DNY59

The BlackRock Core Bond Belief (NYSE:BHK) is a closed-end fund that income-focused buyers can make use of as a technique of reaching their objectives whereas holding their dangers at a minimal. It’s because, this is without doubt one of the few closed-end bond funds that invests primarily in investment-grade belongings. Nearly all of closed-end debt funds make investments their cash in additional speculative securities, comparable to junk bonds or leveraged loans, because of the truth that it was a lot simpler to generate a good degree of earnings off of speculative-grade securities over many of the previous twenty years. That is pure, as a result of these securities have a lot increased yields than investment-grade bonds due to their increased threat of default-related losses. Curiously, although, the BlackRock Core Bond Belief has not wanted to sacrifice a lot by way of yield relative to its friends regardless of investing in safer belongings. As of as we speak, the fund yields 8.27%, which could be very a lot consistent with most junk bond funds. That is one thing that we must always examine, because it doesn’t make a lot sense that an investment-grade bond fund ought to have the ability to compete with junk bond funds by way of yield.

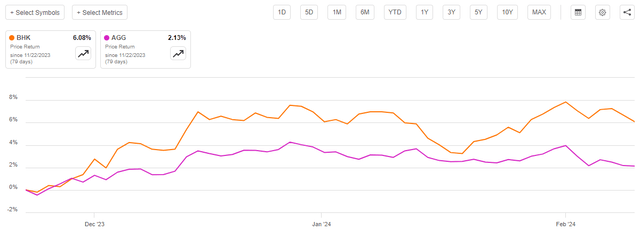

As common readers can little doubt recall, we beforehand mentioned the BlackRock Core Bond Belief in late November 2023. At the moment, the market was wildly optimistic concerning the potential for rate of interest cuts in 2024 and was driving up bond costs in an try and front-run the Federal Reserve. The market continues to be optimistic as we speak, though it has tempered its optimism considerably over the previous few weeks. This has not stopped the fund from delivering a really stable efficiency, nevertheless. As we are able to see right here, its share value is up 6.08% because the date that the earlier article was printed. That is considerably higher than the two.13% acquire of the Bloomberg U.S. Mixture Bond Index (AGG):

Looking for Alpha

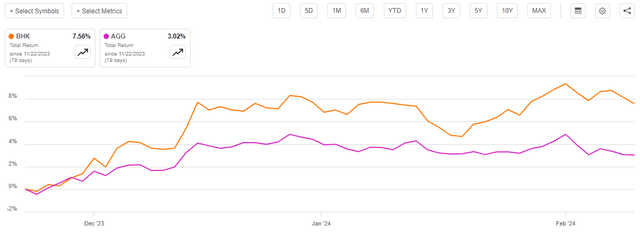

The precise return that was realized by the fund’s buyers is considerably increased than this, nevertheless. As I’ve identified in quite a few earlier articles, the enterprise mannequin for many closed-end funds is to pay out all of their funding earnings to their shareholders within the type of distributions whereas trying to take care of a comparatively steady web asset worth. That is totally different from an index fund or an exchange-traded fund that depends totally on share value actions to offer an funding return. It’s also the rationale why closed-end funds sometimes have increased yields than absolutely anything else available in the market.

The truth that this fund delivers the lion’s share of its funding earnings within the type of direct funds to its buyers implies that we have to take the distributions into consideration when conducting any efficiency analysis. Once we do this, we see that the fund’s buyers benefited from a 7.56% complete return since November 22, 2023. That is clearly significantly better than the three.02% complete return of the Bloomberg U.S. Mixture Bond Index:

Looking for Alpha

That is definitely a really respectable efficiency over such a brief time frame. Certainly, it appears nearly sure to attraction to any income-focused investor. There could possibly be some causes to consider that the market has gotten forward of itself and that these current beneficial properties aren’t going to final. As such, it could possibly be a good suggestion to start lowering your place within the fund as we speak.

