Zolak

Co-produced by Austin Rogers.

Traders immediately don’t have any scarcity of shopping for alternatives to generate passive earnings.

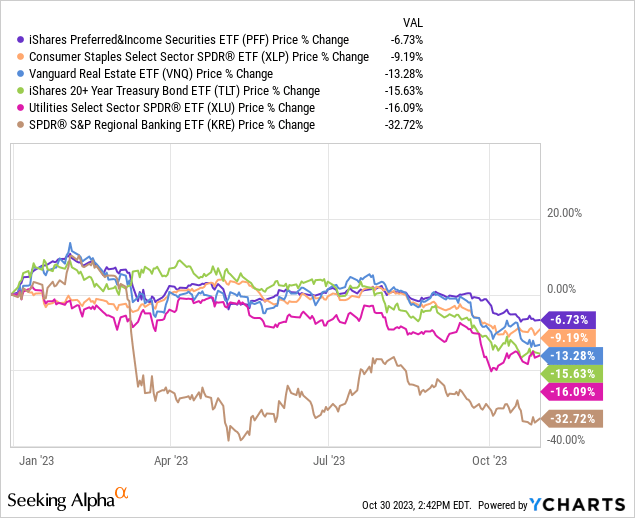

As rates of interest have risen this 12 months, the yields on historically income-producing property/sectors reminiscent of long-term Treasuries (TLT), most well-liked equities (PFF), actual property (VNQ), client staples (XLP), utilities (XLU), and regional banks (KRE) have all spiked greater.

These property/sectors have dropped in value this 12 months anyplace from ~7% to ~33%.

Whereas painful for many who already held these shares and exchange-traded funds, or ETFs, this selloff creates a gorgeous entry level for long-term traders trying to generate passive earnings from their funding portfolios.

That, in fact, assumes that one has money to take a position that is not already invested.

One of many joys of investing for passive earnings is the flexibility to make use of that passive earnings to reinvest in probably the most engaging alternatives out there on the time. We aren’t market timers and admit to having no capability to constantly purchase on the very backside, and thus we normally stay shut to completely invested.

Nonetheless being closely invested in passive income-generating shares provides us a continuing stream of earnings with which to put money into the perfect alternatives.

To illustrate, although, that you’ve been cautious and saved a big money place in reserve. Or maybe you lately inherited a big sum of cash. Or possibly you offered a property and netted a tidy amount of money from the sale.

Nonetheless you obtained it, let’s assume you’ve gotten $100,000 in money and really feel that now could be the fitting time to deploy it into long-term investments that generate passive earnings.

Let’s discover some methods you may go about doing so.

Understanding Your Choices

We’d categorize traders’ publicly traded passive earnings alternatives into three fundamental teams:

- Fastened earnings

- Dividend ETFs

- Frequent shares.

Fastened earnings refers to bonds and most well-liked equities. These are public securities which have a face worth at which they are going to be redeemed in full at a set date, and so they pay a set curiosity or dividend earnings stream that doesn’t develop.

Bonds are thought-about the most secure kind of capital wherein one may make investments as a result of they’re probably the most senior and highest precedence type of capital. Bondholders are paid first, earlier than some other investor.

Most well-liked equities are one other type of fastened earnings that’s decrease in precedence than bonds however greater than widespread inventory.

Fastened earnings is definitely the most secure type of capital by way of the chance of everlasting loss, however there are different types of security to consider. The previous couple of years have reminded traders that there’s additionally the chance of inflation.

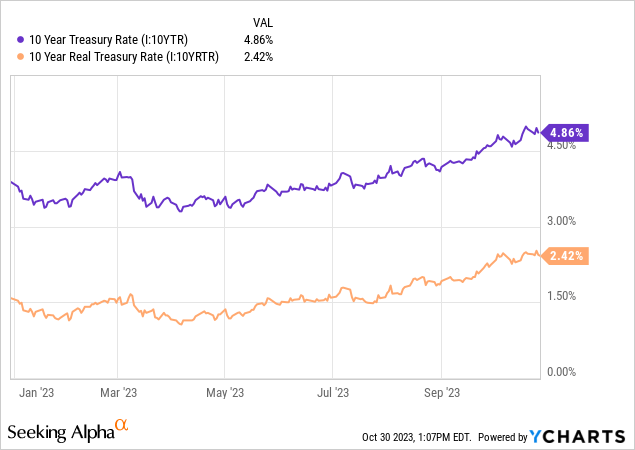

Whereas it could sound interesting to purchase the 10-year Treasury bond (US10Y) at a yield of virtually 5%, the best degree in over 15 years, one must also think about inflation.

