DNY59

Thesis Abstract

In 2022, everybody was anticipating a recession in 2023. Now, we’re one month away from ending the 12 months, and there’s no recession in sight. In reality, we have now seen loads of proof to recommend fairly the alternative. The US financial system is doing very effectively for now.

With that stated, issues can change in a short time, and 2024 might certainly be the 12 months when the recession hits, simply when everybody least expects it.

On this article, I have a look at 4 totally different indicators that may assist us monitor the potential for a US recession. What are these indicators saying now, and what is going to they appear to be 6-13 months from now?

US nonetheless Robust

The latest financial knowledge launched this week continues to help the concept that the US financial system is in outstanding form.

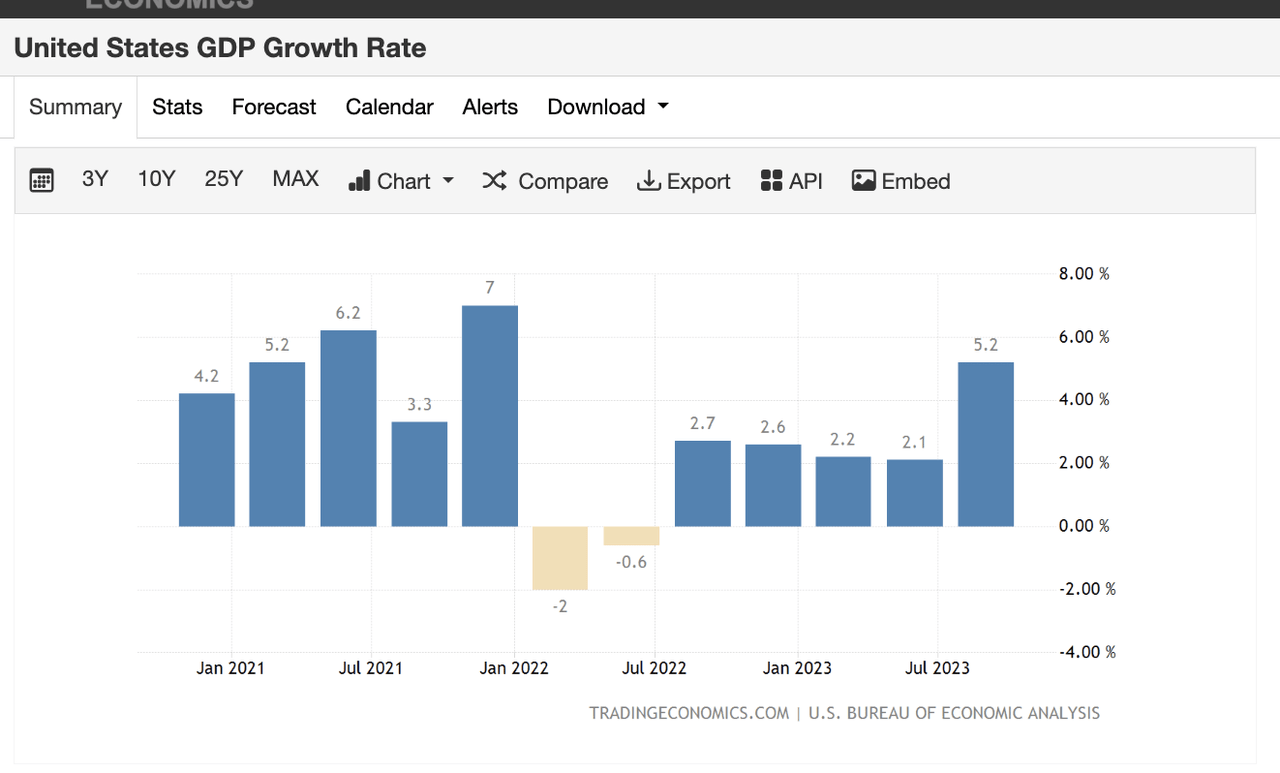

US GDP (Buying and selling Economics)