About The Fund

In accordance with the fund’s webpage, the BlackRock Core Bond Belief has the twin targets of offering present earnings and capital appreciation. Of the 2 of those, solely the concentrate on present earnings makes any actual sense given the fund’s technique. As the web site explains:

BlackRock Core Bond Belief’s funding goal is to offer present earnings and capital appreciation. The Belief seeks to realize its funding goal by investing at the very least 75% of its belongings in bonds which might be funding grade high quality on the time of funding. The Belief’s investments will embody a broad vary of bonds, together with company bonds, US authorities and company securities and mortgage-related securities. The Belief could make investments instantly in such securities or synthetically via using derivatives.

As talked about within the introduction, and as this description makes very apparent, the BlackRock Core Bond Belief invests primarily in investment-grade bonds. Bonds, by their very nature are earnings securities, as they don’t ship any web capital beneficial properties over their lifetimes. This is smart, as an investor will buy a bond at face worth and obtain face worth again when the bond matures. The one funding return for a bond held over its total lifetime is the coupon funds made to the bond’s proprietor. Thus, bonds don’t ship capital appreciation over their lifetimes.

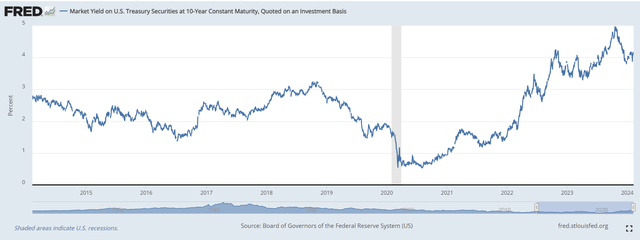

With that stated, bond costs do fluctuate with rates of interest and that gives a chance for the fund to earn some cash by buying and selling the bonds in its portfolio. Its 104.00% annual turnover, which is extremely excessive for a closed-end bond fund, means that it’s trying to enhance the returns from its portfolio by buying and selling bonds. This really makes a specific amount of sense given the extremely low yield of investment-grade bonds over the previous decade or two. This chart reveals the ten-year Treasury fixed maturity over the previous ten years:

Federal Reserve Financial institution of St. Louis

Particularly, this chart reveals the Market Yield on U.S. Treasury Securities at 10-Yr Fixed Maturity. That is an index printed by the Federal Reserve upon which the yields of different types of debt, comparable to investment-grade company bonds, are based mostly. Investopedia affords a definition:

Fixed maturity is the theoretical worth of a U.S. Treasury that’s based mostly on current values of auctioned U.S. Treasuries. The worth is obtained by the U.S. Treasury each day via the interpolation of the Treasury yield curve which, in flip, relies on closing bid-yields of actively-traded Treasury securities. It’s calculated utilizing the day by day yield curve of U.S. Treasuries.

That is necessary for this fund as a result of investment-grade securities will often have a yield that’s not more than 2% increased than the yield of comparable maturity U.S. Treasuries. As we are able to see above, the ten-year fixed maturity of U.S. Treasury securities has not gone over 5% throughout the previous ten years. Nevertheless, throughout most of this era, it was beneath 3%. As such, it was fairly a uncommon prevalence for any investment-grade safety to have a yield-to-maturity exceeding 5% or so over the interval. A 4% to five% yield on a $1 million portfolio would solely present an annual earnings of $40,000 to $50,000 and it appears unlikely that this could be an appropriate degree of earnings for anybody who managed to build up a $1 million portfolio over the course of their careers. As such, we are able to clearly see {that a} fund such because the BlackRock Core Bond Belief couldn’t obtain an affordable degree of earnings or complete return just by shopping for and holding investment-grade securities. This fund must interact in buying and selling and realizing earnings with the intention to present the buyers with one thing aggressive with junk bond funds or most different closed-end funds. Its 104% annual turnover means that it’s certainly doing that to a better diploma than most different closed-end bond funds.