The orange line above reveals the true (inflation-adjusted) 10-year Treasury yield, utilizing a ahead estimated inflation price of about 2.4%.

However this does not precisely illustrate the impact that inflation has on bond curiosity funds, as a result of bonds pay a set earnings stream, whereas inflation is the speed of value development — or the speed at which the buying energy of that fastened earnings stream declines.

The chance of everlasting capital loss from proudly owning particular person bonds could also be low, however the danger of buying energy erosion from inflation is excessive.

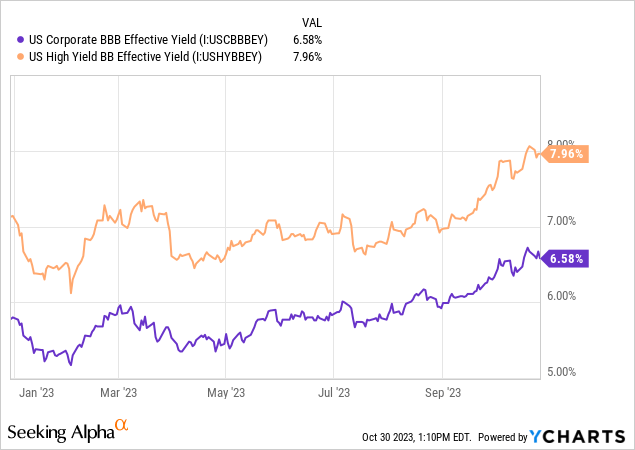

You possibly can additionally have a look at company bonds, each from funding grade corporates (LQD) and excessive yield or “junk”-rated corporates (HYG).

The yields yow will discover within the realm of company bonds vary from round 6% all the best way to eight% and better.

With company bonds, you’ve gotten the identical low danger of capital loss however reasonable danger of buying energy erosion from inflation. However as you’ll be able to see above, you receives a commission a lot greater yields to compensate for the chance of inflation.

In some methods, investment-grade company bonds supply the perfect of each worlds. You get a really low danger of losses from defaults, and also you additionally get greater yields.

The additional you go up the chance curve into the excessive yield or “junk bond” area, although, the extra you’re principally taking equity-like danger by way of potential for capital losses in change for an earnings stream that’s assured to stay flat.

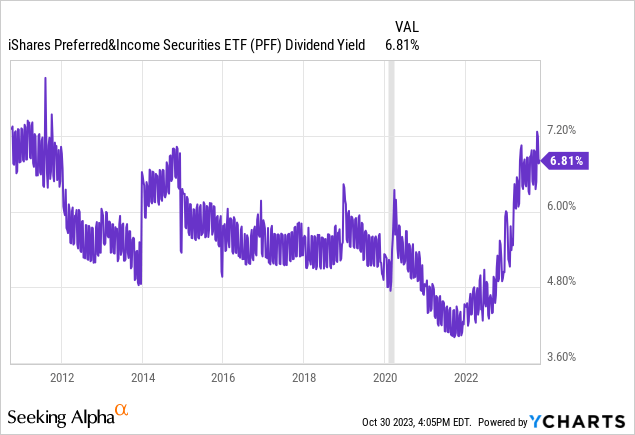

A lot the identical could possibly be mentioned about most well-liked equities, which are sometimes perpetual with no required redemption date. The iShares Most well-liked & Revenue Securities ETF (PFF) presently affords a better yield than at any time because the rapid wake of the Nice Monetary Disaster in 2010-2011.

The benefit of preferreds is that they commerce on main exchanges just like widespread shares, making them straightforward to put money into. Plus, their face values are usually both $25, $50, or $100, making them extra approachable for small-dollar traders than bonds, which generally commerce in $1,000 (or extra) increments.

Whereas it could be a good suggestion for earnings traders to have some degree of allocation to fastened earnings, we might warning in opposition to allocating too closely into fastened earnings, even at present yields.

