Funding thesis

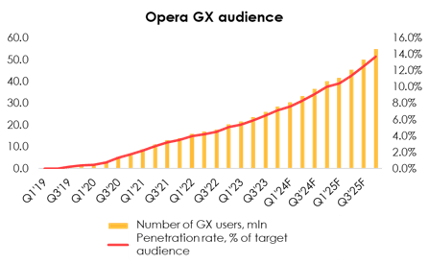

Opera (NASDAQ:OPRA) GX browser, coming to the market in 2019, was a breakthrough for the corporate. Regardless of GX’s persistently excessive consumer base development price in 2020-2023, the present penetration price is simply ~6.5% of the audience, which is able to permit the corporate to keep up a excessive consumer base development price. On the similar time, elevated GX ARPU’s will assist each revenues and EBITDA development charges within the center time period.

kfb/iStock through Getty Photographs

Revival of the model

Opera was based in 1995 and has been growing and selling an internet browser. Till 2000, the software program was delivered as a trial model and it was assumed that prospects would purchase the complete model after a trial interval. Nonetheless, since model 5.0, the browser provided a conditional free model the place customers had been monetized by banner advertisements.

As a big quantity of commercials had been topic to criticism, banners had been deserted in 2005, and the principle earnings of the corporate got here from partnership with Google (GOOG) (GOOGL), as their search engine was used within the default browser. In the meantime, the corporate additionally launched browsers for cell telephones.

Key adjustments started to happen after 2016, when the browser was taken over by a bunch of Chinese language buyers. The enterprise was cut up up – the remaining divisions throughout the mother or father firm had been renamed Otello Company ASA.

In 2017, the corporate launched a brand new product – Opera Neon browser with another design, in 2018 – Opera Information, an AI-based information company primarily concentrating on African audiences, and an up to date model of the Opera Contact cell browser. The brand new merchandise enabled the corporate to launch a brand new IPO with a valuation of ~$115 million.

After elevating funds, the corporate started a cycle of M&A, acquired a number of startups, and launched new merchandise :

- In 2019, the corporate launched the Opera Information Hub platform, a service designed to assist bloggers create content material.

- In 2020, the corporate acquired Estonian fintech startup PocoSys, which develops software program for banking providers.

- In 2021, the YoYo Tech division was purchased out from the Playtech Group and entered the Opera Gaming phase to advertise the event of browser-based video games within the firm’s new Opera GX product. From a browser for most of the people, the corporate switched to a gaming viewers.

- In the meantime, Opera launched the Dify challenge – a fee plugin with a digital pockets and cashback on companion web sites.

Clearly, it is onerous to compete with massive publishers like Google or Microsoft (MSFT) as an everyday browser, as Opera’s ecosystem shouldn’t be that developed. However, the corporate has discovered its audience within the gaming neighborhood. The comparatively free market and the individuality of the product permit Opera to keep up a excessive price of development within the variety of customers and improve revenues.

Opera GX is a worth driver

Opera GX is a browser with a give attention to the gaming neighborhood. Amongst all the corporate’s merchandise, GX was capable of match the area of interest most efficiently. Record of a number of distinctive options of the product:

- Limitation of used PC sources for higher efficiency in video games.

- Constructed-in Discord, permitting you to talk by the app straight from the browser.

- Intensive design customization choices.

- Constructed-in AI primarily based on ChatGPT Aria.

- GX.Retailer and GX.Video games shops that offer you entry to buy video games and digital content material.

The browser was introduced in June 2019 and at present has 26.1 million energetic customers and excessive consumer rankings, with a mean of 4.3-4.6 on a five-point scale.

In response to Statista, the PC gamer market is ~1.8 bn individuals, i.e. nearly 45% of the entire variety of world web customers. In response to administration calculations and Lab 42 survey, the corporate’s whole audience is round 400 mln individuals (excluding China). That’s, regardless of the excessive development price of the consumer base in 2020-2023, the product’s penetration price is at present lower than 7%, which means that the corporate nonetheless has room to develop by way of the variety of customers.

We assume that the variety of customers can develop to ~55 mln by the top of 2025.

Make investments Heroes

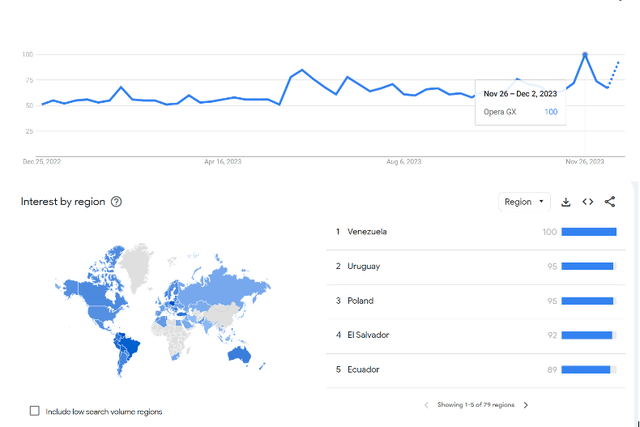

Our assumptions are additionally supported by Google Tendencies information, as GX search curiosity stays secure over time and the browser could be very common all all over the world.

