Working payroll isn’t precisely enjoyable. However each enterprise proprietor must do it in the event that they need to preserve staff glad (and paid).

The payroll course of covers the whole lot that goes into paying staff whereas staying compliant with labor and tax legal guidelines — like registering for tax IDs, precisely monitoring hours, calculating and withholding taxes, and sharing pay stubs.

It’s straightforward for errors to sneak in that might result in sad staff and even regulatory fines.

Payroll is a vital but complicated activity that usually leaves managers scratching their heads. On this article, we’ll allow you to perceive what payroll actually entails, the way to do it proper, and the right software program to streamline the method.

No jargon, no issues — simply actionable insights.

What’s payroll processing?

Payroll processing is managing the cost of wages to staff. It’s not nearly reducing checks — the method contains monitoring worker hours, calculating gross wages, deducting taxes and different withholdings, and at last, delivering cost and pay stubs to staff. It additionally entails record-keeping for audit functions.

Payroll processing ensures correct and well timed wages whereas preserving your enterprise compliant with tax and labor legal guidelines.

Handbook Processing vs. Utilizing a Service

Handbook processing offers enterprise house owners full management over each step. They observe hours, calculate wages, deal with tax deductions, and distribute paychecks on their very own. However, the potential for human error makes it a much less viable possibility for a lot of companies.

For instance, incorrect monitoring of worker hours can result in overpayment or underpayment. And a single miscalculation or missed tax replace can lead to fines or penalties.

Because of this most companies go for a payroll service supplier. Payroll providers deal with all the maths for you — precisely monitoring worker hours, calculating gross wages, and deducting the correct quantity for taxes. This eliminates the danger of human error in calculations, lowering pricey errors.

They make sure you’re at all times compliant. And digital record-keeping reduces the muddle of paperwork, making it simpler to audit your payroll data.

The completely different components of payroll

There are plenty of processes and duties that go into working payroll — it’s good to gather worker data, arrange a payroll schedule, calculate and deduct tax withholdings, and a complete bunch of different stuff that may rapidly really feel overwhelming.

Payroll schedules

A payroll schedule is basically the calendar your enterprise follows to pay its staff. It defines how typically paychecks are distributed — weekly, bi-weekly, semi-monthly, or month-to-month.

For instance, a bi-weekly schedule means staff are paid each two weeks, usually on a selected day like Friday. The payroll schedule you select relies on elements like your enterprise’s money stream and worker preferences and must be in compliance with state and federal legal guidelines.

Payroll taxes

Payroll taxes are deductions from an worker’s paycheck that go in the direction of federal, state, and native tax obligations. This could embrace earnings tax, Social Safety, and Medicare.

For instance, if an worker earns $1,000 in a pay interval and their complete tax fee is 25%, $250 will probably be deducted from their paycheck for taxes. It’s essential for companies to calculate and withhold these taxes to keep away from penalties.

Right here’s an outline of employment taxes within the USA:

| Tax Sort | Description | Accountability |

| Federal Earnings Tax | Withheld from staff’ wages based mostly on their W-4 type. | Employer |

| Social Safety and Medicare Taxes (FICA) | Withheld from wages. Employers match the worker’s contribution. | Employer & Worker |

| Extra Medicare Tax | Additional 0.9% tax on wages that exceed $200,000 in a calendar yr. | Employer (Withholding solely) |

| Federal Unemployment (FUTA) Tax | Paid individually by employers and doesn’t contain worker funds. | Employer |

| Depositing Employment Taxes | Employers should deposit withheld federal earnings tax, FICA, and FUTA taxes. | Employer |

Be aware: For essentially the most correct and present tax charges as relevant to exempt and non-exempt staff, seek advice from the related publications or go to the official IRS web site.

Payroll prices

There could be fairly a number of prices related to working payroll easily. However relying on the kind of payroll system you utilize and whether or not you outsource these actions or not, your payroll prices can range an incredible deal.

Should you’re utilizing a payroll service answer, you’ll have bills like:

- A base month-to-month price and costs for every worker you will have on payroll

- 401k distribution

- Monitoring worker time

- Employees’ compensation

- Direct deposit, state, and federal tax filings

- Paid depart and time beyond regulation pay

- Bonuses

Payroll abstract stories

A payroll abstract report reveals you an outline of all of your payroll actions. This contains worker particulars like web and gross pay and employer taxes. Sustaining and correctly storing these paperwork is essential as you’re required by the federal authorities to submit a number of payroll report varieties, together with Type 940, Type 941, W-2s, and W-3s.