The explanation for that is that whereas fastened earnings gives security from the chance of everlasting capital losses, it doesn’t present security from the chance of inflation.

We favor to take a position the majority of our capital into property that are inclined to each rise in worth and develop their earnings streams over time. That brings us to the subsequent two classes of passive earnings investments.

Dividend ETFs are merely baskets of dividend shares, tradable on main exchanges, which you could purchase as a bundle in change for a charge (the expense ratio) paid to the fund advisor.

This makes it essential to check the method the ETF makes use of to select shares. When shopping for an ETF, you are taking the dangerous with the nice, the overperforming shares and the underperforming ones. Hopefully, the stock-picking methodology it makes use of will decrease the variety of shares that find yourself slicing their dividends, however by way of some recessions, many shares inside a dividend ETF will lower their dividends, which causes the ETF’s distribution to say no.

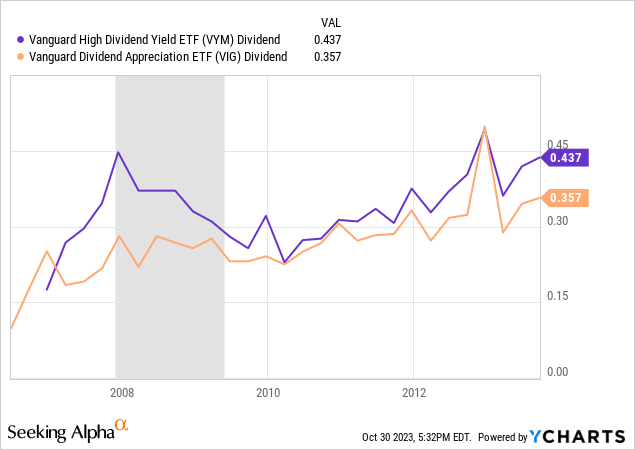

Examine, for instance, the dividends of the Vanguard Excessive Dividend Yield ETF (VYM) to its lower-yielding cousin, the Vanguard Dividend Appreciation ETF (VIG), by way of the Nice Recession of 2008-2009:

VYM’s dividend dropped by about 40%, whereas VIG’s dividend barely declined in any respect.

However the draw back of VIG is that it usually yields solely a bit of over 2%, whereas VYM yields 3.5-4%.

As baskets of shares, the dividend yields of ETFs are principally simply the weighted common of all their constituent holdings’ dividend yields.

Whereas we do not consider the market is completely environment friendly, it is not silly, both. Shares with excessive dividend yields are priced that method for some perceptible motive, no matter whether or not the market’s notion is 100% correct or not.

That’s the reason we predict traders must be cautious with “excessive yield” or “excessive dividend” ETFs. You are taking the dangerous with the nice in these autos, and you can not choose and select which holdings to incorporate and which to exclude.

Then again, ETFs additionally present immediate diversification, permitting traders to achieve publicity to dozens, tons of, and even 1000’s of dividend-paying shares throughout many sectors of the financial system in a single click on.

At their finest, dividend ETFs present each dividend development and dividend security by way of a robust, considerate stock-picking methodology.

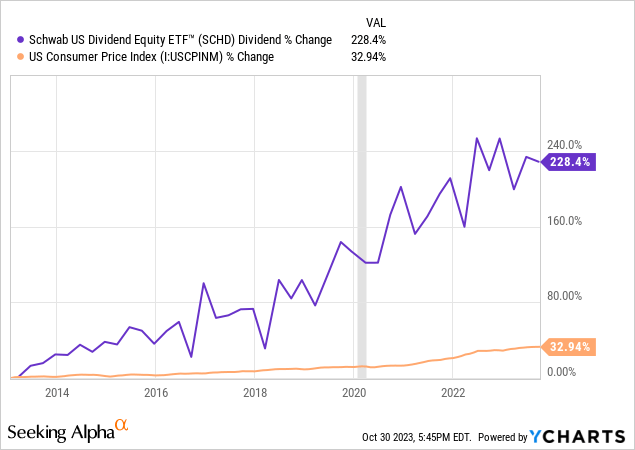

Take, for instance, the Schwab U.S. Dividend Fairness ETF™ (SCHD), which has handily crushed inflation with its dividend development over time even whereas offering a dividend yield over twice as excessive as that of the S&P 500 (SP500).

