cemagraphics

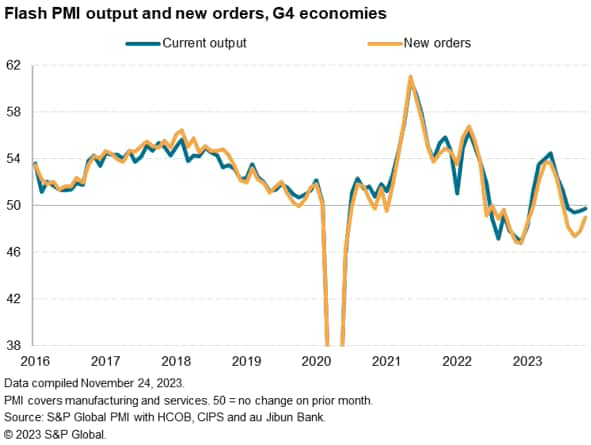

Early PMI survey information for November from S&P International confirmed the foremost developed economies collectively contracting marginally for a fourth month. The decline was once more led by the eurozone, although the downturn confirmed indicators of bottoming out, with a steadying of output within the UK additionally bringing tentative welcome information of diminished recession threat. Progress within the US in the meantime continued to run a lot weaker than earlier within the 12 months, and Japan’s upturn confirmed indicators of stalling.

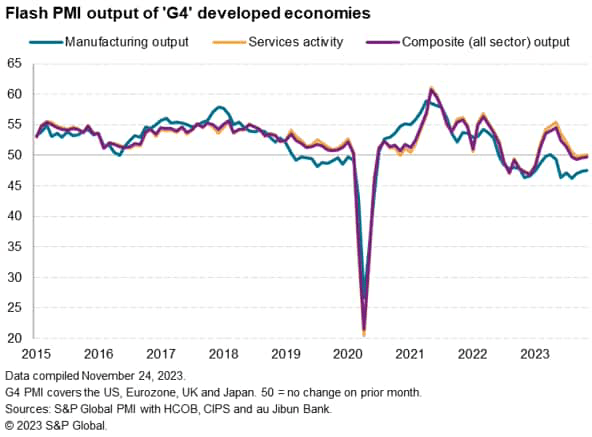

The surveys proceed to point that service sector progress stays very subdued within the G4 on common relative to the surge seen in spring and summer season, whereas manufacturing stays in decline.

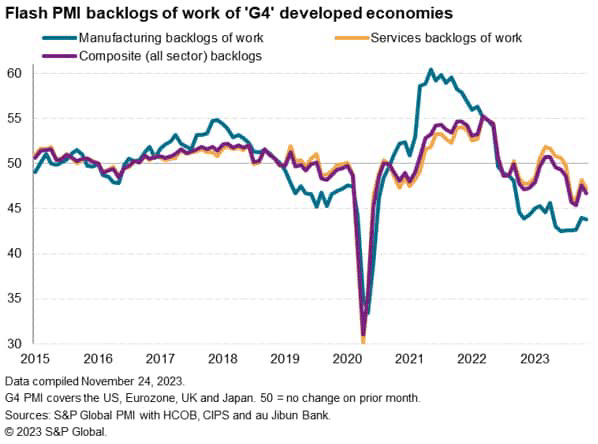

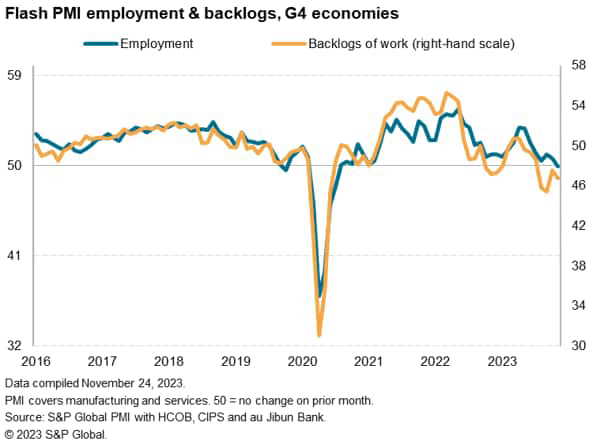

Additional falls in backlogs of labor in each sectors bode sick for the near-term outlook, however there was some easing within the charge of decline of latest orders, which even returned to tentative progress within the US.