You may additionally be liable for an area payroll report, so examine your native employment legal guidelines to cowl your bases.

The way to arrange and course of your payroll

Should you’re the type of supervisor or enterprise proprietor who enjoys getting hands-on with the numbers, there are some things to think about whereas establishing your payroll system. Earlier than you get into the nitty-gritty of it, determine what your payroll insurance policies will probably be and the way you’ll deal with the method.

1. Payroll course of creation

The first step within the handbook payroll course of is all about establishing a dependable system for gathering and documenting your staff’ work hours — timesheets. It’s an information desk that you should use to trace when a selected worker has labored throughout a sure interval.

Some companies use paper timesheets, whereas others use digital or punch clock techniques. Your timesheet course of ought to document begin and finish occasions, breaks, and time beyond regulation.

Right here’s an instance of a weekly timesheet for a producing plant:

| Worker | Position | Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | Day 6 | Complete Hours |

| Worker 1 (Meeting Line Employee) | Common Hours | 8 | 8 | 8 | 8 | 8 | 0 | 40 |

| Time beyond regulation Hours | 0 | 0 | 0 | 0 | 2 | 4 | 6 | |

| Worker 2 (High quality Inspector) | Common Hours | 8 | 8 | 8 | 8 | 8 | 0 | 40 |

| Time beyond regulation Hours | 0 | 0 | 2 | 2 | 0 | 0 | 4 | |

| Worker 3 (Forklift Operator) | Common Hours | 8 | 8 | 8 | 8 | 8 | 0 | 40 |

| Time beyond regulation Hours | 0 | 2 | 0 | 0 | 2 | 4 | 8 |

Within the above instance, every worker data their common and time beyond regulation hours individually, as these are sometimes paid at completely different charges. This ensures that every worker is paid accurately for his or her work and that time beyond regulation is accounted for.

2. Timesheet evaluate and approval

After your staff log their work hours into the timesheet, it’s time for the second step: evaluate and approval. It’s good to confirm that the hours logged align along with your data and expectations, making certain no discrepancies, like over-reporting or under-reporting of hours.

You’ll additionally must cross-check that every one time beyond regulation hours, if any, are accurately documented. Any discrepancies must be addressed and corrected earlier than approval.

Relying on the dimensions of your enterprise, the timecard approval course of could be single-tiered (requiring one particular person’s approval) or multi-tiered (requiring a number of approvals). For instance, in a multi-tiered system, a direct supervisor may evaluate and approve timesheets. Then, the HR division would conduct a ultimate evaluate and approval earlier than processing payroll.

3. Pay calculations

Relating to pay calculations, the strategy you utilize relies on for those who’ve bought part-time or full-time staff. Hourly staff are paid based mostly on the variety of hours they’ve labored throughout a pay interval, whereas salaried staff obtain a predetermined quantity every pay interval, whatever the hours labored.

Right here’s a fast comparability:

| Hourly Worker | Salaried Worker | |

| Cost Construction | Paid per hour | Paid a set quantity yearly |

| Instance Charge/Wage | $15 per hour | $60,000 per yr |

| Hours Labored in a Week | 45 hours (40 common + 5 time beyond regulation) | N/A |

| Common Pay Calculation | 40 hours x $15/hour = $600 | $60,000 ÷ 24 pay durations = $2,500 |

| Time beyond regulation Pay Calculation | 5 hours x $15/hour x 1.5 = $112.50 | N/A |

| Gross Pay | $600 (common) + $112.50 (time beyond regulation) = $712.50 | $2,500 |

4. Tax and deductions calculations

After the gross pay of an worker is calculated, the subsequent step in payroll processing is figuring out the right quantity to deduct for taxes and different deductions. This generally is a complicated course of because of the numerous tax legal guidelines and rules that have to be adhered to.

