fotostorm

Funding motion

I really helpful a maintain score for AppLovin (NASDAQ:APP) after I wrote about it the final time, as I used to be nervous a couple of potential pullback after a powerful rally because the market appeared to have elevated expectations for the inventory. Primarily based on my present outlook and evaluation on APP, I like to recommend a maintain score for the close to time period till the 4Q23 earnings, the place administration ought to give extra insights into FY24. Suppose administration steerage or expectation is that the business slowdown or flattish progress shouldn’t be a significant headwind to APP and that its progress momentum continues (with the AXON 2.0 platform gaining extra share), then I believe switching to a purchase score is sensible because the consensus FY24 estimate is believable.

Evaluation

I consider the way in which the APP inventory worth has reacted to its current 3Q23 efficiency and how its valuation (ahead PE) has trended lately are indicators that the market is anticipating much more from APP. I believe shopping for the inventory right this moment would require confidence in how FY24 goes to end up, and my view is to attend for administration to speak about FY24 steerage and expectations on February 15 (4Q23 earnings) earlier than investing determination.

Beginning with the sturdy 3Q23, APP did very well. In truth, it was one of many best-performing quarters in current historical past, the place APP income grew 21% to $864 million, beating consensus expectations of $796 million. The identical was true for EBITDA, the place APP reported $419 million, strongly beating consensus estimate of $355 million. Administration even raised their 4Q23 expectations, now anticipating 4Q23 income of $910 to $930 million and an EBITDA vary of $420 to $440 million, implying a FY23 income of $3.25 billion on the midpoint (full 12 months progress of 15%) and an EBITDA of $1.18 billion on the midpoint.

I consider the success that APP is seeing in its software program phase goes to assist it meet the 4Q23 steerage. In 3Q23, APP Software program income got here in at $504 million, representing a rise of 65% y/y, and adjusted EBITDA got here in at $364 million, representing a rise of 91% and a margin of 72%. This was a spectacular efficiency, which speaks very effectively of the AXON 2.0 platform. The underlying working metrics additionally level to sturdy momentum, which suggests 4Q23 will see sturdy efficiency as effectively. Among the many AppDiscovery DSP, income per set up grew 40%, with set up volumes additionally rising by 29%. What was much more notable was that each worth and quantity have been progress drivers, clearly suggesting that the AXON 2.0 differentiation in focusing on audiences is working. The expansion implication right here is that AXON 2.0 has the whole ecosystem extra helpful as every of these incremental installs will increase the efficacy and effectivity of advertisers’ advertising {dollars}, which implies advertisers are prone to make investments extra in advertising, which can drive progress for APP because of the income sharing settlement. However, do not forget that weak app income efficiency in earlier quarters? Even that quarter has now circled, rising sequentially for the primary time after 7 lengthy quarters, pushed by APP growing its advertising funding in AXON 2.0 for its personal channel. This, once more, confirmed that AXON 2.0 is working.

With such a powerful efficiency, one would think about that the inventory worth would react very positively. Nonetheless, that’s not the case. APP’s share worth has been just about flattish at $39 (my final put up was at $39 as effectively). I consider that is consistent with what I discussed beforehand: that the inventory valuation, at ~32x beforehand, has a variety of expectations baked in already. If I have been to summarize the share worth efficiency to date into an equation, it could be: very excessive expectations (excessive valuation) + sturdy outcomes = flat share worth motion. My fear with the inventory is that FY24 goes to be an unsure 12 months, and if APP have been to ship one weak quarter, the inventory may see the sell-off that I used to be anticipating beforehand. Keep in mind that a variety of buyers are sitting on good earnings, so any indicators of weak point may drive them to lock in earnings.