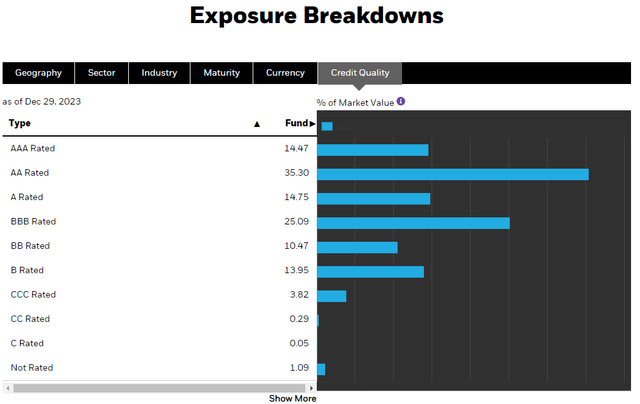

Regardless of what the fund’s description may recommend, the BlackRock Core Bond Belief doesn’t look like solely restricted to investment-grade debt securities. In actual fact, a major proportion of the fund’s belongings are at present invested in junk bonds. We are able to see this right here:

BlackRock

An investment-grade bond is something rated BBB or increased by one of many main score companies. As we are able to see, that describes 89.61% of the fund’s belongings per the above chart. Nevertheless, the above chart additionally states that 29.67% of the fund’s belongings are invested in junk or unrated debt. As I’ve identified in varied earlier articles, unrated debt is nearly all the time going to be speculative-grade by way of precise high quality as a result of nearly any firm that’s able to qualifying as an investment-grade issuer will spend the cash to have its debt rated. In any case, the price of having a score company situation an investment-grade score is cheaper than the incremental curiosity prices that the agency must pay on unrated debt securities.

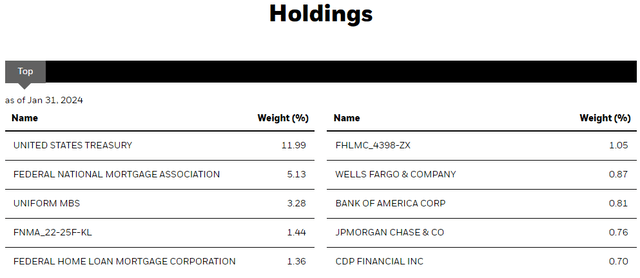

General, it is a a lot increased weighting to junk debt than we’d count on from a fund like this. The fund’s technique description on the web site states that it’s going to not have greater than 25% of its belongings invested in junk debt, however it’s increased than that degree proper now. Nevertheless, because of using leverage, the fund additionally exceeds the 75% required allocation to investment-grade securities as a result of the numbers above complete greater than 100%. This might nonetheless recommend that the fund is exposing itself to a better degree of default-related threat than some buyers might want, although. That will or might not be an issue, particularly after we take into account that this fund is holding securities from 622 issuers. That ought to imply that any particular person issuer (aside from the Federal Authorities) represents solely a really small proportion of the fund’s complete belongings. That’s precisely what we see after we have a look at the fund’s holdings. Listed here are the biggest positions at present held by this fund:

BlackRock

We see right here that six of the fund’s largest positions are issued both by the U.S. Federal Authorities or certainly one of its companies. The one totally personal issuers proven within the checklist above are Wells Fargo (WFC), Financial institution of America (BAC), JPMorgan Chase (JPM), and CDP Monetary Companies. All 4 of those personal issuers account for lower than 1% of the fund’s complete belongings. That strongly implies that the overwhelming majority of the fund’s holdings are considerably lower than that, which ought to imply that any particular person default has a negligible affect on the fund’s total portfolio worth. Thus, there needs to be little or no default threat right here, and as such, the first threat of losses comes from hostile rate of interest actions.

Curiosity Price Threat

Sadly, this threat of hostile rate of interest actions could possibly be a lot increased than most market members are assuming proper now. It’s because there’s a sturdy chance that the Federal Reserve won’t lower rates of interest to the diploma that the market is at present assuming. If that is appropriate, then the belongings held by this fund are considerably overpriced and are positioned to say no in worth within the close to future.

