airdone

With the New Yr now come and gone, traders ought to take this time to replicate on what alternatives lie forward for 2024. For a lot of traders, one of the crucial enticing avenues to discover includes actual property funding trusts, or REITs. Along with sure tax traits that they provide, there’s additionally the profit that, sometimes talking, they pay out distributions that lead to efficient yields which might be larger than what most conventional shares pay. This makes them notably interesting for income-oriented traders reminiscent of these which might be in or close to retirement or those that wish to financial institution capital with the intention to shield in opposition to a possible decline in share costs.

As a worth investor, I’ve usually struggled with REITs. For starters, they’re not often low-cost alternatives. The enticing and constant money flows, in addition to respectable progress, usually signifies that shares are usually not all that low-cost. They’re top quality prospects, nevertheless, which is one thing that ought to attraction to worth traders. And whereas all worth traders differ of their private preferences, I’ve traditionally been distribution-agnostic, preferring as a substitute to deal with whole return versus yield.

Having stated that, there are three specialty REITs that I’ve discovered myself bullish on in recent times. Every agency operates in a distinct segment market and has its personal distinctive traits that may be enticing to traders who’re on the lookout for that particular form of REIT to jazz up their portfolio. Two of those companies I’ve rated a “sturdy purchase,” whereas the opposite has been rated a “purchase.”

A telecom play

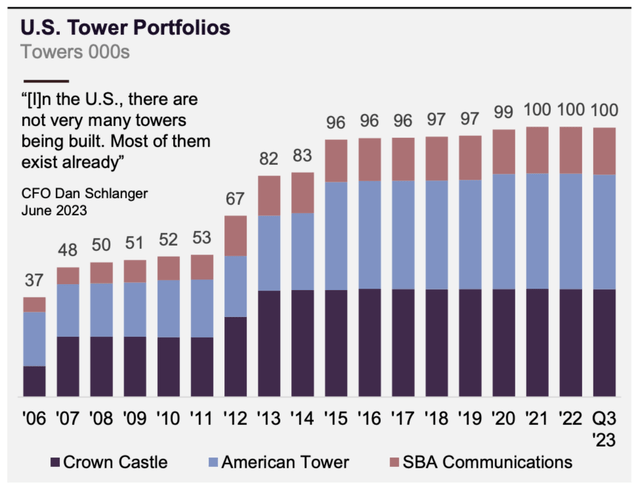

One of many companies that’s excessive on my listing when it comes to all funding prospects has bought to be Crown Citadel Inc. (CCI). For these not conscious, the corporate is an proprietor of telecommunications property, largely home telecommunications towers that it leases out for the aim of facilitating the switch of data from any given level to some other given level. Over the previous a number of years, this has change into a really mature market once we speak concerning the U.S. After seeing the variety of telecommunications towers develop from 37,000 again in 2006 to 96,000 by the tip of 2015, we’ve got seen an nearly full halt within the improve. From 2015 to the current day, we’ve got seen the variety of towers on this nation develop solely barely to 100,000.

Elliott Funding Administration

In search of out completely different alternatives, completely different gamers within the area determined to deal with completely different initiatives. The undisputed big available in the market, American Tower Company (AMT), started rising considerably abroad. In the present day, solely about 47% of its income comes from home towers, whereas 45% includes worldwide towers. The remainder of its income is made-up of information heart operations that the corporate has invested billions of {dollars} in two. That may be a long-term play that’s presently not essentially the most worthwhile. However in the long term, it is possible that information facilities will repay. By comparability, Crown Citadel determined to disregard worldwide tower alternatives, as a substitute investing closely within the fiber and small cell enterprise. Since getting into that market, the corporate has seen its progress sluggish and it has skilled an excessive amount of pushback from activists traders.

In reality, final November, I wrote an article detailing how Elliott Funding Administration Had determined to return out publicly in favor of constructing some vital modifications, together with doubtlessly promoting off the fiber and small cell operations of the corporate. The aim of this text is to not rehash these particulars. Reasonably, I might suggest that you just learn the aforementioned article. I did conclude, nevertheless, that the evaluation made by Elliott had vital benefit and demonstrated that there was enticing worth for shareholders who determined to accumulate Crown Citadel.

Administration appears to be very open to vital modifications at the moment, as evidenced by the truth that, on December twentieth, the agency launched a evaluate course of to be performed by a brand new committee that may also contain enter from Elliott. No matter what comes from that, nevertheless, the market does appear optimistic concerning the enterprise. I say this as a result of, since I first rated the corporate a “sturdy purchase” in early October, shares have generated a return of 25.4% in comparison with the 9.4% seen by the S&P 500 (SP500).

