GCShutter

A Fast Take On Conduent

Conduent Included (NASDAQ:CNDT) offers enterprise course of outsourcing providers to organizations and governments worldwide which have transaction-intensive functions.

I beforehand wrote about CNDT in September 2023 with a Maintain outlook on additional shopper spending headwinds.

The agency is forecasting unpredictability, which, when mixed with anticipated income decline in 2024 and ongoing uncertainty in its giant industrial division, my outlook on Conduent is to Promote.

Conduent Overview And Market

New Jersey-based Conduent offers a spread of outsourced enterprise course of providers to firms, governments and transportation issues.

The corporate is led by president and CEO Cliff Skelton, who was beforehand President of Fiserv Output Options.

The agency’s major choices embrace:

-

Industrial Industries

-

Authorities Providers

-

Transportation.

CNDT seeks new prospects through its direct gross sales and advertising efforts and thru numerous accomplice channel referrals.

Conduent serves just about all main trade groupings, the U.S. authorities and numerous transportation entities.

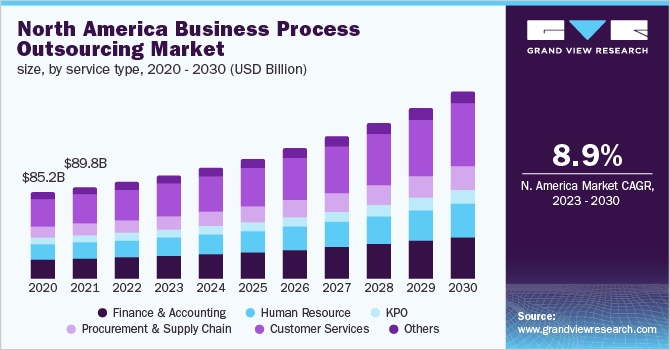

Per a 2023 market analysis report by Grand View Analysis, the worldwide marketplace for enterprise course of outsourcing was an estimated $262 billion in 2022 and is predicted to succeed in $537 billion by 2030.

This represents a forecast CAGR of 9.4% from 2023 to 2030.

The first causes for this anticipated development are the growing utilization of digital instruments and delocalized expertise to maximise enterprise efficiencies whereas enabling the enterprise to deal with its core competencies.

The flexibility of outsourcing providers is rising as different varieties of service course of automation and intelligence add to the return on funding for enterprises.

Under is a chart exhibiting the historic and anticipated future development trajectory of course of outsourcing providers within the U.S. from 2020 to 2030:

Grand View Analysis

Main aggressive or different trade members embrace:

-

24/7 Intouch

-

Appen

-

TDCX

-

Accenture

-

TaskUs

-

Genpact

-

Tata Consultancy

-

Cognizant

-

Teleperformance

-

Telus Worldwide

-

TTEC

-

VXI

-

Sutherland.