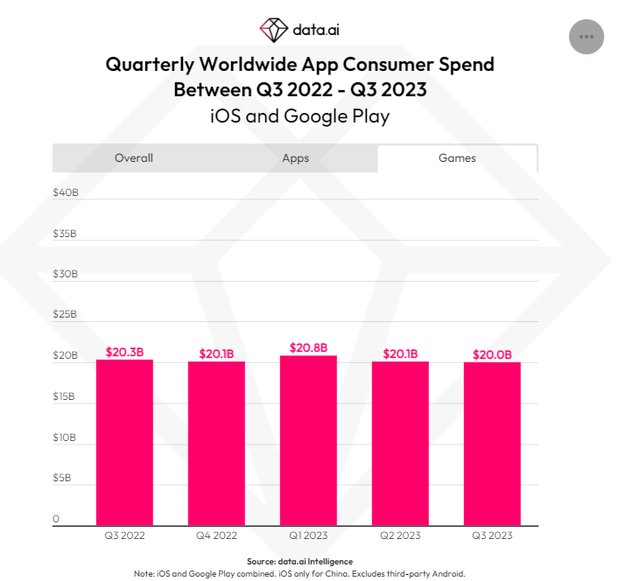

The primary unsure issue is the tempo of the cellular gaming market’s restoration. In accordance with knowledge from knowledge.ai, there may be little to no progress in client spending on cellular video games in 2023. In truth, on a sequential foundation, spending has been in decline, which suggests no indicators of progress on the business degree. Keep in mind that 2023 was presupposed to expertise a straightforward comp on condition that 2022 was a weak gaming 12 months? I consider that is sturdy proof that the weak macroeconomy has impacted shoppers’ spending on cellular gaming and that this weak point is prone to persist for longer than anticipated till the macroeconomy recovers. The implication right here is that how a lot can the in-game promoting market develop if the general client spending for cellular video games is principally flat? My view is that it isn’t going to be rather a lot, and this dynamic will influence APP’s potential to develop as effectively.

knowledge.ai

The bullish argument is that APP can faucet into different progress initiatives to cut back reliance on cellular gaming. Administration has talked about new progress initiatives, resembling coming into the linked tv market by means of the Wurl acquisition and buying the Array OEM enterprise. Nonetheless, these merchandise are nonetheless within the early phases of improvement, for my part. Though these initiatives could show to be important in the long term, I overlook how they’ll influence the inventory’s trajectory within the close to future, notably on condition that the narrative surrounding the corporate remains to be closely centered on cellular gaming. In truth, if administration have been to speculate closely, it could influence near-term earnings progress as revenue margin will get depressed, which can additional damage the inventory’s sentiment.

Valuation

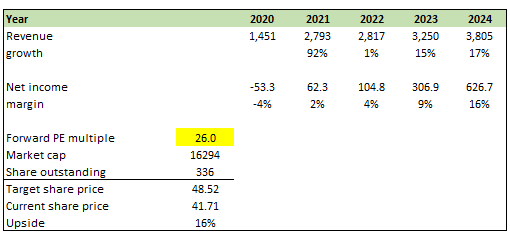

Writer’s work

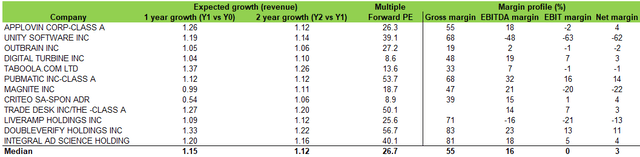

Beforehand, my mannequin was constructed to indicate the draw back in case APP missed its steerage. On this spherical, I inverted and requested myself what the upside may very well be if issues went effectively. With the sturdy 3Q23 efficiency, I consider APP goes to hit its FY23 steerage. The query is: how would FY24 carry out? My assumption is that FY24 may be a powerful 12 months if the macro surroundings recovers, resulting in a restoration in client spending on cellular gaming. Utilizing consensus FY24 assumptions, I assumed FY24 to develop 17% and the online margin to come back in at 16%, implying APP will generate $626 million in web revenue. In contrast to beforehand, the place APP was buying and selling at an elevated a number of, at 26x ahead PE, it isn’t ridiculously costly when in comparison with different adtech friends (APP is anticipated to develop quicker than friends with margins just about in line). Assuming the 26x ahead PE a number of holds, I see a possible for 16% upside from the present share worth. Nonetheless, I’m not recommending an extended place right this moment as I believe it’s higher to attend for administration to set FY24 expectations (it additionally helps to substantiate if consensus 17% progress is believable).

Writer’s work

Danger and remaining ideas

As I highlighted above, macroeconomic elements are actually impacting client spending on cellular video games. If the macroeconomy turns for the worst, we may see additional decline within the business, which may very well be a significant progress headwind as advertisers look to chop promoting budgets.

In conclusion, I like to recommend a maintain score for APP till administration offers extra insights into FY24 efficiency, which I believe goes to be essential in figuring out the inventory’s trajectory. My most important fear is that the cellular gaming market’s sluggish restoration poses uncertainties for FY24 efficiency, particularly if client spending stays flat. Though administration has outlined progress initiatives past cellular gaming, I do not assume it will be ample to maneuver the needle.