da-kuk

January 2024 in Assessment

2024 started on a excessive be aware with an earnings season that surpassed expectations, buoyed by contained inflation and steady rates of interest. The Dow Jones Industrial Common noticed a modest uptick of 0.4%, closing the month at 38,467 factors, edging ever nearer to the numerous milestone of 40,000 factors. Equally, though the S&P 500 remained comparatively flat in January, it closed at 4,925 factors, eagerly poised to breach the 5,000-point mark.

Whereas these psychological thresholds usually garner consideration on account of their attraction to human psychology, personally, their significance is negligible to my long-term funding technique. Whether or not we witness a surge to new all-time highs prompting additional market enthusiasm or a wholesome correction, I constantly favor the latter.

Whereas issues linger in regards to the prospect of a comfortable touchdown, I stay optimistic that any financial downturn, if in any respect, would possible be short-lived much like the 2022 bear market, which, in hindsight, was inconsequential.

In January, AI chief Nvidia (NVDA) emerged as a standout performer within the inventory market, experiencing a outstanding surge of almost 25%, dominating the market panorama. This momentum was mirrored by different tech giants like Superior Micro Gadgets (AMD), Broadcom (AVGO), and Microsoft (MSFT), all exhibiting sturdy efficiency. Whereas my holdings in Nvidia have reached notable ranges, I anticipate a corrective pullback of no less than 10% from its present meteoric rise. Nonetheless, my confidence in Nvidia’s long-term prospects stays unwavering. Predicting its exact valuation right now is speculative, however I firmly imagine its inventory worth will surpass present ranges over the 5-10 12 months funding horizon (which is what issues to me), regardless of short-term fluctuations.

With earnings scheduled for February 21, all eyes are on Nvidia’s steering and its capacity to maintain present market expectations. The query looms: Can it justify the fast rise in expectations, and at what level will it fulfill demand to the extent that future funding cycles might sluggish? Finally, the demand for Nvidia’s GPUs is tethered to company IT budgets, and whereas colossal investments from tech giants like Microsoft or Meta might not materialize yearly, their periodic cycles of funding stay a big issue.

Portfolio Modifications in January

After having fun with a refreshing December Vacation break, I jumped again into my investments in January. I managed to place round $1,760 into the market, largely specializing in my go-to favourite, BDCs (Enterprise Improvement Corporations).

My major picks have been Ares Capital (ARCC) and Hercules Capital (HTGC), each huge gamers within the sector alongside the chief, Major Road Capital Company (MAIN). These two have been increase some hefty spillover dividends over the previous 12 months, which ought to act as a security web when web funding earnings takes successful from falling rates of interest. So, I am not anticipating any dividend hikes quickly. As an alternative, I am hoping for some particular dividends as soon as the Fed begins slicing charges (though why they’d try this anytime quickly with the economic system going robust is past me).

If we do get these particular dividends, it may deliver down inventory costs, making the yields much more engaging for future purchases. In January, my strikes added $122 to my yearly dividend earnings, kicking off the 12 months on a constructive be aware. My purpose is to elevate my dividend earnings by about $100 every month, largely doable because of the excessive yields from BDCs.

Total, the common yield on value of my new investments in January averaged round 6.7%, reinforcing my perception in BDCs as a core a part of my portfolio. I am banking on their dividends staying regular—that is what I am all about in terms of producing earnings. Time will inform if I am on the cash or simply overly optimistic.