Given such a big improve, traders can be sensible to marvel if I’m nonetheless as bullish on the corporate as I used to be again then. The reply is completely. That is the case although administration is forecasting a slightly weak 2024 fiscal yr. You see, in keeping with administration, EBITDA for 2023 ought to are available in at round $4.42 billion. Nonetheless, larger bills and different elements are anticipated to drive this all the way down to $4.16 billion in 2024. In the meantime, AFFO (adjusted funds from operations) ought to drop from $3.28 billion in 2023 to $3.01 billion this yr.

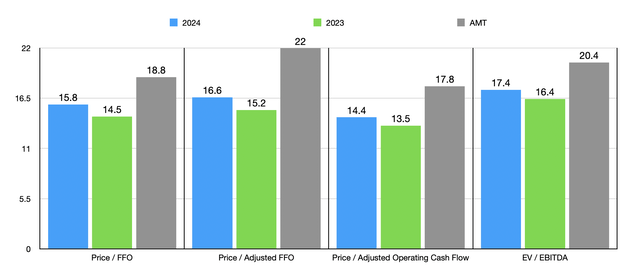

Writer – SEC EDGAR Information

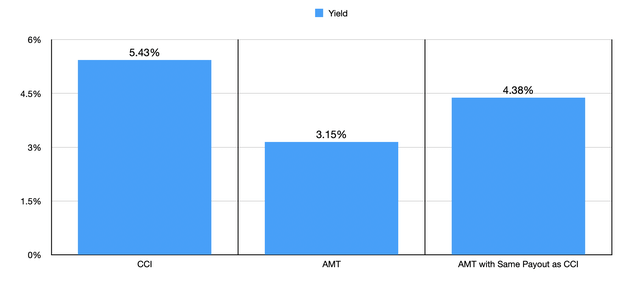

Within the chart above, I made a decision to worth the corporate utilizing these estimates and counting on the belief that different profitability metrics ought to drop on the identical price that these ought to. As you possibly can see, shares are nonetheless fairly a bit cheaper than what rival American Tower occurs to be buying and selling for. After all, the image is extra difficult than that. There are positives and negatives behind proudly owning shares of both enterprise. Let’s take a look at the subject of yield. If we use the newest value for every agency, the yield paid out by Crown Citadel occurs to be 5.43%. That is considerably larger than the three.15% paid out by American Tower.

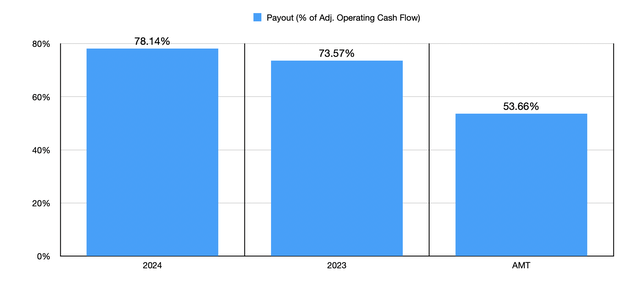

Writer – SEC EDGAR Information

This does require some further depth, nevertheless. If we use the extra conservative 2024 estimates, Crown Citadel is paying out 78.14% of its adjusted working money circulate towards distributions. On condition that solely round $53 million of its capital expenditure price range is anticipated to contain upkeep prices, subtracting that out from adjusted working money circulate is kind of irrelevant. This isn’t an space that requires vital maintenance prices. So nearly all the adjusted working money circulate produced by the corporate must be free for distributions, progress, and debt discount.

By comparability, American Tower is paying out 53.66% of its adjusted working money circulate towards distributions. Which means it has much more wiggle room than Crown Citadel presently provides. However even when American Tower had been to extend its payout to match what Crown Citadel distributes, and if shares of American Tower had been to stay unchanged, its yield would nonetheless solely hit 4.38%.

