In the event you’re contemplating beginning a enterprise concerned in importing or exporting merchandise, you’ll have to find out about commodity codes and HS classes. These are used to categorise items for import and export, to ensure they’re moved safely and in compliance with customs, tax and responsibility rules.

On this information we’ll take a look at when and why commodity codes are used, what they appear like, and methods to discover the appropriate one in your wants.

Right here’s all you’ll want to find out about commodity codes.

>See additionally: EU import modifications – what’s altering from January 1

What are commodity codes?

A commodity code gives particulars of the products you’re importing or exporting, resembling what they’re, what they’re made from, how they’re used and even how they’re packaged. This info is used for monitoring imports into the nation, and ensuring that hazardous objects are correctly handled, but in addition for calculating import responsibility and VAT.

To import something into the UK, you’ll want to ensure the appropriate commodity code is included in its customs declaration. In the event you can’t accurately match your items to the appropriate code, you’ll not solely be be paying the flawed customs duties but in addition risking critical authorized penalties.

Attainable penalties of utilizing the flawed commodity code

- Having to pay top-up taxes (import VAT and duties)

- Having to pay a customs nice

- Having your deliveries delayed to pissed off prospects

- Having your items seized

Yow will discover the proper commodity code utilizing the on-line commerce tariff lookup device. Alternatively, you will get particular recommendation from HMRC, or use the Authorities-issued product classification guides to assist.

Why you’ll want to find out about commodity codes

Commodity codes have plenty of makes use of in import and export companies. They’re used when finishing paperwork for customs declarations and might affect the quantity of tax and responsibility you pay to import or export a product. Utilizing the proper commodity code can also be necessary to be sure to’re following any related authorized or security rules when importing merchandise which may be harmful or restricted.

Construction of the code publish Brexit

Commodity codes now need to be included within the customs declaration that you’ll want to offer to clear any items by way of UK or EU customs. This can clarify how a lot taxes – VAT and tariffs – try to be paying.

The UK is utilizing the usual international 10-digit format, as does the EU, which might add 4-digit codes required to use sure measures, resembling commerce defence or sure suspensions.

Commodity codes are made up with a spread of digits that determine a selected product. They specify the kind of product, supplies used and the manufacturing technique as follows:

- HS code digits: It begins with the worldwide customary – Harmonised System, or 10-digit HS code. The UK has used this format since January 2021

- EU further digits: The EU has added as much as an additional 4 – making doubtlessly 14 in complete. These additional EU numbers are: 2 digits CN heading (Mixed Nomenclature); 2 digits TARIC (Built-in Tariff of the European Communities)

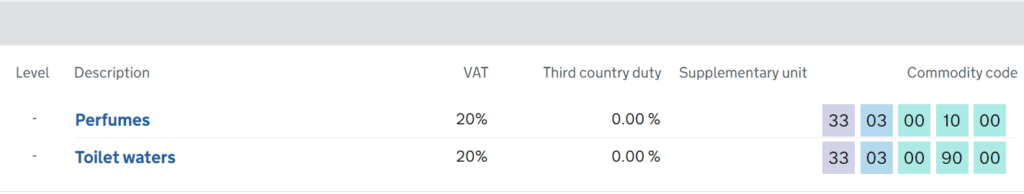

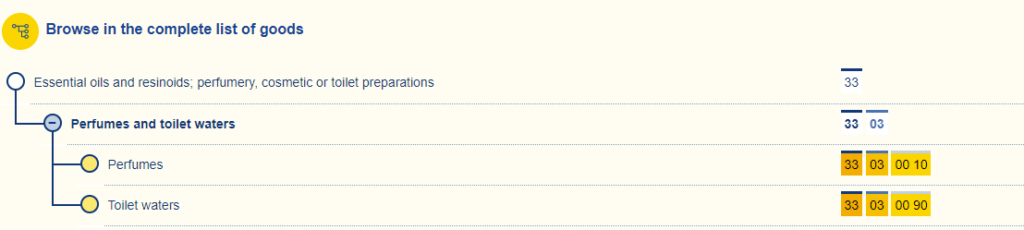

For instance, when you seek for the commodity code for “fragrance” on the UK commerce tariff search engine, the UK HS code is 3303001000.

Yow will discover the EU commodity code by way of the Access2Markets on-line service, which ought to match typically.

Professional tip: The Access2Markets is geo-blocked when you’re in Nice Britain and the nation you enter within the “nation from” discipline is an EU member state; though it’s not blocked if the “nation from” is the UK.

It’s potential that the EU and UK don’t classify each merchandise the identical. Nonetheless, as each are members of the World Customs Organisation, they apply the Harmonised System, which is expressly designed to realize uniform classification throughout contracting events.

Professional tip: If anyone is exporting from the EU then the EU export declaration would solely require the EU commodity code to 8-digits. The longer commodity code can be required on the UK import declaration.

A UK enterprise can use the Access2Markets (with the “nation from” being the UK), to acquire a commodity code, truncate it to 8-digits to be used on the EU export declaration. Alternatively, you should use the superior search operate on the EU TARIC web site and truncate.

So with just some numbers, the importers and exporters – and each different authority and organisation which handles the merchandise on the best way – know precisely what they’re coping with.

Discover your commodity code with the commerce tariff search for

- Go to the UK authorities commerce tariff search for web page

- Hit Begin Now

- Enter the search time period you need to use – the dialogue field will mechanically populate with frequent searches that can assist you

- Prompt commodity codes will seem, beginning with the HS chapter and headings that can assist you slender it all the way down to the proper class of merchandise

- You possibly can proceed to look the strategies utilizing different info, resembling what the merchandise is made from or how it’s packaged

- As soon as you discover the proper merchandise kind you’ll be proven the HS code, and any necessary info related to this code – resembling whether or not or not you want a licence to import or export objects beneath this code.