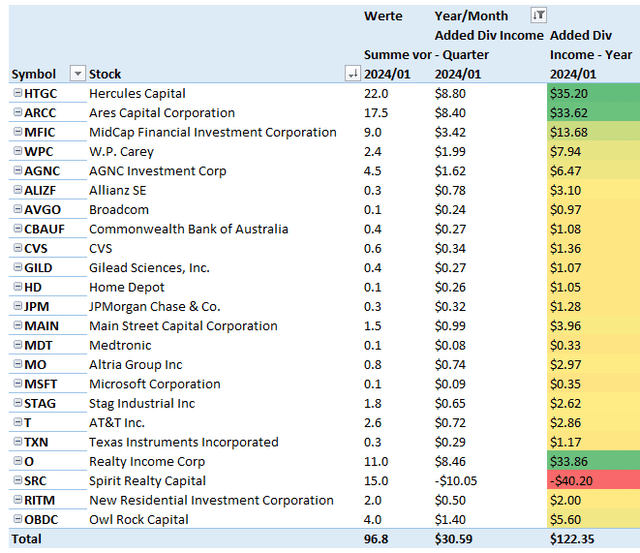

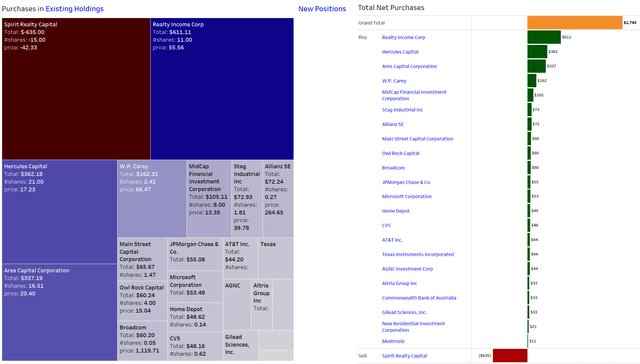

All these purchases break down as follows:

Added Dividend Revenue (Designed by writer)

All web purchases in January may be discovered beneath:

Internet Purchases in January (Designed by writer)

Dividend Revenue January 2024

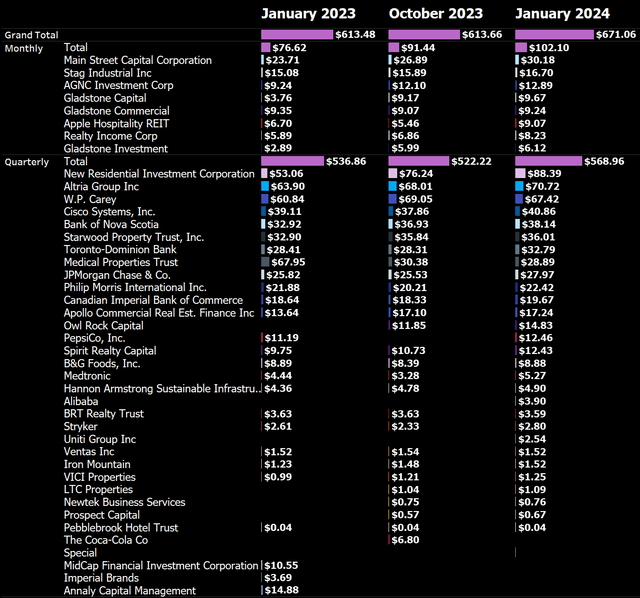

Dividend earnings hit a brand new all-time document for January of $643, up each 5% yearly and quarterly.

Essentially the most noteworthy improvement to me was the numerous leap in dividends from month-to-month dividend payers, climbing from $76 to $102 over the previous 12 months. This regular enhance signifies that additional money is coming in each single month, which is fairly candy. This month was the primary time that common earnings crossed the $100 mark with none particular dividends, setting the subsequent goal to purpose for at $150.

It also needs to be famous that January 2024 marked the final time I’ll have obtained a dividend fee from Spirit Realty Capital following the acquisition by Realty Revenue (O). To make up for that misplaced earnings in January I’ll proceed to take a position into Rithm Capital (RITM), W.P. Carey (WPC) and Blue Owl Capital Company (OBDC).

