f9photos/iStock through Getty Photos

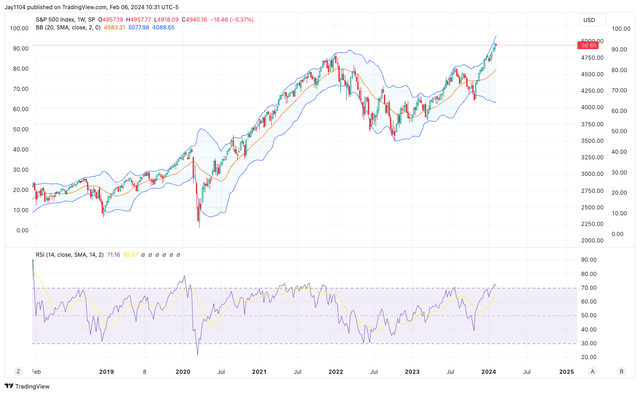

The S&P 500 (SP500) and some of its key sectors have reached over-bought ranges based mostly on a number of technical indicators suggesting that this market is overextended from a technical standpoint at a time when the dynamics of the choices market are flashing warning indicators in all places, and anticipated future returns plunge.

As mentioned beforehand, the choices market has helped push the fairness market to those overbought ranges every day, weekly, and month-to-month. However the dynamics of those overbought circumstances are shifting, and the window for a big market decline just isn’t solely open, however the time for the unwind seems to be in progress.

The overbought ranges within the S&P 500 could be seen on the every day and weekly chart by wanting on the relative energy index, which climbed above 70 through the center of final week. It is not usually that the S&P 500 sees its RSI rise above 70 on the weekly chart. It solely occurred as soon as through the rally of 2023 and earlier than that you need to return to late 2021.

TradingView

These circumstances are additionally current in sectors like Semiconductors, with the VanEck Semiconductor ETF (SMH) additionally seeing its RSI on the weekly chart climb above 70. That decisive transfer within the sector probably displays the massive transfer increased in shares like Nvidia (NVDA) and AMD (AMD). Along with the SMH ETF seeing its RSI rise above 70, it has additionally seen its worth rise above the higher Bollinger band, one other overbought situation on the weekly chart.

TradingView

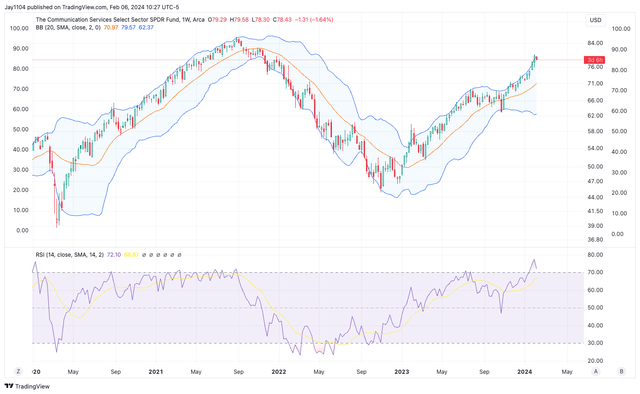

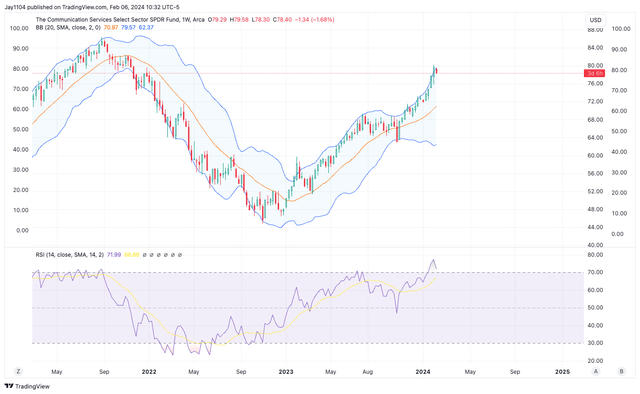

The Communication Providers Choose Sector SPDR (XLC) ETF additionally finds itself equally positioned, with the RSI climbing to greater than 77 final week. On the similar time, the value closed above the higher Bollinger band, additionally flashing the circumstances of being overbought on two separate indicators. The transfer increased within the XLC is probably going a mirrored image of the sturdy efficiency of Meta (META)

TradingView

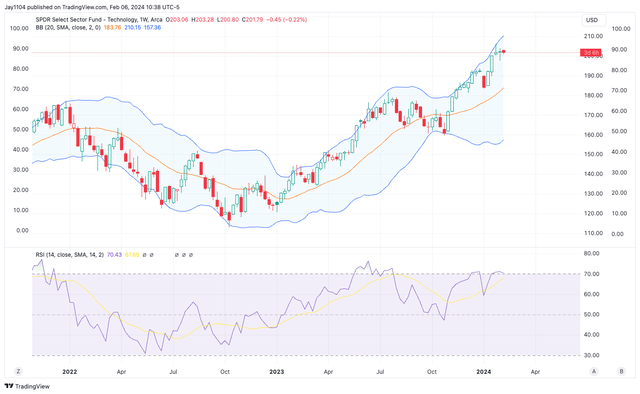

The SPDR Choose Sector Expertise ETF (XLK) has reached comparable overbought ranges, however solely with the RSI climbing above 70. Unlikely, the opposite has not seen its worth rise above the higher Bollinger band. So, whereas the ETF could possibly be thought of overbought based mostly on the relative energy index, it does not current the identical total exuberance.