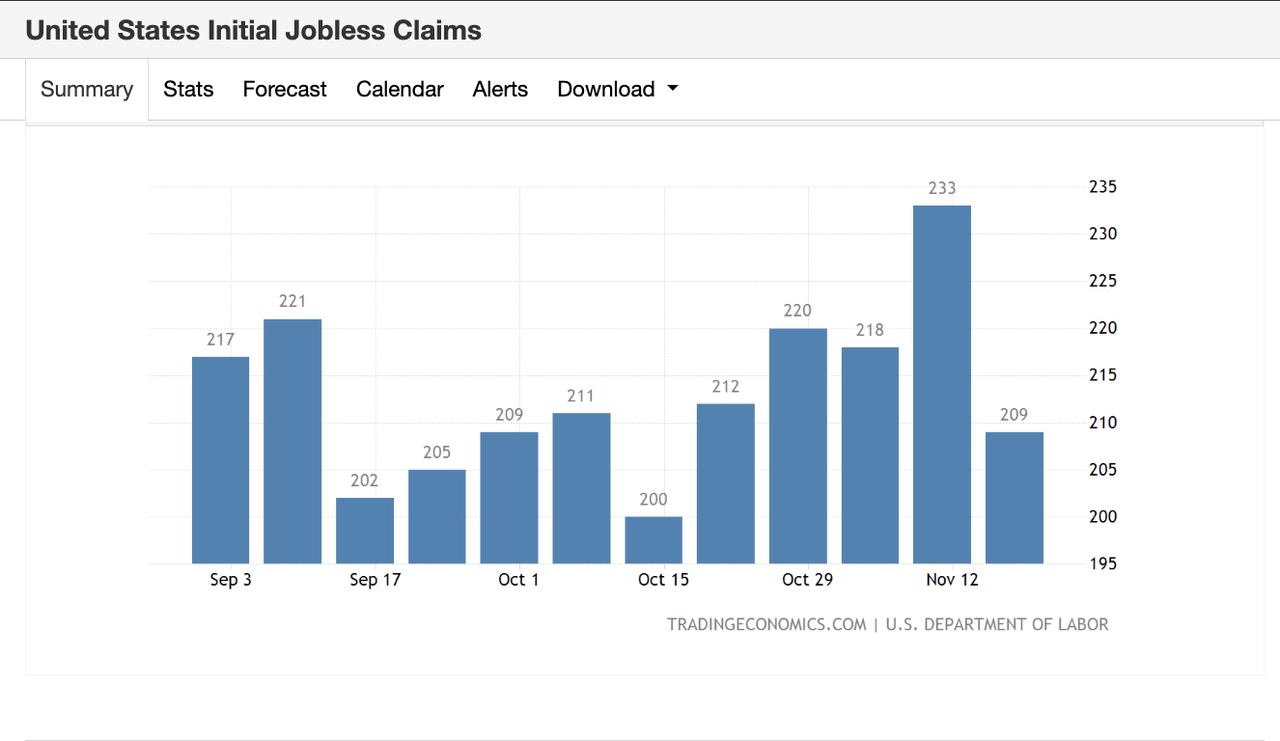

The latest GDP knowledge exhibits that the financial system grew at 5.2% during the last quarter. In the meantime, the job market continues to be tight with jobless claims falling once more within the final launch:

Jobless declare (Buying and selling Economics)

It is onerous to make a case for a tough touchdown right here, and it appears everybody would agree.

