time jobs to pay for a two-bedroom house in Los Angeles.

Providing correct pay to your employees might help enhance worker retention and satisfaction. However, wage will increase additionally have an effect on your online business funds, particularly in case you have a small one. So, how do you make sure you’re paying dwelling wages to your staff whereas being worthwhile and following state rules?

On this article, we’ll undergo how a lot it is advisable pay your folks based on county and metropolis mandates. As well as, we’ll talk about tips on how to stay compliant amid adjustments and tips on how to pay your folks pretty with out lowering revenue margins.

What’s the California Minimal Wage?

Based mostly on the 2016 SB 3, and inflation changes, California’s minimal wage is $15.50 per hour regardless of the enterprise dimension. Up to now, companies with beneath 25 workers paid a decrease hourly charge in comparison with bigger companies. Beginning in 2023, all companies are anticipated to pay the identical minimal wage regardless of their dimension (with some exceptions).

Every county and metropolis units its personal minimal wage limits and, as much as this date, solely Hayward companies with lower than 25 workers pay $15.50 per hour. All the opposite counties and cities have increased minimal charges.

Be aware: Whereas $15.50 is the minimal hourly wage in California, the federal charge continues to be at $7.25 per hour. Plus, not like in different states, California doesn’t permit employers to pay with tip credit score, so there’s no tipped minimal wage within the Golden State. Try this California employment legislation information to make sure you’re complying with native rules.

What’s the minimal wage in LA County?

The adjusted minimal wage charge for unincorporated areas of LA County is $16.90. You possibly can examine if your online business is in Unincorporated LA County right here.

Nevertheless, the cities inside LA County have totally different minimal wage charges. For instance:

- Los Angeles Metropolis: $16.78

- Pasadena: $16.93

- West Hollywood: $19.08

Which California cities have a better minimal wage?

As talked about, minimal wage charges differ from metropolis to metropolis, so be sure to assessment the information on your particular locality (extra on this beneath).

Listed here are the 5 cities in California with the very best minimal wage charge:

- Berkeley: $18.07

- San Francisco: $18.07

- Mountain View: $18.15

- Emeryville: $18.67

- West Hollywood: $19.08

California minimal wage abstract

Right here’s a fast look into what’ve lined to date:

- The hourly charge in California ranges from $15.50 to $19.08

- As of January 1st, 2023 all employers ought to pay the identical minimal wage per locality regardless of the variety of workers (with sure expectations)

- There’s no tip credit score or tipped minimal wage in California, all employers must pay the total quantity

- West Hollywood is the very best paying metropolis, for extra details about particular metropolis and county charges, confer with the chart beneath

