murat4art

Funding Motion

I beneficial a maintain ranking for TransDigm Group (NYSE:TDG) after I wrote about it the final time, as I believed the valuation was too excessive. That suggestion performed out nicely from August to October, when the inventory traded down by greater than 10%. What I didn’t anticipate was a really sturdy 4Q23 that drove a pointy rerating in valuation, resulting in an all-time excessive share value of $1015. Based mostly on my present outlook and evaluation of TDG, I’m revising my ranking to purchase as the expansion outlook for FY24 is healthier than I anticipated. The sturdy 3Q23 additionally proved that development momentum will not be slowing down. With this revised development outlook, even when valuation re-rates to the historic common, the upside continues to be engaging. TDG’s steadiness sheet additionally stays sturdy, suggesting extra alternatives for M&A.

Evaluate

TDG fared very nicely for the 4Q23 quarter, beating consensus on all main fronts: income, EBITDA, and EPS. FY24 steering additionally got here in above consensus estimate. The sturdy quarter was accompanied by a brand new $2 billion particular dividend. In particulars, TDG reported 4Q23 EPS of $8.03 vs. consensus of $7.55. The sturdy EPS efficiency was pushed by sturdy natural income development of 19%, supported by Industrial aftermarket development of 27%, Industrial OEM development of twenty-two%, and Protection development of 15%. EBITDA grew per income energy, touching $963 million, which displays a margin of 52%, a rise of 220bps. Wanting forward, administration offered the preliminary FY24 data:

- Income steering vary of $7.48 to $7.68 billion, exceeding consensus pre-results expectation of $7.4 billion;

- EBITDA steering vary of $3.87 to $4.01 billion;

- Adjusted EPS of $31 to $32.94.

I stay optimistic on all of TDG’s major finish markets and anticipate the sturdy development to proceed into FY24. Firstly, I view the sturdy bookings remark (consult with the 3Q23 earnings name) for every finish market as a number one indicator of development. Recall that TDG noticed related energy in bookings final yr, and FY23 development efficiency adopted by way of properly.

Secondly, TDG ought to see a good macro surroundings in FY24 because the world’s largest financial system (the US) seems to be recovering from the painful inflationary and excessive charges of 2023. Suppose the Fed minimize charges as hinted; this might be a significant increase to the financial system, which ought to circulate by way of to customers’ discretionary wallets as the price of dwelling comes down (resulting in extra potential air journey).

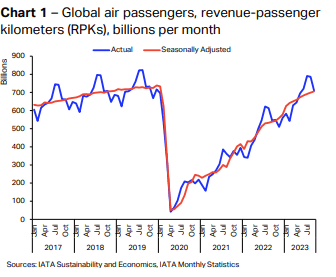

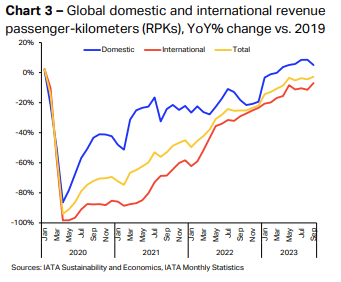

Thirdly, in accordance with the Worldwide Air Transport Affiliation (IATA), passenger development continues to get better steadily with no main slowdown in momentum. Notably, international worldwide income passenger kilometers (RPKs) are nonetheless beneath the CY19 stage, indicating that we’re removed from reaching the normalized stage but. As customers’ discretionary revenue improves (if the US financial system recovers because the Fed signifies), I anticipate RPK to proceed rising. Traditionally, TDG aftermarket quantity is nicely aligned with international RPK development, and I anticipate the pattern to proceed as nothing structurally has modified.

