(Bloomberg) — A Constancy Worldwide cash supervisor has offered the overwhelming majority of US Treasuries from funds he oversees on expectations the world’s greatest economic system nonetheless has room to increase.

Most Learn from Bloomberg

Singapore-based George Efstathopoulos, who helps handle about $3 billion of earnings and development methods at Constancy, offered the majority of his 10-year and 30-year Treasuries holdings in December. He’s now turning to belongings that usually do effectively in occasions of excellent financial development to spice up returns.

“We don’t anticipate form of a recession anymore,” mentioned Efstathopoulos. “The likelihood of no touchdown remains to be small, however it’s been growing. If that will increase far more, probably we is not going to be speaking about Fed cuts anymore” in 2024.

Efstathopoulos is amongst these cooling on Treasuries because the US economic system’s resilience forces buyers to rethink bets on interest-rate cuts. Some are going a step additional, speculating the Federal Reserve’s subsequent transfer might even be a hike, after the current robust inflation and jobs stories.

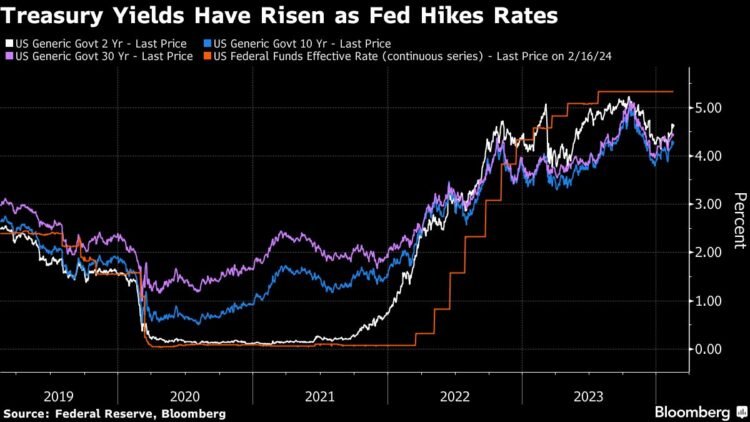

Merchants at the moment are pricing underneath 4 quarter-point interest-rate cuts in 2024, down from wagers for 150 foundation factors of cuts this 12 months beginning March. Bonds are reflecting the swing in sentiment, with 10-year US yields advancing greater than 40 foundation factors for the reason that begin of the 12 months to 4.3%, as feedback from Fed officers additionally reinforce expectations of higher-for-longer charges.

Fed Vice Chair Philip Jefferson warned on Thursday concerning the risks of easing an excessive amount of in response to easing worth pressures, whereas Fed Minneapolis President Neel Kashkari mentioned “we nonetheless have some work to do” on inflation.

Efstathopoulos offered Treasuries as concern over US development pale. The asset is often much less enticing amid elevated borrowing prices, and when costs replicate the Fed’s median forecast of three quarter level interest-rate cuts this 12 months.

He additionally offered bonds from different developed markets, together with gilts and bunds, whereas leaving some publicity to inflation-linked US authorities debt and an idiosyncratic place in Austrian bonds.

The US economic system is displaying “extra indicators of re-acceleration than it’s of slowing down,” Efstathopoulos mentioned, including that “I wouldn’t be shocked in a few quarters down the street we find yourself seeing form of manufacturing PMI in a extra enlargement form of territory” in developed markets.

Information on Thursday strengthened his view as US jobless claims dropped to the bottom stage in a month, underscoring the power of the economic system.

Nonetheless, funds comparable to Jupiter Asset Administration are taking a unique view, opting to load up on Treasuries whereas seeing dangers of a tough touchdown after the Fed’s most aggressive tightening cycle in a long time.

Prefers Shares

Efstathopoulos helps oversee a variety of methods, together with a worldwide multi-asset development and earnings fund that gained 5% within the 12 months to Jan. 31, in keeping with an organization factsheet.

Compared, the Bloomberg International-Combination Whole Return Index of worldwide investment-grade bonds rose about 0.9% in the identical interval. The fund had dropped 2.31% over a 3 12 months interval, the factsheet confirmed.

Efstathopoulos took revenue on a prime money-making bullish India equities commerce final month as costs soared, rotating as a substitute to US mid-cap and Greek shares. He additionally likes Japanese banks.

The technique is now extra optimistic on shares however “very underweight length,” he mentioned referring to a measure that usually displays the sensitivity of a bond portfolio to modifications in rates of interest.

“We’ve gone by a large disinflation interval and development appears to be OK, and the labor market appears to be OK,” he mentioned. “If that is the place we land, it is a excellent place.”

(Updates with Fed feedback in sixth paragraph.)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.