Let’s proceed the above instance. We already calculated Gross pay, so now we are able to simply calculate the web pay after deductions:

| Hourly Worker | Salaried Worker | |

| Cost construction | Paid per hour | Paid a set quantity yearly |

| Gross pay | $600 (common) + $112.50 (time beyond regulation) = $712.50 | $2,500 |

| Instance deductions | Federal, state, native taxes, Social Safety, Medicare, Well being Insurance coverage | Federal, state, native taxes, Social Safety, Medicare, Well being Insurance coverage |

| Instance deductions calculation | Let’s say complete deductions come as much as $162.50 | Let’s say complete deductions come as much as $600 |

| Internet pay | $712.50 (gross pay) – $162.50 (deductions) = $550 | $2,500 (gross pay) – $600 (deductions) = $1,900 |

5. Make funds

Making funds promptly and accurately is a vital a part of sustaining belief and satisfaction amongst your staff. Guaranteeing everybody understands how their pay is calculated and what deductions are made can even assist forestall any points or misunderstandings.

Right here’s the way it works:

- Select a cost technique: This may very well be via direct deposit (the place funds are transferred electronically to the worker’s checking account), paper examine, or pay card (a reloadable debit card onto which an employer hundreds an worker’s pay). Direct deposit is often essentially the most handy for each events and ensures staff obtain their pay promptly.

- Schedule the funds: Then, as per the established payroll schedule (weekly, biweekly, semi-monthly, or month-to-month), course of the cost. If utilizing direct deposit, make sure you provoke the switch a number of days prematurely to permit time for the banks to course of the transaction. Should you’re issuing checks, guarantee they’re printed, signed, and able to distribute on payday.

- Ship pay stubs: Together with their pay, present staff with a pay stub — an in depth breakdown of their pay for the interval. The pay stub ought to embrace gross pay, web pay, and particulars of any deductions, akin to taxes and profit contributions.