Conduent’s Current Monetary Developments

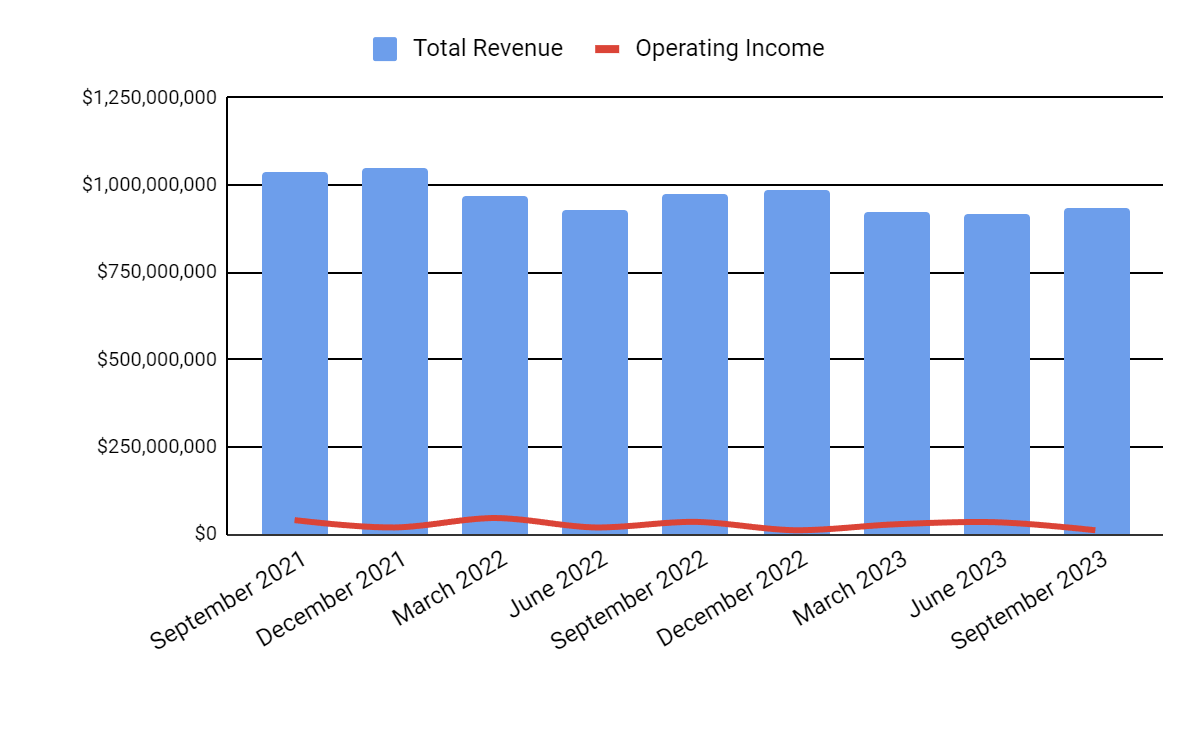

Complete income by quarter (blue columns) has continued to say no because of softness in its Industrial phase, which accounts for the most important phase the corporate serves; Working revenue by quarter (crimson line) has additionally dropped not too long ago:

In search of Alpha

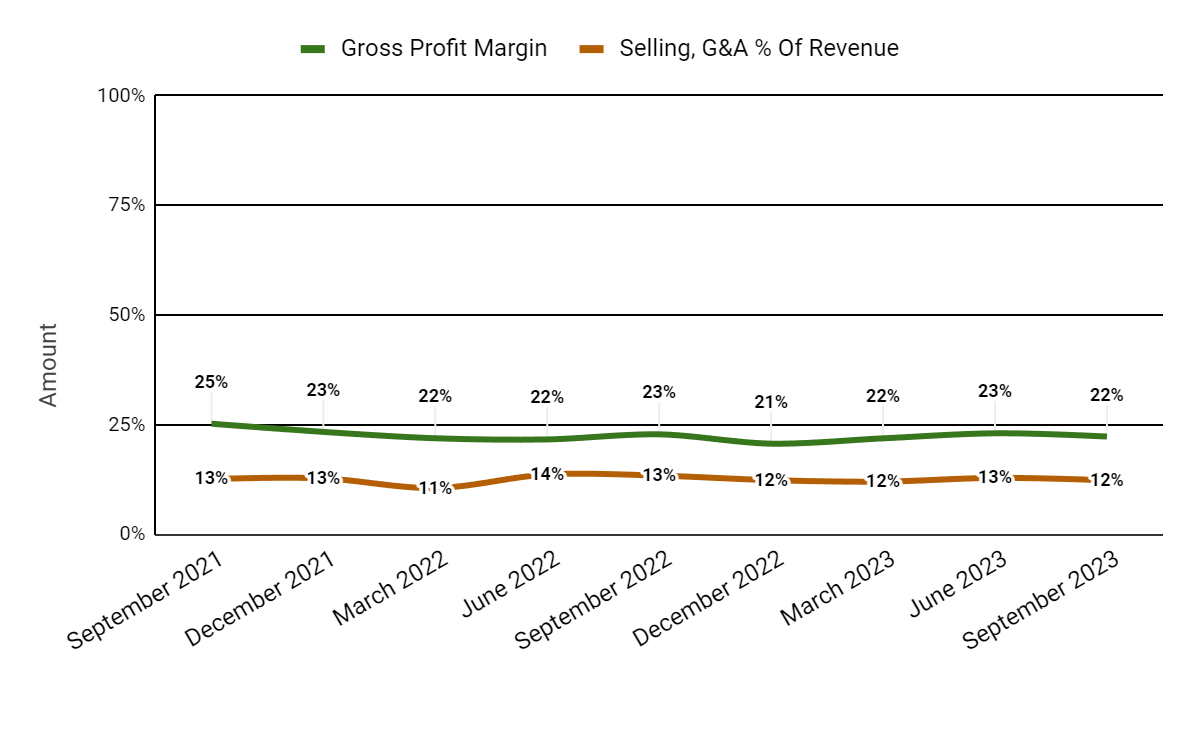

Gross revenue margin by quarter (inexperienced line) has remained secure in current quarters; Promoting and G&A bills as a share of whole income by quarter (amber line) have additionally modified little.

In search of Alpha

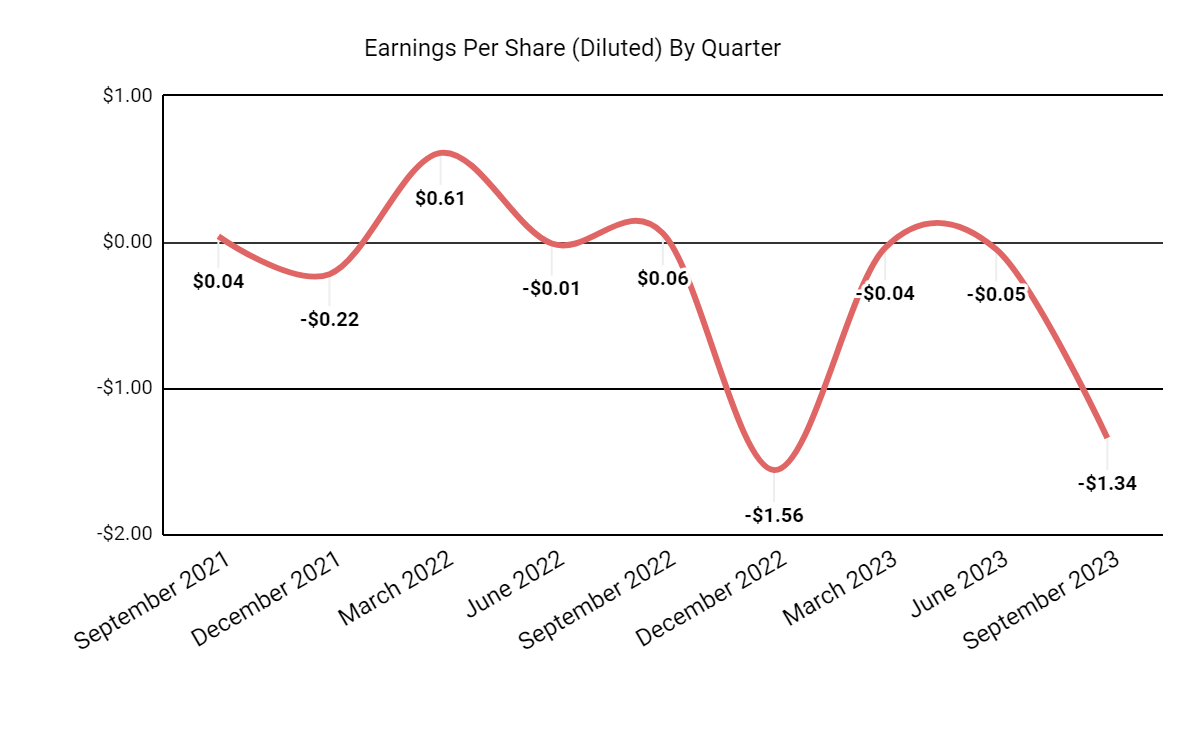

Earnings per share (Diluted) have been unstable and turned sharply adverse in two of the final 4 quarters:

In search of Alpha

(All information within the above charts is GAAP.)

