Learn on to be taught extra about what occurred within the gold sector in 2023.

Gold worth in Q1

2023 was a much less unstable 12 months for gold than 2022, however the yellow metallic nonetheless skilled some drastic worth adjustments, particularly in the course of the first half of the 12 months. Gold began the interval at US$1,839 and shortly trended upward, buoyed by a weak US greenback and a 37 foundation level drop within the US 10 12 months Treasury yield. The metallic discovered further assist via central financial institution purchases, and by the top of January had reached the US$1,950.17 mark.

Features made via the primary month didn’t maintain via February, nonetheless. The gold worth plunged on the US Federal Reserve’s 0.25 p.c fee hike on February 1, and continued to retreat because the US economic system, the greenback and Treasury yields all noticed beneficial properties. The valuable metallic in the end fell to a year-to-date low of US$1,809.87 on February 23.

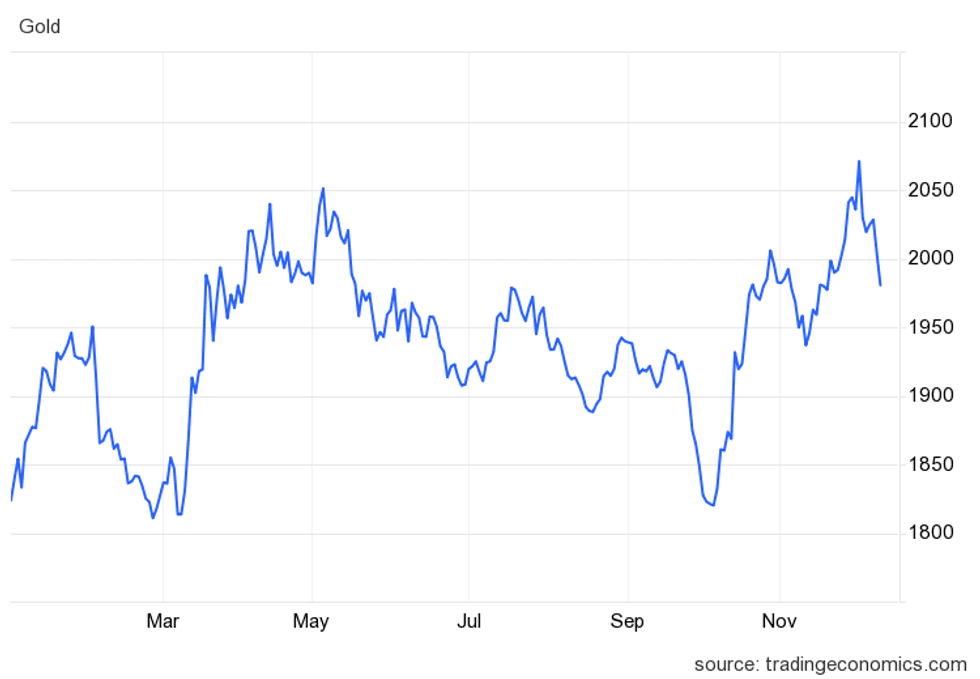

Gold worth from January 1, 2023, to December 11, 2023.

Chart by way of Buying and selling Economics.

A reversal got here in early March as a banking disaster hit the US, starting with the collapse of Silicon Valley Financial institution (SVB). A lot of SVB’s cash was in Treasury bonds, which turn into riskier when rates of interest are excessive — SVB didn’t have the money available to cowl growing money withdrawals from struggling tech trade shoppers.

Because of this, it introduced on March 8 that it had bought off a few of its securities portfolio at a lack of US$1.8 billion. The transfer despatched its share worth plummeting, and federal regulators stepped in as shoppers clamored to withdraw their money.

That very same day, Silvergate Financial institution in California introduced it was winding down operations and liquidating property. This occasion was adopted shortly after with the March 12 information that Signature Financial institution in New York Metropolis was additionally being shuttered. The 2 banks had turn into vital monetary establishments for cryptocurrency firms, with failed crypto trade FTX being a serious consumer of Silvergate.

These collapses despatched shockwaves via the worldwide monetary system, and contributed to the mid-March collapse of Credit score Suisse, Switzerland’s second-largest financial institution. It had been stricken by years of mismanagement and scandal.

The banking disaster helped the gold worth leap from US$1,814.04 on March 5 to US$1,989.13 by March 15. The quarter closed out with the second of the Fed’s 2023 fee hikes on March 22. The central financial institution tacked on one other 0.25 p.c to boost charges to five to five.25 p.c.

Gold worth in Q2

The second quarter was characterised by a continued insecurity within the international banking system, and these considerations allowed gold to interrupt above US$2,000 on April 3. Ongoing investor fears drove the value of gold to a near-record excessive of US$2,049.92 on Might 3. Nevertheless, the Fed introduced its third fee hike of the 12 months that day, growing charges to five.25 to five.5 p.c and conserving the yellow metallic’s beneficial properties in test.

With rates of interest at a 22 12 months excessive and confidence returning to the banking sector, investor sentiment for gold waned in late Might and into June as interest-bearing property gained traction.

Gold worth in Q3

The third quarter was the quietest a part of the 12 months for gold, though main international indexes just like the Dow Jones Industrial Common (INDEXDJX:.DJI), the S&P 500 (INDEXSP:.INX), the S&P/TSX Composite Index (INDEXTSI:OSPTX) and the Nikkei 225 (INDEXNIKKEI:NI225) hit year-to-date or close to year-to-date highs within the first half of the quarter.