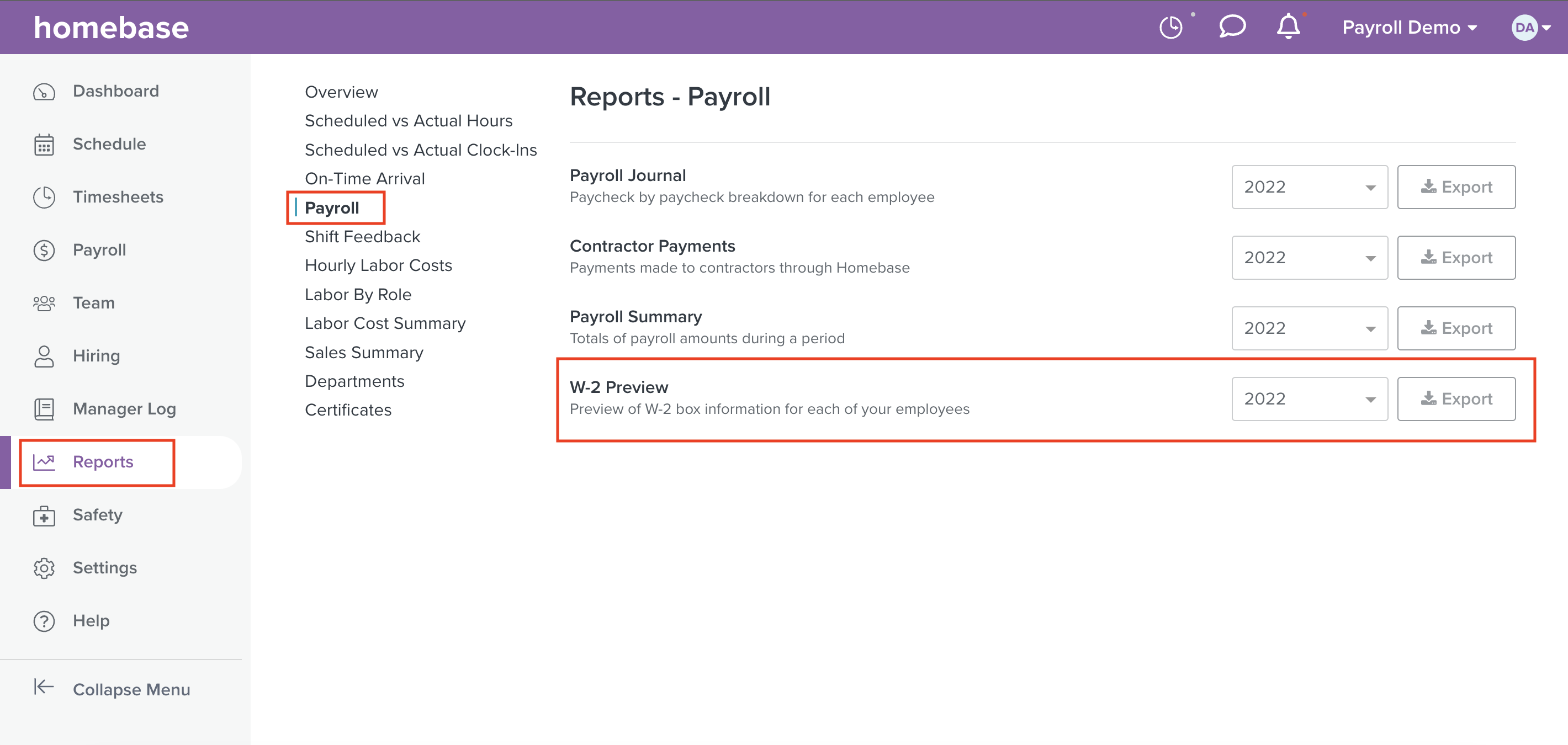

6. Finish-of-year reporting and knowledge storage for compliance

On the finish of every tax yr, employers have the duty of making ready and distributing sure tax varieties. The most typical is the W-2 type, which particulars an worker’s earnings and tax withholdings for the yr.

Aside from worker tax varieties, you additionally want to organize and file your enterprise’s personal tax returns. This contains paying any employer federal unemployment taxes (FUTA), and reconciling and paying any remaining Social Safety, Medicare, and earnings tax withholdings.

Moreover, sustaining thorough payroll data is a should for authorized compliance and inside monitoring. Information ought to embrace staff’ private data, timecards, wage data, and payroll dates. These data must be saved secure and safe but accessible for at the very least three years, in keeping with the Honest Labor Requirements Act (FLSA).

Be aware: In case of audits from the Inner Income Service (IRS) or Division of Labor, having correct and full payroll data could make the method smoother. Keep in mind, non-compliance can lead to penalties, so preserving good data is crucial.

The way to streamline payroll with Homebase

There are a lot of steps concerned in finishing up the payroll course of by yourself, and they are often tough and exhausting to perform, particularly for those who don’t use any HR providers to help you.