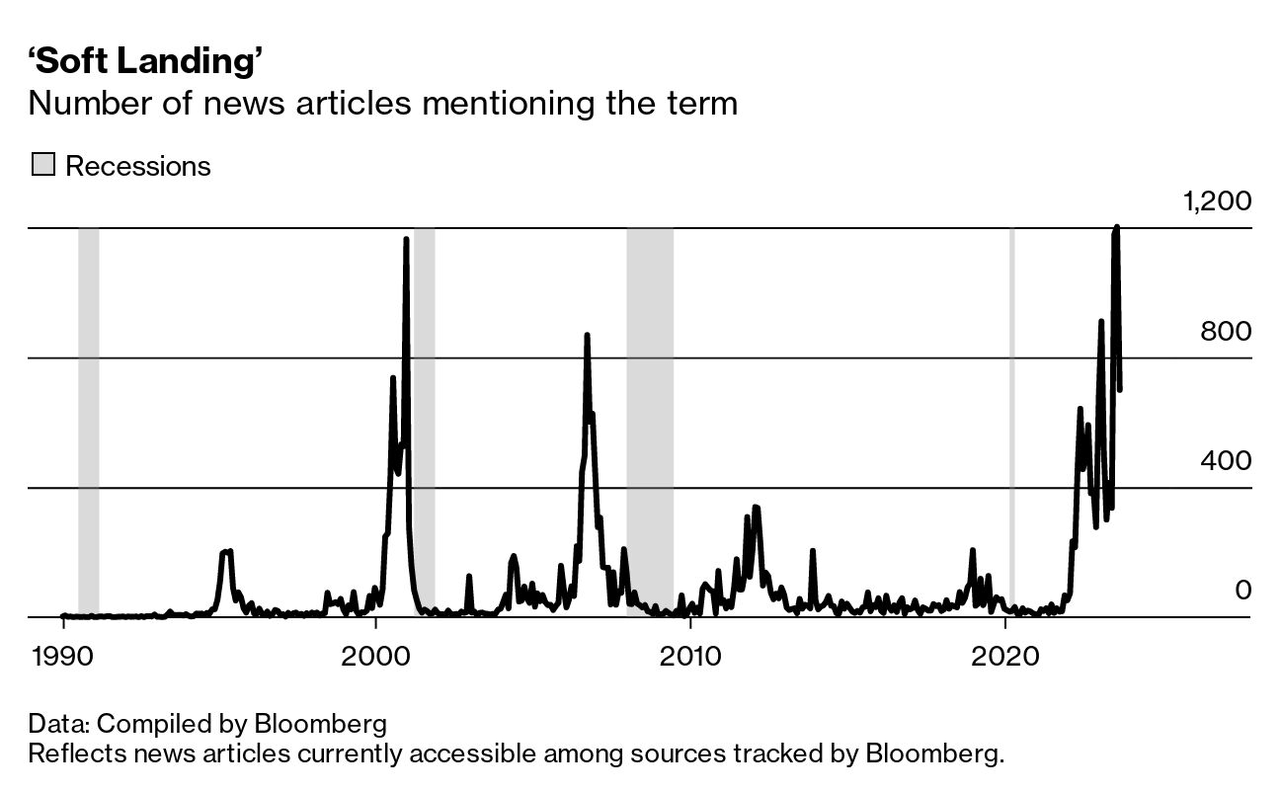

Mushy Touchdown Articles (Bloomberg)

Mockingly, this itself may be seen as a contrarian indicator. The variety of information articles mentioning “delicate touchdown” peaked simply forward of the 2001 recession and the 2008 recession.

As I’ve talked about earlier than, a delicate touchdown is usually simply the preliminary levels of a tough touchdown.

Main Financial Indicators

Main Financial Indicators, because the identify suggests, are a reasonably easy manner of making an attempt to anticipate adjustments within the financial panorama.