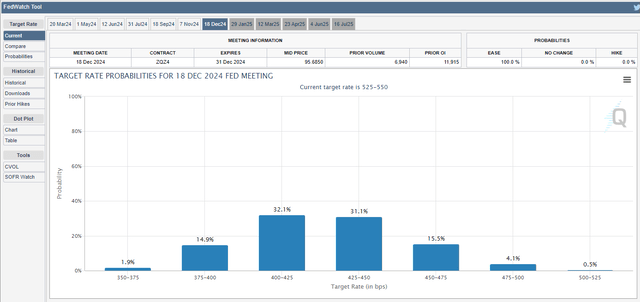

First, allow us to take a look on the market’s present rate of interest assumptions. In accordance with the Chicago Mercantile Trade, the federal funds futures market is at present assigning a 63.2% chance that the federal funds goal price will probably be 400 to 450 foundation factors by the top of the yr:

Chicago Mercantile Trade

That means that the market expects 4 or 5 25-basis factors cuts by the top of the yr. As I identified in varied earlier articles, previous to the January assembly, the market anticipated the primary of those cuts to happen on the March assembly of the Federal Open Market Committee. Nevertheless, the statements that have been made following the January assembly strongly steered that there’s extremely unlikely to be any price lower in March. The statements steered that the Federal Reserve wanted extra information exhibiting that the economic system was cooling down and inflation was “sustainably decrease” earlier than reducing rates of interest. Because of this, the market is at present solely assigning a 16.0% chance that rates of interest will probably be lower on the March assembly. There’s an 84.0% chance that rates of interest will stay the identical.

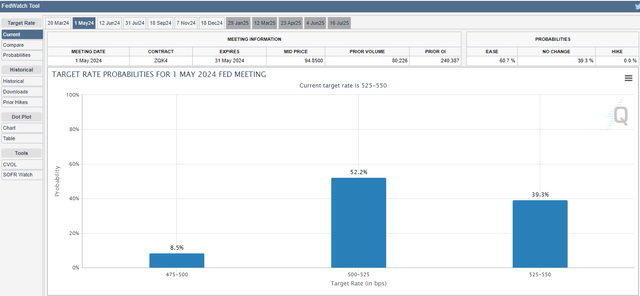

Nevertheless, it’s a totally different story for the Could 2024 assembly. Listed here are the present market projections for the federal funds price following the Could assembly:

Chicago Mercantile Trade

The market is at present assigning an 8.5% chance that the federal funds goal price will probably be 475 to 500 foundation factors and a 52.2% chance that the federal funds goal price will probably be 500 to 525 foundation factors following the Could assembly. That implies that the market believes that the federal funds price will probably be lowered by both 25 or 50 foundation factors, with a 60.7% chance. It is rather troublesome to consider that the market will probably be confirmed appropriate. To begin with, there is just one information launch exhibiting employment and inflation information between the March and the Could conferences. If the information was not exhibiting adequate progress to help a March lower, it appears unlikely that there will probably be something in a single information launch that can instantly make the Federal Reserve change its thoughts about rates of interest.

If we assume that this would be the case, and the Federal Reserve doesn’t lower rates of interest in Could, we’re left with the potential of very fast rate of interest cuts throughout the second half of the yr if the market’s present expectations are to be met. That likewise appears extremely unlikely to truly occur. First, the Federal Reserve has solely as soon as in historical past lower rates of interest 5 occasions throughout a single calendar yr exterior of an enormous recession. The Federal Authorities will nearly definitely use each fiscal coverage software that it has to keep away from a extreme recession so near a presidential election. The presidential election additionally turns into necessary for financial coverage, because the Federal Reserve will in all probability wish to keep away from accusations that it’s reducing rates of interest in an try to assist the incumbent. Thus, within the absence of an extremely extreme recession, the Federal Reserve will in all probability select to keep away from drawing consideration to itself. Whereas I do know that many readers won’t wish to hear it, it’s really simpler to make a case that there will probably be zero price cuts in 2024 quite than the 4 or 5 that the market is at present pricing into bonds.

For its half, the members of the Federal Open Market Committee, which is answerable for setting the federal funds goal price, are projecting that the efficient federal funds price will probably be 4.6% on the finish of 2024. That means three 25-basis level cuts, which can also be fewer than the market is at present projecting.