| Locality | Efficient date | Charge | Small employer charge (>25 employees) |

| Alameda | 7/1/2023 | $16.52 | |

| Belmont | 1/1/2023 | $16.75 | |

| Berkeley | 7/1/2023 | $18.07 | |

| Burlingame | 1/1/2023 | $16.47 | |

| Cupertino | 1/1/2023 | $17.20 | |

| Daly Metropolis | 1/1/2023 | $16.07 | |

| East Palo Alto | 1/1/2023 | $16.50 | |

| El Cerrito | 1/1/2023 | $17.35 | |

| Emeryville | 7/1/2023 | $18.67 | |

| Foster Metropolis | 1/1/2023 | $16.50 | |

| Fremont | 7/1/2023 | $16.80 | |

| Half Moon Bay | 1/1/2023 | $16.45 | |

| Hayward | 1/1/2023 | $16.34 | $15.50 |

| Los Altos | 1/1/2023 | $17.20 | |

| Los Angeles | 7/1/2023 | $16.78 | |

| Los Angeles County (unincorporated) | 7/1/2023 | $16.90 | |

| Malibu | 7/1/2023 | $16.90 | |

| Menlo Park | 1/1/2023 | $16.20 | |

| Milpitas | 7/1/2023 | $17.20 | |

| Mountain View | 1/1/2023 | $18.15 | |

| Novato | 1/1/2023 | $16.07* | $15.53 |

| Oakland | 1/1/2023 | $15.97 | |

| Palo Alto | 1/1/2023 | $17.25 | |

| Pasadena | 7/1/2023 | $16.93 | |

| Petaluma | 1/1/2023 | $17.06 | |

| Redwood Metropolis | 1/1/2023 | $17.00 | |

| Richmond | 1/1/2023 | $16.17 | |

| San Carlos | 1/1/2023 | $16.32 | |

| San Diego | 1/1/2023 | $16.30 | |

| San Francisco | 7/1/2023 | $18.07 | |

| San Jose | 1/1/2023 | $17.00 | |

| San Mateo | 1/1/2023 | $16.75 | |

| San Mateo County (unincorporated) | 4/1/2023 | $16.50 | |

| Santa Clara | 1/1/2023 | $17.20 | |

| Santa Monica | 7/1/2023 | $16.90 | |

| Santa Rosa | 1/1/2023 | $17.06 | |

| Sonoma | 1/1/2023 | $17.00 | $16.00 |

| South San Francisco | 1/1/2023 | $16.70 | |

| Sunnyvale | 1/1/2023 | $17.95 | |

| West Hollywood | 1/1/2023 | $19.08 |

*Very giant enterprise charge (100+ workers): $16.32

How can small enterprise house owners guarantee they’re compliant with California state labor legal guidelines?

Staying compliant whereas being in cost and managing a small enterprise isn’t a simple job. That is very true once you’re additionally setting schedules, working payroll, calculating time beyond regulation funds, masking for others on sick depart, interviewing and hiring, and doing taxes.

Dealing with every thing manually makes it straightforward to miss a small however necessary facet of your online business or make calculation errors that depart you out of compliance with the legislation.

