Chip Somodevilla/Getty Photos Information

There are principally three the explanation why I essentially like Palantir Applied sciences Inc. (NYSE:PLTR) despite the fact that it seems to commerce wealthy at first look. On high of that, Palantir seems to have discovered an answer to its scaling drawback (Boot camps). I believe that is ensuing within the re-rate within the markets that is ongoing. If the Boot camp development stalls out or that thesis is improper, I might count on the inventory to fall again once more.

The essential basic causes I like Palantir are that it has: 1) very sticky enterprise mannequin with quite a lot of pricing energy down the road 2) robust tradition that is differentiated and sure inspiring to insiders, 3) management is unconventional however considerate. It is not that CEO Alex Karp will not make errors (fewer than I, would I am certain), however I believe he’ll be taught from them. I initially purchased some across the IPO and wrote it up, as an attention-grabbing however speculative lengthy under its IPO worth within the fall of 2022.

I additionally purchase into the concept that the corporate is not producing the margins it could finally get as a result of it’s within the early phases of pushing out a posh product into very conventional and slow-moving sectors (like governments and massive enterprise). The best way I see it, the worth of its product can be magnified by the sudden availability of AI fashions that you simply and I can speak to, and that may perceive your intentions nicely sufficient to make merchandise like that of Palantir all of a sudden vastly extra useful.

It’s shortly turning into very attention-grabbing to unlock enterprise proprietary or confidential information obtainable all through your enterprise. It’s now not the playground of knowledge specialists and is unusable by anybody else until it was structured. Each time I hearken to somebody working in a big enterprise, one of many first issues that has them fearful about utilizing (or having their colleagues/workers use) LLMs like ChatGPT, and so forth., is all kinds of knowledge compliance. One other extensively heard concern is of knowledge breaches, cybersecurity, and so forth. Palantir was initially conceived to serve the U.S. authorities, and cybersecurity is essential. It is rather laborious to succeed in the best ranges of safety and compliance when these need to be layered on high of an information or AI product however weren’t an integral a part of the design from the outset.

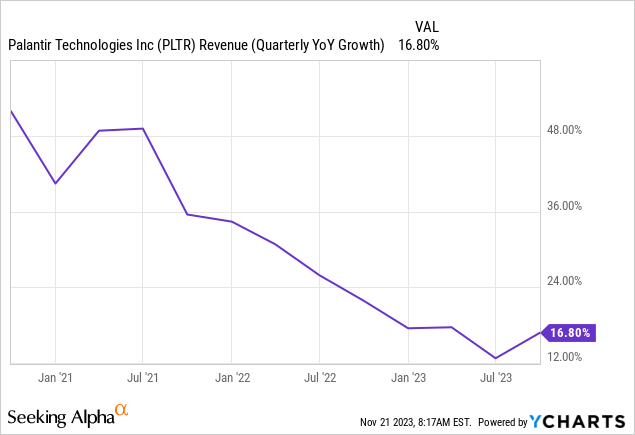

What’s been considerably worrisome is that Palantir’s year-over-year development stored falling. Partly, it’s comprehensible as a result of the corporate was coming off very excessive development charges, and corporations are inclined to IPO when issues are going very nicely. However it was attending to a disappointing development price, and that is with the backdrop of the battle in Ukraine.

Lately, income development has accelerated again up once more. This might be a blip within the information, however the motive I imagine there’s grounds for optimism is that Palantir began with its AIP Boot Camps round ~5 months in the past. They had been very captivated with these on the current earnings name, they usually would be the answer the corporate has been on the lookout for to effectively “promote” its advanced product.

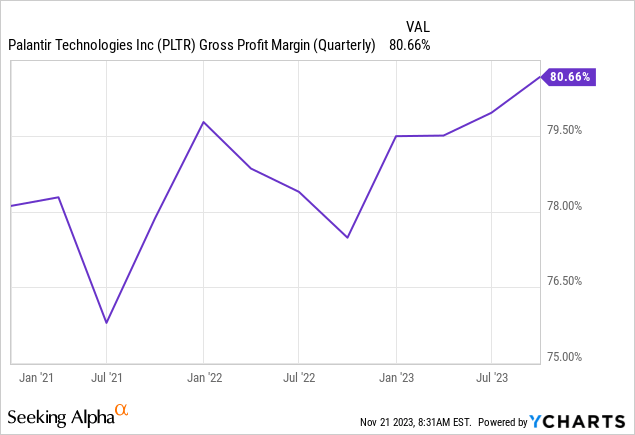

This might additionally clarify the uptick in gross margins:

This is what the corporate stated about that on its earnings name:

Possibly to start out with the second right here with AIP. I believe you need to actually suppose that the boot camp is extra than simply what’s occurring within the boot camp. Since you’re exiting the boot camp with a sequence of use instances which might be manufacturing prepared or close to manufacturing prepared which you can go ahead with. You are exiting the boot camp with because the buyer and often IT with sufficient hands-on expertise with the product which you can truly maintain going and compounding it going ahead.