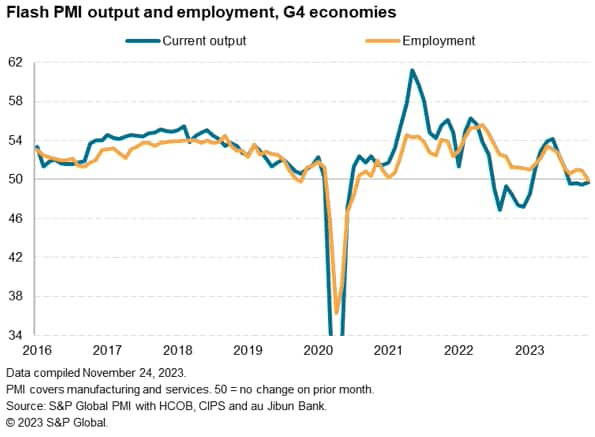

The sustained decline so as backlogs and inflows of latest orders however inspired companies to chop employment throughout the G4 for the primary time for the reason that early months of the pandemic, hinting that companies have turn into more and more cost-conscious within the face of a difficult demand setting.

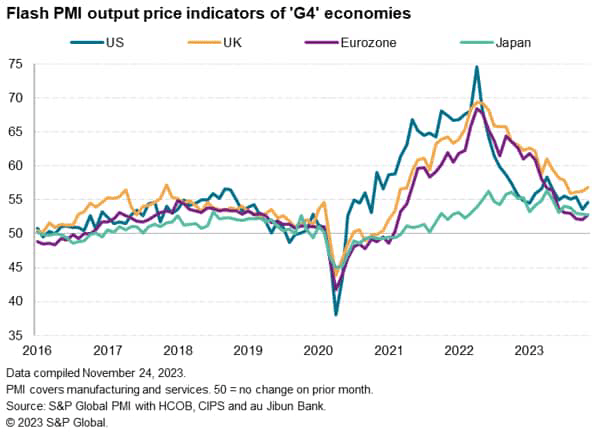

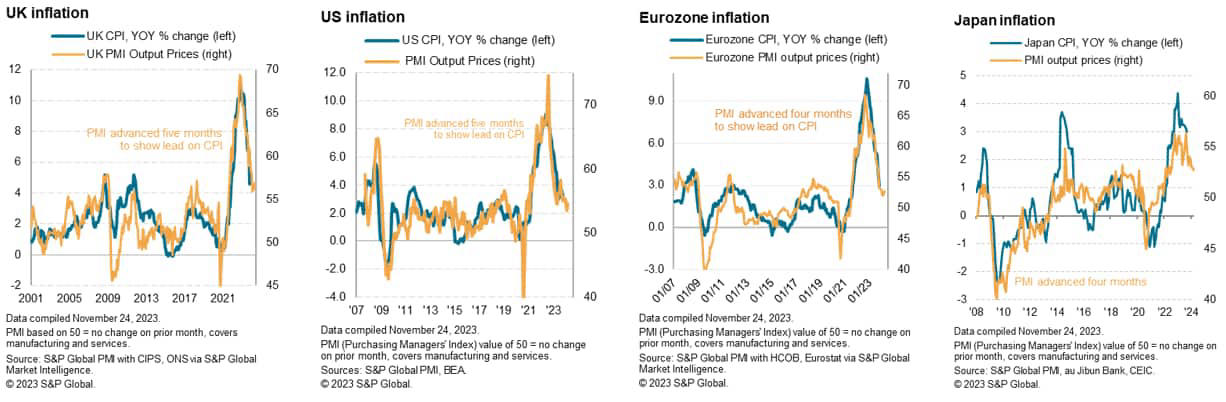

Inflationary pressures in the meantime ticked greater, albeit remaining muted by current requirements. Service sector inflation stays the important thing space of inflationary strain, that means the order guide and employment traits for this sector proceed to be the important thing indicators to look at in coming months to gauge the influence of pricing energy and wage bargaining energy on inflation, and therefore the coverage response.

