He could also be overshadowed by bigger rivals within the US and Europe, however Ken Moelis’s lengthy courtship of governments in Dubai and Saudi Arabia is paying off.

Article content material

(Bloomberg) — In a low-key second-floor workplace within the coronary heart of Dubai’s bustling monetary middle, bankers working for Moelis & Co. are busier than ever — a lot in order that the agency has needed to tear down partitions so as to add desks for its enlargement drive.

Within the in any other case stark office, cabinets are coated with Lucite deal tombstones that includes fairness choices and offers by Center Jap corporations — from Saudi Arabia’s petroleum behemoth Aramco to Abu Dhabi Nationwide Oil Co. Envious rivals whisper that Moelis has turned its Center Jap operation into one of many financial institution’s greatest income mills per worker — no imply feat in part of the world that’s not recognized for giant charges.

Commercial 2

Article content material

Article content material

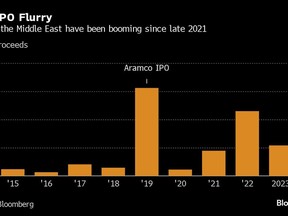

This all displays the frenzy of dealmaking that’s gripped the Center East whereas bankers elsewhere endure a dearth of enterprise. Gulf preliminary public choices have raised greater than $30 billion during the last two years, and Moelis — a minnow by Wall Avenue requirements — has labored on greater than half of people who employed unbiased monetary advisers.

That, bankers say, is the payoff for years of relationship constructing by its founder Ken Moelis. But it surely has additionally concerned large compromises and dangers. The Wall Avenue veteran selected to take care of his relationship with Saudi Arabia’s authorities within the aftermath of the 2018 killing of presidency critic Jamal Khashoggi. He’s additionally caught by means of dramatic downturns in Dubai. Extra just lately, the widening Israel-Hamas struggle has provided contemporary reminders of the challenges of a area inclined to political turbulence and frequent boom-and-bust cycles.

Boutique banks like Moelis “will be extra versatile in navigating totally different markets and taking hiring alternatives as they come up,” stated George Traub, founding father of Lumina Capital Advisers, a Dubai-based mid-market company adviser. However pricing within the dangers of upheaval within the Gulf will also be significantly troublesome, he stated, “as non-linear outcomes are doable.”

Commercial 3

Article content material

Greater Rivals

Ken Moelis nonetheless sees the Center East as essential for his New York-based agency’s wider enterprise and he’ll proceed to concentrate on it, in accordance with individuals aware of the matter. It’s been sharply overshadowed by greater rivals elsewhere. In Europe, it ranked No. 22 on M&A advisory final yr, whereas in Asia Pacific, that rating drops to No. 35. In all, the agency makes lower than $1 billion in annual income globally — largely pushed by its US enterprise.

Despite the fact that IPOs globally tumbled to their lowest degree in additional than a decade in 2023, the Center East had one among its finest years on document as governments racing to make their economies much less oil reliant bought stakes in state-owned corporations. The offers have continued regardless of the Israel-Hamas struggle, and the wealthiest Gulf international locations have barely been affected.

Ken Moelis, 65, has already caught with the Center East by means of thick and skinny. In 2009, he boarded a airplane to pitch for a $25 billion restructuring of state holding firm Dubai World because it teetered getting ready to default. His agency ended up advising the federal government on the complicated restructuring plan involving greater than 70 collectors.

Article content material

Commercial 4

Article content material

That settlement cemented his popularity with among the United Arab Emirates’ prime officers and laid the foundations for extra transactions.

However he’s additionally made public relations outreaches that have been more durable for greater banks to make due to their world profile.

In October 2018, Ken Moelis and the agency’s Vice Chairman Eric Cantor stood out as two of the one prime US financiers who attended Saudi Arabia’s flagship funding convention in Riyadh, simply weeks after the homicide of Khashoggi by authorities brokers within the Saudi Arabian embassy in Turkey. Crown Prince Mohammed bin Salman denied involvement, however many businessmen and buyers shunned the nation within the wake of the brutal killing.

Most of Moelis’s Wall Avenue friends, together with JPMorgan Chase & Co. Chief Govt Officer Jamie Dimon and BlackRock Inc.’s boss Larry Fink, pulled out of the occasion amid the controversy. That transfer earned Moelis the belief of the dominion’s prime choice makers in a area recognized to reward loyalty, the individuals stated.

The agency has “constructed sturdy relationships with the area’s choice makers and has been concerned in some landmark offers which put them on the map,” stated Tom de Waele, Bain & Co Inc.’s managing associate for the Center East. “After you have established the precise monitor document and degree of belief with key choice makers, you see a fly wheel impact kicking in.”

