photoschmidt

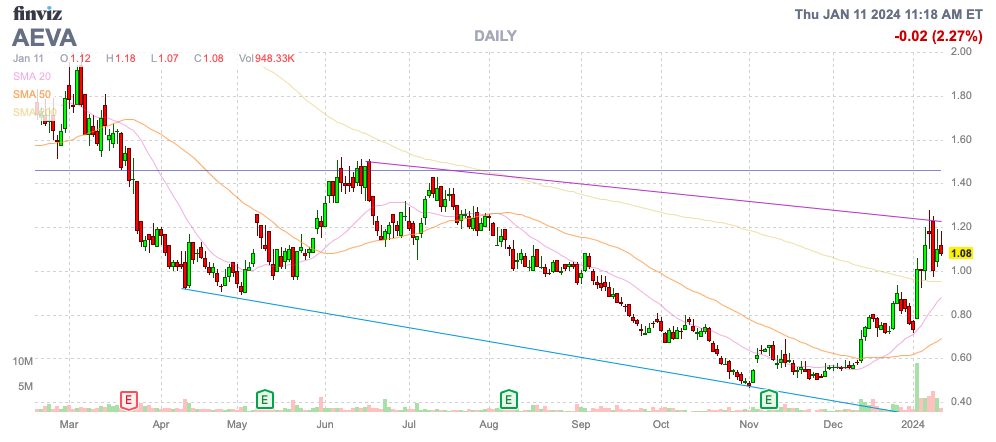

Just a few months in the past, Aeva Applied sciences, Inc. (NYSE:AEVA) was buying and selling round $0.50 with restricted market curiosity within the Lidar inventory inflicting NYSE itemizing points. Now, the 4D Lidar sensor firm has all of the sudden introduced an enormous trucking deal and the inventory has soared again above $1. My funding thesis continues to be Bullish on the inventory, however Aeva continues to be distant from shifting away from a pre-revenue firm.

Supply: Finviz

Nonetheless Far Away

Throughout CES, Aeva introduced a doubtlessly massive deal with Daimler Truck to combine their Lidar sensors in a collaboration with Torc Robotics to allow SAE Stage 4 autonomous car capabilities starting with the Class 8 Freightliner Cascadia truck platform. Although not included within the announcement, media experiences prompt the deal worth quantities to $1 billion in future orders over an unspecified interval of normally not less than 5 years.

The issue right here for Aeva is the distant timeline. The partnership would possibly start through the present quarter, however Daimler Truck’s manufacturing will not ramp up till 2027, and the deal requires clients to purchase self-driving vehicles with the Lidar sensors included.

As talked about by Aeva within the press launch, the corporate changed an current provider of 3D Time-of-Flight, Lengthy-Vary Lidar with their FMCW know-how. In line with a previous press launch, Luminar Applied sciences (LAZR) fashioned a partnership with Daimler Truck again in late 2020, which embrace Daimler buying a minority stake in Luminar.

Whereas changing an business chief in Luminar is a constructive signal, it is also a part of why the market is now hesitant to aggressively put money into the Lidar shares. Primarily, the deal is 3 years away from quantity income, but in addition indicators exist an current provider might be changed. Although the automotive sector is historically a troublesome sector to exchange current suppliers except going out years into future car fashions.

Again in This fall, Aeva additionally introduced official offers with Might Mobility and Nikon. The corporate now has the manufacturing offers missing in beforehand years to offer a degree of future viability.

The Might Mobility deal is fascinating, with transit applications already offering 350,000 rides in Ann Arbor, MI; Arlington, TX; Grand Rapids, MN; and Solar Metropolis, AZ, with extra deployments deliberate to start in 2024. The deal does not begin manufacturing ramp till 2025, leaving shareholders once more with a prolonged time earlier than quantity gross sales hit the books.

Extra Dilution Forward

The most important downside going through Aeva is that the corporate is simply now saying offers a number of years away from significant manufacturing ramps. The Lidar firm has needed to increase substantial extra capital since going public to fund ongoing losses.

Aeva reported Q3 ’23 revenues of simply $0.8 million, really dipping from $1.4 million within the prior-year interval. The corporate misplaced $30.3 million within the quarter and had damaging free money circulate of $29.1 million.

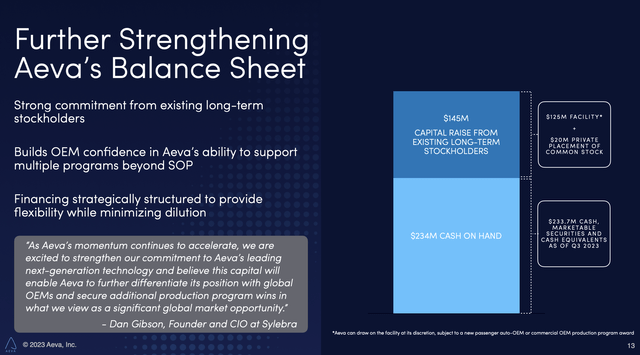

The corporate ended Q3 with a money steadiness of $234 million earlier than the latest capital increase. Aeva continues to be operating at practically $120 million annual money burn fee with restricted revenues till not less than 2026, or past.

Again in November, the corporate introduced agreements to lift as much as $145 million in extra capital in mixed non-public placement of $20 million and a non-voting most popular shares facility of $125 million. The capital raises come from current long-term stockholders and strategically place Aeva to win extra OEM applications.

Supply: Aeva Q3’23 presentation

Aeva had a share depend of 223 million shares, putting the market cap at a minimal $250 million previous to the latest capital increase. The corporate ended up promoting 37 million shares at solely $0.58 per share to spice up the absolutely diluted share depend to 260 million shares earlier than even accounting for the popular shares and 15 million warrants issued with an train worth of solely $1.

The most important query to investing right here is the binding nature of the Lidar offers, contemplating the key automotive offers concerned changing current ToF Lidar rivals, Buyers have to attend years to make sure these claimed orders of $1 billion materialize.

Analysts solely forecast 2024 income of $14 million, with a leap over $50 million in 2025, however the one main Tier 1 deal does not ramp-up manufacturing till 2027. Aeva has an extended path forward to cowl ongoing money burn charges earlier than any of the latest offers ramp into material-enough revenues to chop the money burn.

Takeaway

The important thing investor takeaway is that Aeva Applied sciences, Inc. has been on a stunning roll, with latest Lidar sensor deal bulletins after the inventory was left for useless in mid-2023. The inventory probably has extra upside in 2024, however traders nonetheless have an extended street forward with questions on additional dilution and whether or not these offers will really materialize as offered.