January 2024 Dividend Revenue (Designed by writer)

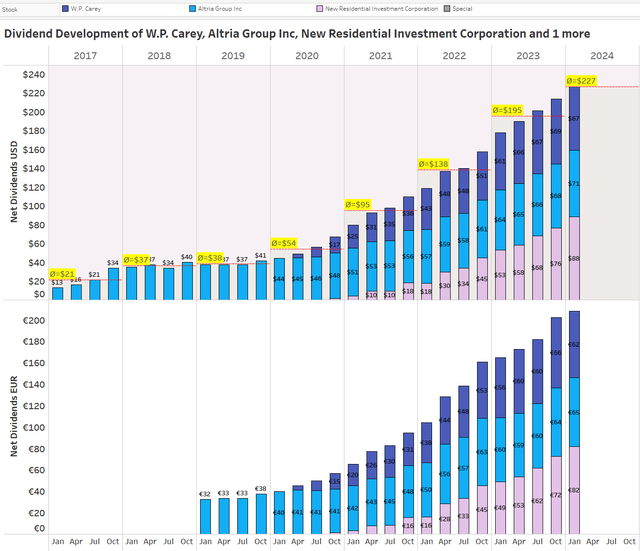

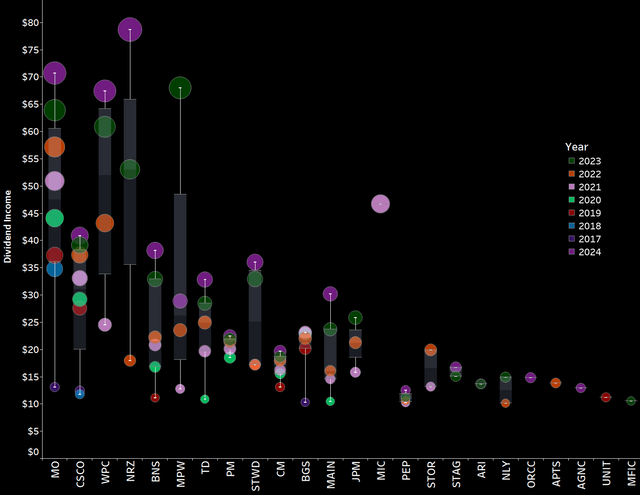

In January, the dividend earnings from my prime three common payers reached $227, a bump from final 12 months’s common of $195. Taking a look at it quarterly, we have gone from $213 to $227. This uptick is primarily pushed by common investments in each W. P. Carey and Rithm Capital.

All that is depicted beneath:

Prime 3 Dividend Payers (Designed by writer)

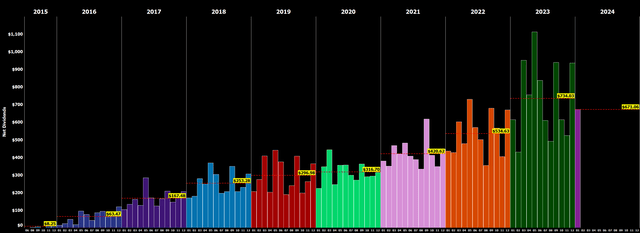

Here’s a chart that exhibits the event of my web dividend earnings by month over time between 2015 and 2023. You may see the expansion of my dividend earnings and the common annual dividend for every year:

All-time Dividend Improvement (Designed by writer)

This chart is my favourite as a result of it illustrates the development of my dividend earnings over time and permits me to simply see the common annual dividend for every year.

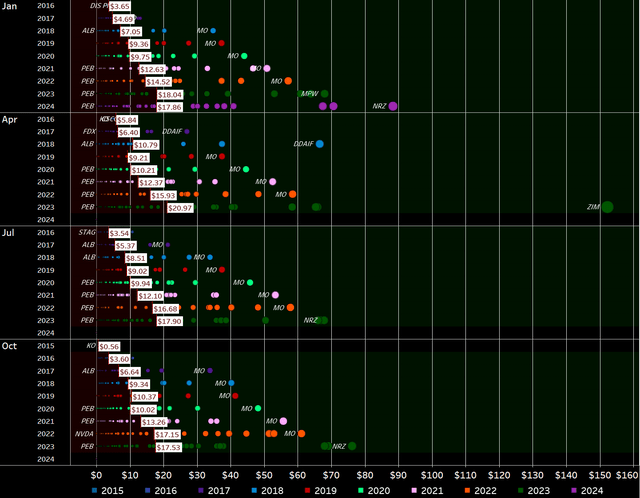

Subsequent, I’ve plotted all the particular person dividend funds I’ve obtained, coloring them by 12 months and arranging the years aspect by aspect as an alternative of horizontally as in earlier updates. This visualization permits for a extra complete evaluation of the distribution of my dividend funds over time.