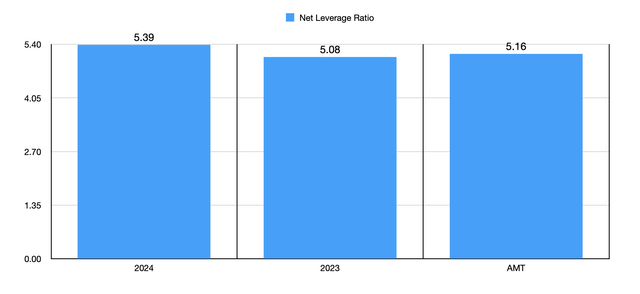

Writer – SEC EDGAR Information

In the case of leverage, the businesses are very shut to 1 one other. The web leverage ratio of American Tower is 5.16. If we use the 2023 estimates for Crown Citadel, we get a studying of 5.08. And if we use the 2024 estimates, this rises solely modestly to five.39. These variations are, in my view, little greater than a rounding error. Though the distribution paid out by Crown Citadel is extra interesting at the moment, the one draw back that’s vital concerning the corporate is that its distribution progress has been remarkably sluggish in comparison with what American Tower has achieved.

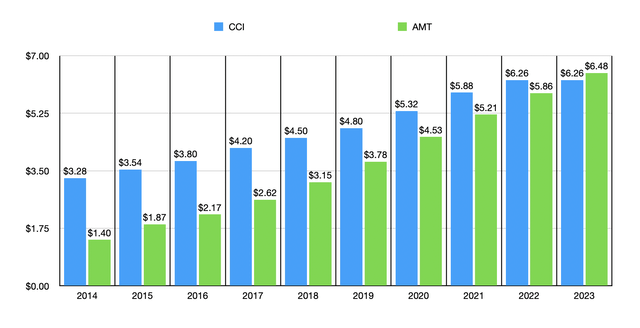

Writer – SEC EDGAR Information

Again in 2014, Crown Citadel paid out $3.28 per share every year. By 2022, that quantity had grown to $6.26 for an annualized progress price of 8.4%. Over the identical window of time, American Tower had seen its distribution develop from $1.40 per share to $5.86 per share for an annualized progress price of 19.6%. For 2023 by way of doubtlessly 2025, the administration crew at Crown Citadel has indicated it intends to maintain the distribution unchanged at $6.26. By comparability, the efficient distribution on an annualized foundation for American Tower had grown to $6.48. As the corporate continues to develop extra quickly than its competitor, we’re prone to see continued outperformance on the expansion facet for the distribution in favor of American Tower. Even so, given how low-cost shares of Crown Citadel occur to be and the strong distribution presently paid out, to not point out the potential worth that could possibly be unlocked from its fiber and small cell property, I do nonetheless desire Crown Citadel even because the inventory has risen properly.

Writer – SEC EDGAR Information

An workplace REIT value contemplating

Proper now, just about something tied to the workplace area market is taken into account to be very unattractive. And that is for an excellent motive. Even previous to the pandemic, there was a delicate shift away from staff being within the workplace and as a substitute working remotely. However the pandemic quickly accelerated this development and, to some extent, made it possible that we are going to by no means return to the times of workplace dominance. No matter what your views are on this shift, it’s a actuality that’s inflicting points for any corporations associated to the possession and leasing out of workplace property.

Utilizing the newest information accessible, as an illustration, as of November of final yr, the emptiness price of all workplace property on this nation got here out to 18.2%. That is the very best on report. However while you take a look at utilization price, the image is way worse. Even at this time, with the pandemic lengthy since over, the workplace utilization price is hovering at between 50% and 60% of what it was previous to the pandemic.

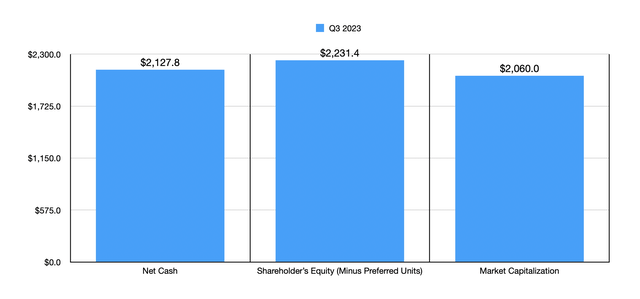

Floor zero for this ache will possible be any REITs specializing in the possession of workplace properties. Nonetheless, as I identified in an article revealed in June of final yr, Fairness Commonwealth (EQC) is a distinct animal solely. For these trying on the firm the primary time, the image will look very completely different than what a conventional REIT may appear to be. For starters, the corporate’s market capitalization proper now’s $2.06 billion. And but, within the first 9 months of 2023, the agency generated income of solely $45.4 million. That’s materially decrease than what you’ll anticipate for an organization this huge. Whenever you begin digging deeper, you begin to perceive why the image is this fashion. Over the span of round 9 years, administration bought off 164 properties and three land parcels, with the properties accounting for 44.3 million sq. toes. The corporate ended up bringing in $6.9 billion of money, plus $704.8 million of inventory in one other REIT. In the present day, it now has solely 4 properties in its portfolio that comprise 1.5 million sq. toes of area.

