Within the face of a difficult macro backdrop, Roku (NASDAQ:ROKU) has carried out nicely over the previous yr. It has regularly crushed analyst expectations, and its Q3 print featured extra new customers approaching board than had been anticipated, the profitable implementation of value reducing measures and a information that referred to as for constructive EBITDA in This autumn and 2024.

With the streaming video platform about to ship its This autumn outcomes (Thursday, February 15, after the markets shut), Wedbush analyst Alicia Reese thinks a strong report and outlook is about to drop. “Roku has dedicated to constructive EBITDA in 2024, and we expect it’s on observe to exceed expectations,” the analyst stated. “We predict that lots of Roku’s initiatives will end in income development increased than we modeled, and along with improved expense administration, ought to drive constant earnings development.”

Wanting on the greater image, as advert {dollars} transition from linear TV to digital related TV (CTV), Roku retains on taking market share. Moreover, because the advert market bounces again, the corporate is poised to “develop profitably” as a platform and free ad-supported TV (FAST) channel chief. Furthermore, Reese believes Roku’s new promoting merchandise, Roku Banner Adverts on Roku Metropolis, and Roku Motion Adverts (an e-commerce partnership with Shopify) signify a “vital alternative forward.”

As for the uncooked numbers, Reese is asking for This autumn income of $965 million, adjusted EBITDA of $20 million and EPS of $(0.54). The Avenue has these numbers at $966 million, $16 million and $(0.55), respectively. Reece’s estimates consider energetic accounts reaching 78.2 million, a 3.2% sequential enhance and an 11.8% year-over-year enchancment and TTM ARPU of $40.21, a 2% quarter-over-quarter drop and a 3.5% decline in comparison with the yr in the past interval.

Advert traits are exhibiting indicators of enchancment, with scatter pricing anticipated to hit an “inflection level” within the first quarter. Reese says Roku’s growing prominence as a platform and its capability to promote throughout varied CTV and TV channels provides it a major benefit as promoting spend picks up. “In Q3,” notes the analyst, “Roku noticed indicators of a rebound in video promoting, even whereas linear and general promoting spend considerably declined all through the business, and we count on this rebound to proceed into 2024.”

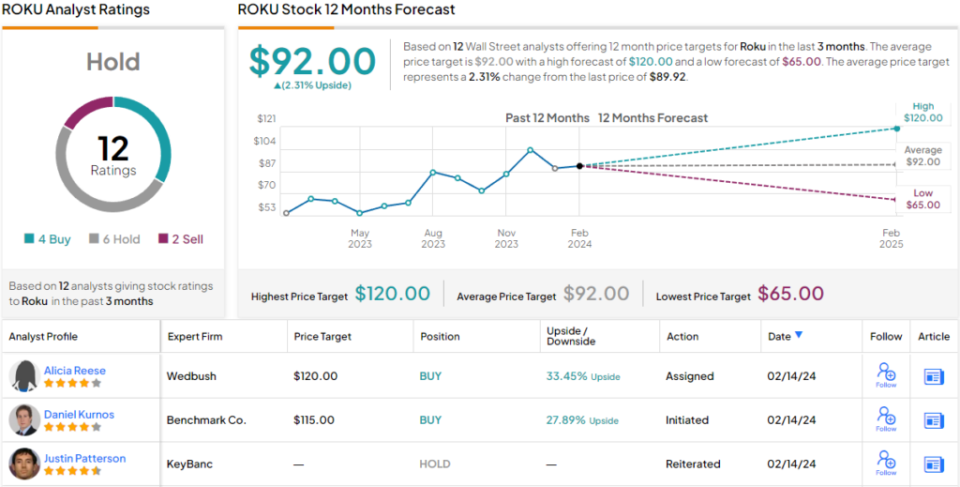

Conveying her confidence, Reese reiterated an Outperform (i.e., Purchase) ranking for the shares whereas her nonetheless Avenue-high value goal of $120 represents 12-month development of twenty-two%. (To look at Reese’s observe report, click on right here)

Nevertheless, Reese is at the moment the Avenue’s greatest ROKU bull, and elsewhere, the inventory receives an extra 3 Buys, 6 Holds and a couple of Sells, all culminating in a Maintain consensus ranking. With the common value goal at the moment stands at $92, the analysts anticipate shares to remain range-bound for the foreseeable future. (See Roku inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally vital to do your personal evaluation earlier than making any funding.