IATA

IATA

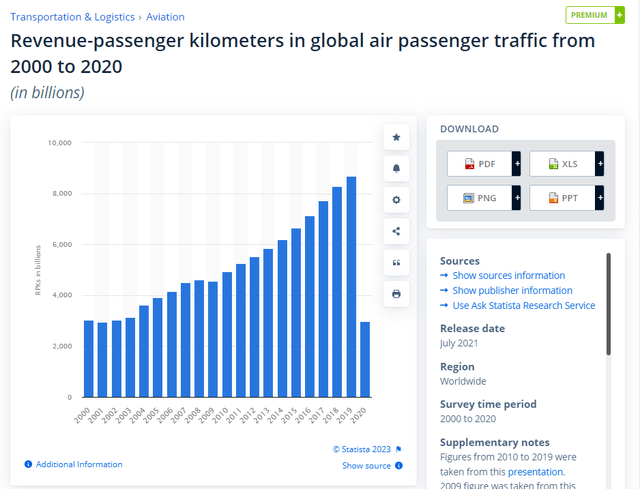

Administration feedback additionally recommend that total TDG continues to be removed from a normalized stage, as volumes are nonetheless modestly beneath 2019 ranges as we speak. Whereas they famous Freight and enterprise plane are above pre-COVID ranges, the remaining enterprise (passenger and interiors) continues to be down 15+%. As such, if we take into consideration the place the business ought to have been if COVID didn’t occur, TDG nonetheless has a big room to get better. That is particularly contemplating the historic passenger market energy (RPK development has been 1 approach up for the reason that 2000s), 4 years of GDP development, and the potential restoration of Chinese language vacationers. Air site visitors ought to proceed to develop from right here on out, due to all of those components.

Statista

Lastly, I just like the $1.4 billion acquisition of CPI Worldwide’s Digital System Enterprise (EDB). This aligns properly with TDG’s enterprise mannequin from a enterprise standpoint. Roughly 70% of EDB’s income comes from the aftermarket, and almost all of its income comes from proprietary merchandise. Given the present stage of uncertainty surrounding the end result, I cannot be factoring this into my estimates. Assuming, nevertheless, that it does move, TDG can have an opportunity to implement its playbook (altering costs, cross-selling, and many others.) and improve development and margin.

On the purpose of margin, administration laid out their FY24 steering for EBITDA margin to be at 52% on the midpoint, which suggests an enchancment of fifty bps on a year-over-year foundation. At first look, this seems to be a weak information, as Calspan is a headwind to margin. Nevertheless, my sense is that administration is likely to be too conservative of their steering, because the adj EBITDA margin fee for 2H23 was already at 52.2% and most of this era already included Calspan.

By way of steadiness sheet and capital allocation, TDG ended the quarter with a internet debt of ~$16.4 billion, and if the EDB acquisition goes by way of, internet debt ought to contact $20 billion. This suggests an FY24 internet debt to EBITDA leverage of round 5x. That is nonetheless a significant enchancment in comparison with the historic leverage ratio, and as such, I don’t see the enterprise going through any liquidity points. Importantly, if the Fed actually cuts charges, TDG ought to see a optimistic curiosity expense tailwind over the approaching quarters. TDG also needs to haven’t any subject decreasing leverage because the enterprise continues to generate greater than $1 billion of FCF and is anticipated to generate ~$4 billion of FCF in FY24/FY25 based mostly on consensus estimates.

Valuation

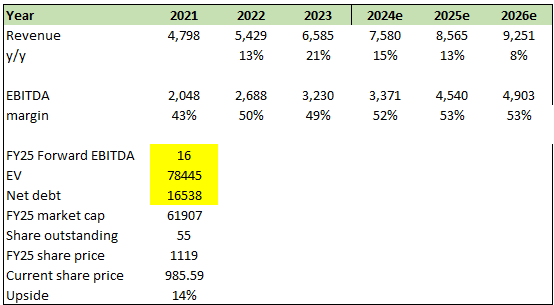

Creator’s work

With the sturdy 4Q23 efficiency and visual development drivers, I’m pushing out the expansion deceleration into FY25 and FY26 (I modeled the slowing to be FY24 and FY25 beforehand). My FY24 assumption is predicated on administration steering, which has traditionally been correct. Since FY13, reported income has usually been consistent with steering (<1% distinction on common). As for margin, I imagine administration is downplaying expectations because the 2H23 EBITDA margin is already above steering. Nevertheless, for conservative sake, I assume the identical margin as steering and anticipate enlargement in FY25. Beforehand, I believed that the TDG valuation was too excessive; nevertheless, with the revised outlook, I believe the valuation is now engaging, even when it reverts again to the historic common. There’s a good likelihood for valuation to maintain at 17x ahead EBITDA, and in that case, the upside within the close to time period could possibly be increased than I anticipate.

Danger and Ultimate Ideas

Integration danger stays an inherent danger to TDG’s M&A-driven technique. I acknowledge that TDG administration has sturdy competency in integrating their acquired targets. Nevertheless, that doesn’t eradicate this danger. A sequence of dangerous acquisition and integration hiccups might harm the administration popularity and the credit score that the market provides to the administration staff. All in all, I’m upgrading my ranking for TDG to a purchase as a result of stronger-than-anticipated development outlook for FY24. Wanting forward, optimistic macroeconomic indicators, bookings development, and steady restoration in air journey ought to maintain development for longer than I initially anticipated.