That is necessary as a result of buyers and different market members have been shopping for up bonds in accordance with the expectations of the federal funds futures market. That is the rationale why the yield of the ten-year U.S. Treasury notice has fallen from its most up-to-date multi-year excessive of 4.988% on October 19, 2023, to 4.177% as we speak:

CNBC

When bond yields decline, it implies that their market value goes up. As already talked about, the yield of all the securities held by the BlackRock Core Bond Belief correlates to the yield of the ten-year U.S. Treasury notice. Thus, we are able to assume that the worth of all of the belongings which might be held by the fund has risen together with the ten-year U.S. Treasury notice.

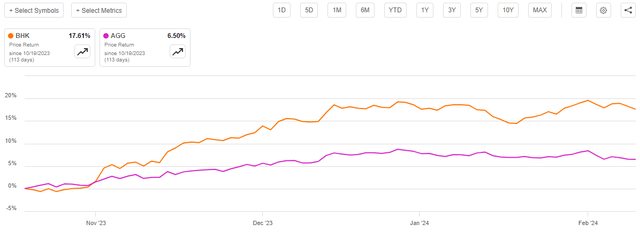

That is precisely what we see. As we are able to see right here, shares of the BlackRock Core Bond Belief are up 17.61% since October 19, 2023. That is considerably greater than the 6.50% acquire of the Bloomberg U.S. Mixture Bond Index:

Looking for Alpha

Nevertheless, if the Federal Reserve doesn’t lower rates of interest to the diploma that the market desires, as appears seemingly, then this run-up was unwarranted, and the fund is prone to see a share value decline and provides again a few of its beneficial properties. It due to this fact could also be a good suggestion to dump a few of your place and understand your earnings earlier than you lose them to a market correction.

Leverage

As is the case with most closed-end bond funds, the BlackRock Core Bond Belief employs leverage as a technique of boosting the efficient yield of its portfolio. That is one thing that has been vital with the intention to acquire cheap yields from any bond portfolio over many of the previous twenty years because of how low-interest charges have been for many of the interval. As well as, that is how the fund’s weightings (as mentioned earlier) are in a position to exceed 100%. I mentioned how this works in my earlier article on this fund:

Briefly, the fund is borrowing cash and utilizing that borrowed cash to buy bonds and related belongings. So long as the rate of interest that the fund pays on the borrowed cash is lower than the yield of the bought securities, the technique works fairly nicely to spice up the efficient yield of the portfolio. As this fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges, it will usually be the case. With that stated, this fund is just not going to learn as a lot from this technique as we speak because it did just a few years in the past when rates of interest have been successfully zero.

Sadly, using debt on this style is a double-edged sword. It’s because leverage boosts each beneficial properties and losses. As such, we wish to make sure that the fund is just not using an excessive amount of leverage as a result of this could expose us to an extreme degree of threat. I don’t usually prefer to see a fund’s leverage exceed a 3rd as a proportion of its belongings for that reason.

As of the time of writing, the BlackRock Core Bond Belief has leveraged belongings comprising 34.66% of its complete portfolio. That is increased than the one-third degree that I would like to see, however it’s nonetheless higher than the 35.86% leverage ratio that the fund had after we final mentioned it in late November. The explanation for that is pretty apparent. The worth of the belongings which might be held within the fund’s portfolio has elevated, however the fund has not borrowed any extra money.

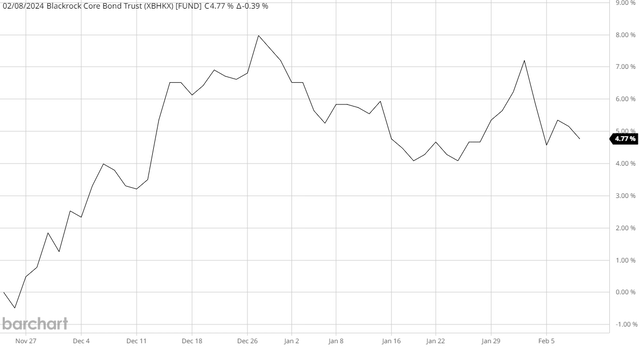

This chart reveals the fund’s web asset worth from November 22, 2023 (the publication date of my earlier article on this fund) till as we speak:

Barchart

As we are able to see, the fund’s web asset worth is up 4.77% because the date of the prior article. Thus, assuming that the fund’s borrowings remained static, they need to now characterize a smaller proportion of the fund’s total portfolio. This seems to be the case.

