)

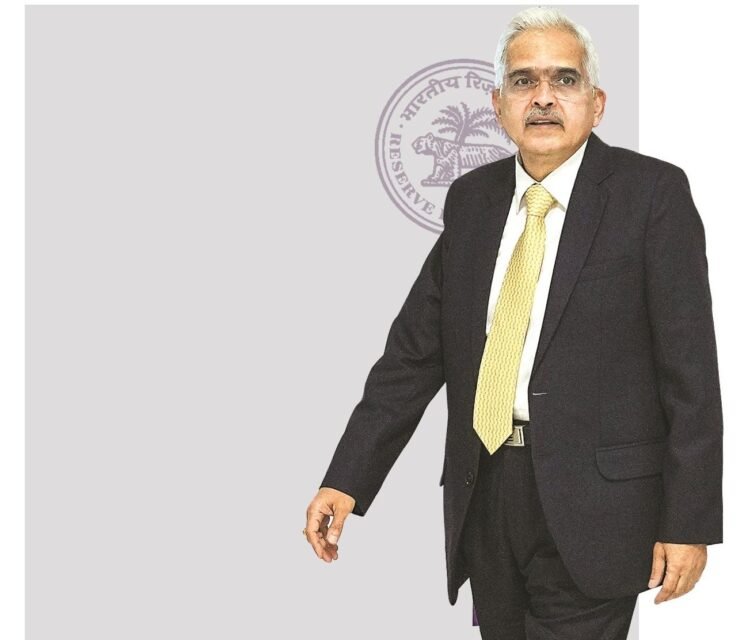

Shaktikanta Das, RBI Governor

The Reserve Financial institution of India’s (RBI’s) six-member financial coverage committee on Thursday determined to keep up the established order on the coverage repo whereas retaining an accommodative stance — with a 5-1 majority on each resolutions.

Curiously, it was for the primary time a member, Jayanth Varma, voted in favour of a charge minimize on this cycle — by 25 foundation factors (bps). Exterior member Varma additionally voted to vary the stance to impartial.

“The uncertainties in meals costs, nevertheless, proceed to impinge on the headline inflation trajectory,” RBI Governor Shaktikanta Das stated.

“Inflation has seen a big moderation from the highs of the summer time of 2022 … That stated, the job will not be but completed, and we must be vigilant about new provide shocks that will undo the progress made to date,” Das stated, including that the central financial institution wanted to make sure profitable navigation of the final mile of disinflation. “Secure and low inflation at 4 per cent will present the mandatory bedrock for sustainable financial progress.”

The RBI, which for the primary time introduced its progress projection for subsequent monetary yr, pegged actual gross home product (GDP) progress at 7 per cent. Inflation for FY25 was projected at 4.5 per cent. Whereas CPI (shopper worth index) inflation is anticipated to be at 5 per cent in Q1FY25, it should fall to 4 per cent in Q2. This has pushed again expectations for a discount within the repo charge to the second quarter of FY25.

After climbing the repo charge by 250 bps to six.5 per cent between Could 2022 and February 2023, the RBI paused in April final yr. That is the sixth consecutive assembly when the established order is maintained.

In the course of the post-policy media interplay, Deputy Governor Swaminathan J stated the transmission was incomplete the place lending charges have been linked to the marginal value of fund-based lending charge (MCLR).

“The charges on the deposit aspect reset a lot quicker and they’re handed on just about quicker as we now have seen that deposit charges have nearly performed out. Whereas on the lending aspect, charges take way more time to go,” Swaminathan stated.

Markets have been dissatisfied with the hawkish tone because the BSE Sensex ended 1 per cent or 723.57 factors down, and the 10-year benchmark yield erased early good points after the coverage announcement.

“Towards our expectations, we predict the tone of the statements from the governor and the MPC maintained the extent of hawkishness from the December assembly,” Rahul Bajoria, managing director and head of EM Asia (ex-China) economics, Barclays.

“The main target remained on navigating the final mile of disinflation, which within the governor’s view is the ‘most difficult’,” Bajoria stated, including that the governor’s confidence on progress and projections for a similar, recommend the MPC, for now, sees no need for financial coverage easing to help progress.

Abheek Barua, chief economist, HDFC Financial institution, stated the RBI left little room for any imminent coverage pivot and, subsequently, “we don’t anticipate charge cuts to occur earlier than the August 2024 coverage”.

“Watchful of dangers of delayed begin of charge minimize cycle to past June 24,” stated Morgan Stanley in a be aware to its purchasers. “…the moderation in inflation opens up room for a shallow charge minimize cycle (cumulative 50 bps), as we now have in our base case ranging from June 24. Nevertheless, we’re watchful of dangers of a delayed begin to the speed minimize cycle, from a stronger-than-anticipated progress development, slower moderation in inflation,” the be aware stated.

Whereas the market was additionally dissatisfied by the shortage of recent measures to handle liquidity points, the central financial institution introduced a 14-day variable charge repo public sale for a notified quantity of Rs 1.75 trillion.

“The main target of liquidity administration stays to align the weighted common name charge with the repo charge,” stated a report from IDFC First Financial institution.

“System liquidity deficit is anticipated to ease by the tip of March 2024, as authorities expenditure picks-up. Therefore, by April we anticipate the in a single day charges to maneuver in the direction of the repo charge, on a constant foundation,” the report stated.

First Revealed: Feb 09 2024 | 12:16 AM IST