da-kuk

Palo Alto Networks’ (NASDAQ:PANW) Q1 FY2024 outcomes have been considerably tender, with NGS development starting to average and {hardware} gross sales normalizing. The corporate stays effectively positioned although, as a consequence of its giant buyer base and broad portfolio of options. Particularly, XSIAM and SASE ought to drive development going ahead. The inventory is beginning to look absolutely valued although, which means buyers mustn’t depend on additional a number of growth to drive returns.

Market

There are a variety of cybersecurity traits that ought to show favorable to Palo Alto over time. The SEC now requires corporations to disclose breaches inside 4 days, growing the necessity for instruments that allow corporations to quickly establish and remediate points. This could assist drive demand for safety operations instruments like Palo Alto’s XSIAM.

Adversarial cybersecurity exercise additionally continues to extend, each when it comes to the quantity and scale of assaults. Particularly, ransomware assaults are growing in frequency and severity. This could see cybersecurity spending proceed to extend as a proportion of IT budgets.

Consolidation can be an rising development that’s more likely to show useful to Palo Alto. A few of that is being pushed by clients, with 75% of corporations pursuing a vendor consolidation technique. There are literally thousands of cybersecurity corporations and the most important solely has 1.5% market share. This means that cybersecurity is structurally totally different from many different software program classes, though this could possibly be set to alter. The rising significance of information and cloud infrastructure supplies economies of scale, and synergies between instruments are making an built-in portfolio of options the popular method.

Whereas the long-term outlook is favorable, Palo Alto’s enterprise continues to face near-term headwinds because of the macro atmosphere. Scrutiny stays elevated and gross sales cycles are longer than regular. Companies are adjusting to the upper rate of interest atmosphere although, with a lot of cybersecurity distributors suggesting that market circumstances have been stabilizing.

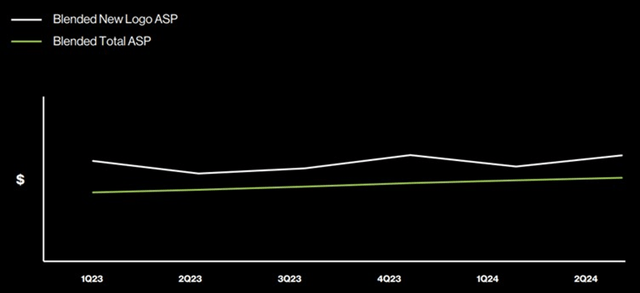

Palo Alto lately said that the pricing atmosphere has stabilized, coming after pricing stress within the earlier fiscal yr. Pricing stress has been attributed to opponents attempting to dislodge Palo Alto. This presumably refers to Palo Alto’s next-gen safety choices, which is fascinating provided that CrowdStrike’s (CRWD) pricing has been pretty secure. This might then be a reference to SASE, the place Cloudflare (NET) seemingly has a considerably lower-priced product.

Determine 1: CrowdStrike Pricing (supply: CrowdStrike)

Information

The rising complexity and class of assaults signifies that information is now central to cybersecurity. Palo Alto believes that for many corporations, 45% of safety information comes from the firewall and one other 40% comes from the endpoint. Palo Alto’s giant buyer base (~62,000 firewall clients) and strong place inside the firewall market subsequently offers it a powerful aggressive place from an information perspective. Palo Alto analyzes round 76 terabytes of information per day and believes that it’s the largest consumer of BigQuery on the earth. This entry to information is behind Palo Alto’s XSIAM answer and is troublesome for many corporations to copy.

As a counterpoint, CrowdStrike has said that round 85% of the dear information comes from the endpoint as information will get filtered as it’s transferred throughout the community, inflicting a lack of constancy.

Palo Alto Networks

Palo Alto lately advised that it’s centered on integrating its options. This might counsel that the corporate is now approaching a full suite of options and that the tempo of acquisitions could decline going ahead. Palo Alto remains to be pursuing acquisition in the interim although, lately buying Dig Safety and Talon Cyber Safety for 232 million USD and 435 million USD respectively.

Firms like CrowdStrike have been touting their unified options, which is clearly a shot at Palo Alto’s technique. There are execs and cons to inner improvement although. For instance, it could possibly be argued that Fortinet’s deal with inner improvement has left it on the again foot in SASE.

With prices entrance of thoughts for purchasers, together with the rates of interest, Palo Alto has carried out a lot of methods to assist appeal to and retain clients. The corporate lately made the Unit 42 Speedy Incident Response Retainer out there without charge to all of its strategic clients. Different actions embrace annual billing plans, financing by means of PANFS, and accomplice financing.

SOC

Palo Alto believes that present safety operations middle approaches are outdated and that the market is about to endure a paradigm shift. SOCs monitor, detect, and reply to threats however that is changing into troublesome because of the quantity and complexity of assaults. SIEM is used post-breach or post-event to determine what occurred, however enforcement and remediation capabilities are wanted. Automating the safety operations middle can be essential, as there’s a labor scarcity inside cybersecurity. SOC presents a 30 billion USD alternative, which Palo Alto believes may develop to 80-90 billion USD over the following decade, pushed by AI.