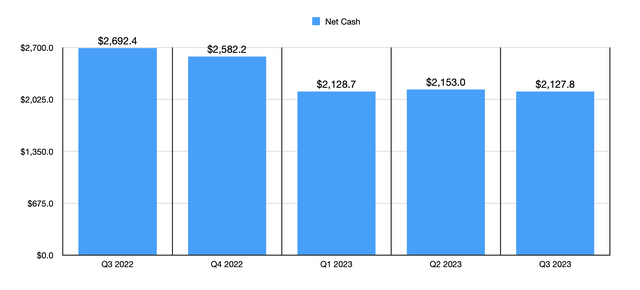

After paying down its debt to nothing, the corporate amassed An incredible amount of money. By the tip of the 2021 fiscal yr, the enterprise had $2.80 billion of money and money equivalents on its books. However over time, administration purchased again widespread inventory within the agency and paid out some distributions. Within the first 9 months of final yr, the enterprise repurchased $60.2 million of widespread items. That was down, nevertheless, from the $130.5 million of purchases reported for a similar window of time one yr earlier. Then again, in February of 2023, administration paid out a particular distribution of $4.25 per share, amounting to $468.2 million.

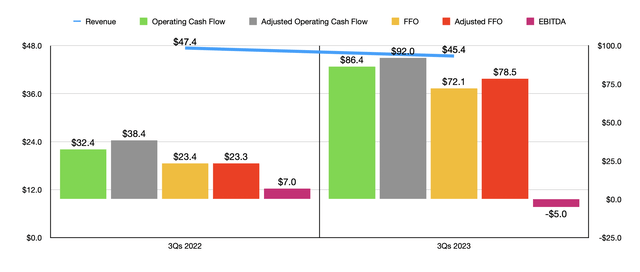

Writer – SEC EDGAR Information

In the case of general profitability, the image for the corporate is sort of enticing. Regardless of the modest quantity of income, it generated $86.4 million in working money circulate and $92 million of adjusted working money circulate within the first 9 months of final yr. Within the chart above, you possibly can see these numbers and others, and the way they stack up in opposition to the identical window of time one yr earlier. It is extremely uncommon for earnings to be larger than income, even within the REIT market. Nonetheless, administration has benefited tremendously from investing that extra money on this excessive rate of interest atmosphere. Whereas I totally anticipate rates of interest to start falling this yr, so long as they keep elevated, the enterprise ought to do effectively to generate further optimistic money flows.

Writer – SEC EDGAR Information

For my part, the best-case state of affairs for shareholders is that, as rates of interest fall, administration will determine to make use of the $2.13 billion in money and money equivalents that the corporate has, along with potential leverage, to purchase up enticing property. To be completely sincere, given my very own view concerning the workplace area market, I might strongly desire that it diversify into nearly some other kind of actual property. However even when we assume that administration will simply proceed to payout the money to shareholders till the corporate dwindles, that is not all that terrible a state of affairs. At current, the ebook worth of fairness of the corporate, after stripping out $122.9 million in liquidation worth of most well-liked items, is $2.23 billion. Given how shares are priced proper now, which means simply by shopping for the inventory and liquidating the corporate, shareholders ought to get upside of 8.3%. That is on high of money flows that can possible be $70 million or extra every year for this yr and certain $40 million to $50 million every year every year thereafter.

Absent one thing horribly silly occurring, I battle to think about a state of affairs the place shareholders might truly lose cash on this identify. Nonetheless, the market has thus far disagreed with me. Since my bullish article on the corporate again in June of final yr, shares have seen draw back of seven.2% whereas the S&P 500 has been up by 10.7%.