For probably the most half, buyers shouldn’t have to fret an excessive amount of concerning the fund’s leverage, regardless of it being a bit increased than my one-third desire. Bond funds are typically in a position to carry a better degree of leverage than fairness funds as a result of relative stability of their belongings. The truth that this fund invests primarily in investment-grade securities provides to this degree of security, as the chance of default losses is significantly lowered in comparison with a junk bond fund. As such, the leverage needs to be acceptable right here, though it’s value noting that this fund will in all probability decline greater than the Bloomberg U.S. Mixture Bond Index if the Federal Reserve fails to fulfill the market with respect to rates of interest.

Distribution Evaluation

As talked about earlier on this article, the first goal of the BlackRock Core Bond Belief is to offer its buyers with a excessive degree of present earnings and capital appreciation. As it is a bond fund, the securities will ship most of their returns within the type of direct funds to their homeowners, however the fund seems to be partaking in a considerable quantity of buying and selling exercise with the intention to understand capital beneficial properties and generate some realized returns that method. Thus, it has two strategies of manufacturing funding earnings, and the leverage permits the fund to obtain present earnings and capital beneficial properties from extra securities than it may management with its personal fairness capital. That reinforces the efficient returns that the fund receives from the portfolio, in addition to the earnings that it has out there to reward its shareholders. The fund swimming pools collectively all the cash that it receives from these varied sources and distributes it to its buyers, after subtracting its personal bills. We are able to in all probability assume that this could give the fund’s shares a reasonably excessive yield.

That is certainly the case, because the BlackRock Core Bond Belief pays a month-to-month distribution of $0.0746 per share ($0.8952 per share yearly), which supplies it an 8.27% yield on the present share value. That is consistent with many closed-end funds that spend money on higher-yielding, riskier belongings comparable to junk bonds. It’s, admittedly, nonetheless decrease than the yield of the very best leveraged mortgage funds, however that isn’t obscure because the market’s rate of interest expectations have resulted in short-term charges being increased than long-term charges.

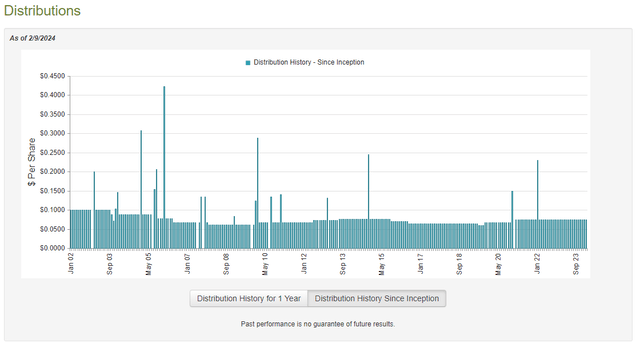

The BlackRock Core Bond Belief has been considerably in keeping with respect to its distribution, but it surely has been removed from excellent. As we are able to see right here, the fund’s distribution has been each raised and lower a number of occasions over its historical past:

CEF Join

The truth that the fund’s distribution has different considerably over time may show to be a turn-off for these buyers who’re looking for to earn a protected and safe earnings to make use of to pay their payments and finance their life. Nevertheless, this is without doubt one of the few funds investing in fixed-rate bonds that didn’t lower its payout following the fast enhance in rates of interest that occurred over the course of 2022. Which may be interesting to some, though we must always definitely examine its funds, because it appears odd that this fund was in a position to accomplish a activity that its friends couldn’t. It is perhaps overdistributing and destroying its web asset worth within the course of, which isn’t sustainable over an prolonged interval.

