The OECD expects world inflation to recede sooner in most economies in comparison with its earlier estimates, however urged central bankers to remain alert because it’s too quickly to declare victory.

Article content material

(Bloomberg) — The OECD expects world inflation to recede sooner in most economies in comparison with its earlier estimates, however urged central bankers to remain alert because it’s too quickly to declare victory.

Deflation in China is deepening, whereas annual revisions confirmed US inflation is on a downward pattern. Nonetheless, value pressures in Brazil didn’t sluggish by as a lot as forecast at first of the yr, whereas wage development maintained momentum in Japan.

Commercial 2

Article content material

Article content material

Listed here are a number of the charts that appeared on Bloomberg this week on the newest developments world economic system, geopolitics and markets:

World

The world’s main central banks should not drop their guard within the battle in opposition to inflation because it’s too quickly to say if sharp rate of interest will increase have contained underlying value pressures, the OECD mentioned.

Australia’s central financial institution left rates of interest at a 12-year excessive and signaled additional tightening stays attainable. India saved charges regular however maintained a hawkish coverage stance. Thailand, Iceland, Serbia, Uganda, Poland, Mexico additionally left charges unchanged. Kenya hiked by greater than anticipated, and Nigeria raised rates of interest on short-term debt. The Czech Republic and Peru minimize charges.

Main delivery corporations are warning that the safety scenario within the Crimson Sea is constant to deteriorate, regardless of efforts by the west to restrict assaults by Yemen’s Houthi rebels. The delivery corporations’ perceptions of danger matter as a result of they’re what is going to dictate when vessels return to the area. The entire homeowners mentioned they are going to proceed to re-route their ships till it’s secure to journey the Crimson Sea.

Article content material

Commercial 3

Article content material

Asia

China’s client costs dropped 0.8% final month, essentially the most because the world monetary disaster, piling stress on the federal government to step-up assist for a stumbling financial rebound that’s roiling markets. The producer value index fell 2.5%, marking 16 straight months of deflation for factory-gate prices.

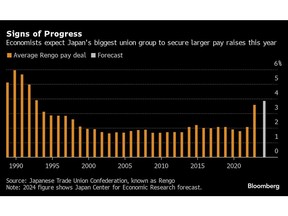

Japan’s annual wage negotiations have kicked off in earnest, drawing elevated consideration because the Financial institution of Japan appears for proof of a virtuous wage-price cycle that will enable it to exit from the world’s final unfavorable fee regime. Information out Tuesday confirmed wage development strengthened by lower than anticipated in December whereas nonetheless exhibiting indicators of enough underlying momentum to maintain the BOJ on monitor.

US

US inflation was about the identical on the finish of final yr as initially reported after incorporating annual revisions, based on new knowledge revealed Friday. The uneventful revision will come as a aid for Federal Reserve officers who’re searching for extra proof that value pressures are sustainably receding earlier than they start reducing rates of interest.

The US commerce deficit narrowed final yr by essentially the most since 2009 as the worth of imported items declined and the providers surplus elevated. The nation’s merchandise deficit with China final yr shrank 27% to an unadjusted $279.4 billion, the smallest since 2010.

Commercial 4

Article content material

American households took on extra debt on the finish of final yr, and a few of these loans are more and more going dangerous, based on knowledge from the Federal Reserve Financial institution of New York. Though general US delinquency charges stay under pre-Covid ranges, these for bank cards and auto loans at the moment are greater.

Rising Markets

Brazil’s annual inflation slowed lower than anticipated at first of the yr, underscoring the challenges dealing with the central financial institution because it lowers borrowing prices.

Europe

German industrial output prolonged its hunch to a seventh month in December, underlining the struggles gripping Europe’s largest economic system. The general stage of manufacturing is now at its lowest since June 2020, and stripping out the shock of the pandemic, the final time it was so weak was in 2010.

Britain’s labor market is tighter than thought, reflecting adjustments to inhabitants estimates in official knowledge that confirmed extra younger individuals of working age than earlier than. Unemployment by the brand new measure was 3.9% within the three months by means of November, effectively under the 4.2% estimated utilizing earlier knowledge, the Workplace for Nationwide Statistics mentioned.

European economies obtained a poor invoice of well being in a survey of specialists that confirmed elevated recession dangers as a consequence of geopolitical conflicts and heightened power prices. Within the euro zone, the possibilities of two consecutive quarters of declining output by year-end are highest in Germany and the Netherlands.

—With help from Philip Aldrick, Claire Ballentine, Matthew Boesler, Mia Glass, William Horobin, Robert Jameson, Alex Longley, James Mayger, Colum Murphy, Mark Niquette, Jana Randow, Andrew Rosati, Zoe Schneeweiss, Alex Tanzi, Sanne Wass, Sonja Wind and Erica Yokoyama.

Article content material