Writer – SEC EDGAR Information

The times of “excessive” progress are gone

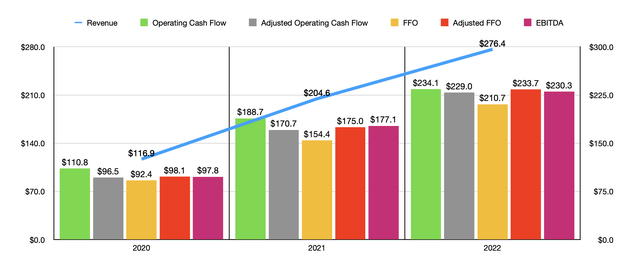

The final area of interest REIT that I wish to level you to is one which I’ve been bullish on for a while. The corporate in query is Modern Industrial Properties, Inc. (IIPR), which owns and operates actual property that caters to the hashish business. By and enormous, the agency has grown by the use of acquisition, approaching hashish operators that had been on the lookout for further low-cost capital that could possibly be used to develop in what was, just a few years in the past, a quickly rising area. It will purchase these property off of the hashish companies and lease them again to them, usually beneath long run agreements. Even at this time, because the business has died down, Modern Industrial Properties has a weighted common time remaining on its leases of 14.9 years. In the case of the commercial REIT market, that is thought-about fairly excessive in comparison with what I’ve sometimes seen, with a common vary of between 5 and eight years.

Writer – SEC EDGAR Information

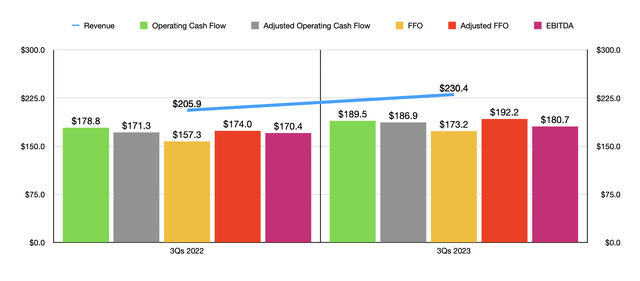

Even up by way of 2022, Modern Industrial Properties was benefiting from the continued legalization of hashish, not just for medicinal functions, but in addition leisure functions, to develop. In 2020, as an illustration, the corporate generated income of solely $116.9 million. By 2022, gross sales had grown to $276.4 million. As you possibly can see within the chart above, profitability metrics for the corporate have adopted an analogous trajectory. And within the chart beneath, you possibly can see that it has loved continued progress all through 2023, with that information protecting the primary 9 months of that yr in comparison with the identical time of the 2022 fiscal yr.

Writer – SEC EDGAR Information

Up to now, the thrill available in the market, mixed with giant quantities of money available and low rates of interest, made it simple for Modern Industrial Properties to broaden variant however these days of speedy progress are coming to an finish. In 2021, the corporate bought 14 properties comprising 2.27 million sq. toes of area. That price shareholders about $288 million. In 2022, the corporate bought solely 9 properties that made up 591,000 sq. toes and that price a way more modest $166.6 million. And within the first 9 months of 2023, the corporate acquired solely 215,000 sq. toes of area for a paltry $35.2 million. Regardless of this slowdown, shares have performed fairly effectively. Since I first rated the corporate a “purchase” again in 2019, shares have seen upside of 70.6% while you embody the distributions that it pays out. That just about matches the 71% upside seen by the S&P 500 over the identical window of time.

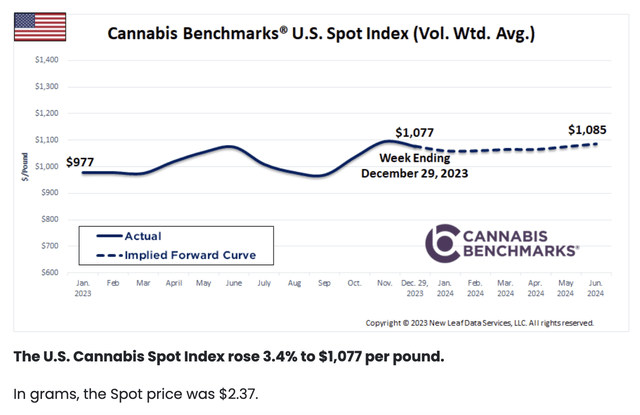

Whereas the pandemic actually had an affect on the hashish market, the massive drawback for the area concerned and over funding in hashish manufacturing capability. Demand was considerably overestimated and hopes {that a} nationwide ban on the product can be lifted proved to be untimely. The excellent news, and that is what provides me hope, is that there are indicators that the worst for the business is now over. For the week ending December twenty ninth of 2023, the spot value per pound of hashish was $1,077. That is up from the $977, a rise of 10.2%, in comparison with what was seen on the identical time one yr earlier. Present forecasts name for the spot value to rise additional to roughly $1,085 per pound. It is also vital to notice that Florida and Pennsylvania are seeing vital pushes to legalize it for leisure functions. And in November of final yr, my dwelling state of Ohio grew to become the twenty fourth state to legalize it for leisure customers.