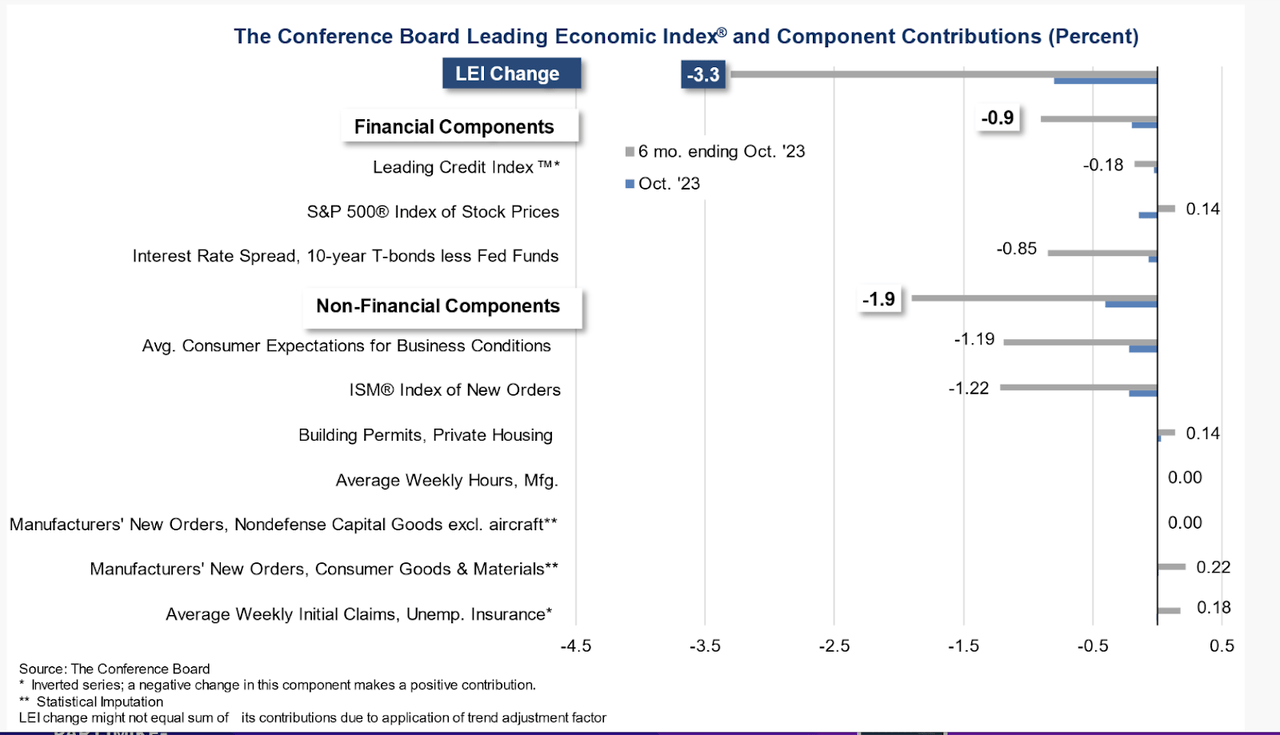

It’s made up of assorted elements as we are able to see under.

LEI elements (Convention Board)

Issues like credit score, manufacturing, wages and GDP are all measured to create the Convention Board LEI.

That is how the US’s appears as we speak:

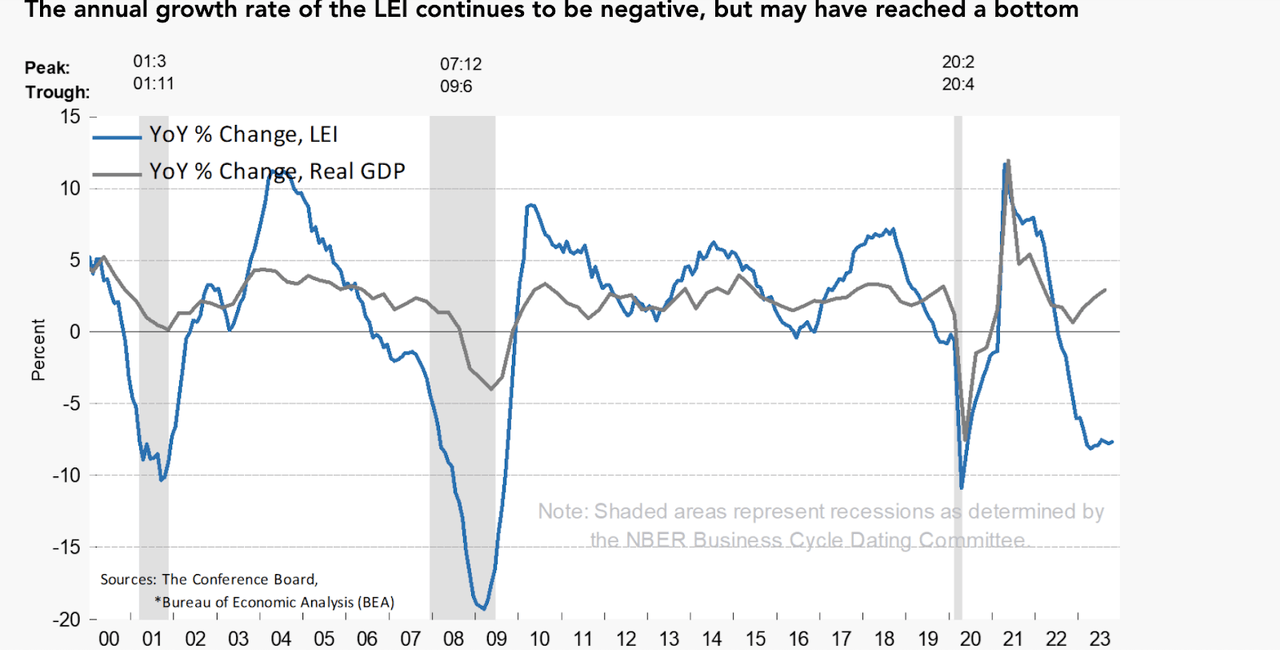

LEI YoY Progress (Convention Board)

The shaded areas present earlier recessions, which we are able to see have coincided with intervals of extremely destructive YoY change within the LEI.

And whereas most of the LEI declined in 2022-23, we might have now reached a backside because the LEI begins to show. Discover additionally how Actual GDP has sharply modified course.

Based mostly on the LEI, one could be inclined to consider the US might have narrowly prevented a recession.

Sahm Rule

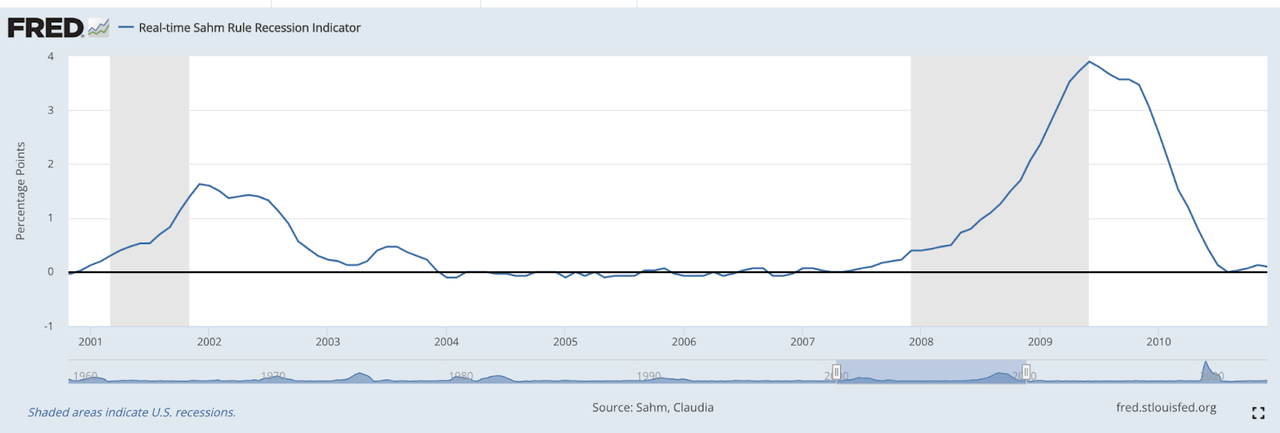

“Sahm Recession Indicator indicators the beginning of a recession when the three-month shifting common of the nationwide unemployment price (U3) rises by 0.50 share factors or extra relative to its low throughout the earlier 12 months.”

Supply: Wikipedia

St Louis Federal Reserve developed this on October nineteenth, and is a manner of figuring out the speed of change of unemployment.