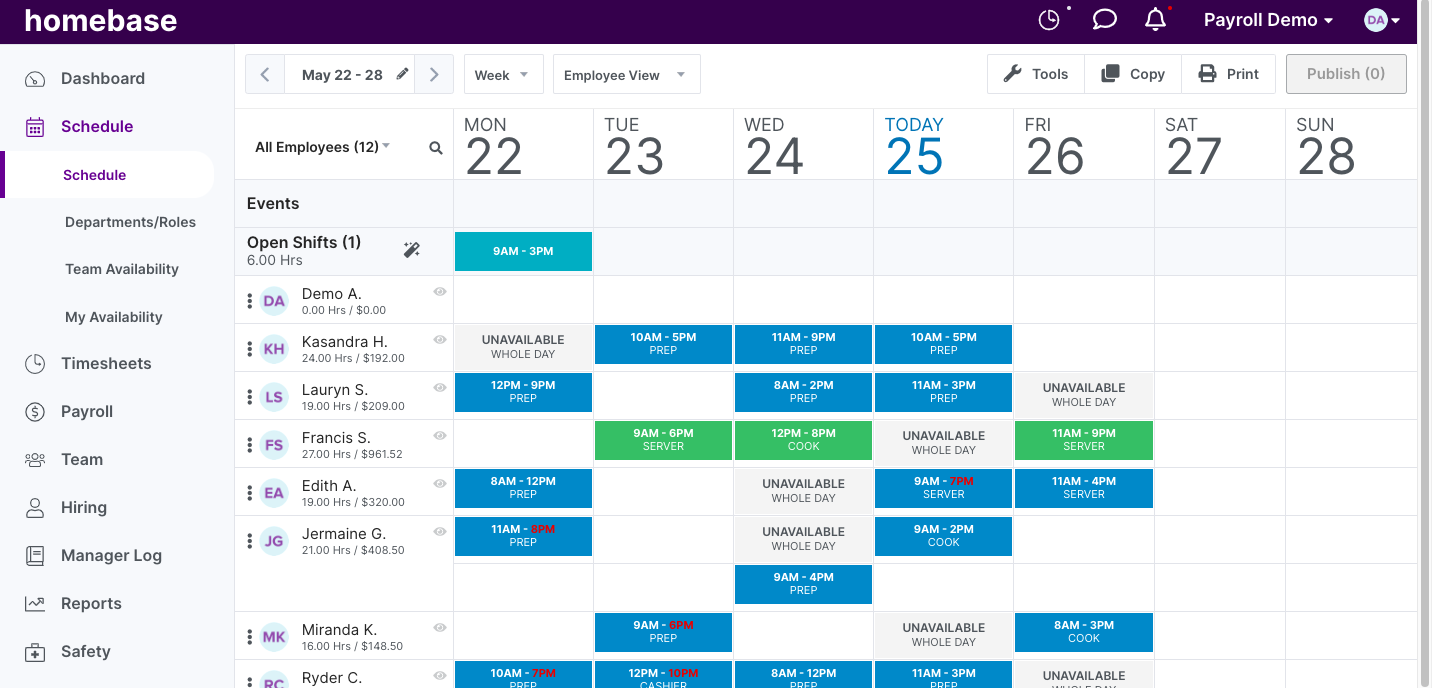

All in all, one of the simplest ways to make sure you’re staying on prime of rules and are being compliant is through the use of an all-in-one HR and staff administration platform like Homebase.

This device helps you create work charters, arrange a clock-in and out system at your online business, and pay precisely based on California 2023 labor legal guidelines — with little motion out of your aspect.