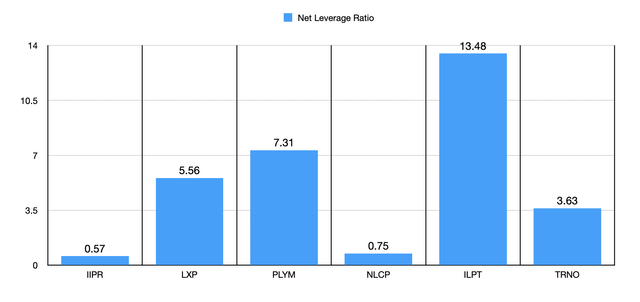

Along with the business displaying some indicators of restoration, there are different advantages to the corporate. For starters, its internet leverage ratio is barely 0.57 primarily based on my estimates. Within the chart beneath, you possibly can see its internet leverage ratio in comparison with the online leverage ratio of 5 different industrial REITs. Solely one among these, NewLake Capital Companions (OTCQX:NLCP), is corresponding to this at 0.75. It is no coincidence that NewLake Capital Companions can be one other hashish REIT.

Writer – SEC EDGAR Information Writer – SEC EDGAR Information

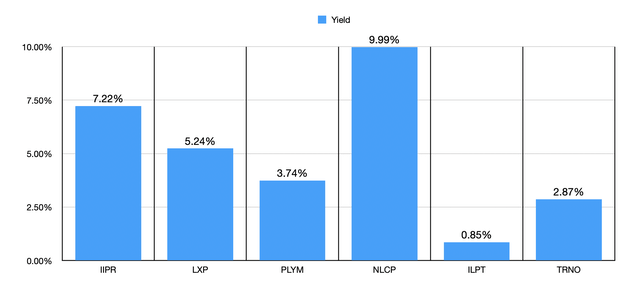

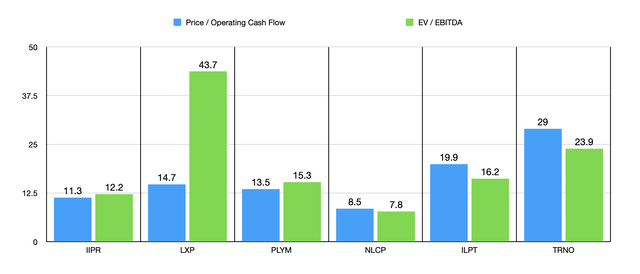

Within the subsequent chart, I additionally confirmed the yield of every of those corporations. Even by REIT requirements, Modern Industrial Properties pays out a hefty amount of money, with an efficient yield of seven.22% as of this writing. Of the opposite gamers within the area, solely NewLake Capital Companions is larger at 9.99%. I then, within the chart beneath, determined to worth all of those corporations utilizing two completely different valuation metrics. Solely one of many 5 companies ended up being cheaper than Modern Industrial Properties utilizing both of the metrics. As you may think, that firm is none aside from NewLake Capital Companions.

Writer – SEC EDGAR Information

Now, given the comparable internet diverge ratios of each companies, and the decrease share value and better yield that NewLake Capital Companions provides, you may marvel why I’m selling Modern Industrial Properties as a substitute of it. Merely put, in my opinion, NewLake Capital Companions is the riskier of the 2 companies. For starters, Modern Industrial Properties is way bigger, with 108 properties beneath its belt in comparison with 37. The times of speedy progress are possible up to now, which means that it might be tougher and doubtlessly costly for a smaller participant to scale. However, along with this, there’s the problem of publicity. 25% of NewLake Capital Companions’ income comes from its largest tenant, with a whopping 79% coming from its high 5 largest tenants. These numbers for Modern Industrial Properties are far more modest at 15% and 40%, respectively. So within the occasion that the hashish market continues to battle, Modern Industrial Properties will nearly actually be extra steady by comparability.

Takeaway

For traders on the lookout for fascinating REITs with distinctive circumstances, I undoubtedly consider that the three corporations that I highlighted on this article must be taken very critically. Two of them payout slightly hefty yields relative to comparable companies. All three of them have traits that distinguish them from their friends and, absent one thing sudden occurring, I’ve a tough time believing that these companies will show to be dangerous or subpar investments. For now, for the explanations I’ve already said all through this text, I’m retaining the businesses rated as they had been rated beforehand, with the primary two as “sturdy purchase” prospects and the opposite being a “purchase.”

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.