Palo Alto’s XSIAM product was launched near 12 months in the past and did round 200 million USD of bookings within the first 9 months. XSIAM combines an endpoint agent with an information lake and AI, permitting imply response instances to say no dramatically.

Palo Alto’s Cortex buyer rely elevated by 25% YoY in Q1 FY2024 to over 5,300 clients. Whereas that is spectacular, Palo Alto seems to view Cortex largely as a buyer acquisition instrument for XSIAM. The corporate’s XSIAM pipeline is now over 1 billion USD, of which 500 million USD was created within the final quarter alone.

SASE

Palo Alto estimates that SASE shall be a 20-30 billion USD market, and to date solely round 15% of the market has adopted this structure. Palo Alto continues to counsel that there are solely two and a half gamers out there. Presumably referring to Palo Alto, Zscaler, and one among Fortinet, Cato, or Cloudflare.

Palo Alto lately acquired Talon Cyber Safety to assist its SASE enterprise. Talon supplies distant browser isolation know-how. The mix of Talon and Prisma SASE will allow customers to securely entry enterprise purposes from any gadget. Palo Alto has advised that this isn’t at present addressed by any SASE vendor however each Cloudflare and Zscaler have browser isolation options.

SASE is a vital development driver for Palo Alto in the intervening time, with its SASE ARR growing roughly 60% YoY in Q1.

Cloud Safety

Palo Alto’s cloud safety enterprise shall be bolstered by the deliberate acquisition of Dig Safety, which is able to present Information Safety posture administration capabilities. Round 70% of organizations have information saved within the public cloud, and the safety of that information is threatened by generative AI and a proliferation of cloud providers. Palo Alto plans on integrating Dig’s capabilities into its Prisma Cloud platform.

{Hardware}

There continues to be an industry-wide normalization on the {hardware} facet of Palo Alto’s enterprise. As provide chain pressures have eased, backlogs have been lowered, and for some corporations, that is now impacting gross sales. Palo Alto has said that it by no means had a big backlog, which can be contributing to the relative energy of its product enterprise. Going ahead Palo Alto expects mid- to low-single digit {industry} product development.

Monetary Evaluation

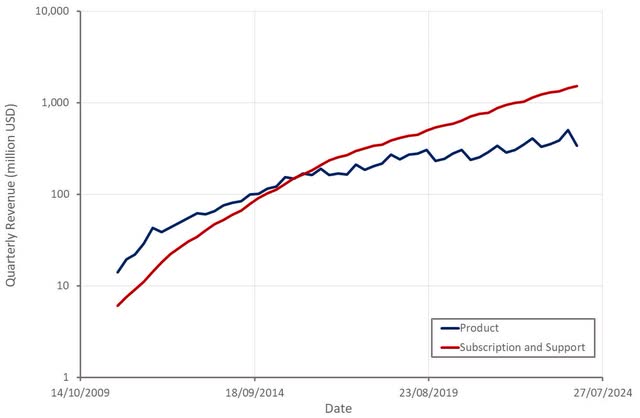

Palo Alto’s income elevated 20% YoY in Q1 FY2024 pushed by development in next-gen safety options. NGS ARR grew 53% YoY and is now in extra of three billion USD. Product income grew 3% and whole service income grew 25%, with subscription income rising 29% and assist income rising 17%. Development was pretty constant throughout areas, with Palo Alto’s Americas enterprise rising 20%, EMEA up 19%, and JPAC growing 23%.

Second quarter income is anticipated to be 1.955-1.985 billion USD, a rise of 18%-20% YoY. For the complete fiscal yr, income is anticipated to extend 18-19%, with NGS ARR anticipated to develop 34-35% YoY. The anticipated decline in NGS development ought to be regarding for Palo Alto buyers, as it’s this a part of the enterprise that has been Palo Alto’s development engine over the previous few years.

Determine 2: Palo Alto Income (supply: Created by writer utilizing information from Palo Alto Networks)

Palo Alto continues to win new clients, significantly bigger organizations, and is driving adoption of its platform inside that buyer base. As of Q1, 56% of the International 2000 has transacted with Palo Alto. 34% of Palo Alto’s buyer base has deployed all three type elements. Inside Palo Alto’s high 100 community safety clients, 60% have bought all three type elements, and on common these clients spend over 15 instances greater than Palo Alto’s different community safety clients.

