Juanmonino/E+ through Getty Pictures

Kaspi.kz Joint Inventory Firm (OTC:KAKZF) has built-in itself into the each day lives of Kazakhs through a ‘super-app’ platform spanning three core providers – fintech (digital bank card Kaspi Purple and Kaspi Kredit), e-commerce (Kaspi.kz market), and funds (Kaspi Pay). The corporate has leveraged its platform into quarter after quarter of spectacular monetary development, most not too long ago outperforming consensus estimates but once more in Q3 2023 on the highest and backside traces.

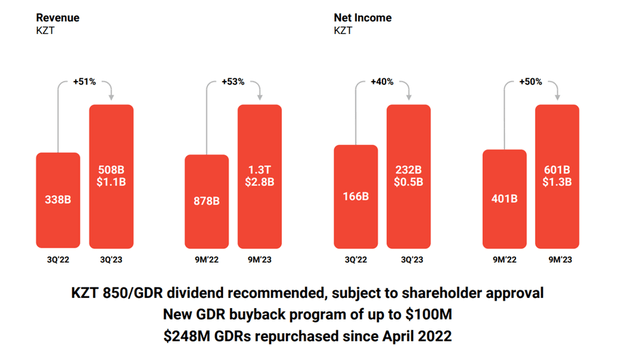

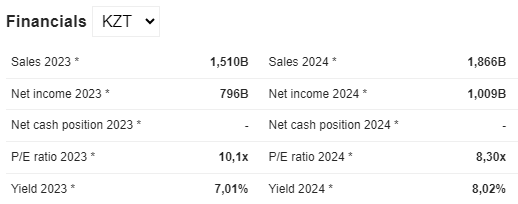

Administration hasn’t supplied up to date steerage numbers for This fall because of regulatory restrictions forward of a possible US main itemizing, which may imply heightened volatility within the meantime. However valuations aren’t stretched in any respect – even on the heels of its quarterly earnings momentum. Be aware the inventory is just priced at ~8x fwd earnings relative to 40-50% earnings development all through the primary 9 months of this yr. Whereas ready, Kaspi traders receives a commission a well-funded ~10% dividend yield (per the newly advisable payout in Q3) and a further $100m buyback through the depositary receipts (GDRs).

Kaspi

The important thing valuation hurdle stays Kaspi’s main itemizing on the comparatively illiquid Kazakhstan Inventory Change and its tightly held float (administration owns a big chunk of the shares). Administration is actively working to vary this, nevertheless, by itemizing within the US. Barring any unexpected hiccups in its registration with the Securities and Change Fee (SEC), a US share itemizing is probably going on the playing cards within the coming months, which is able to develop the investor base and inject huge liquidity into this thinly traded inventory. Forward of a US itemizing catalyst that does not but appear to be within the worth, all indicators level to a significant re-rating on the horizon.

Marketscreener

No Scarcity of Progress in Q3

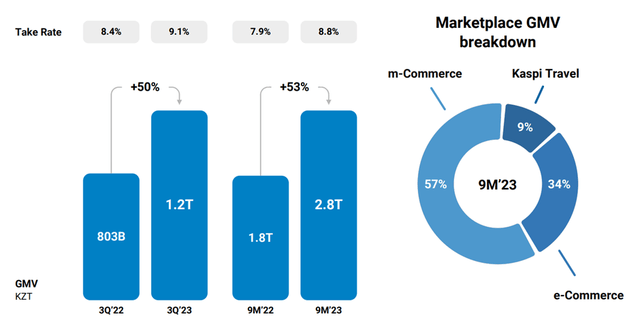

Kaspi’s Q3 outcomes noticed sturdy development throughout all of its core segments, driving total income development to +51% YoY. Inside Market, buyer numbers and transaction frequency moved considerably increased but once more, leading to a +50% YoY gross merchandise worth development and an elevated ~9% take fee. Whereas the e-commerce efficiency was little doubt helped by a document Juma gross sales occasion (Kazakhstan’s model of Black Friday), the extent of this quarter’s YoY development highlights the underlying momentum in Kaspi’s ecosystem.

Kaspi

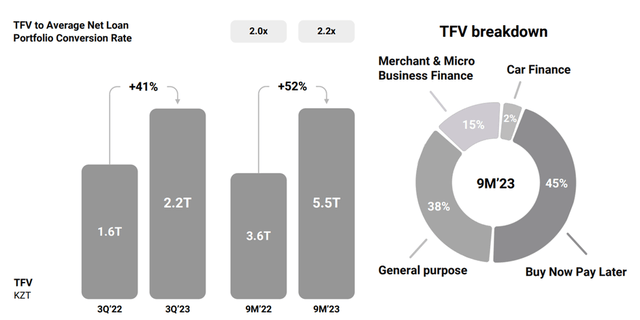

Fintech was much less of a P&L driver this time round because of strain on Kaspi’s spreads. That stated, the fintech enterprise has achieved properly within the context of the cyclical swings within the broader Kazakh economic system – the overall finance worth, a gauge of loans and financing product issuance by the platform, notably grew at a +41% YoY tempo. On common, mortgage development additionally reached +35% YoY for the quarter, well-matched by an extra growth of Kaspi’s buyer base and common deposit balances. And any headwinds to total mortgage yields (nonetheless very sturdy at ~19%) had been largely because of a rising share of lower-yielding merchandise like ‘purchase now pay later’ somewhat than any structural weak point.