Main developed economies contract as orders hunch

Enterprise exercise throughout the 4 largest developed economies – the G4 – fell for a fourth successive month in November. Nonetheless, the speed of decline remained solely marginal, easing fractionally in October, in line with provisional PMI survey information. The flash PMI output index for the G4 economies inched up from 49.5 in October to 49.7, a four-month excessive but nonetheless beneath the 50.0 no-change stage.

By sector, weak point was led by manufacturing, the place output contracted throughout the G4 for a seventh successive month. Manufacturing unit output throughout the G4 has now actually fallen regularly over the previous 17 months barring April of this 12 months. Disappointingly, factories additionally continued to wind down their inventories of each purchases and completed items in November to level to a sustained drag on international manufacturing facility manufacturing from the stock cycle.

A marginal rise in service sector output throughout the G4 improved on the fractional decline seen in October however means exercise within the sector has now been largely stagnant for 4 months, contrasting with the strong progress spurt seen earlier within the 12 months.

Europe-US divergence persists

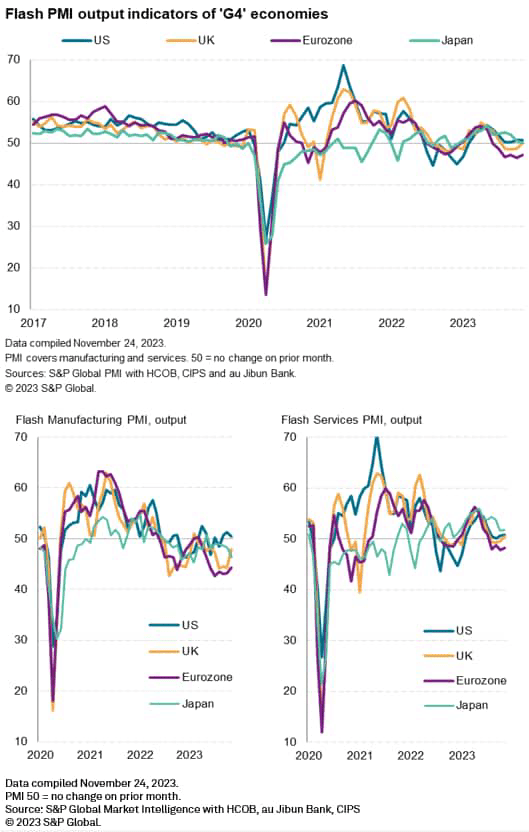

Geographically, the flash PMI information add to indications that the eurozone financial system is more likely to contract within the fourth quarter, whereas progress within the UK has remained largely stalled and the US will see GDP develop, however at a much-reduced charge in comparison with the second and third quarters. Japan is indicated to muster modest progress.

Eurozone output fell for a sixth month, albeit the speed of decline moderating in November. The flash composite PMI studying of 47.1, up from 46.5 in October, however indicated that the tempo of decline remained one of many steepest recorded by the PMI for the reason that debt disaster in 2012 if pandemic lockdown months are excluded. An eight-month of falling manufacturing output was accompanied by a fourth month of contraction within the service sector, although charges of decline moderated in each circumstances.

The UK in the meantime reported a marginal rise in output, the composite flash PMI rising from 48.7 in October to 50.1 to thereby hit a four-month excessive and finish a three-month spell of decline. The advance was led by the primary enchancment in service sector output for 4 months. Though manufacturing manufacturing fell for a ninth straight month, the decline was the smallest recorded since June.

America composite flash PMI in the meantime held regular at 50.7, registering a fourth month of very subdued progress but nonetheless pointing to a extra resilient progress development in comparison with that seen in Europe. Whereas service sector progress edged as much as a four-month excessive, although notably stays far weaker than seen earlier within the 12 months, manufacturing facility output progress slowed near stagnation.

Lastly, progress stalled in Japan, which was the one G4 financial system to see the extent of the composite PMI fall between October and November, down from 50.5 to 50.0, its lowest for the reason that restoration started in January. A modest achieve in service sector output was offset by an intensifying downturn in manufacturing facility output, which dropped on the sharpest charge since February.

Developed world employment falls

The general image of largely stalled enterprise exercise was accompanied by the survey employment information pointing to a weakening labour market throughout the G4. Staffing ranges throughout manufacturing and companies declined – albeit solely fractionally – for the primary time since July 2020 (in the course of the early pandemic lockdowns). Among the many G4, solely Japan reported greater employment, with marginal declines reported elsewhere. The drop in US employment was notably important in being the primary seen for the reason that early pandemic lockdowns, and within the eurozone the decline was the primary for the reason that lockdowns of early-2021. UK employment fell for a 3rd month.