TradingView

Choices Flows

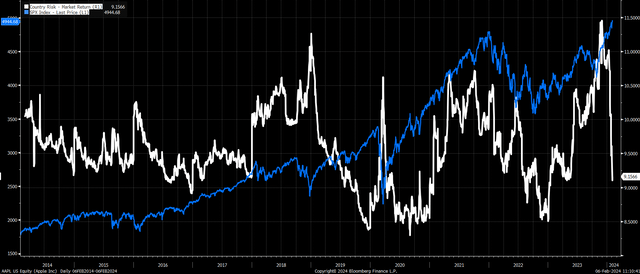

These overbought circumstances seem to mirror, in some circumstances, the positioning out there in choose shares that make up a few of these sectors. It might additionally consequence from the implied volatility dispersion commerce mentioned beforehand and possibility hedging flows that had been very supportive of the shares over the previous couple of months.

However with the massive January choices expiration date and vital earnings behind us, these supportive hedging flows ought to be diminished and implied volatility ranges throughout the mega-cap shares have now fallen too sharply decrease ranges.

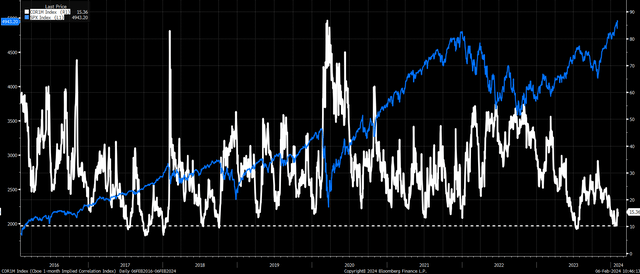

Bloomberg

It has led the 1-month implied correlation index to rise off its latest lows after difficult the degrees final seen in July 2023 and elements of 2017 and 2018- durations that additionally noticed stretched sentiment, resembling in January 2018. Normally, when the implied correlation index rises, the S&P 500 reverses its positive factors and heads decrease, as has been the case previously.

TradingView

When the implied correlation index falls, the implied volatility of the S&P 500 strikes in the wrong way of the parts within the S&P 500. When the implied correlation index rises, it’s a perform of the implied volatility of each the index and basket of shares shifting in the identical course and being extra correlated.

So, not less than on the floor, the present overbought studying on the S&P 500 and some sectors, primarily those which have probably the most vital impression on the implied volatility dispersion commerce, seems to sign that the market has reached an overextended place.

It does not need to imply that inventory costs and indexes fall; it might consequence within the index marking time and consolidating sideways. Nevertheless, valuation and progress charges recommend the market might see a big pullback.

Anticipated Market Returns Plunge

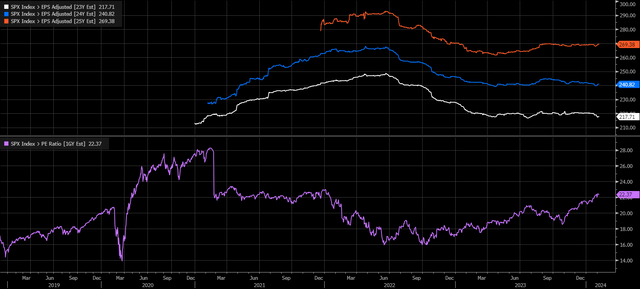

The S&P 500 is buying and selling at greater than 22 instances 2024 earnings estimates, which places it again at ranges final seen in 2021 when rates of interest had been close to zero and the Fed was conducting QE. That is against the in a single day Fed Funds charge now being greater than 525 bps increased, because the Fed is working quantitative tightening.

TradingView

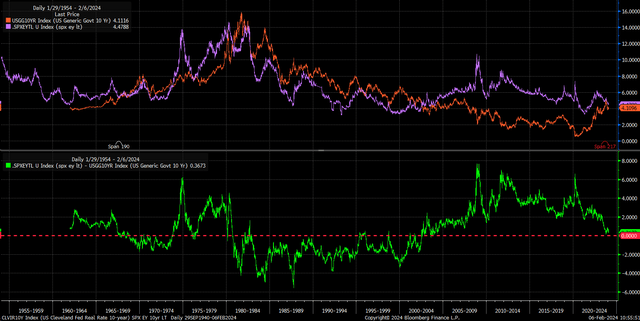

In the meantime, the unfold between the final twelve months’ earnings yield and the 10-year charge has contracted to simply 35 bps. That’s the narrowest the unfold has been because the Nineties and is related to a time of falling rates of interest, not throughout a time of rising curiosity, resembling within the Nineteen Sixties and Nineteen Seventies.

TradingView

Moreover, the anticipated market returns have plummeted. Prior to now, adjustments in market anticipated returns have, at instances, acted as a number one indicator of the course of the S&P 500. It could possibly be that the numerous positive factors witnessed within the broader indexes and lots of market sectors have pulled ahead future returns.

TradingView

All of this appears to level to an overheated market that wants an enormous reset, which seems to be already in movement.