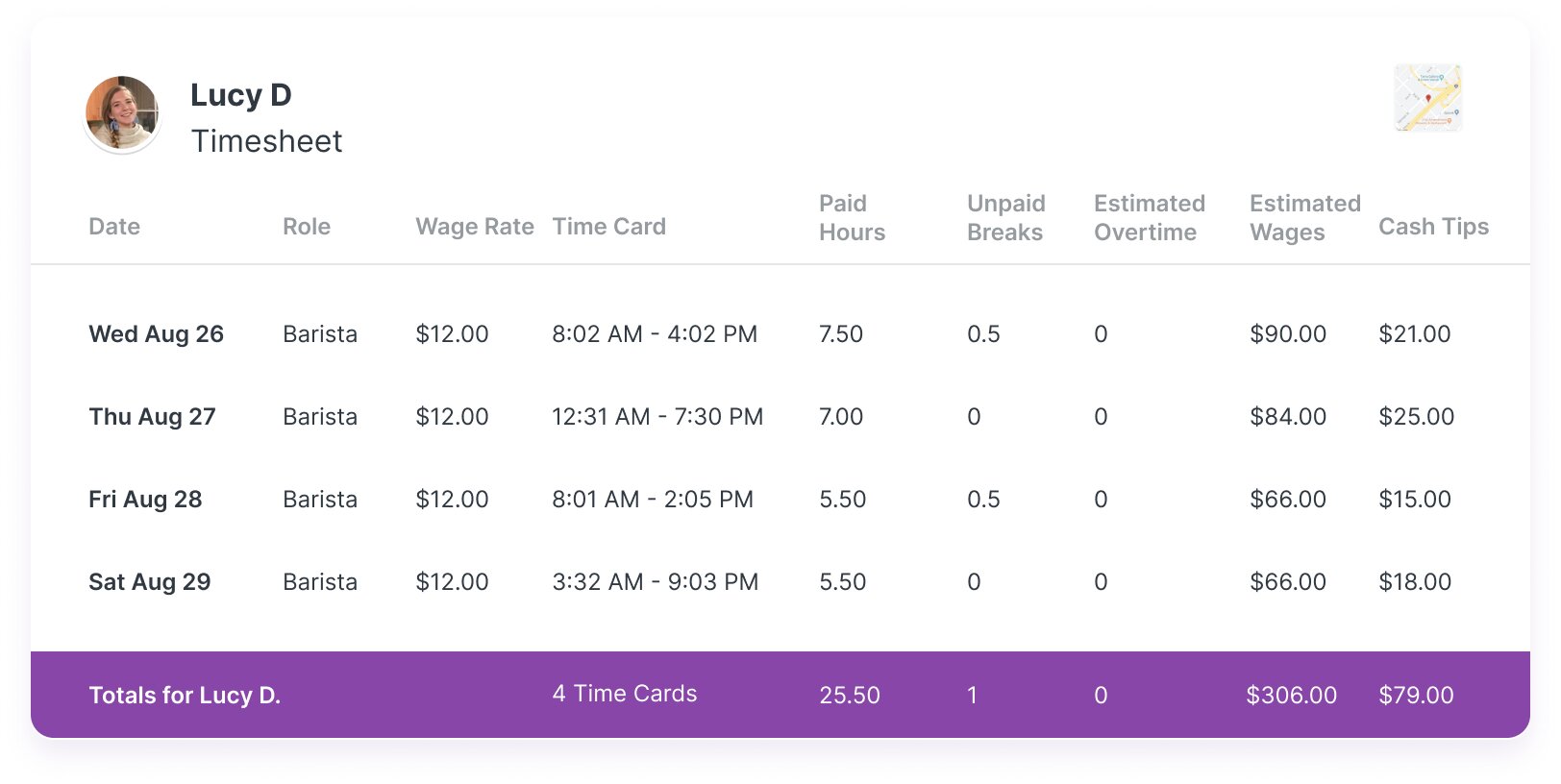

So, as an alternative of manually creating schedules, Homebase can do it robotically for you. Or, as an alternative of working late on a Friday manually coming into the timesheet information into your payroll system, you need to use Homebase’s time clock, and easily assessment and approve your staff’s hours. It’s also possible to pay folks straight from there with out having to enter the information into another app — though you possibly can join Homebase to your most popular payroll system.

Homebase additionally calculates time beyond regulation, PTO, and taxes, and reminds workers in case their file is lacking any data. It additionally offers you entry to HR advisors who might help you assessment your insurance policies and reply particular questions relating to native legal guidelines and rules.

How can small companies put together for minimal wage will increase?

With the Nationwide Buyer Value Index (CPI) anticipated to achieve 5.16% in April 2024, the minimal wage charge is prone to maintain rising within the subsequent couple of years. Taking proactive steps to extend revenue margins and making ready for future will increase means that you can maintain offering your workers with correct pay with out being extremely impacted by it.

Listed here are concepts to implement in your online business and get ready for potential wage will increase:

1. Audit your bills

Overview your month-to-month earnings and bills to provide you with a staffing plan that aligns together with your potentialities and see if there are any prices you possibly can reduce. For instance, you would possibly profit from hiring short-term workers for seasonal spikes fairly than hiring full-time workers and letting them go after a few months. Test together with your HR advisor to make sure you’re staying compliant.

Auditing your bills additionally helps you to establish if there are any pointless companies, suppliers, and even workers you’re incurring. This audit ought to depart you with particular subsequent steps that will help you shut these gaps.

2. Enhance costs

Conducting monetary audits means that you can decide whether or not or not you’re charging the fitting costs. In lots of instances, you would possibly want to vary your charges to get a much bigger revenue margin and have extra wiggle room to present your workers a dwelling wage.

You would possibly must plan for periodic value will increase and notify your prospects about your choice. Be sure you clarify why you’ll be rising your costs and point out that it’s since you need to proceed providing correct pay to your staff.

3. Discover extra reasonably priced suppliers

Greater costs aren’t the one method to improve your revenue margins. The audit may allow you to establish when you’re paying an excessive amount of cash to a specific supplier.

Audit how a lot you pay for sure provides and benchmark these costs. It’s potential that you just would possibly discover a higher possibility out there that means that you can both negotiate charges or change distributors. Ensure you proceed to supply the identical degree of service to your prospects regardless of inner modifications.

4. Enhance your hiring practices

Retaining workers is extra reasonably priced than hiring and coaching new ones. So, deal with bettering your hiring practices: ask for suggestions, supply trial intervals, and set up a coaching program to extend your possibilities of retaining them. Additionally, providing greater than minimal wage might help you scale back your turnover charge and improve morale and engagement.

Based on the newest information from the Bureau of Economics, a mean individual must earn $4.423,5 a yr to stay in California. Assuming that the 2021 quantity continues to be true, a minimal wage employee would wish to work no less than two full-time jobs to afford dwelling bills. In case your workers can’t make a dwelling with the wage that you just pay them, they’re prone to be demotivated or search for different choices. So, providing a dwelling wage as an alternative of a minimal wage might help you decrease your turnover charges.

