400tmax

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) might be one of the crucial intriguing investments amongst large tech, buying and selling at a considerably low valuation in comparison with the remainder of the group.

Nonetheless, plainly the corporate’s administration continues to pile one mistake over one other, with the most recent being a demo of its extremely anticipated Gemini mannequin, which overexaggerated its present capabilities.

For my part, the controversial launch overshadows larger and extra basic issues, together with monetization capabilities, and dangerous strategic selections which span throughout many traces of the Alphabet enterprise.

These are issues that traders ought to fastidiously take into account earlier than leaping in on the low valuation.

Introduction – Who Will get The Credit score For The Yr-To-Date Efficiency?

I’ve maintained a Purchase score on Google since I began overlaying the corporate on Looking for Alpha again in March, though I continuously reiterated my view that the corporate’s administration is destroying worth.

In my first article, I emphasised operational inefficiencies, wasteful non-core actions, and a scarcity of concentrate on shareholder curiosity. In my second article, I mentioned Google’s important inferiority within the cloud and talked in regards to the firm’s complacency, claiming it is ready for exterior components to enhance relatively than striving for in-house enhancements.

Regardless of its flaws, Google has supplied traders with a 49.37% return year-to-date, and it isn’t too removed from all-time excessive ranges. Nonetheless, for my part, the credit score for its efficiency needs to be principally attributed to a low valuation to start the yr, in addition to easing exterior components and altering market sentiment.

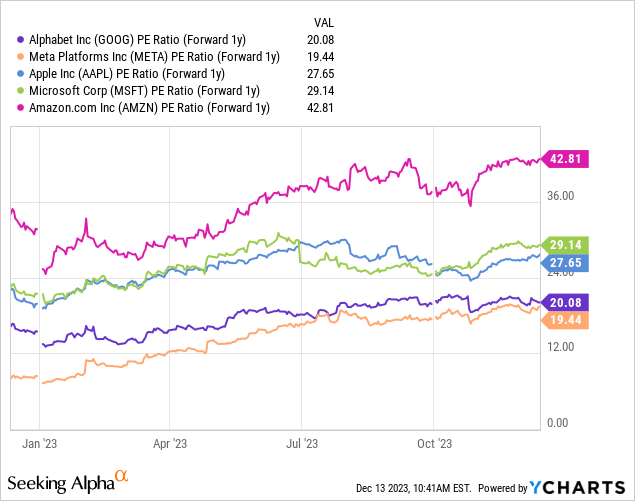

Right now, Alphabet trades at a 20.0x P/E a number of over its projected 2024 EPS, which is marginally above Meta at 19.4x, and considerably beneath Microsoft (MSFT), Apple (AAPL), and Amazon (AMZN), which commerce at 29.7x, 33.4x, and 42.8x, respectively. That is additionally considerably beneath Google’s historic common, which stands within the 25x-26x vary.

Contemplating regulatory questions which were weighing down on Alphabet for a few years now, it is clear that traders are removed from score the corporate as excessive as they used to.

On one hand, Google nonetheless dominates the search engine market and owns a one-of-a-kind asset in YouTube. Then again, the corporate continues to lag behind Amazon and Microsoft in cloud and AI, its most vital development drivers.

As well as, traders are fairly annoyed with the corporate’s lack of concentrate on effectivity, rising losses in non-core actions, and incapability to generate significant revenue from the cloud enterprise.

Let’s sort out every downside at a time, and assess whether or not or not it’s fixable.

The Questionable Demo Is One Factor, However What About Monetization?

The overly constructive demo naturally generated a number of buzz. It additionally overshadowed a way more vital query, which is how Google plans to generate income from AI normally and Gemini particularly. Here is an instance from Citi analysts, who’re fairly bullish on the Gemini launch however fail to quantify its precise monetization affect.

If Alphabet does not need to assist us and Citi does not need to assist us both, we’ll have to aim and reply that query ourselves. For my part, there are three main fronts the place AI (and Gemini) can produce tangible worth for Google shareholders, specifically, Google Cloud, search, and ad-targeting.

Elevated Demand For Google Cloud

Following varied product bulletins from Amazon and Microsoft, Google will lastly introduce its personal Gemini-based add-ons to the Google Cloud suite, which may help development.