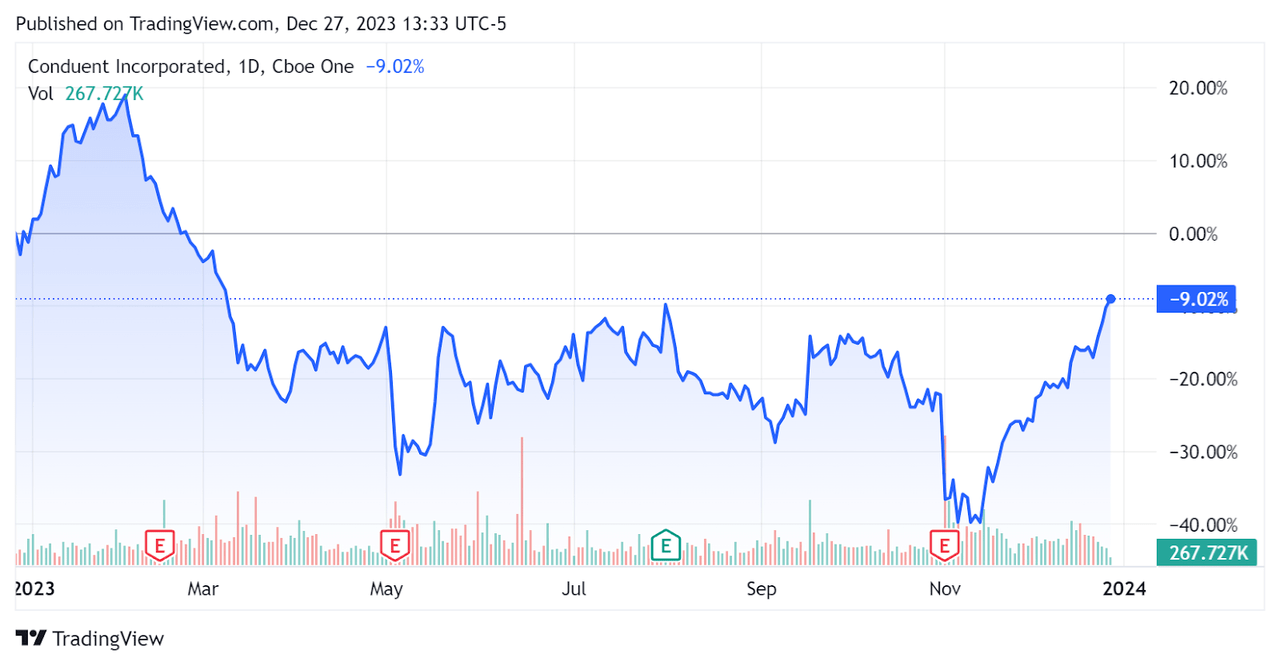

Prior to now 12 months, CNDT’s inventory value has fallen by 9.02%:

In search of Alpha

For steadiness sheet outcomes, the agency ended the quarter with $451.0 million in money and equivalents and $1.3 billion in whole debt, of which $40.0 million was categorized as the present portion due inside 12 months.

Over the trailing twelve months, free money used was ($45.0 million), throughout which capital expenditures have been $63.0 million. The corporate paid $19.0 million in stock-based compensation within the final 4 quarters.

Valuation And Different Metrics For Conduent

Under is a desk of related capitalization and valuation figures for the corporate:

|

Metric |

Quantity |

|

EV/Gross sales (FWD) |

0.5 |

|

EV/EBITDA (FWD) |

5.9 |

|

Worth/Gross sales (TTM) |

0.2 |

|

Income Progress (YoY) |

4.2% |

|

Web Earnings Margin |

-16.9% |

|

EBITDA Margin |

7.2% |

|

Market Capitalization |

$799,620,000 |

|

Enterprise Worth |

$2,020,000,000 |

|

Working Money Movement |

$18,000,000 |

|

Earnings Per Share (Absolutely Diluted) |

-$2.99 |

|

2024 FWD EPS Estimate |

$0.08 |

|

Income Progress Estimate (FWD) |

-3.2% |

|

Money Movement/Share (TTM) |

-$0.45 |

|

In search of Alpha Quant Rating |

Promote – 2.04 |

(Supply – In search of Alpha.)