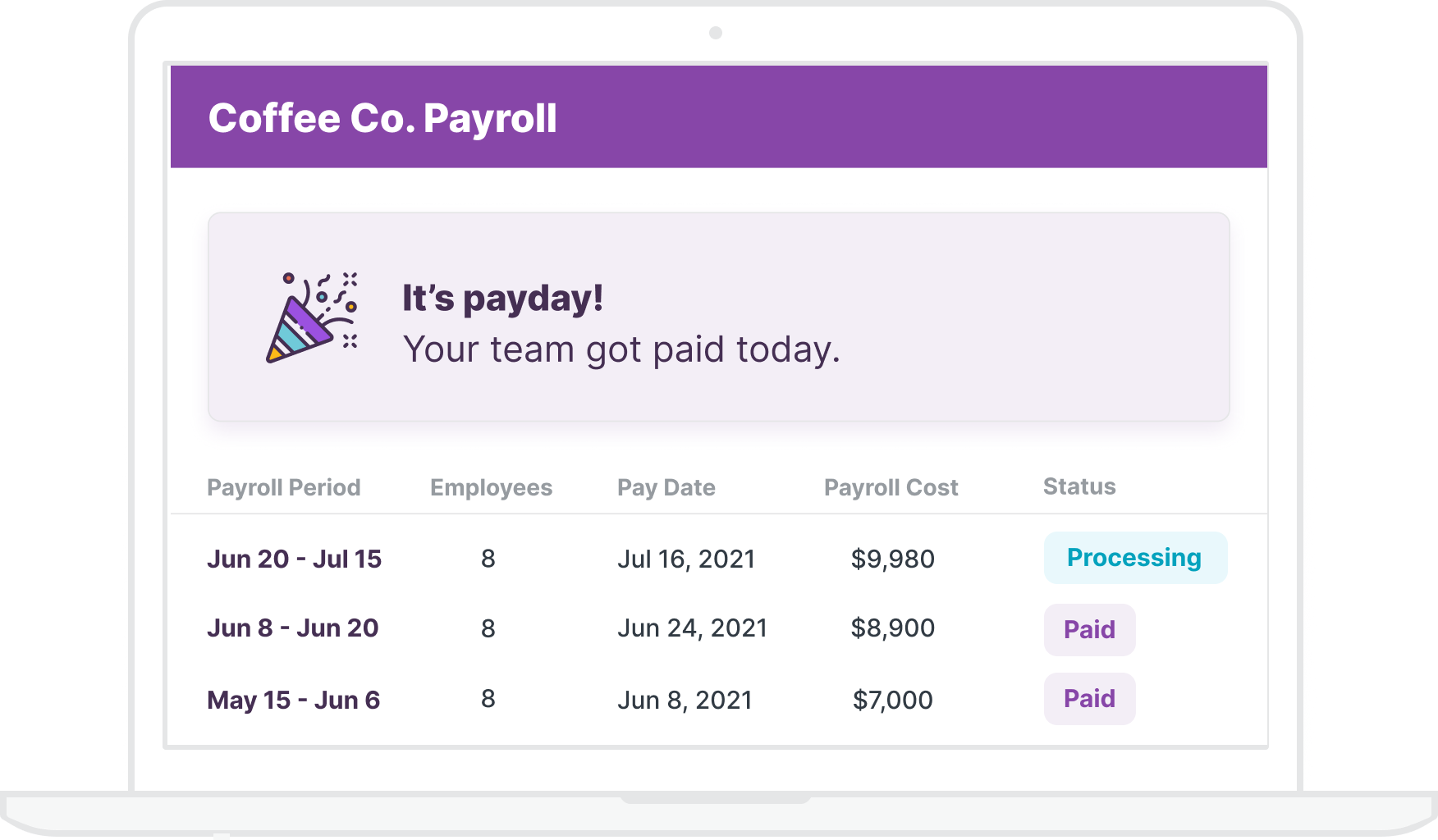

Payroll software program particularly designed for small companies like Homebase can prevent the headache of getting to recollect each single payroll step your self and working the danger of falling out of compliance, even unintentionally. Right here’s how Homebase can simplify your payroll and allow you to keep compliant with ease:

1. Implement a digital payroll course of

Once you shift your payroll on-line with a device like Homebase, you increase accuracy and effectivity. Let’s say you’re working a medium-sized restaurant with a crew of 20 full-time and part-time staff. Every week, your staff clock out and in at completely different occasions, perhaps even in numerous roles, with completely different charges.

With the previous manner, you’d spend valuable hours each week manually inputting timesheets, calculating wages, and determining taxes. One misplaced decimal or missed time beyond regulation could cause a payroll mess.However a device like Homebase mechanically tracks worker hours, which means your timesheets are correct to the minute. It even adjusts for time beyond regulation and paid day off. Now, your timesheets are correct and prepared for payroll with out your handbook enter.