The issue is that each Microsoft and AWS are the dominant gamers within the house, with a first-movers benefit. Gemini should be considerably superior with a view to make enterprises select Google over the dominant gamers.

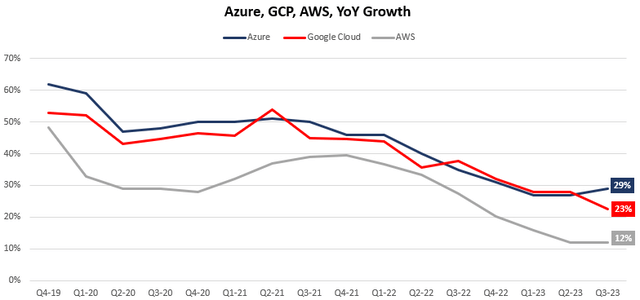

Created and calculated by the writer utilizing information from the businesses’ monetary experiences; Microsoft’s fiscal quarter is 2 intervals forward of the calendar yr, which means Q3-23 is Microsoft’s fiscal Q1-24.

As we are able to see, Alphabet’s GCP, regardless of its smaller dimension, grew slower than Azure in calendar Q3-23, and was the one one which skilled deceleration within the quarter. The inferior efficiency may be attributed to normal weak spot in comparison with the opposite gamers, in addition to no actual AI contribution.

Accelerated Development In Search & Bard

Beginning with search, it is exhausting to think about a world the place Google captures extra worth from search than it already does. I’m of the opinion that Google’s AI ambitions on this house are extra defensive than offensive, particularly as the corporate continues to lose share to non-pure search choices like TikTok or Instagram (ask your self the place you go to seek for a restaurant, journey concepts, or a product evaluate).

And on the Bard entrance, the enterprise mannequin stays unclear. In the meantime, ChatGPT surges forward with its 2-million builders base, premium subscriptions, and already obtainable API modules.

Improved Advert-Focusing on

As Citi mentions of their evaluation, higher ad-targeting, fueled by higher AI capabilities, ought to help development and profitability in Google’s legacy promoting companies, throughout YouTube, search, and the remainder of the divisions.

Nonetheless, I imagine the Gemini launch is not a game-changer on that entrance, as machine studying has been fueling these companies for a few years. For an anecdote, OpenAI was initially based by poaching main AI engineers from Google and Fb, pushed by a aim to take among the AI energy away from large tech. So ad-targeting is already exploiting important machine-learning know-how, and there is no cause to count on a sudden acceleration in that entrance from Google.

And even on the promoting entrance, plainly Google is lagging behind Meta, with Meta rising promoting revenues by 23.5% within the quarter, in comparison with Google Providers’ 10.8% development (though it isn’t an ideal comparability).

Lagging Behind…

Microsoft said AI will likely be its quickest enterprise to succeed in $10 billion in revenues and has already launched a number of merchandise together with Copilots, and OpenAI-based merchandise in Azure. Amazon has had Bedrock, CodeWhisperer, and a number of other different AI choices obtainable for fairly a while.

In the meantime, even after the Gemini launch, there’s nonetheless a number of uncertainty surrounding Google’s AI merchandise, and its skill to compete with the 2 dominant gamers. To me, till there’s a way more quantifiable plan and better readability, the inventory will proceed to commerce on the low finish of its valuation vary.

Strategic YouTube Selections

I made a decision to focus on YouTube particularly, as I believe it is a good instance of the general questionable technique set out by Alphabet’s administration.

Core YouTube, for my part, is certainly one of, if not essentially the most, impeccable belongings owned by Google. YouTube’s worth proposition for content material creators is by far the main providing, and whereas it does compete with the likes of TikTok and Instagram, there’s actually no various for 60-second-plus movies. As well as, these different platforms are method much less engaging for creators, who sometimes must go outdoors the platform for monetization or construct their very own promoting enterprise (i.e. influencers).