Sadly, we would not have an particularly current doc that we are able to seek the advice of for the aim of our evaluation. The fund’s most up-to-date monetary report corresponds to the six-month interval that ended on June 30, 2023. As such, this report won’t embody any details about how the fund dealt with the 2 very disparate bond market environments that we skilled throughout the second half of 2023. For instance, over the July via October interval, bond costs have been typically declining, and yields have been rising because the market regularly accepted that its optimism about rate of interest cuts within the second half of 2023 was misguided. This development reversed itself starting in mid-October and bond costs started rising, which undoubtedly supplied the fund with some alternatives to appreciate capital beneficial properties. We might want to wait till the fund releases its full-year 2023 monetary report back to see how nicely it dealt with these two environments. That doc will hopefully be launched over the subsequent few weeks.

As probably the most present monetary report continues to be the identical one as we mentioned in November, I cannot trouble rehashing the numbers. Briefly, the fund did handle to cowl its distributions throughout the first half of 2023, but it surely needed to depend on unrealized capital beneficial properties to perform it. The fund’s web funding earnings and web realized beneficial properties (web realized losses, within the case of the primary half of 2023) have been inadequate to completely cowl the distributions that the fund paid out. That’s quite regarding because of the truth that unrealized beneficial properties could also be erased by any type of correction available in the market.

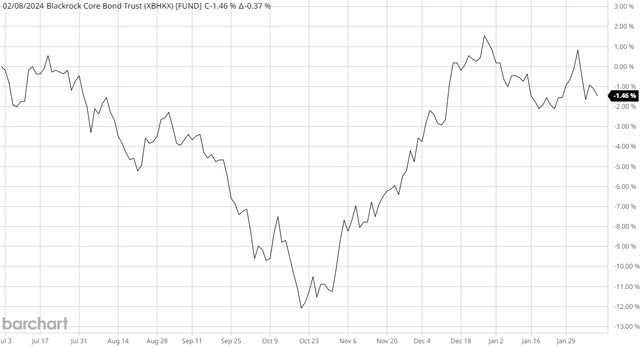

Sadly, issues seem to have deteriorated because the publication date of the fund’s most up-to-date monetary report. This chart reveals the fund’s web asset worth since June 30, 2023:

Barchart

As we are able to see, the BlackRock Core Bond Belief noticed its web asset worth decline by 1.46% because the cut-off date of its most just lately launched monetary report. This implies that the fund was not in a position to earn adequate funding earnings to cowl its distributions over the interval, though it did handle to get fairly shut. Nevertheless, this does nonetheless forged some doubt on the fund’s skill to maintain its distribution going ahead. The chance of a distribution lower seems to be actual, particularly if the Federal Reserve fails to fulfill the market’s rate of interest expectations. This barely strengthens the case for a score downgrade on the fund.

Valuation

As of February 8, 2024 (the newest date for which information is at present out there), the BlackRock Core Bond Belief has a web asset worth of $10.77 per share, however the shares at present commerce for $10.82 every. This provides the fund’s shares a 0.5% premium on web asset worth at this time value. That is bigger than the 0.27% premium that the shares have had on common over the previous month.

It isn’t typically advisable to buy shares of any fund at a premium on web asset worth. It’s because you’re mainly shopping for the fund’s belongings for greater than they’re really value. The truth that this fund is promoting for a premium proper now may imply that its present value is a fairly cheap degree for profit-taking although, which could possibly be the best choice right here as we speak.

Conclusion

In conclusion, the BlackRock Core Bond Belief has delivered a really sturdy efficiency over the previous few months as varied market members try and front-run an anticipated sequence of cuts to the federal funds price in 2024. Nevertheless, it appears extremely unlikely that the Federal Reserve will really lower rates of interest to the diploma that the market expects. Most financial information proper now means that the economic system is way too sturdy to help beliefs {that a} extreme recession will set in to help rate of interest cuts. As well as, the Federal Reserve will nearly definitely face political accusations of interference in a presidential election if it cuts within the absence of a extreme recession. As such, the belongings held by this fund are in all probability overpriced and after we mix this with the truth that it has did not cowl its distributions because the center of 2023 and its shares are promoting at a premium, it seems like an opportune time to promote shares and understand current earnings.