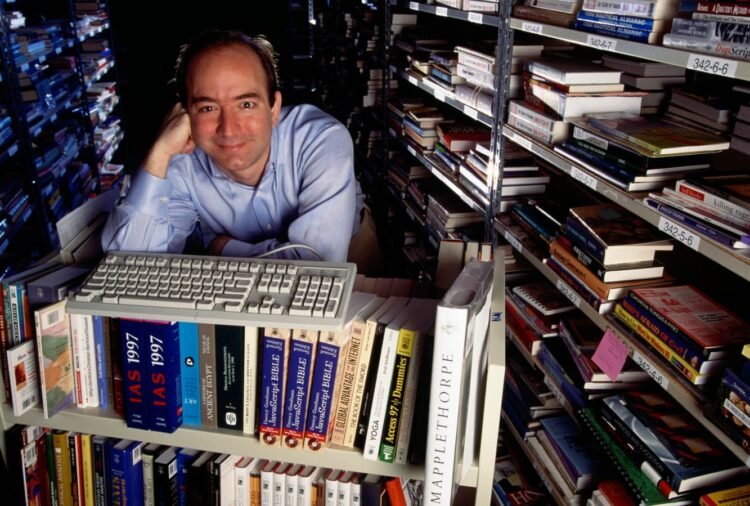

Bezos Selecting Books: Brilliance or Luck?

getty

Jeff Bezos invested $250,000 in Google in a very-early spherical as a result of he appreciated the entrepreneurs — Larry Web page and Sergey Brin. Based mostly on the success of this funding, an analyst means that the strange investor can contemplate a web-based platform “for anybody wanting to contribute to and develop with rising leaders in expertise and enterprise.”

Listed below are 4 elements that can assist you perceive Bezos’s smarts and determine whether or not it’s best to contemplate investing by way of a web-based platform.

#1. Beating the chances in Amazon.com.

Since most of the smartest VCs had rejected Google, Bezos was both good or fortunate. Given his monitor file, we will attribute his perception and resolution to brilliance. He’s mentioned to have sifted by way of about 600 merchandise earlier than selecting books as Amazon’s first product, which was good as a result of there’s a large listing of books, most of which aren’t in bookstores. He may additionally low cost the worth as a result of he didn’t have the fastened prices of bookstores, and the books could possibly be drop shipped by the wholesaler. The important thing lesson for entrepreneurs: Discover the best mixture of rising development, product on the rising development, buyer phase that may profit essentially the most from the product on the rising development, and direct opponents that may be overwhelmed by higher execution. Bezos obtained his edge within the product, whereas different unicorn-entrepreneurs obtained their edge within the buyer (Sam Walton, Michael Dell and Brian Chesky) or the technique (Invoice Gates).

#2. Investing in Google as an angel.

Not many small buyers get to see ventures like Google as a result of most house runs are in Silicon Valley, or they search excessive quantities per angel, and it’s unimaginable to determine a house run like Google earlier than there’s proof of potential. Bezos obtained to see Google at a really early spherical as a result of he had already launched Amazon, and he was in a position to detect the good potential of Google regardless that different, extra skilled VCs had rejected Google. Provided that solely about 1 out of 100,000 ventures turns into a house run reveals that Bezos was each good and fortunate.

#3. The percentages of investing success by way of crowdfunding websites.

Right here is an instance the place the entrepreneur, Palmer Luckey did nice by promoting his enterprise to Fb. His crowdfunding angels didn’t do as nicely. The truth is that early-stage VCs fare nicely as a result of they’ve the clout to management the enterprise and the sources to be the early dominators of an rising trade. Many of the others within the enterprise funding chain don’t do as nicely. So, crowds might need to be glad with non-financial returns. Crowdfunding websites are an excellent software for entrepreneurs to lift capital from many buyers with out lack of management. However whether or not these websites are nice for buyers is debatable. Provided that about 2% of VCs earn about 95% of VC earnings means that 98% of VCs don’t earn a lot. And VCs have extra clout than crowds to barter a greater deal. Early VCs usually have the best to vary CEOs to recruit professionals if the entrepreneur isn’t succesful, and so they make investments a lot later than crowds and angels when the danger is considerably decreased. Few angels win in enterprise financing.

#4. The percentages of investing success for those who make investments since you just like the entrepreneur.

Solely when you’ve got Bezos’s instincts – provided that VCs, the key professionals in early-stage VC fail on 80% of their offers. Most billion-dollar entrepreneurs succeeded attributable to their expertise, however it’s powerful to guage expertise till there’s proof of potential – not only a pitch deck. About 10 VCs rejected Apple as a result of they weren’t impressed with Jobs, and the board fired Jobs. So, for those who just like the entrepreneur, be happy to take a position. However be ready to lose your funding as a result of excessive danger. And be ready for the entrepreneur to dilute your pursuits when the enterprise can entice enterprise capital. Additionally, be ready for the entrepreneur to discover a “higher class” of family and friends when the enterprise takes off.

MY TAKE: It will be nice if journalists who tout crowd funding and angel investing studied the chances and made positive that crowds and angels know the dangers. There’s a distinction between shopping for a lottery ticket and “investing” all of your financial savings in lottery tickets.

So, is Bezos good or fortunate? Nobody can deny that he’s good. However is he additionally fortunate? He gained the “ovarian lottery” as Buffett so eloquently put it. Bezos was born in the best place, with the best genes and expertise, and on the proper time to leap on the rising Web development for which he was supremely certified. And Google turned out to be one of many best investments of all time. Is that brilliance or sheer luck?