Manufacturing unit jobs had been reduce within the G4 for a second successive month, dropping in all 4 economies. The eurozone manufacturing facility payroll decline was particularly marked and the sharpest since October 2012 if early pandemic months are excluded. UK job losses additionally remained steep, albeit easing. Whereas the US manufacturing facility jobs decline was far much less extreme than seen in Europe, the previous two months have however seen the steepest payroll losses for the reason that international monetary disaster in early pandemic months are excluded. A marginal decline was recorded in Japan.

Service sector employment in the meantime got here near stalling on common throughout the G4. Resilient hiring in Japan was countered by the primary drop in US companies employment for the reason that early pandemic months and solely marginal good points within the eurozone and UK, albeit the latter representing an enchancment on declines seen within the prior two months.

Falling orders trace at additional strain on jobs

The general worsening jobs image on the G4 stage was partially linked to a deterioration in enterprise output expectations for the 12 months forward in November but in addition mirrored a fifth successive month-to-month drop in new orders throughout items and companies. Notably, demand – as measured by new order inflows – throughout the G4 continued to fall at a sharper charge than output, the latter being supported by companies persevering with to eat into backlogs of orders amassed in prior months. These backlogs throughout the G4 have now been in decline for seven successive months, dropping in November at one of many steepest charges seen since comparable information had been first out there in 2009, barring solely the early pandemic months.

Backlogs of labor fell at elevated and marked, charges within the US, UK, and eurozone – hinting at persistent output progress weak point and strain on payroll numbers within the months forward – however remained regular in Japan.

One brighter be aware was a cooling within the charge of decline of latest orders to solely a modest tempo in November. Upcoming information will likely be eyed for indicators of latest orders returning to progress, and therefore offering a much-needed justification for companies’ present manufacturing capability ranges. A tentative such return to new orders progress within the US was already signalled by the November flash PMI, and charges of decline eased in Europe.

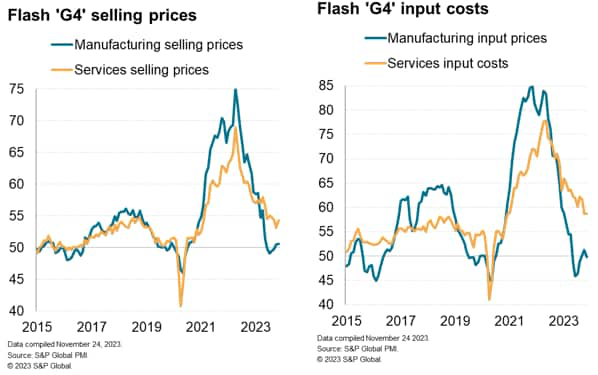

Promoting value inflation ticks greater, however value progress weakens

From an inflation perspective, common promoting costs for items and companies rose at an elevated charge throughout the G4, albeit nonetheless operating at one of many lowest charges seen since early 2021. Enter value inflation in the meantime moderated additional, slipping to its lowest since November 2020, so as to add some encouragement to the prospect of promoting value inflation cooling once more within the coming months.

Promoting value inflation picked up within the US, Eurozone, and UK, the latter remaining particularly elevated by historic requirements. The eurozone reported the bottom charge of the three, reflecting the comparatively weaker demand setting. The speed of enhance in Japan eased to its lowest since February 2022.

Manufacturing promoting costs barely rose throughout the G4 on common, albeit with a strong enhance seen in Japan and to a lesser extent the US. A marked fall in items costs was in the meantime seen within the eurozone, with UK costs largely unchanged.

Service sector promoting costs in the meantime rose at a barely elevated charge in comparison with October, with enter value inflation softening barely. Each charges consequently stay elevated by historic requirements, together with in all G4 economies, and persist because the principal space of concern in relation to stubbornly excessive core shopper value inflation.

The employment information will subsequently be particularly necessary to look at going ahead, serving to to evaluate wage bargaining energy as labour prices usually characterize the lion’s share of service sector enter prices, whereas new order inflows will likely be a key information to demand-pull inflation strain.

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.