Dividend Cost Bubbles (Designed by writer)

By visualizing the information on this method, we get a transparent image of how dividend funds are unfold out over totally different years, providing useful insights into the general development of my dividend earnings over time.

This visualization is initially fairly cluttered, but it surely accommodates a wealth of data. It exhibits each particular person dividend fee I’ve obtained since I started my funding journey in 2015, represented as a circle that’s coloured and sized based on its contribution. The view is organized by month and 12 months, permitting for a extra complete evaluation of the event of my dividend earnings over time. For every year and month, a white rectangle signifies the common month-to-month dividend. The realm the place dividends fall beneath the common is stuffed in darkish crimson, whereas the realm above the common is coloured darkish inexperienced.

One of these knowledge visualization permits for an in depth examination of the distribution of my dividend funds over time and permits me to simply determine developments and patterns in my earnings development.

January 2024 Dividends (Designed by writer)

Now zooming in on January, we are able to instantly see a lot of huge colourful circles in a sea of black. The larger the circle and the larger the space to the earlier circle for a similar inventory, the larger is the change in dividend earnings in comparison with the prior years.

We will clearly see the dominance and significance of Altria (MO), W. P. Carey, and Rithm Capital. They’ve a powerful presence within the visible illustration.

Taking a better have a look at the dividends for 2024, I am happy to see largely purple circles on the prime of the size, precisely the place I would like them to be. These sizable purple circles signify a rise in dividend earnings, aligning with my objective of maximizing development. Nonetheless, one noticeable outlier is the sharp lower in dividend earnings from Medical Properties Belief (MPW), stemming from final 12 months’s substantial dividend lower.

Total, my purpose is to look at quite a few massive orange circles positioned on the highest level on the size. This signifies a constructive pattern of accelerating dividend earnings, which is exactly what I am striving for.

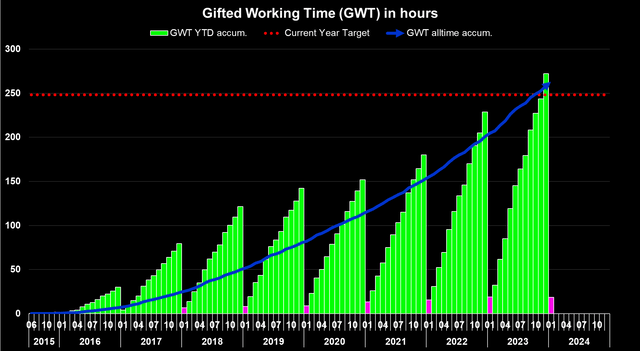

One other method to categorical the month-to-month dividend earnings is when it comes to Gifted Working Time (GWT). Assuming a mean hourly charge of $36.25 for 2024, my GWT and annual web dividends have been as follows:

- 2018: 121 hours GWT, $3,000 in annual web dividends

- 2019: 142 hours GWT, $3,600 in annual web dividends

- 2020: 152 hours GWT, $3,800 in annual web dividends

- 2021: 180 hours GWT, $5,050 in annual web dividends

- 2022: 229 hours GWT, $6,400 in annual web dividends

- 2023: 272 hours GWT, $8,800 in annual web dividends

- 2024: Concentrating on no less than 248 hours GWT, $9,000 in annual web dividends

The general goal for the 12 months with $9,000 in annual web dividends may be very conservative, however I anticipate that I should take out some danger from my portfolio as I’m eyeing to boost capital for actual property investments if I encounter the appropriate deal. Nonetheless, because the 12 months unfolds, I do anticipate to have the ability to move that concentrate on and probably even attain my subsequent milestone of $10,000 as properly. That will be an excellent achievement however nothing I’m banking on to succeed in this 12 months – it could be the icing on the cake.