So there’s this exit velocity that is basic to it, the place it isn’t simply the go-to-market movement, it truly now turns into the implementation movement. It turns into the way in which wherein you have interaction with companions as a result of now companions can run their boot camps. Companions can drive use case development for themselves round what got here out of the boot camp and the exit velocity round that. So I believe it is fairly profound and why you are seeing each our emphasis of it and the impression that it is having on each the financials and the working actuality of the enterprise.

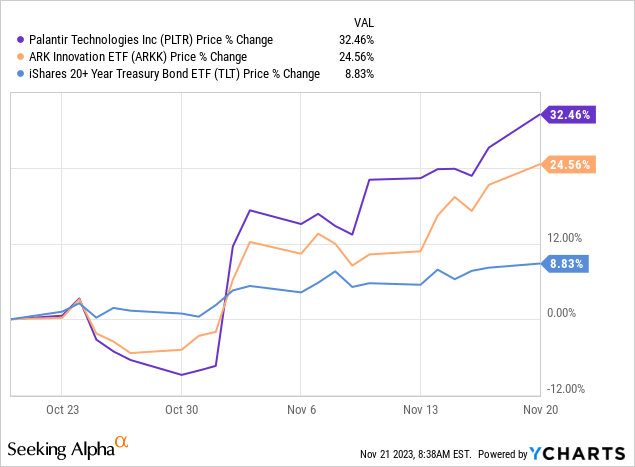

Palantir is now on monitor to conduct boot camps for greater than 140 potential clients, and about half of those are scheduled for November. They’re doing extra of those boot camps than they’ve finished U.S. business pilots within the earlier yr. The share worth has just lately rallied. That is in all probability partially as a result of speculative tech as a bunch has rallied just lately. These had been typically thought of to be price delicate and certainly, the lengthy bond has rallied as nicely up to now month. Nevertheless, I additionally suppose the market is sniffing out margin and income acceleration, which is after all, a robust cocktail.

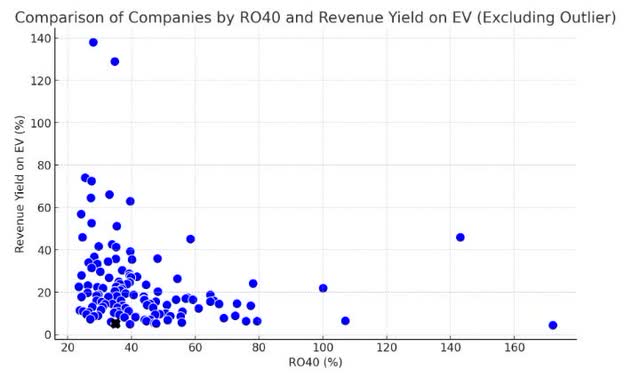

That is very true for Software program as a Service (“SaaS”) companies. Typically employed strategies to worth these corporations are EV/income comparisons or the rule of 40 strategies. The graph under reveals Palantir as a black cross inside a universe of U.S. tech corporations scored on these metrics:

tech corporations RO40 vs Income Yield on EV (by writer)

At the moment, Palantir has respectable development charges, however even inside this aggressively valued cohort, it’s clearly on the larger finish of the vary by way of valuation. Meaning, the market is at the least partly pricing in accelerating development. However, it’s seemingly additionally a perform of Palantir’s enterprise mannequin and mission-critical product line. Its merchandise aren’t simple to promote, however after that, they’re very laborious to chop.

Conclusion

Palantir’s newly developed progressive gross sales strategies by means of AIP Boot Camps are a possible reignition of the corporate’s development trajectory. Palantir’s skill to ship high-security, AI-driven options to historically slow-moving sectors is clearly extra useful than ever. There are conflicts throughout to remind every kind of establishments (state-owned or not) that they should step up their recreation.

Its valuation stays on the upper finish even inside a bunch that historically will get awarded wealthy multiples. The corporate’s distinctive enterprise mannequin which I count on to be characterised by super-high buyer retention drives a few of that. In any other case, so much relies on the continued success of the brand new gross sales technique. If this effort falters I believe the inventory will retrace some. Lastly, Karp has talked about that Palantir is now eligible for S&P 500 (SP500) inclusion. Which will already be contributing to positive aspects as nicely. I do imagine it’s a useful tailwind and plan to discover it in a future article.