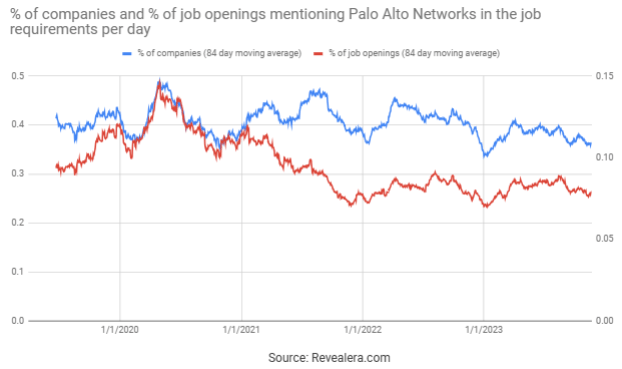

Determine 3: Job Openings Mentioning Palo Alto Networks within the Job Necessities (supply: Revealera.com)

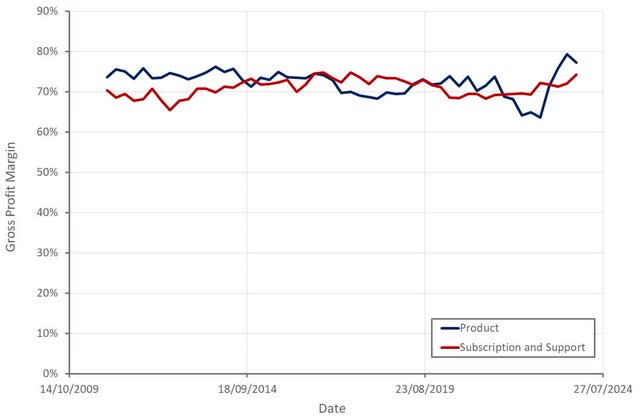

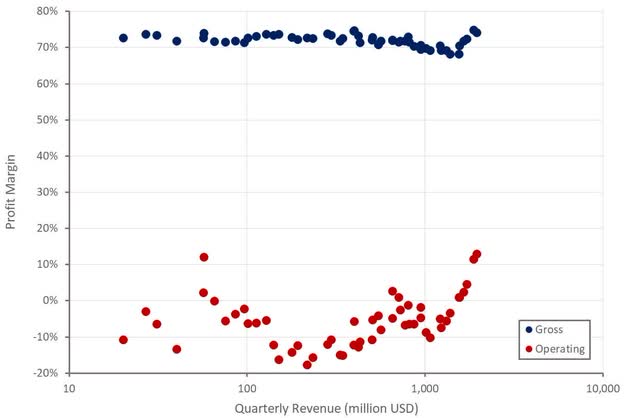

Palo Alto’s product gross revenue margins are trending larger due to development within the contribution from high-margin software program income. The easing of provide chain pressures additionally seemingly contributed to the rebound in product gross revenue margins. The expansion of Palo Alto’s XSIAM and SASE options must also be supportive of gross revenue margins. Given Palo Alto’s reliance on the hyperscalers for infrastructure, SASE margins might not be that prime although.

Determine 4: Palo Alto Gross Revenue Margins (supply: Created by writer utilizing information from Palo Alto Networks)

Relying on how competitors evolves and the dimensions that’s reached, cybersecurity leaders like Palo Alto seem like heading in direction of working revenue margins effectively in extra of 30%. With Palo Alto demonstrating robust working leverage over the previous 2 years, that is now being mirrored within the inventory value.

Determine 5: Palo Alto Revenue Margins (supply: Created by writer utilizing information from Palo Alto Networks)

Conclusion

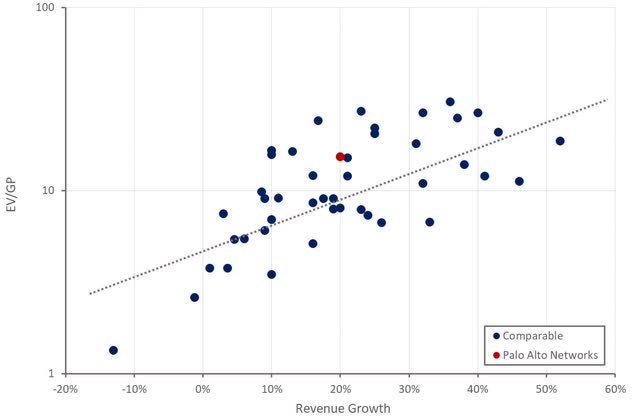

The market is at present inserting a premium on profitability, and this case is more likely to persist whereas rates of interest are elevated and financial uncertainty is excessive. That is favorable for Palo Alto, because it is among the few cybersecurity corporations providing each strong development at scale and profitability.

The corporate is now going through headwinds on the {hardware} facet of its enterprise, though, given its present income combine, this isn’t a big concern. Development is being pushed by cross-selling next-gen safety options to its current buyer base and leveraging its giant gross sales drive to quickly develop the income of acquired companies.

There’s a danger of development deceleration as Palo Alto begins to saturate its current buyer base although. Given the worth of options like SASE and XSIAM per buyer, and comparatively low adoption charges, this may occasionally not happen for a while but. Palo Alto’s inventory seemingly continues to do okay going ahead, offered the macro atmosphere stays secure, however there might not be way more room for a number of growth.

Determine 6: Palo Alto Relative Valuation (supply: Created by writer utilizing information from In search of Alpha)