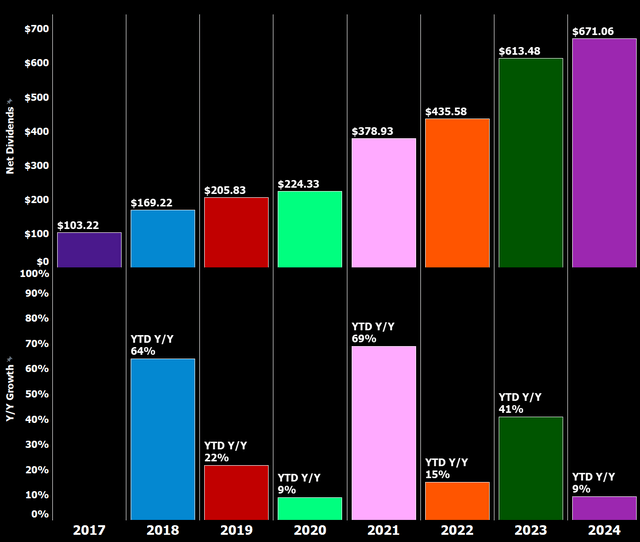

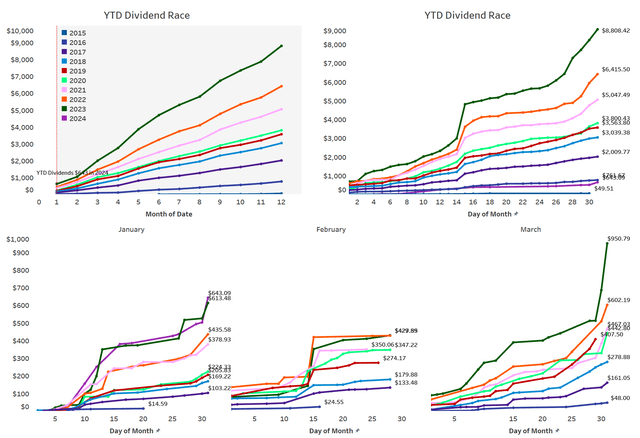

Throughout the years, my YTD Dividend Race has been as follows:

- 2018: Disappointing

- 2019: Phenomenal, benefiting from a low baseline within the prior 12 months

- 2020: Pretty disappointing

- 2021: Phenomenal

- 2022: Significantly better than anticipated fueled by the very weak euro

- 2023: Breathtaking

YTD Dividend Progress (Designed by writer)

I’ve up to date the YTD Dividend Race chart to point out the event of YTD dividend earnings every day, permitting us to see that the majority of my dividend earnings is generated mid-month and in direction of the tip of the month. The chart additionally breaks down the event by month for the present 12 months, making it straightforward to determine important jumps in earnings.

YTD Dividend Race (Designed by writer)

Expressed in GWT, it presents itself as follows:

Gifted Working Time in Hours (Designed by writer)

What this exhibits is as follows:

- All time (blue space) – Round 1,227 hours, or 153 days, of energetic work have been changed with passive earnings because the begin of my dividend journey. Assuming a five-day workweek, this interprets into virtually half a 12 months in complete.

- Full-year 2024 (inexperienced bars) – Round 19 hours, or 2.3 days, of energetic work have been changed with passive earnings in 2024, which is mainly equal to half a working week funded with dividends. That’s nice progress and I can not wait so as to add one other month to that statistic.

- Highlighted in pink is the accrued complete on the finish of the present reporting month (January).

This visualization permits us to see the general influence of my dividend earnings on the quantity of energetic work I’m able to exchange with passive earnings. It additionally permits us to see the progress made year-to-date, in addition to the accrued complete on the finish of the present reporting month.

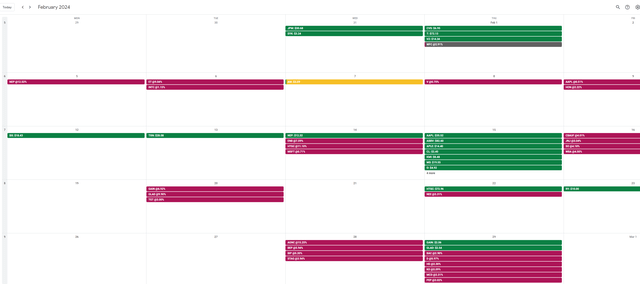

Upcoming February Dividends

Opposite to January, February options considerably fewer dividend payers however amongst them are the massive annual dividends from German firms in addition to the nonetheless sizable dividend from AT&T (T). Past that dividend funds are total concentrated within the first half of the month with just one significant dividend fee from the Royal Financial institution of Canada (RY) anticipated within the second half of February. It’s unclear although to me at this stage whether or not Hercules Capital will once more solely pay in March or return to its normal dividend fee sample.