Commercial 5

Article content material

Greatest Advisor

The financial institution is now one of many greatest world funding banking operations within the Center East, with double the variety of advisors than some greater Wall Avenue rivals. Moreover IPOs, it’s additionally energetic in regional M&A and advises corporations which are conducting strategic critiques. Restructurings are one other of its key choices within the area.

Regardless of its giant footprint, the financial institution has solely 4 managing administrators within the area and depends closely on a cadre of extra junior govt administrators, vice presidents and associates. The Center East and North Africa workplace is led by Rami Touma, a former Credit score Suisse banker, who can also be a Harley Davidson aficionado.

Moelis’s success within the Gulf is partly because of the dedication of its prime US administration, the individuals aware of the matter stated. Its founder and Cantor, a former US politician-turned banker, fly to the Center East three-to-four occasions a yr to pitch concepts. Their common presence attracts shoppers in a area the place selections are sometimes made by royals and a handful of prime advisers, the individuals stated.

Nonetheless, charges within the area can generally be decrease than anticipated. Moelis was among the many banks that organized Aramco’s $29 billion IPO in 2019. Analysts on the time predicted the providing may generate “tens of tens of millions of {dollars}” in charges for Moelis, however ultimately banks shared a charge pool of simply over $100 million, an unusually small quantity relative to the deal’s measurement.

Commercial 6

Article content material

Moelis didn’t remark for this story and doesn’t disclose income from the Center East, that are dwarfed by these from Europe and the Americas.

Talking on the 2018 occasion in Riyadh, Ken Moelis described relationships as an organization’s most useful asset — even when there’s no strategy to account for them on the steadiness sheet.

Gulf leaders have welcomed Moelis’s loyalty. On the Qatar Financial Discussion board final Could, Saudi Arabia’s power minister Abdulaziz bin Salman Al Saud greeted Ken as “my man,” and praised him for being significantly better than the opposite bankers advising the dominion on the Aramco IPO.

On the identical convention, the Wall Avenue veteran praised the Center East’s potential to “make selections, function rapidly, reduce by means of the pink tape, and lastly, suppose long run” with out having “to cope with union issues.”

“This is likely one of the few locations on the earth that’s really making investments for the following 5 to 10 years,” he stated.

Regional Bets

Nonetheless, Moelis’s first-mover benefit within the Center East is being eroded as increasingly more rivals muscle in on the deal surge and the greater than $2 trillion held by sovereign wealth funds. Rothschild & Co. has additionally been concerned in landmark offers for years, rivaling Moelis in measurement and entry to key shoppers. The boutique moved a senior fairness capital markets banker to Dubai from Hong Kong in late 2022 to seize a much bigger slice of the IPO increase. Advisory specialists from Lazard Ltd. to Jefferies Monetary Group Inc. are additionally beefing up groups.

Commercial 7

Article content material

The IPO market within the Gulf is comparatively insulated from regional geopolitical threat, and in areas like native expertise and companies continues to be “a magnet for brand new rising corporations that want capital,’’ stated Karen Younger, a senior analysis scholar at Columbia College’s Heart on World Power Coverage.

Since opening its hub within the Dubai Worldwide Monetary Centre in 2011 and hiring JPMorgan veteran Yorick Van Slingelandt, Moelis’s regional enterprise has grown from an eight-person staff to a workforce of about 45.

However not all of Moelis’s bets within the area have paid off. The corporate was concerned in quite a lot of offers involving special-purpose acquisition corporations, most of which have been pulled.

In the meantime, though rivals begrudgingly acknowledge Moelis’s success within the area, in addition they say it has generally operated extra like a consultancy than an funding financial institution to win extra profitable work on big-ticket offers. It additionally prices a rolling charge for strategic recommendation — a mannequin that’s pretty distinctive to the Center East the place rulers with grand ambitions encompass themselves with consultants, in accordance with executives.

Commercial 8

Article content material

Final yr, Moelis appointed Moaath Alangari to run its workplace in Riyadh after securing a license to function within the kingdom, giving the agency a front-row seat to the crown prince’s formidable plans.

“The dangers for boutiques like Moelis is that they’ve doubled down on Saudi Arabia and the area as one among their key development markets, given the potential,” stated Lumina’s Traub. “It will be attention-grabbing to see whether or not when deal exercise picks up in 2024 throughout Europe and the US if that funding thesis continues to be legitimate and the way the important thing sources are deployed.”

—With help from Fareed Sahloul and Ben Bartenstein.

Article content material