Key Factors

- The iShares Silver Belief ETF has trailed the SPDR Gold Shares ETF over the previous yr, however one business insider says silver could take the lead in 2024.

- Silver has functions in red-hot industries akin to inexperienced vitality and medical tech.

- The gold-to-silver ratio, presently excessive, might drive demand for silver shares if it signifies undervaluation.

- 5 shares we like higher than iShares Silver Belief

The iShares Silver Belief NYSEARCA: SLV exchange-traded fund has underperformed the SPDR Gold Shares NYSEARCA: GLD over the previous yr, however is it time for the state of affairs to reverse?

Silver mining shares listed on main U.S. exchanges embody Newmont Corp. NYSE: NEM, Wheaton Treasured Metals Corp. NYSE: WPM, Compañía de Minas Buenaventura S.A.A. NYSE: BVN, Coeur Mining NYSE: CDE, Fortuna Silver Mines Inc. NYSE: FSM, Hecla Mining Co. NYSE: HL, First Majestic Silver Corp. NYSE: AG and Pan American Silver Corp. NYSE: PAAS.

A few of these corporations even have operations within the space of gold mining, in addition to different metals.

As a bunch, gold and silver miners have lagged behind most others.

Fairness market, Bitcoin rallies dented treasured metals

There are a few culprits behind the underperformance. First, as fairness markets rallied in latest months, treasured metals misplaced their glitter as hedges in opposition to a downturn.

Extra just lately, because the Securities and Change Fee gave the nod to Bitcoin ETFs, cash has been flowing away from treasured metals and towards cryptocurrencies.

The Bitcoin ETFs have been marketed as an alternative choice to gold as a technique to retailer worth resulting from its shortage, relative to different belongings.

However even when gold, the extra conventional treasured metallic hedge slumps, is silver about to rotate into management?

Jonathan Rose, co-founder and CEO of Genesis Gold Group, a Los Angeles firm that guides traders towards gold and silver as a way of wealth preservation.

Traders search gold and silver amid stock-market volatility

Rose instructed MarketBeat that as financial pressures drive down fairness markets and the greenback, treasured metals have traditionally proven an inverse correlation.

“When traders are involved, they go to the upper floor of gold and silver,” he stated. “Right now, silver particularly is fascinating due to the thrill round its industrial makes use of. We anticipate silver in 2024 to have one in every of its highest buying and selling volumes in historical past.”

Prior to now month, the SLV ETF has outpaced the GLD ETF.

Industrial utilization presently favors the efficiency of silver, because the white metallic is a part in photo voltaic panels, electronics, water purification programs, automobiles and different gadgets. As industrial shares as a bunch rally on the potential for decrease rates of interest, and on fewer supply-chain hassles, that bodes nicely for silver.

Two of the fastest-growing industries, inexperienced vitality and medical applied sciences, depend on silver, Rose stated.

“Industrial demand for silver doubled final yr and new developments requiring the valuable metallic are materializing each week,” he added. “This makes silver significantly enticing to traders who need to have the ability to liquefy belongings rapidly if mandatory.”

Rose cautions that investing in silver shares comes with the identical danger and reward potential as every other shares.

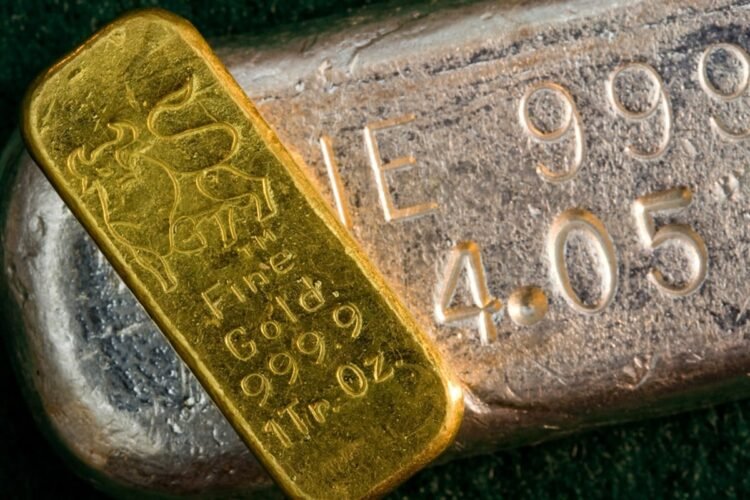

Proudly owning the bodily commodities is ‘completely different ballgame’

“Proudly owning bodily treasured metals is a distinct ballgame that hedges in opposition to these dangers. As any good analyst will admit, a various portfolio is a contented portfolio,” he stated.

For traders preferring utilizing shares fairly than holding the arduous belongings or commodities themselves, most of the treasured metals shares are issued by small corporations, which might add danger and cut back volatility.

Silver usually displays increased volatility than gold, providing higher potential for short-term beneficial properties, which might contribute to silver shares rallying in 2024.

As well as, silver tends to be extra inexpensive for retail traders, doubtlessly attracting a broader investor base and growing liquidity in silver shares.

Ratio alerts silver could also be able to rally

For instance, the SPDR Gold Shares chart reveals the ETF buying and selling at round $186, whereas the iShares Silver Belief chart reveals a worth between $21 and $22.

Moreover, the gold-to-silver ratio, which measures what number of ounces of silver it takes to purchase one ounce of gold, can affect funding selections on an institutional degree.

The present gold-to-silver ratio is 88.959, increased than the historic common.

When this ratio is excessive, indicating silver is undervalued relative to gold, traders could pivot in direction of silver shares, driving up demand.

Earlier than you take into account iShares Silver Belief, you may need to hear this.

MarketBeat retains monitor of Wall Avenue’s top-rated and finest performing analysis analysts and the shares they suggest to their shoppers each day. MarketBeat has recognized the 5 shares that high analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and iShares Silver Belief wasn’t on the checklist.

Whereas iShares Silver Belief presently has a “maintain” score amongst analysts, top-rated analysts consider these 5 shares are higher buys.

MarketBeat’s analysts have simply launched their high 5 brief performs for February 2024. Study which shares have probably the most brief curiosity and methods to commerce them. Click on the hyperlink beneath to see which corporations made the checklist.