The snapshot beneath is taken from my free-for-all launched Dividend Calendar (make sure that to comply with directions within the video) and exhibits my anticipated dividend funds in February.

My Dividend Calendar (Designed by writer)

On the finish of January, my dividend portfolio consists as follows:

| Apple Inc. | (AAPL) | 10.94% | 24,246 |

| Visa Inc. | (V) | 4.40% | 9,740 |

| NVIDIA Company | (NVDA) | 4.26% | 9,446 |

| Microsoft Company | (MSFT) | 4.18% | 9,269 |

| AbbVie Inc | (ABBV) | 3.78% | 8,366 |

| Ares Capital Company | (ARCC) | 3.58% | 7,920 |

| McDonald’s Corp. | (MCD) | 3.32% | 7,346 |

| Commonwealth Financial institution of Australia | (OTCPK:CBAUF) | 2.55% | 5,653 |

| Major Road Capital Company | (MAIN) | 2.39% | 5,305 |

| Cisco Methods, Inc. | (CSCO) | 2.35% | 5,204 |

| Broadcom Inc. | (AVGO) | 2.15% | 4,758 |

| Stag Industrial Inc | (STAG) | 2.10% | 4,642 |

| JPMorgan Chase & Co. | (JPM) | 2.08% | 4,600 |

| W.P. Carey | (WPC) | 2.04% | 4,527 |

| Allianz SE | (OTCPK:ALIZF) | 2.00% | 4,426 |

| AT&T Inc. | (T) | 1.99% | 4,404 |

| House Depot | (HD) | 1.94% | 4,305 |

| Johnson & Johnson | (JNJ) | 1.94% | 4,287 |

| Shell | (SHEL) | 1.88% | 4,164 |

| Hercules Capital | (HTGC) | 1.88% | 4,159 |

| Texas Devices Included | (TXN) | 1.59% | 3,526 |

| Wells Fargo & Co. | (WFC) | 1.48% | 3,278 |

| Gilead Sciences, Inc. | (GILD) | 1.46% | 3,234 |

| New Residential Company | (RITM) | 1.39% | 3,078 |

| Southern Co. | (SO) | 1.35% | 2,981 |

| Blackstone Group LP | (BX) | 1.34% | 2,968 |

| Toronto-Dominion Financial institution | (TD) | 1.30% | 2,876 |

| Altria Group Inc. | (MO) | 1.29% | 2,866 |

| Intel Company | (INTC) | 1.25% | 2,774 |

| Apollo Funding | (MFIC) | 1.20% | 2,654 |

| Siemens Healthineers | (OTCPK:SEMHF) | 1.17% | 2,600 |

| Financial institution of Nova Scotia | (BNS) | 1.17% | 2,598 |

| Enbridge | (ENB) | 1.09% | 2,412 |

| BMW | (OTCPK:BMWYY) | 0.99% | 2,184 |

| Realty Revenue Corp. | (O) | 0.83% | 1,835 |

| Procter & Gamble Co. | (PG) | 0.80% | 1,780 |

| PepsiCo, Inc. | (PEP) | 0.78% | 1,735 |

| BP2 | (BP) | 0.78% | 1,732 |

| Morgan Stanley | (MS) | 0.78% | 1,719 |

| BP1 | (BP) | 0.77% | 1,705 |

| Daimler | (OTCPK:MBGAF) | 0.71% | 1,575 |

| Philip Morris Worldwide Inc. | (PM) | 0.63% | 1,389 |

| Starwood Property Belief, Inc. | (STWD) | 0.61% | 1,360 |

| Honeywell Worldwide Inc. | (HON) | 0.61% | 1,343 |

| Financial institution of America Corp. | (BAC) | 0.58% | 1,292 |

| Stryker | (SYK) | 0.56% | 1,247 |

| Brookfield Renewable Companions | (BEP) | 0.48% | 1,064 |