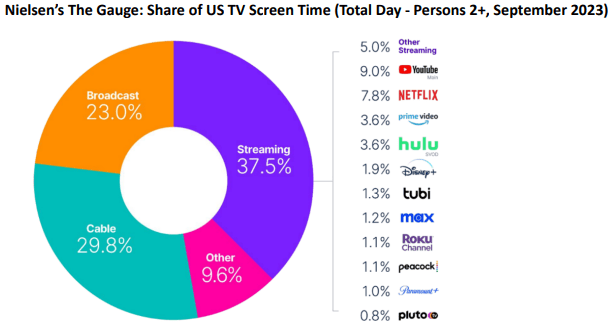

Netflix Q2-23 Letter To Shareholders; Primarily based on Nielsen Information.

YouTube constantly takes extra share of TV time, and stays the primary streaming choice within the U.S., confidently above Netflix. And, YouTube has a major benefit over rival streamers, because it does not must spend any cash on content material, and any danger of success or failure that comes with it.

However what did Google’s administration resolve to do? It determined to enter the lower-margin TV enterprise. Reportedly, the corporate is paying $2 billion {dollars} yearly for NFL rights and is now within the enterprise of promoting TV bundles. In an identical ‘late-to-the-party’ vogue, identical to with Bard, Alphabet entered the sphere after one other large rival, Amazon.

It additionally entered the short-form video panorama with YouTube Shorts, but it stays method behind in Shorts monetization (in contrast to Meta which has reached neutrality with Reels).

Whereas it might be argued that these are adjoining engaging companies Google ought to need to take part in and are accretive to core YouTube, I believe this demonstrates some form of sample from Google’s administration.

Valuation

All of it comes right down to this. As you possibly can see in my earlier article (and spoiler alert: on this article as properly), I saved a Purchase score for Google all year long, which turned out to be right. I did so regardless of my very lengthy checklist of issues with the corporate, and the reason being fairly easy – most of those issues are already priced in.

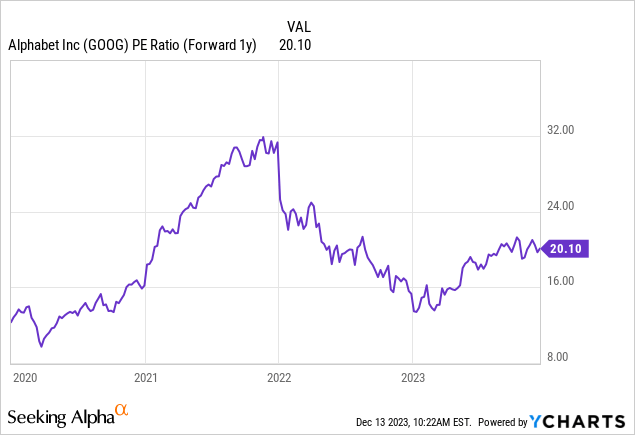

Within the first part of the article, we noticed that Alphabet is almost tied with Meta for the most affordable inventory amongst large tech. Now, Alphabet’s valuation relative to its historic ranges, we are able to additionally see that it is buying and selling on the low finish of its vary. With a 20.1x P/E over anticipated 2024 earnings, Google’s guardian is buying and selling practically 23% beneath its 5-year common.

For my part, the market is at present valuing Alphabet primarily based on the belief no in-house turnaround goes to occur within the foreseeable future. What do I imply by a turnaround? Nicely, there’s loads that Alphabet’s administration can do to obtain extra credit score from the market.

They will use the massive pile of money that is been sitting lifeless on the stability sheet and go for accelerated buybacks. They will lower non-core initiatives. They will turn into extra clear and impressive about their targets with new initiatives like Gemini. The checklist goes on and on.

Conclusion

Alphabet operates a number of of the highest-quality companies on this planet with YouTube, Google, and GCP. Following a few years of management, it appears the market views Google’s guardian as one of many ugly ducklings of huge tech, as the corporate trades for a considerably decrease valuation in comparison with its friends and in comparison with its historic ranges.

For my part, it turns into increasingly obvious that Alphabet has loads of pillars to enhance upon, as the corporate lags behind its rivals with product launches, innovation, and effectivity enhancements.

Nonetheless, I estimate all these issues are already priced in. This a lot potential for enchancment mixed with a really undemanding valuation, leads me to reiterate Alphabet as a Purchase, regardless of its many flaws.