Not each inventory rose final yr. Think about these 4 — Nike (NYSE: NKE), MarketAxess (NASDAQ: MKTX), Paycom Software program (NYSE: PAYC), and The Hershey Firm (NYSE: HSY) — which fell between 10% and 42% in 2023. That stands in stark distinction to the S&P 500 index’s 23% rise.

Regardless of these worrying drops, nothing modified dramatically for the more severe relating to any of the 4 dividend growers’ operations. This disconnect between declining share costs and every firm’s management place in its area of interest could create alternatives for traders centered on the lengthy haul.

These firms are residence to well-funded dividends that provide the potential to develop far into the longer term. This is why these S&P 500 shares are 4 of my prime choices to purchase in 2024 and maintain ceaselessly.

1. Nike

With a complete return north of 92,000% since its preliminary public providing (IPO) in 1980, Nike has an unbelievable monitor report of remaining essentially the most dominant model in footwear and attire.

To assist quantify simply how highly effective the Nike identify is, take into account that Kantar Brandz listed it because the Thirteenth-most-valuable model in 2022, forward of companies like Coca-Cola, Tesla, and Netflix. This top-tier model energy is noteworthy for traders. The businesses in Kantar Brandz’s prime 100 annually have posted inventory returns stronger than the S&P 500 by a rating of 357% to 245% since 2006.

Greatest but for traders, Piper Sandler’s 2023 survey on U.S. youngsters’ spending confirmed that Nike remained the far-and-away chief in footwear and attire, with 61% and 35% of respondents calling the corporate their favourite for every phase. This strong mindshare amongst Gen Z buyers indicators that Nike’s present struggles are short-term and shouldn’t be an ongoing drawback as these younger buyers age and start making extra monetary choices on their very own.

On the monetary facet, Nike pays a 1.4% dividend yield that solely makes use of 40% of its internet earnings, leaving a promising development runway for traders in search of passive earnings. It is grown this dividend by 11% yearly during the last 5 years. Nike guarantees to reward affected person traders who’re keen to attend out the at the moment unfriendly client spending atmosphere that helped its inventory slide 20% within the final yr.

Due to its best-in-class model, pleasant money returns to shareholders, and a rightsizing stock that has dropped 17% from its 2022 highs, Nike appears like a premium enterprise buying and selling on the truthful value of 25 occasions free money circulation (FCF).

2. MarketAxess

With its deal with bringing bond buying and selling into the digital age, MarketAxess has delivered complete returns above 1,700% since its IPO in 2004. Nonetheless, even following this unbelievable run, the corporate’s development story needs to be removed from over.

Regardless of this period of supercomputers and synthetic intelligence, CEO Christopher Gerosa estimates that lower than 40% of U.S. high-grade and high-yield bonds is traded electronically, like they’re on MarketAxess’s all-to-all platform. These figures drop even decrease, to five% or 7%, for rising markets. With Gerosa and MarketAxess anticipating digital bond buying and selling to mature and account for over 80% of trades for every bond group, the corporate’s development story may nonetheless be in its early chapters.

Whereas this development runway gives loads of intrigue for traders over the long run, the subdued ranges of volatility in right this moment’s markets proceed to weigh on MarketAxess’s monetary outcomes, sending its inventory down 16% previously yr. Though I’m an enormous fan of those calmer markets, this isn’t a wonderful factor for MarketAxess particularly, because it thrives from the elevated bond buying and selling that normally happens alongside increased ranges of volatility.

With a 1% dividend yield that has grown by 12% yearly over the previous decade — and that solely makes use of 44% of the corporate’s internet earnings — MarketAxess is completely satisfied to pay traders to attend for the inevitable turnaround within the digital bond buying and selling market. The corporate studies earnings on Jan. 31, so MarketAxess will quickly present us with some insights into the character of this turnaround.

3. Paycom

Paycom gives cloud-based human capital administration (HCM) instruments comparable to expertise acquisition and administration, time and labor administration, payroll, and human assets. It has turn into a 12-bagger in lower than a decade since its IPO. After launching its automated and employee-guided payroll answer, Beti, in 2021, the corporate noticed a dramatic lower in payroll errors and omissions from its prospects.

It is a nice signal, proper? After all — no less than, in the long run. This new providing is a large profit to its prospects and their happiness. However within the quick time period, this streamlining of its prospects’ payrolls has weighed on Paycom’s development charges, because it beforehand made cash fixing these errors and omissions.

