Justin Sullivan

We beforehand lined Roblox Company (NYSE:RBLX) in September 2023, discussing its shiny prospects as one of many long-term Metaverse winners, attributed to the aggressive progress efforts throughout completely different platforms and partnerships.

Regardless of so, we maintained our Maintain ranking then, since the inventory had additionally pulled ahead most of its upside potential, with its inflated valuations providing buyers a minimal margin of security.

On this article, we will talk about why RBLX stays a speculative inventory, with the administration’s deal with delivering excessive progress implying its incapability to generate constructive internet earnings profitability.

Regardless of the gaining traction and the injection of optimism from the administration, we keep our stance that the inventory is overvalued right here and is prone to be overvalued shifting ahead.

Within the intermediate-term, we consider that the RBLX inventory could proceed to commerce sideways, with it solely appropriate for swing merchants with larger threat tolerances.

The RBLX Funding Thesis Has Improved – Although Nonetheless Overly Inflated

Most lately, RBLX has reported a double beat on their FQ3’23 earnings name, with bookings of $839.45M (+7.5% QoQ/ +19.6% YoY) and GAAP EPS of -$0.45 (+2.1% QoQ/ +10.2% YoY).

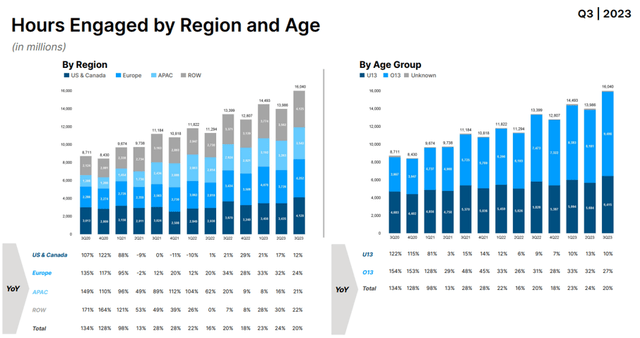

The expansion in its bookings is spectacular certainly, attributed to the growth in its Common Every day Lively Customers [DAU] to 70.2M (+4.7M QoQ/ +11.4M YoY), steady Common Bookings per DAU of $11.96 (inline QoQ/ YoY), and rising Hours Engaged at 16B (+2B QoQ/ +2.6B YoY).

These numbers point out its means to draw new customers whereas rising the stickiness of its choices, offering additional tailwinds to its prime line progress.

That is additionally noticed in RBLX’s increasing gross revenue margins of twenty-two.4% (+3.6 factors QoQ/ +13 factors YoY), implying its improved scale of operations and stabling Developer Trade Charges.

With an estimated paying consumer life of 28 months and deferred revenues of $2.2B (+4.2% QoQ/ +25.7% YoY), it seems that the corporate’s prime line is safe within the near-term.

RBLX’s Hours Engaged by Area and Age

On the one hand, these tailwinds have been negated by RBLX’s accelerating adj working bills of $239.98M (+4.5% QoQ/ +28% YoY) by the most recent quarter, after adjusting for its non-cash stock-based compensations.

That is on prime of the sustained share dilution to 619.35M in share depend (+6.66M QoQ/ +21.57M YoY), with its shareholders’ fairness constantly eroded to this point.

Subsequently, whereas the administration has been in a position to develop its viewers globally whereas ageing them up, with 56.9% (+0.8 factors QoQ/ +2.7 YoY) now over 13 years of age, it’s obvious that the main focus for progress has impacted its means to generate internet earnings profitability anytime quickly.

Then again, RBLX has been in a position to file $81.06M in adj EBITDA (+113.9% QoQ/ +59.3% YoY) and $59.51M in Free Money Stream profitability in FQ3’23 (+172.1% QoQ/ +189.9% YoY), partly attributed to the administration’s optimized capex of $53.2M (-52% QoQ/ -60.1% YoY).

This has instantly contributed to the QoQ enchancment in its stability sheet, with the money/ short-term investments of $2.15B (+1.8% QoQ/ -28.8% YoY) seemingly implying its means to develop with out having to depend on costly/ dilutive capital raises forward.

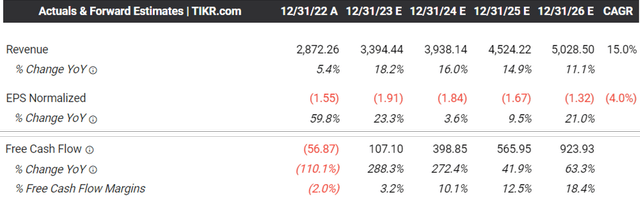

As well as, the RBLX administration has considerably confirmed the FY2024 reserving worth of $4.03B (+18.8% YoY) and adj EBITDA estimates of $489.9M (+36.1% YoY), with the FCF technology prone to be boosted by the a lot decrease projected capex of $100M (-68% YoY).

That is on prime of the long-term goal of “annual bookings progress of over +20% and rising margins by 100-300 foundation factors per yr over the following 3-5 years,” suggesting its means to maintain its excessive progress pattern.