What occurs when you don’t have a commodity code or use an incorrect one?

In the event you use an incorrect commodity code, you may discover that your items are seized or delayed by customs. You may pay incorrect VAT or responsibility, and – when you pay too little – may very well be answerable for additional charges and prices.

Some objects can solely be imported or exported with a licence, resembling vegetation, animals, or something doubtlessly hazardous. In the event you attempt to transfer these merchandise utilizing an incorrect commodity code, you’ll be breaking the legislation, and can end up in critical authorized bother.

The best way to discover out the appropriate commodity code

An alternative choice, when you can’t discover the commodity code you’re searching for, is to ask HMRC for recommendation on one of the best match code in your product. You possibly can contact HMRC utilizing the next electronic mail tackle:

classification.enquiries@hmrc.gsi.gov.uk

HMRC will reply to your electronic mail inside 5 working days. The EU member states have varied comparable instruments.

Earlier than you ask for recommendation

You’ll want to incorporate details about the product you’re planning to import or export, to get recommendation on the commodity code. Your message ought to embrace:

- Firm identify, if relevant

- Contact identify

- Contact particulars (electronic mail tackle and a contact quantity)

- The choice which greatest describes your merchandise: agricultural, chemical, textiles or ceramics – together with meals, drink, plastics, cosmetics, sports activities tools, video games, toys, clothes, sneakers, electrical, mechanical or miscellaneous – together with autos, optical and measuring gadgets, equipment, musical devices, metallic, furnishings, lighting, paper, printed matter, straw, glass, wooden, jewelry

- What the products are made from (if multiple materials, present a breakdown of supplies)

- What the products are used for

- How the products work or operate

- How the products are introduced or packaged

- Any code you suppose most closely fits your items

- A part of the code when you’ve been in a position to partially classify it

It’s best to ship a separate electronic mail for every product you need assistance with.

>See additionally: How will Brexit have an effect on my imports and exports? The place to seek out customs assist

The best way to acquire an EU-wide BTI ruling

In some circumstances it may be useful to use for a BTI – a Binding Tariff Data ruling, to verify your commodity code. It’s a authorized doc that confirms the commodity code agreed for the product you’re exporting, so there’s no guesswork concerned.

Getting a BTI might be useful since you’ll have certainty concerning the commodity code wanted in your imports or exports. It doesn’t value something to get a BTI ruling, however you might have to pay if there are assessments wanted, for instance, to find out the supplies utilized in your product.

This ruling normally lasts for 3 years and is legally binding all through the EU.

The EU operates a centralised EU Customs Dealer Portal that each one BTI ruling functions need to undergo. All processes by way of this portal at the moment are executed electronically and yow will discover the related particulars and associated sources right here: European Fee Taxation and Customs Union – BTI

The best way to apply for a BTI ruling

tariff.classification@hmrc.gov.uk

Use the above electronic mail to use to entry the EU Customs Dealer Portal when you’re primarily based in Britain, placing “Enrolment EU Central Service” within the topic line, together with your EORI quantity.

Yow will discover out extra concerning the course of right here.

HMRC will purpose to answer to your electronic mail inside 5 working days to verify you’ve been set as much as entry the EU Central Service and provide the hyperlink to entry it.

After you have the hyperlink, you’ll want to offer:

- Detailed details about your items, which might range relying in your items

- Brochures, manuals, images and samples the place applicable. If you’d like this info to stay confidential, you should inform HMRC

It’s also possible to let HMRC know what you suppose the commodity code ought to be.

What occurs after you’ve utilized

HMRC goals to answer to your software inside 4 months. You’ll be given a authorized doc informing you of the proper commodity code in your items and the beginning date for the interval of validity of the data. The doc additionally exhibits:

- Distinctive reference quantity

- The identify and tackle of the holder of the data, legally entitled to make use of it (selections are non-transferable)

- Description of the products (together with any particular marks and numbers) to determine your items on the frontier

- Foundation of the authorized justification for the choice

Nonetheless, six international locations – together with Britain – have their very own BTI ruling software websites that you would be able to undergo along with the EU central service.

Making use of for a BTI when you’re in Northern Eire

Binding Tariff Data selections might be issued by HMRC to merchants or people which have an EORI quantity that begins XI for items you’re aspiring to import into or export from:

- Northern Eire

- any EU member states, when you’re established in Northern Eire

Yow will discover extra details about making use of for a BTI determination when you’re primarily based in or exporting to Northern Eire right here.

Why commodity codes are necessary

Discovering the appropriate commodity code is likely one of the first stuff you’ll have to do earlier than you possibly can import or export items. It may be just a little complicated, however there may be assist at hand to be sure to get the appropriate code for your corporation wants. With the sources outlined right here, it’s best to be capable to discover all you’ll want to begin getting your import/export enterprise off the bottom.

Additional sources and guides

Import information: three important ideas and every thing you’ll want to know – Steering for navigating importing in a post-Brexit world.

Tariffs on items imported into the UK – The best way to verify the tariff charges that apply to items you import.

The Border Goal Working Mannequin and the way it will have an effect on your corporation – A proof of the brand new guidelines and processes for meals and plant imports that can come into pressure in 2024

5 issues to recollect when exporting for the primary time – Exploring the important thing challenges for first-time exporters