Traditionally, SCHD has supplied all the advantages of a dividend ETF with minimal drawbacks.

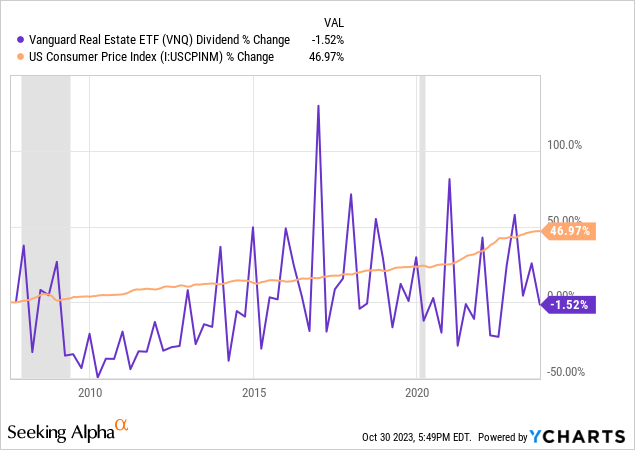

On the opposite finish of that spectrum, think about the Vanguard Actual Property ETF (VNQ), which owns nicely over 100 actual property funding trusts (“REITs”) and different actual estate-related corporations, offering diversification throughout all sub-sectors of actual property.

This can be a sector recognized for paying beneficiant dividends and rising these dividends over time, however there’s a vast variation between the best high quality and finest managed REITs and the decrease high quality, poorly managed REITs. That’s the reason VNQ’s dividend has not even managed to maintain tempo with inflation over time.

There are numerous nice REITs inside the VNQ that not solely supply above-average yields however have additionally grown their dividends sooner than inflation over time. However the common mirrored in VNQ can not boast such a file.

Selectivity is essential.

Lastly, dividend-paying widespread shares are the third class of passive earnings investments. Shopping for particular person shares gives the selectivity essential to keep away from the pitfalls of sure ETFs.

Frequent shares have the alternative danger profile as bonds, uncovered to some danger of everlasting capital losses (relying on the person inventory) however usually shielded from the chance of buying energy erosion through dividend development.

In fact, corporations do not have to pay dividends. This can be a capital allocation resolution. Generally administration groups will select to cut back or remove dividend payouts, whether or not due to a drop in earnings or just a need to allocate that capital otherwise.

To mitigate this danger, traders can have a look at shares with long-established information of paying and yearly rising their dividends to shareholders. It clearly takes a few years to determine these information, and administration groups will normally combat arduous to protect them.

Inside the realm of REITs, listed here are a couple of high-quality names to think about:

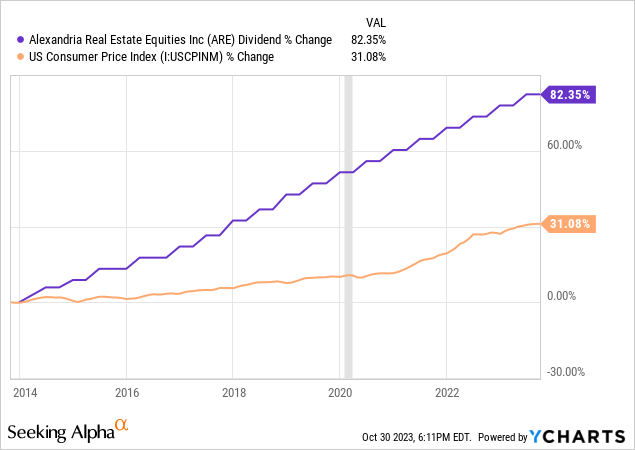

- Alexandria Actual Property Equities (ARE), which owns Class A life science amenities situated within the nation’s prime analysis clusters. ARE presently yields 5.3% and has a protracted file of rising its dividend at 6% per 12 months.