Lastly, readers should not neglect RBLX’s huge tailwinds arising from the rising Metaverse market dimension from $50.54B in 2021 to $626.65B in 2030, increasing at an accelerated CAGR of +45.2%.

Extra Massive Tech firms are more and more invested within the AR/ VR/ XR headsets as effectively, with Apple’s (AAPL) Imaginative and prescient Professional headsets to be launched over the following few months, instantly competing with Meta’s (META) Quest 3/ Professional headsets.

Even Qualcomm (QCOM) has hinted that Samsung (OTCPK:SSNLF) and Google (GOOG) (GOOGL) are already engaged on their next-gen variations of spatial computing platform, with a variety of Chinese language-based firms following of their footsteps, together with Xiaomi’s launch in early 2023 and Huawei’s by the tip of 2024.

With RBLX already out there on Meta Quest, Sony (SONY) PlayStation, and Microsoft’s (MSFT) Xbox, it’s unsurprising that we’ve got seen rising DAUs, bookings, and deferred revenues as mentioned above, based mostly on the rising lifetime installs of over 17M from these platforms.

The administration has additionally tried to rebrand the platform as a social media platform, based mostly on the strategic introductions of latest APIs and avatar updates. These permit the customers to customise their private on-site expertise whereas embedding communication capabilities in cell phones, with a plan to incorporate “some other gadgets” within the far future.

The Consensus Ahead Estimates

These efforts point out the RBLX administration’s deal with delivering progress throughout completely different age teams, geographical places, use instances, and platforms have negated its means to generate break even and/ or constructive internet earnings profitability for the “foreseeable future.“

Regardless of the projected constructive Free Money Stream technology from FQ4’23 onwards, we consider that a lot of the money is probably going for use to fund its progress alternatives with close to zero prospects of dividend payouts, because the inventory’s prospects are solely tied to its potential capital appreciation.

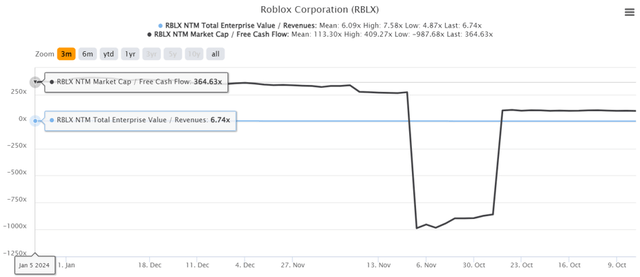

RBLX Valuations

Nevertheless, with RBLX’s FWD EV/ Revenues valuation of 6.74x and FWD Market Cap/ Free Money Stream valuation of 364.63x already elevated, in comparison with the current backside of 5.12x/ 103.68x and sector median of two.55x/ 19.31x, we’re unsure if there’s any upside prospects at present ranges.

These numbers are paying homage to the bloated valuation ranges noticed in the course of the hyper-pandemic heights, with any top-line misses prone to convey forth painful corrections forward.

So, Is RBLX Inventory A Purchase, Promote, or Maintain?

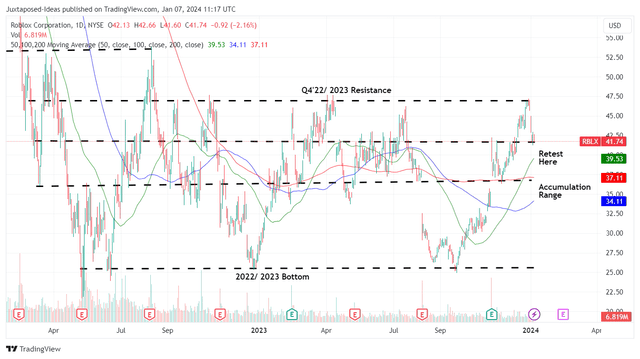

RBLX 1Y Inventory Worth

Mixed with RBLX’s sideways motion since February 2022 and the brief curiosity of 4.48% on the time of writing, it seems that the inventory is extra prone to be a swing commerce candidate forward. That is between the 2022/ 2023 assist ranges of $26s and This fall’22/ 2023 resistance ranges of $46s.

Whereas swing trades might be extremely worthwhile, we additionally consider that the potential volatility implies the inventory will not be appropriate for readers whom are on the lookout for a steady long-term funding thesis.

Subsequently, whereas we’re extremely optimistic concerning the potentials of the next-gen spatial computing platform and Metaverse, it seems that RBLX’s excessive progress prospects stay speculative for therefore lengthy that it’s unprofitable on an working earnings and adj EPS foundation.

Traders trying so as to add right here should proceed with warning certainly. Regardless of the gaining traction and the injection of optimism from the administration, we keep our stance that the inventory is overvalued right here and is prone to be overvalued shifting ahead.

For context, readers should additionally word that a part of the current rally is attributed to the cooling inflation and the elevated chance of a Fed pivot in Q1’24, with the SPY equally up by +13.9% for the reason that October 2023 backside.

With the inventory market greed index more and more elevated as a result of supposed comfortable touchdown, we consider that there could also be a reasonable pullback within the total inventory market, with RBLX prone to be affected as effectively.

On account of the potential capital losses, we want to keep up our Maintain (Impartial) ranking right here.