| Gladstone Funding | (GAIN) | 0.47% | 1,036 |

| The Coca-Cola Co. | (KO) | 0.47% | 1,035 |

| Goal Company | (TGT) | 0.45% | 991 |

| Gladstone Capital | (GLAD) | 0.43% | 964 |

| Gladstone Business Company | (GOOD) | 0.43% | 950 |

| Unilever NV ADR | (UL) | 0.43% | 943 |

| CVS Well being Corp. | (CVS) | 0.42% | 934 |

| AGNC Funding Company | (AGNC) | 0.40% | 885 |

| Royal Financial institution of Canada | (RY) | 0.38% | 839 |

| Apple Hospitality REIT | (APLE) | 0.38% | 835 |

| Sino AG | (XTP.F) | 0.37% | 813 |

| 3M Co. | (MMM) | 0.36% | 807 |

| Annaly Capital Administration | (NLY) | 0.36% | 806 |

| Verizon Communications Inc. | (VZ) | 0.35% | 777 |

| Medtronic | (MDT) | 0.34% | 748 |

| NextEra Vitality Companions LP | (NEP) | 0.34% | 746 |

| Canadian Imperial Financial institution of Commerce | (CM) | 0.28% | 624 |

| Vonovia | (OTCPK:VONOY) | 0.28% | 621 |

| BASF | (OTCQX:BASFY) | 0.28% | 616 |

| Dominion Vitality Inc. | (D) | 0.26% | 583 |

| Antero Midstream Company | (AM) | 0.26% | 579 |

| NextEra Vitality | (NEE) | 0.25% | 549 |

| Apollo Business Actual Est. Finance Inc. | (ARI) | 0.25% | 545 |

| Exxon Mobil Company | (XOM) | 0.24% | 521 |

| Medical Properties Belief | (MPW) | 0.23% | 504 |

| Kinder Morgan Inc. | (KMI) | 0.20% | 435 |

| Mastercard | (MA) | 0.19% | 420 |

| B&G Meals, Inc. | (BGS) | 0.19% | 414 |

| Sixt | (OTC:SXTSY) | 0.17% | 372 |

| Colgate-Palmolive Firm | (CL) | 0.17% | 366 |

| Walgreens Boots Alliance Inc. | (WBA) | 0.16% | 360 |

| Owl Rock Capital Company | (OBDC) | 0.15% | 335 |

| ZIM Built-in Transport Companies | (ZIM) | 0.15% | 333 |

| Alibaba Group Holding Ltd. | (BABA) | 0.15% | 325 |

| Pfizer Inc. | (PFE) | 0.15% | 324 |

| Omega Healthcare Buyers Inc. | (OHI) | 0.13% | 292 |

| BRT Realty Belief | (BRT) | 0.11% | 242 |

| Blue Owl Capital | (OWL) | 0.09% | 205 |

| Bayer AG | (OTCPK:BAYZF) | 0.08% | 174 |

| Fresenius SE | (OTCPK:FSNUF) | 0.07% | 145 |

| Spirit Realty Company | (SRC) | 0.06% | 143 |

| Boeing | (BA) | 0.06% | 133 |

| Equitrans Midstream Company | (ETRN) | 0.06% | 122 |

| Diversified Healthcare Belief | (DHC) | 0.04% | 100 |

| Uniti Group Inc. | (UNIT) | 0.04% | 89 |

| Walt Disney Co. | (DIS) | 0.04% | 84 |

| Financial institution of Montreal | (BMO) | 0.04% | 80 |

| The GEO Group Inc. | (GEO) | 0.03% | 70 |

| Fresenius Medical Care | (FMS) | 0.03% | 70 |

| Newtek Enterprise Companies | (NEWT) | 0.02% | 50 |

| Service Properties Belief | (SVC) | 0.01% | 33 |

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.