Sahm Rule (FRED)

Again in 2002 and 2009, the Sahm Rule did moderately effectively at “predicting” the recession. Nevertheless, it’s true that by the point the indicator had reached 0.5 we had been already in a recession. In 2001, we entered a recession when the indicator reached 0.3, and in 2008, when it reached 0.4.

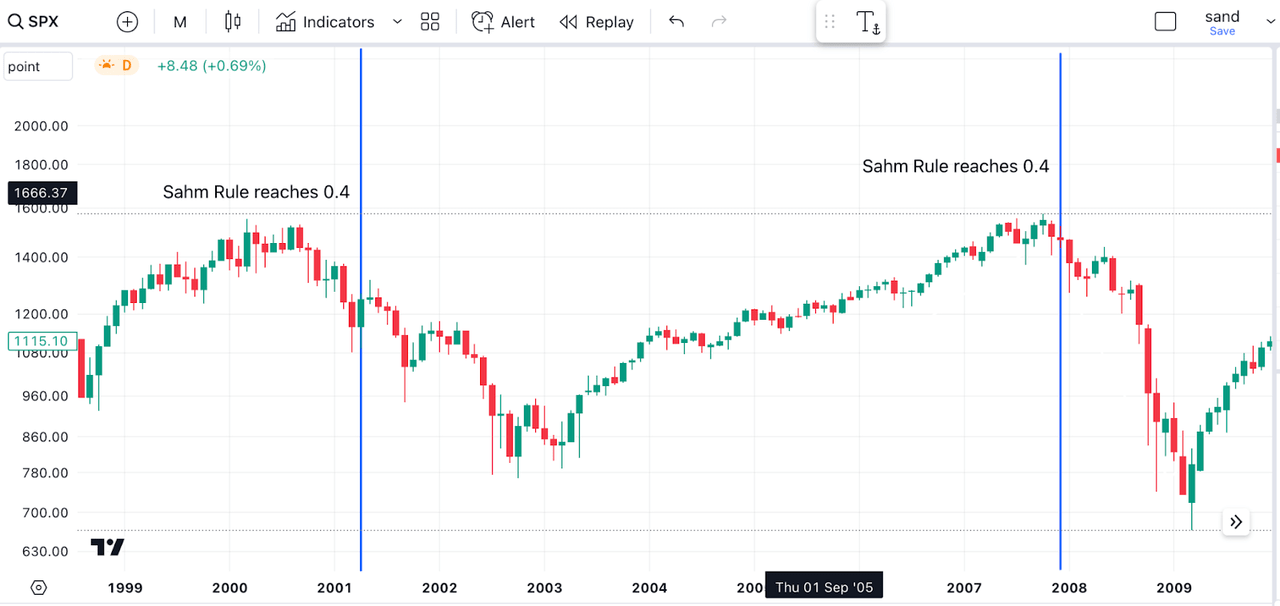

In each situations, although, one would have finished effectively to promote when this indicator reached 0.4:

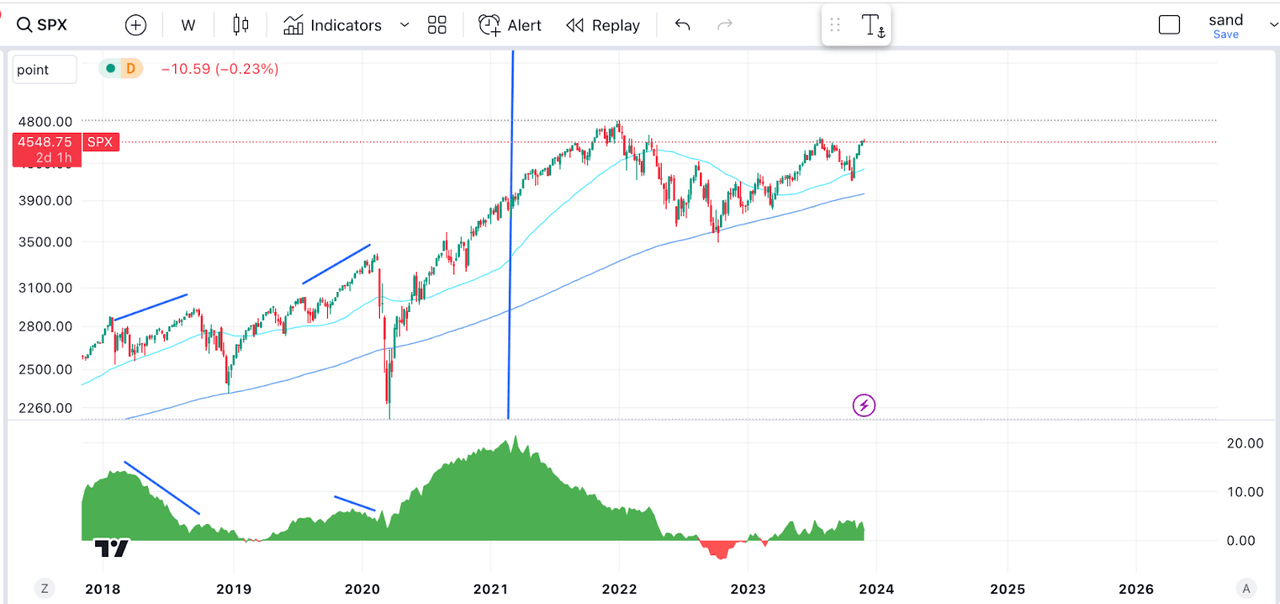

SPX and Sahm Rule (Writer’s work)

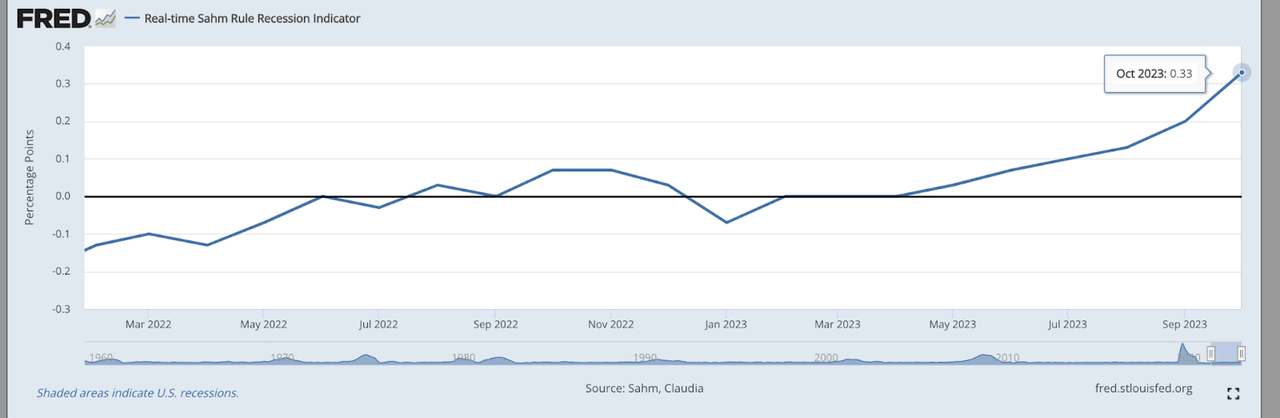

As we speak, the Sahm indicator sits at 0.33

Sahm Rule (FRED)

Although unemployment continues to be low, it has been deteriorating. If this had been to achieve 0.4, it might be a purpose for alarm, in my view.