The July via September interval noticed the gold worth pattern downward, however the greatest losses got here on the finish of the quarter. On September 20, the Fed introduced it could maintain rates of interest at 5.25 to five.5 p.c. 5 days later, the value of gold started to plunge, first dropping under US$1,900 after which falling additional to finish the interval at US$1,848.63.

Gold worth in This fall

With gold falling to a year-to-date low of US$1,820.01 on October 4, the dear metallic gave the impression to be on observe to drop under the US$1,800 mark within the fourth quarter. Nevertheless, the October 7 assaults by Hamas on Israel began a brand new spherical of violence within the Center East, sparking considerations about neighboring Arab states being drawn into the battle.

Because the battle continued, gold made beneficial properties all through October, closing at US$2,007.08 on October 27; it fluctuated between US$1,930 and US$2,000 via the top of November. Gold’s momentum continued on the again of Israel-Hamas worries and different elements, reaching document excessive of US$2,152.30 throughout intraday buying and selling on December 3.

The tip of the 12 months additionally noticed traders waiting for the Fed’s subsequent transfer. The consensus is that the central financial institution is completed with hikes and will not make one other transfer till it begins to decrease charges in mid-2024. Nevertheless, the Fed is maintaining a tally of the economic system and has steered fee hikes aren’t off the desk because it tries to satisfy its 2 p.c inflation goal.

Gold provide and demand in 2023

Whereas provide and demand dynamics aren’t normally a main issue in the case of the gold worth, sturdy central financial institution shopping for has helped preserve the yellow metallic elevated within the face of excessive rates of interest.

After setting a document in 2022 with purchases of 1,136 metric tons, central financial institution demand is on observe to set a recent document in 2023 — in complete, 800 metric tons had been purchased via to the top of Q3.

Gold M&A exercise in 2023

2023 is predicted to deliver the highest stage of gold sector M&A in a decade. From a jaw-dropping merger to a staggering preliminary public providing (IPO), listed below are some highlights that made the headlines.

Pan American and Agnico Eagle purchase Yamana

On March 31, Pan American Silver (TSX:PAAS,OTC Pink:PAASF) and Agnico Eagle Mines (TSX:AEM,NYSE:AEM) finalized their acquisition of Yamana Gold. Underneath the phrases of the deal, Pan American assumed management of Yamana’s Latin American property, including to its portfolio the Jacobina mining complicated in Brazil, the El Peñón and Minera Florida mines in Chile and the Cerro Moro mine and MARA improvement venture in Argentina.

Yamana’s Canadian property had been transferred to Agnico Eagle, consolidating its possession of each the Canadian Malartic mine and the Wasamac venture in Quebec, Canada, together with a number of exploration properties in Ontario and Manitoba.

B2Gold buys Sabina Gold and Silver

April 19 noticed B2Gold (TSX:BTO,NYSEAMERICAN:BTG) full its US$832 million acquisition of Sabina Gold and Silver. The association gave B2Gold entry to Sabina’s Again River Gold District in Nunavut, Canada, which consists of 5 mineral claims alongside an 80 kilometer belt, together with the totally permitted Goose venture.

Enormous gold IPO in Indonesia

July 7 introduced Indonesia’s greatest IPO this 12 months and one of many world’s best-performing IPOs in 2023: PT Amman Mineral Internasional (IDX:AMMN). The corporate raised the equal of over US$713 million in its debut, and shares have since surged 250 p.c in worth, giving the agency a market cap of US$30 billion as of December 11.

Newmont takes over Newcrest within the greatest deal of the 12 months

The largest deal of the 12 months was the merger of gold-mining titans Newmont (TSX:NGT,NYSE:NEM) and Newcrest. It was percolating within the minds of traders because it was first introduced on February 5, however wasn’t finalized till November 6 after shareholders from each firms overwhelmingly voted in favor of the deal.

Calibre Mining proposes merger with Marathon

On November 13, Calibre Mining (TSX:CXB,OTCQX:CXBMF) entered into an settlement to accumulate Marathon Gold (TSX:MOZ,OTCQX:MGDPF). If the deal is authorised, the businesses will mix to kind a mid-tier gold producer centered on operations within the Americas with common annual gold manufacturing of about 500,000 ounces.

Investor takeaway

Banking and geopolitical instability labored in opposition to excessive rates of interest and bond yields to maintain the gold worth elevated via a lot of 2023, even permitting the yellow metallic to make a recent all-time excessive.

With battle nonetheless simmering between Russia and Ukraine, and tensions at a boiling level within the Center East, gold could possibly keep its momentum in 2024, maybe spurring investor curiosity in equities.

“There are quite a lot of implausible firms on the market which have actually good sources which can be promoting for 1 / 4 to a fifth of what they might be promoting for in, not a euphoric market, however a normalized market,” Brien Lundin, editor of Gold E-newsletter, stated on the New Orleans Funding Convention initially of November.

Whereas gold shares, significantly juniors, will all the time be a riskier funding than the metallic itself, 2024 may current entry factors for traders searching for elevated income from firms whose backside strains have benefited from the excessive worth of gold for the previous few years.

Remember to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t replicate the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.