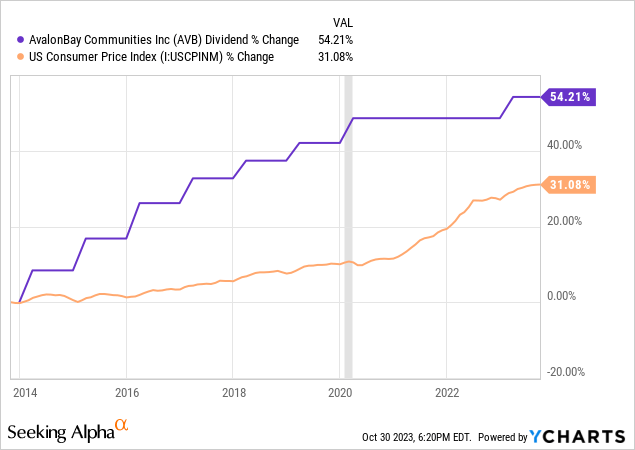

- AvalonBay Communities (AVB), the biggest multifamily REIT within the US with an enormous portfolio of primarily Class A flats in suburban areas of coastal cities however a rising presence in fast-growing Sunbelt markets like Texas, Florida, and North Carolina. AVB yields over 4% and has paid a usually rising dividend for 28 years. Even with a pause in its dividend development throughout COVID-19, the REIT’s dividend has nonetheless risen sooner than inflation within the final decade.

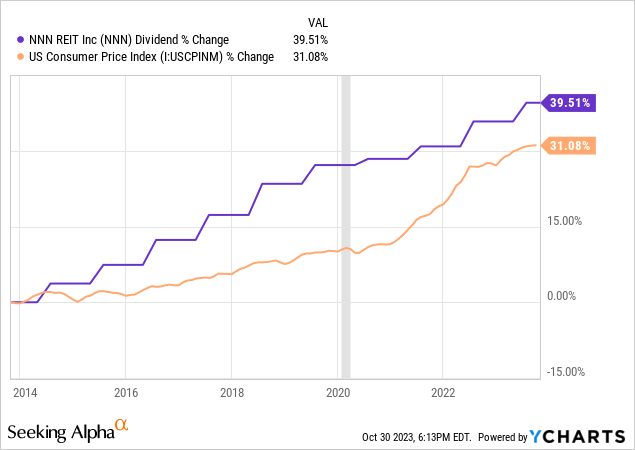

- NNN REIT (NNN), previously Nationwide Retail Properties, owns a big and diversified portfolio of single-tenant internet lease retail properties like comfort shops, quick meals eating places, and automobile washes. NNN yields 6.4% and boasts a 30+ 12 months file of elevating its dividend yearly at a price that has crushed inflation within the final decade.

Backside Line: How We Would Make investments $100,000 For Passive Revenue Immediately

Everybody’s state of affairs and targets are completely different, so it’s all the time arduous to provide basic ideas like this.

However for many who want to put money into long-term investments for passive earnings, alternatives immediately are huge and immensely engaging.

If it was our cash, we might allocate a portion of it to all three classes of passive earnings investments mentioned above. How a lot precisely is as much as one’s private discretion, however right here is one potential allocation association that concurrently generates a excessive yield and inflation-beating earnings development:

| Allocation | Yield | Dividend Development | |

| Funding Grade Bonds / Preferreds | 25% | 7% | 0% |

| Dividend ETFs | 25% | 4% | 6% |

| Dividend-Paying Frequent Shares | 50% | 5% | 5% |

| WEIGHTED AVERAGE | 5.25% | 4% |

For those who invested $100,000 this manner, you’ll generate $5,250 within the first 12 months, however we estimate that earnings stream may develop at a price of about 4% per 12 months from dividend development.

Here is how the passive earnings from that invested $100,000 would theoretically develop over time:

| 12 months 1 | $5,250 |

| 12 months 2 | $5,460 |

| 12 months 3 | $5,678 |

| 12 months 4 | $5,905 |

| 12 months 5 | $6,142 |

| 12 months 6 | $6,387 |

| 12 months 7 | $6,643 |

| 12 months 8 | $6,909 |

| 12 months 9 | $7,185 |

| 12 months 10 | $7,472 |

That is solely a hypothetical state of affairs, in fact, however we predict it’s totally believable and lifelike.

The underside line is that in case you are trying to make investments a lump sum of money for passive earnings, think about all classes of investments.