(Bloomberg) — Central bankers continued their forceful push-back in opposition to market bets for rate of interest cuts, deepening a worldwide selloff throughout shares and bonds.

Most Learn from Bloomberg

European Central Financial institution President Christine Lagarde stated on Wednesday that aggressive bets on interest-rate cuts aren’t serving to policymakers within the battle to subdue inflation. That adopted feedback on Tuesday from Federal Reserve Governor Christopher Waller, who urged warning on the tempo of price cuts.

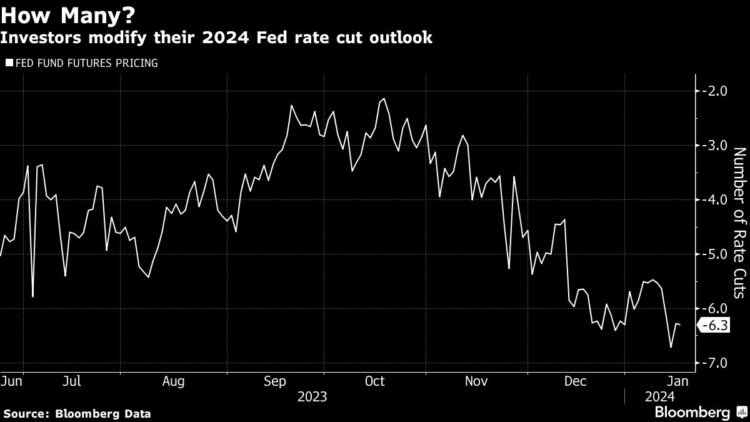

Swaps market pricing for a Fed price lower in March has dropped to round 65% from 80% on Friday, whereas cash markets pushed again bets on the timing of the ECB’s first quarter-point lower to June, from April. German two-year yields — among the many most delicate to modifications in financial coverage — rose six foundation factors to 2.66%.

The Stoxx Europe 600 index slumped greater than 1% on the open, with all business sectors within the purple. The Treasury two-year yield climbed 5 foundation factors to 4.28% and the greenback prolonged its rally to a fourth day.

Primary assets led the decline in Europe after recent information amplified issues about China’s economic system.

Hong Kong’s Dangle Seng Index tanked almost 4%. The CSI 300 mainland Chinese language benchmark additionally fell 1.6%. The losses got here after official figures confirmed whereas China reached its 2023 financial purpose, the nation’s housing hunch has worsened and home demand remained listless.

In commodities, oil declined because the drag from a stronger US greenback and broader risk-off tone offset issues over escalating Center East tensions, together with continued assaults on ships within the Purple Sea by Iran-backed Houthi rebels.

Elsewhere, gold was regular after a Tuesday decline of greater than 1% to commerce round $2,028 per ounce and Bitcoin was regular above $43,000.

Key occasions this week:

-

Eurozone CPI, Wednesday

-

US retail gross sales, industrial manufacturing, enterprise inventories, Wednesday

-

Fed points Beige E-book survey of regional financial circumstances, Wednesday

-

New York Fed President John Williams speaks, Wednesday

-

ECB President Christine Lagarde and ECB Governing Council members Klaas Knot and Boris Vujcic communicate at Davos, Wednesday

-

US housing begins, preliminary jobless claims, Thursday

-

Republican presidential main debate in New Hampshire, Thursday

-

ECB President Christine Lagarde participates in Davos panel dialogue, Thursday

-

ECB publishes account of December coverage assembly, Thursday

-

Atlanta Fed President Raphael Bostic speaks, Thursday

-

Canada retail gross sales, Friday

-

Japan CPI, tertiary index, Friday

-

US current residence gross sales, College of Michigan shopper sentiment, Friday

-

ECB President Christine Lagarde and IMF Managing Director Kristalina Georgieva communicate in Davos, Friday

-

San Francisco Fed President Mary Daly speaks, Friday

Among the predominant strikes in markets:

Shares

-

The Stoxx Europe 600 fell 1.3% as of 8:10 a.m. London time

-

S&P 500 futures fell 0.5%

-

Nasdaq 100 futures fell 0.8%

-

Futures on the Dow Jones Industrial Common fell 0.4%

-

The MSCI Asia Pacific Index fell 1.7%

-

The MSCI Rising Markets Index fell 1.9%

Currencies

-

The Bloomberg Greenback Spot Index rose 0.1%

-

The euro was little modified at $1.0874

-

The Japanese yen fell 0.5% to 147.86 per greenback

-

The offshore yuan was little modified at 7.2189 per greenback

-

The British pound rose 0.3% to $1.2669

Cryptocurrencies

-

Bitcoin fell 2% to $42,574.14

-

Ether fell 2.7% to $2,535.6

Bonds

-

The yield on 10-year Treasuries superior one foundation level to 4.07%

-

Germany’s 10-year yield superior 4 foundation factors to 2.30%

-

Britain’s 10-year yield superior 12 foundation factors to three.92%

Commodities

-

Brent crude fell 1.1% to $77.46 a barrel

-

Spot gold fell 0.2% to $2,024.24 an oz

This story was produced with the help of Bloomberg Automation.

–With help from Iris Ouyang and James Mayger.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.