Commentary On Conduent

In its most up-to-date earnings name (Supply – In search of Alpha), administration’s ready remarks highlighted the elevated diversification of its income streams, with a powerful quarter from its Authorities healthcare phase.

Administration has been taking steps to rationalize its portfolio of choices and beforehand introduced the sale of its BenefitWallet enterprise.

The agency additionally continues to market its FedNow community functionality for fast fee processing.

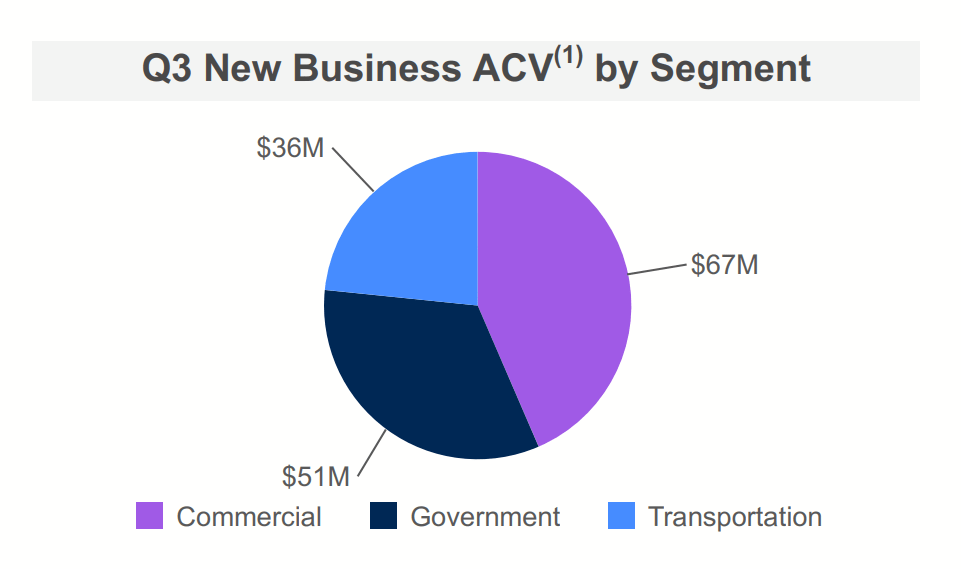

New enterprise gross sales have been stronger in Authorities and Transportation verticals, whereas its Industrial vertical “continues to be impacted by macro-economic traits.”

Nevertheless, since its Industrial vertical accounts for the most important share of the agency’s enterprise, per the next Q3 2023 chart from the corporate, it has an outsized affect on the agency’s outcomes:

In search of Alpha

For the quarter’s outcomes, whole income fell by 4.6% year-over-year, whereas gross revenue margin slid by 0.5%.

Promoting and G&A bills as a share of income dropped by 1.1% YoY, however working revenue fell sharply by 66.7%.

The corporate’s monetary place is average, with loads of liquidity however substantial long-term debt and materially adverse free money stream.

The agency’s worker retention fee was characterised by CEO Skelton because the “strongest since I arrived and enhancing.”

Nevertheless, the corporate is seeing longer gross sales cycles amid a extra cautious shopping for surroundings amongst its Industrial phase prospects, its largest phase.

It will probably weigh on future income development together with the divestiture of its BenefitWallet enterprise for $425 million, which is predicted to shut in Q1 2024.

Trying forward, 2023 topline full-year income is predicted to say no by 3.6% versus 2022’s outcomes.

2024 income is now anticipated to drop an additional 3.2%, per consensus estimates.

Additionally, administration expects better unpredictability in its authorities and transportation billing milestones, presaging probably larger volatility in outcomes in This autumn 2023 and 2024.

Given such unpredictability mixed with anticipated income decline in 2024 and ongoing uncertainty in its giant industrial division with the potential for continued gross sales cycle delays, my outlook on Conduent Included inventory is to Promote.