Google Tendencies

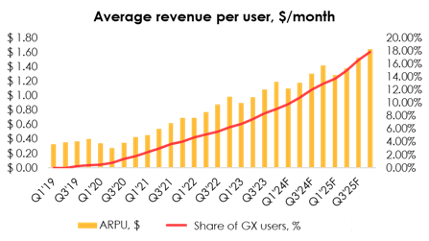

Amongst all merchandise, GX has the best common income per consumer, which will even allow the corporate to keep up excessive income and EBITDA charges.

Right now, the GX viewers accounts for less than 8.4% of the entire variety of Opera customers, however even regardless of the low share and conditionally free distribution mannequin, the common income per consumer has nearly tripled in 4 years. We assume that as “low cost” Opera Now customers are changed by energetic development of GX viewers, the corporate will have the ability to preserve ARPU development charges on the degree of 15-20% per yr.

Make investments Heroes

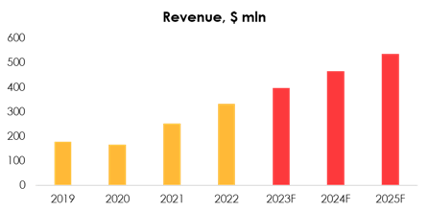

Thus, we assume Opera’s income might be $397 mln (+19.9% YoY) for 2023, $466 mln (+17.3% YoY) for 2024, and $536 mln (+15.2% YoY) for 2025.

Make investments Heroes

Secure enterprise profitability

Regardless of its comparatively small firm dimension and consumer base, in addition to fixed product updates, Opera has a reasonably secure natural profitability profile. In contrast to many IT firms, worker compensation within the type of inventory shouldn’t be the one cause why Opera is a worthwhile enterprise.

In response to AltIndex, Opera has solely about 606 workers and a quarterly wage finances of about $19 mln, of which $2 mln is stock-based compensation. Given the energetic growth of the gaming enterprise, we assume that the employees will improve and the wage finances will develop by a mean of 13% per yr.

Advertising prices elevated considerably in 2020-2021 with the launch of GX as Opera launched an enormous promoting marketing campaign to advertise the product, however the finances was decreased in 2022. In response to the corporate, 73% of latest customers come organically, 12% by paid advertising initiatives and 14% with the acquisition of a tool with pre-installed software program. We assume that Opera’s advertising coverage will proceed and the finances will develop in proportion to income sooner or later.

Different prices, which embrace consulting, licensing, hire, journey, and many others., are additionally secure and common $4-5 million per quarter or 4.5% of income.

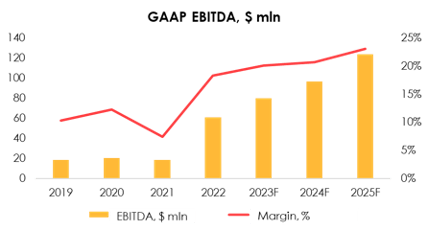

We challenge GAAP EBITDA of $80 mln (+32% YoY) in 2023, $97 mln (+21% YoY) in 2024 and $124 mln (+28% YoY) in 2025, and adjusted EBITDA (internet of dilution) of $89 mln (+31% YoY), $103 mln (+15% YoY) and $131 mln (+24% YoY), respectively.

Make investments Heroes

Valuation

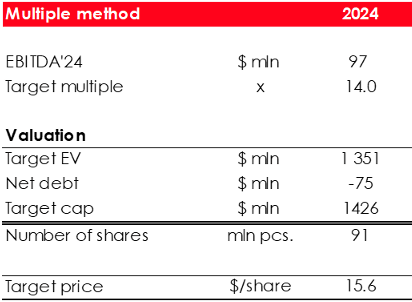

For valuation functions, we use an business EV/EBITDA a number of of 14.0x. The bottom for a number of estimation consists of such firms as Alphabet, pre-2022 Baidu (BIDU), Meta Platforms (META), and many others.

Based mostly on our calculations, the truthful valuation of Opera shares is $15.2/share discounted at 13%. Ranking BUY.

Make investments Heroes

Conclusion

Regardless of the presence of great rivals corresponding to Microsoft and Alphabet, Opera managed to search out its audience and an unoccupied area of interest out there. The Opera GX product meets the calls for of recent avid gamers a lot better than its analogs, which permits the corporate to extend its consumer base and ARPU at a excessive price. As well as, the corporate exhibits a secure degree of profitability with out diluting the shareholder capital.

To handle your positions, we advocate to observe Opera earnings releases.