5. Funds for time beyond regulation or modify enterprise hours

In California, it is advisable pay further hours if an individual works greater than eight hours in a day, greater than 40 hours in per week, or does eight hours of labor on the seventh consecutive day of the week. The surplus hours are paid at one and one-half occasions the same old hourly wage.

If the individual works greater than 12 hours a day or greater than eight hours on the seventh consecutive day, you need to pay them no less than twice the common charge for the extra work. Ensure you get knowledgeable recommendation to adjust to California time beyond regulation legal guidelines.

Since time beyond regulation could be costly, you need to set a month-to-month funds apart to cowl it. Nevertheless, you too can audit your online business hours and look into lowering open hours if there are occasions or days when your online business isn’t busy. This lets you scale back your payroll and scale back the necessity for further hours.

6. Give you promotions

Generally rising costs, reducing prices, and retaining workers isn’t sufficient. There are occasions once you simply must promote extra. Suppose creatively about how you could find extra prospects and improve your earnings with out turning into overburdened.

For instance, in case you have a espresso store, you possibly can provide you with a constancy program. Each time a buyer buys 5 coffees, they earn a cookie. Do the maths and supply no matter is sensible for your online business, however incentivizing your prospects to change into recurring and spend extra will allow you to improve your revenue margins.

7. Scale back your providing

It’s also possible to conduct an audit of your service or product providing and decide that are underperforming. Lowering your providing might help you narrow pointless prices.

Let’s return to the espresso store instance. Let’s say you found you’re incessantly throwing away soy milk as a result of it expires. Trying into it, you notice prospects desire oat milk and only one in 15 prospects ask for soy milk. This data means that you can cease serving soy milk and get monetary savings.

8. Automate sure duties with an all-in-one HR system

Audit your operations and decide if there are any duties that may be carried out by a system. Are you able to arrange self-service checkout stations at your store? Are you able to delegate payroll to an automatic device like Homebase? Are you able to streamline your folks operations?

With an all-in-one HR system like Homebase, you possibly can automate your operations with out having to have a number of workers engaged on these duties. For instance, let’s say you may have a number of branches of your espresso store. Every location has a supervisor who’s answerable for scheduling, approving day off, reviewing and coming into timesheets into the payroll system, notifying workers of bulletins, and coaching new folks. It’s loads of guide work to allow them to’t deal with a couple of department at a time.

Homebase means that you can delegate these duties to the device and reduces the necessity for devoted department managers. One might deal with a number of places from afar and solely go to the department for interval checkups, particular wants, or managing battle.

Aside from that, groups can clock out and in by way of their telephones, you possibly can talk with them by way of the enterprise chat, set automated schedules primarily based on their availability, and pay them straight from the system. Plus, you don’t have to fret about compliance, as a result of we allow you to assure you’re at all times on prime of your native legal guidelines and rules.

Complying with California minimal wage: What it is advisable know

Small companies want to remain compliant with state legal guidelines, not solely to offer honest pay but in addition to remain in enterprise. As of 2023, the California minimal wage stands at $15.50 per hour, however the charges differ in cities and counties, so it is advisable assessment which applies to you.

It’s necessary to focus on that California not differentiates minimal wages primarily based on enterprise dimension (with some exceptions) and that it doesn’t permit for tip credit score. So, in cities like West Hollywood, it is advisable pay the total hourly charge of $19.08.

It’s potential that minimal wage charges proceed to vary all through the next years. So, you need to take proactive steps to extend your revenue margins and be capable to afford your staff’s wage. To take action, you need to look into:

- Auditing your bills, operations, and suppliers to establish potential cost-cutting alternatives

- Rising costs with an adjusted revenue margin

- Enhance your hiring practices to recruit higher, extra lasting workers

- Automating your folks operations and lowering headcount

Partnering with an all-in-one HR and staff administration system like Homebase empowers you to simplify workforce administration. We allow you to keep compliant, offer you entry to HR specialists, observe your staff’s time, and pay precisely. All with the minimal quantity of guide work.