Kaspi

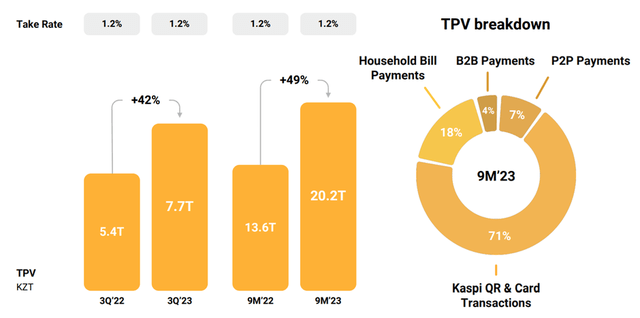

Equally on the funds facet, transaction values had been up +42% YoY on each increased cost prospects (+15% YoY) and balances (+22% YoY). B2B funds, particularly, are exhibiting sturdy development (albeit off a low base) and may proceed to help phase efficiency. Continued money circulation era from its core companies additionally means administration has ample steadiness sheet headroom to develop – with out tapping into exterior funding. To date, new development initiatives like e-groceries, journey, and classifieds are already flowing by to core revenues and, not like many different ‘super-app’ friends in rising markets, have not been massively cash-burning.

Kaspi

No Steering for Now, however Loads of Momentum

Regardless of the Q3 beat, there wasn’t a steerage elevate this time round. No adverse sign right here, although, because the silence was extra to adjust to the SEC’s registration course of for a future US itemizing. That stated, administration did cite extra momentum initially of This fall regardless of the broader financial headwinds in Kazakhstan. There’s additionally one other Juma marketing campaign in November, a well timed increase for the Market phase. Given the momentum within the 9 months to this point, I’ve no points underwriting extra upside into Q3. And if present valuations are something to go by, there’s doubtless nonetheless ample room for extra upward revisions forward.

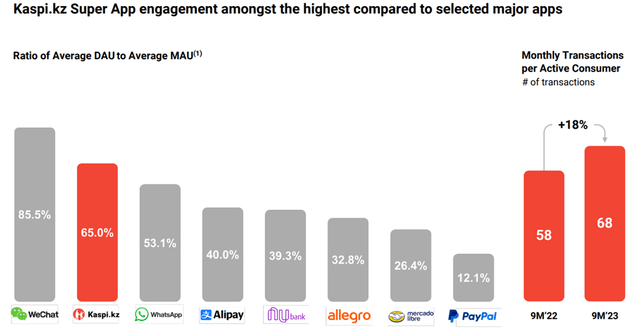

Including to the bullish This fall outlook is Kaspi’s announcement of a KZT850/GDR dividend payout (implied ~10% yield), in addition to a further $100m GDR buyback – in each instances, well-covered by its money era and sturdy steadiness sheet. Even after the massive payout, there can be greater than sufficient left over to reinvest in core development – key focus areas right here embody enterprise penetration on the Funds facet and capturing digitalization alternatives for Market. Plus, there’s a lovely basket of development choices that is being constructed out, as an example, e-grocery penetration (already reached profitability) and on-line classifieds growth (into transactions vs. the present advertising-based mannequin). Many of those synergize properly with the Kaspi ecosystem and reinforce its already ‘sticky’ moat – a key driver behind its rising engagement versus different ‘tremendous apps’ globally.

Kaspi

Compelling Progress Story with a US Itemizing Catalyst

Kazakhstan’s ‘super-app’ Kaspi.kz has unjustly flown below the radar in recent times. Not solely has it continued to outpace expectations by the cycles, however not like many different rising market ‘super-app’ platforms, Kaspi is rising with out sacrificing profitability or diluting shareholders. The YTD adj earnings development of +46% YoY (+40% YoY in Q3) is not mirrored within the present ~8x fwd P/E valuation both, leaving ample room for upside from right here. Additional including to the enchantment is a robust capital return coverage (high-single-digit to ~10% dividend yield and a $100m buyback of its GDRs) – just about unprecedented for high-growth ‘super-app’ names. Issues may change shortly, although, with administration at the moment negotiating a US itemizing, that may drive higher protection, liquidity, and far broader investor possession. This could, in flip, see the inventory re-rate increased in step with its elevated development trajectory. Internet, I feel present ranges provide traders a compelling entry level.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.