Yield inversion

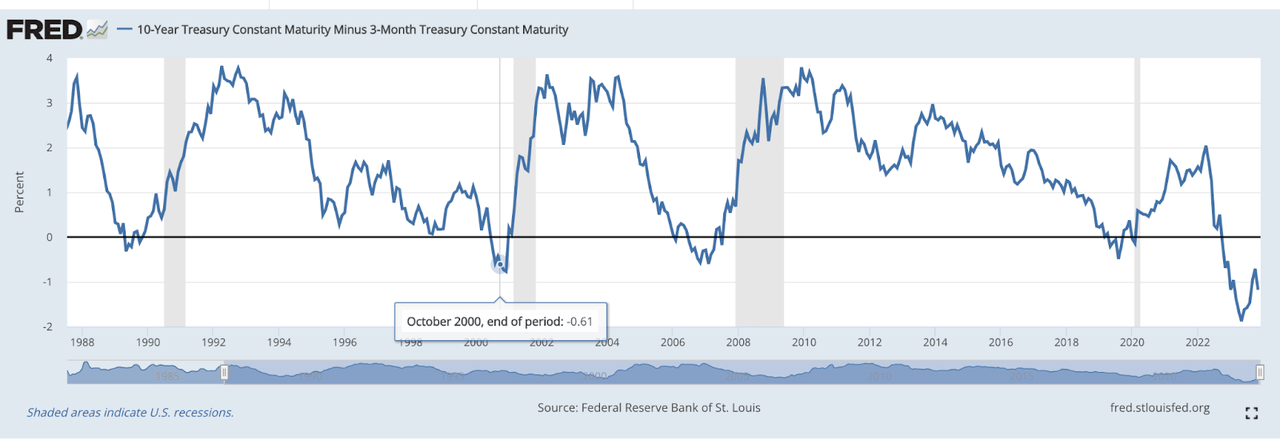

The Yield inversion is one other very fashionable indicator that’s usually touted. Yield inversions have been superb at predicting recessions lately:

Yield Inversion (FRED)

The chart above exhibits the unfold between the 10YR notes and 3-month payments. First, let’s be aware that when talking of inversions, we are able to use many various variations. One other well-liked one is 10YR-2YR, for instance. As we are able to see right here, a yield inversion has preceded the final 4 recessions.

However why? What does an inverted yield curve imply precisely?

The yield curve tends to invert when the long-term finish of the curve begins to fall. This occurs as a recession begins to be priced in, and development charges are anticipated to fall. The yield then inverts, and a recession comes following the un-inversion.

Typically, the yield uninverts because the Fed begins reducing the Fed Funds, affecting the curve’s short-end.

In current months, the Yield curve started uninverting because the lengthy finish of the curve started to rise. This is named a bear steepening. Which is not usually good, because the identify suggests.

Nevertheless, in current months, long-term charges have begun to ease. Might they’ve stopped already?

In 2024, the Fed is anticipated to start slicing charges, which might contribute to an inversion of the curve. However in and of itself, just a few price cuts shouldn’t damage the market. In reality, the market would doubtless cheer these price cuts.

In 2019, markets rallied as charges had been reduce. It is solely when charges are reduce shortly as soon as a recession is already clearly underway that we are able to discover a “correlation”. However, if something, recessions trigger price cuts, not the opposite manner round.

M2

M2 is a measure of broad cash, which incorporates money and deposits. It’s usually seen as indicator of the well being of the financial system. Decrease M2 means deposits are shrinking, maybe as a consequence of tighter lending requirements.

M2 and SPX (Writer’s work)

The chart above exhibits the evolution of the SPC and the YoY change in M2 within the pane under. As we are able to see, adjustments within the development of M2 may be good indicators of market tops and bottoms. For instance, in 2020, markets rallied as M2 was reducing, and shortly after, we had a high. Markets then topped in 2021 as M2 development peaked and bottomed when it went destructive.

M2 has now begun rising, which is supportive of a inventory market rally. In 2024, international central financial institution price cuts ought to be supportive of extra M2 development, as decrease charges facilitate lending/borrowing.

Takeaway

These indicators laid out above may help us decide the place the financial system goes, however none can present us with sure solutions. Macro is as a lot artwork as it’s science, and every thing needs to be interpreted. Guidelines are made to be damaged, and previous occasions aren’t essentially indicative of what’s going to occur sooner or later.

My very own take? Given the expansion in M2 and the approaching price cuts, mixed with the present power within the US financial system, I believe the inventory market will rally within the first half of 2024. Markets will cheer the delicate touchdown narrative, however will they be proper?

I worry by the second half of 2024, we might see clear indicators of recession, and if that’s the case, I will be taking income, hopefully close to the highest.