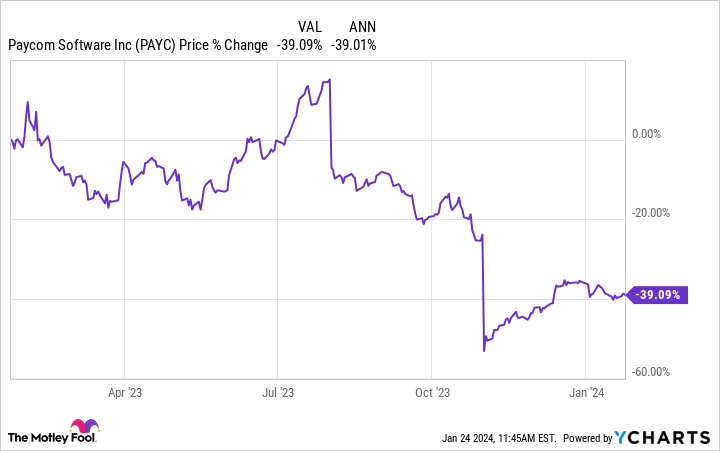

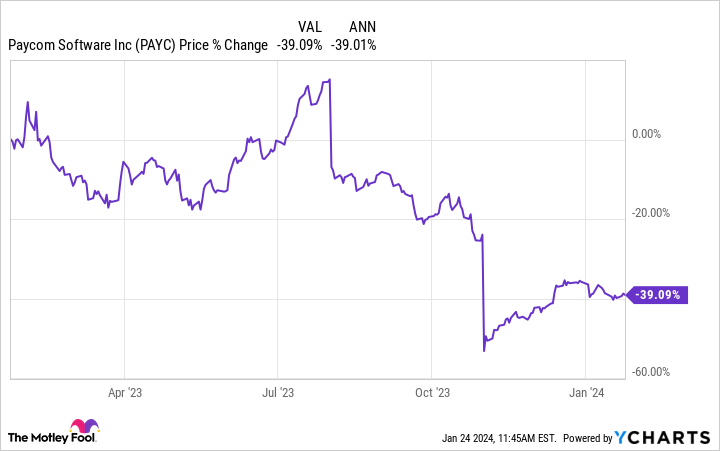

This trade-off between short-term ache and long-term alternative is what makes Paycom so attention-grabbing right this moment, particularly with its inventory down round 40% previously yr.

In the end, this could show to be a implausible “drawback” for Paycom. Beti’s early success highlights why the corporate’s choices stay essentially the most beloved amongst its prospects in its HCM area of interest. With a brand new 0.8% dividend yield that administration expects to proceed elevating yearly — and that solely makes use of 26% of the corporate’s internet earnings — Paycom could possibly be a budding dividend development story.

With its gross sales rising by 22% regardless of these nice-to-have headwinds, Paycom may rapidly outgrow its price-to-earnings (P/E) ratio of 34.

4. Hershey

As essentially the most worthwhile chocolatier and confectioner amongst its publicly traded friends — on a return on invested capital (ROIC) foundation — The Hershey Firm has recorded market-beating annualized returns of 13% since its 1978 IPO. Powered by its namesake Hershey model and its possession of the Reese’s and Package Kat manufacturers, the corporate is residence to 3 of the highest 5 most-recognizable chocolate labels within the U.S.

Due to this widespread recognition and over 100 beloved manufacturers, Hershey maintains round a forty five% share of the U.S. chocolate market and a 30% share of the sweet, mint, and gum (CMG) area of interest.

This mix of top-notch profitability, model energy, and trade management leaves Hershey uniquely well-positioned to outlive threats like Mr. Beast’s Feastables choices and the rise of GLP-1 weight-loss medicine. It is residence to a well-funded 2.3% dividend yield that’s its highest for the reason that 2020 crash and a P/E ratio of 21 that’s at its lowest since 2019, following a ten% drop during the last yr. I am going to fortunately purchase extra of this beloved American model at a reduction for my daughter.

Do you have to make investments $1,000 in Nike proper now?

Before you purchase inventory in Nike, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nike wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of the S&P 500 since 2002*.

*Inventory Advisor returns as of January 22, 2024

Josh Kohn-Lindquist has positions in Coca-Cola, Hershey, MarketAxess, Netflix, Nike, Paycom Software program, and Tesla. The Motley Idiot has positions in and recommends MarketAxess, Netflix, Nike, Paycom Software program, and Tesla. The Motley Idiot recommends Hershey and recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a disclosure coverage.

4 High S&P 500 Dividend Development Shares Down Between 10% and 42% to Purchase in 2024 and Maintain Ceaselessly was initially revealed by The Motley Idiot