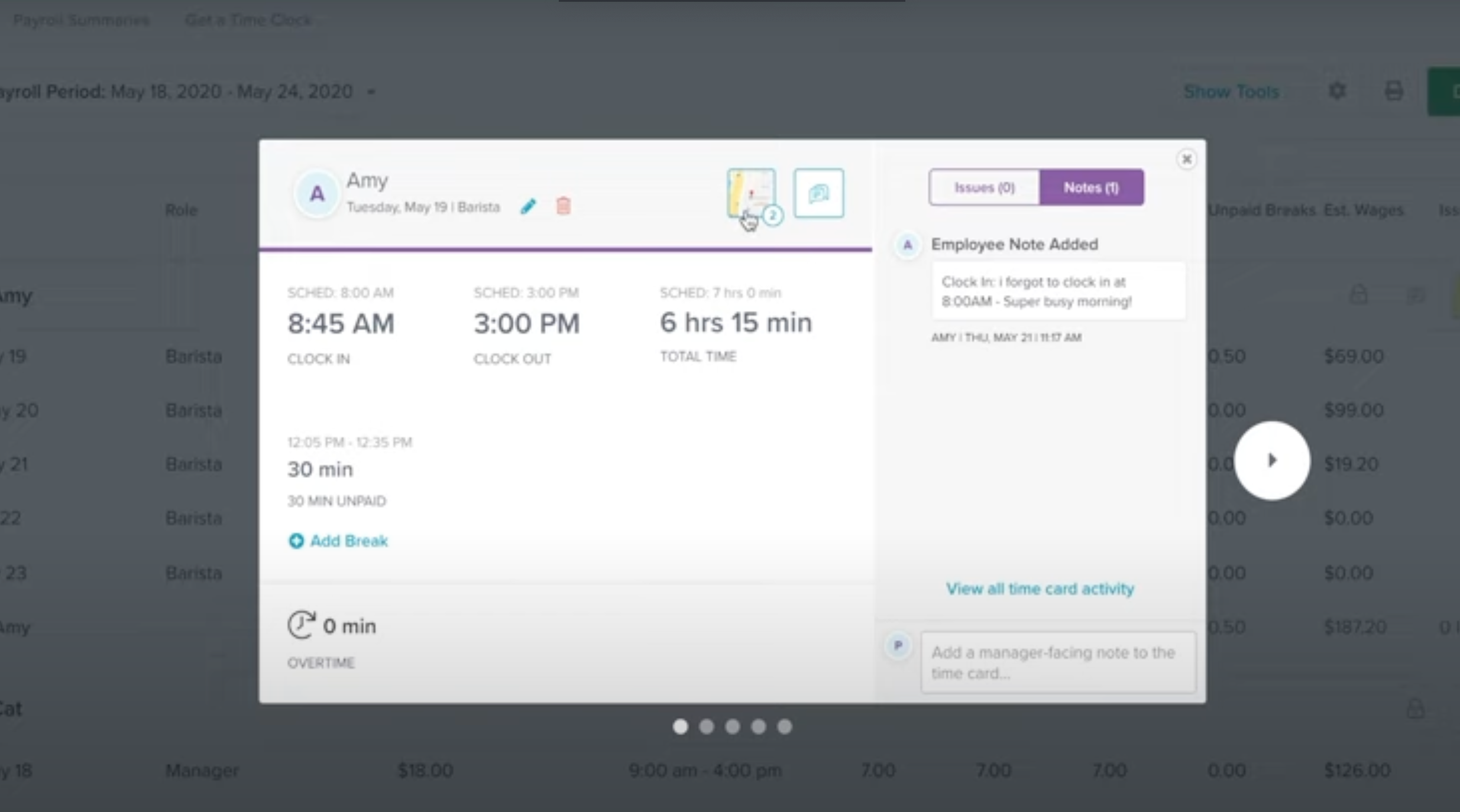

2. Approve timesheets

Let’s say it’s the top of the workweek, and your staff’ timesheets are populated with their clock-in and clock-out knowledge. In a handbook system, you’d be sorting via these, probably matching them in opposition to schedules or cross-checking for errors. However with Homebase, these timesheets are already digitized and precisely populated.

You possibly can choose how typically you need to run payrolls and the day when your payroll begins. Then you’ll be able to verify which payroll interval you need to approve or choose customized dates. You possibly can kind, group, and customise the view. Every row magnifies to point out the precise time your staff clocked in, breaks taken, earlier edits made, and GPS snapshots of the place your staff clocked in from.

Plus, as soon as a time card is accepted, it’s locked from future edits. Solely managers and customers with permission can edit accepted time playing cards.

Wish to be taught extra about approving timesheets with Homebase? See it in motion:

3. Your automated answer runs pay and tax calculations

Managing pay and tax calculations can typically be essentially the most intimidating a part of the payroll course of. Why? As a result of the very last thing any enterprise desires is an surprising letter from the IRS or a disgruntled worker due to a payroll tax miscalculation or incorrect cost.

Homebase mechanically sends you notifications when an worker is near time beyond regulation. YOu can even arrange customized break and time beyond regulation guidelines that adjust to federal, state, and native labor legal guidelines and FLSA guidelines.

Homebase calculates the right tax withholdings for every worker, sends the right funds, and forwards the withheld taxes to the correct authorities businesses. Plus, the platform mechanically processes tax filings, issuing 1099s and W-2s to your staff and contractors. So, as an alternative of drowning in tax varieties and calculations, you’ll be able to concentrate on what issues most — working your enterprise.

Seamless payroll in a matter of clicks

Payroll is the lifeblood of your enterprise. Each worker, out of your latest rent to your seasoned professionals, relies on it. It entails monitoring correct hours, exact tax calculations, and punctual funds. And the stakes are excessive.

Errors can result in sad staff, hefty penalties, and a complete lot of pointless stress. However an all-in-one device like Homebase might help your enterprise arrange a totally automated system for monitoring time and paying employees.

Homebase can mechanically calculate wages and taxes and ship the right funds to staff, the state, and the IRS. We additionally supply HR and compliance options and hiring and onboarding capabilities so you’ll be able to talk your insurance policies simply to each new crew member.And with our free plan, small companies can entry many of those high-impact options for as much as 20 staff at a single location with none value. As a result of with Homebase, you’ll be able to management your and your crew’s time by yourself phrases.