ING Economics, a high monetary and financial evaluation suppose tank, launched a report final week that boldly predicted that federal rates of interest will seemingly be reduce six instances in 2024. ‘’We’re presently forecasting 150bp of charge cuts in 2024 with an additional 100bp in early 2025’’, the report mentioned. This can be a huge declare, particularly after the constant charge rises we’ve been seeing over the previous 12 months, with charges presently standing at 5.25%-5.50%.

What Are the Components Behind the Prediction?

Broadly talking, ING defines the present financial local weather as ‘’cooling,’’ which is strictly what the Fed wanted to cease mountain climbing the charges. Three primary parameters all level to an financial slowdown. The primary is a cooling labor market. ING is cautious to level out that the job market is ‘’cooling, not collapsing.’’ Based mostly on the latest job market knowledge, each preliminary and persevering with jobless claims are rising, with persevering with jobless claims exhibiting a surge, up 32,000 to 1.865 million.

It’s not that corporations are firing employees. They’re simply not hiring new ones. All of that is ‘’proof of a cooling, however not collapsing, labor market,’’ as per the report.

The second issue that offers ING the boldness to make the prediction is the gradual easing of inflation pressures. ING metrics are exhibiting that inflation has slowed from 3.7% to three.5%, with indicators that the financial system is on monitor to achieve the goal inflation charge of two%, which is the goal the Fed has been working towards with its fiscal tightening insurance policies.

Lastly, client spending is slowing down in actual phrases. ING knowledge means that though client spending remains to be buoyant, it’s being propped up by debt and the utilization of financial savings. The important thing takeaway is that folks’s actual incomes are stagnating, with bank card delinquencies on the rise. The tip of scholar mortgage reimbursement aid can be contributing to monetary pressures, contributing to slower financial exercise general.

All of those elements mixed are fueling ING’s confidence in predicting a repeated slashing to rates of interest starting within the second quarter of 2024. ING’s chief worldwide economist, James Knightley, wrote, “We have now modest progress and cooling inflation and a cooling labor market—precisely what the Fed desires to see. This could affirm no want for any additional Fed coverage tightening, however the outlook is wanting much less and fewer favorable.”

What Are Different High Economists Saying About 2024 Charges?

The overall expectation shared by economists and markets is that charges will lower, however not earlier than the summer time of 2024. The CME Fed Watch Software is presently predicting that charges may begin reducing in June.

Some knowledgeable economists and financiers are extra optimistic of their forecasts. The billionaire and founding father of Pershing Sq. Administration, Invoice Ackman, informed Bloomberg that he expects the Fed to begin reducing charges as early as March. Ackman sees ‘’an actual threat of a tough touchdown’’ if inflation retains taking place whereas charges stay elevated. Funding financial institution UBS is even bolder in its forecast, predicting a 2.75% charge drop within the first quarter. The financial institution predicts that the Fed will reduce charges drastically with a purpose to put together for a looming recession within the second quarter.

The Fed itself has been markedly cautious in its statements, saying over and over that it’s too early to begin predicting charge decreases. Actually, the Fed hasn’t even definitively signaled that it’s completed elevating charges, not to mention committing to decreasing them. Atlanta Federal Reserve President Raphael Bostic informed CNBC again in late October that he doesn’t foresee a charge reduce till ‘’late 2024’’. Bostic mentioned: “There’s nonetheless a whole lot of momentum within the financial system. My outlook says that inflation goes to return down nevertheless it’s not going to love fall off a cliff.”

In a nutshell, Bostic doesn’t suppose there will likely be a recession. Any charge cuts will likely be modest, and they’ll come later within the 12 months slightly than sooner. The cautious observe could be sensible provided that repeated recession forecasts thus far haven’t materialized, with inflation solely simply starting to return down. We’re not even certain that the all-important goal charge of two% will likely be reached in 2024. So, it’s seemingly too early to inform whether or not the optimistic ING prediction will come true.

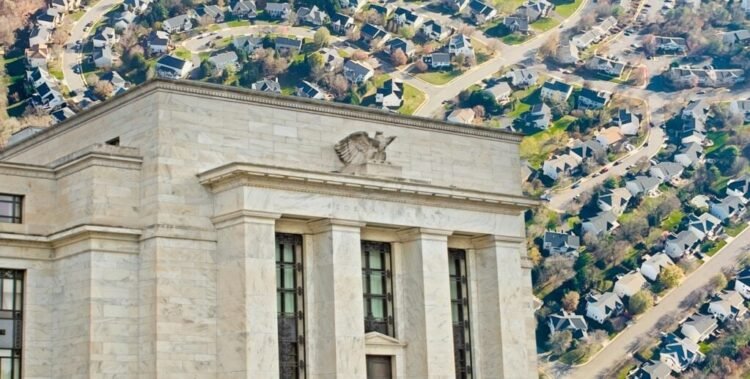

The Impression on Housing

The overall consensus is that with decrease charges, demand will return to the housing market in higher numbers. There’s additionally a idea swirling round that the “lock-in” impact that’s been plaguing the market ever since charges began growing will unlock as charges fall. Sellers will really feel much less inclined to cling to their traditionally low charges of three% and money their houses in for a 5.5% charge.

Whether or not this involves fruition remains to be a debate, however many, particularly buyers, are wanting ahead to a lower-rate atmosphere.

Prepared to reach actual property investing? Create a free BiggerPockets account to study funding methods; ask questions and get solutions from our group of +2 million members; join with investor-friendly brokers; and a lot extra.

Word By BiggerPockets: These are opinions written by the creator and don’t essentially symbolize the opinions of BiggerPockets.