Key Factors

- Put credit score spreads will credit score your account the max acquire up entrance.

- Put credit score spreads are comprised of two legs, a brief put and an extended put, at a lower cost.

- Put credit score unfold profit from Theta or time decay, whereas Theta erodes name debit spreads.

- 5 shares we like higher than Intel

In case you are bullish on any optionable inventory in any inventory sector, you possibly can play any variety of choices trades. The simplest directional technique is to purchase a name choice. Nonetheless, you’ll struggle time everytime you personal an extended name choice because the Theta (time decay) works towards you. Even when the underlying inventory stays flat, the choice loses cash incrementally daily by the Theta worth. You even have the prospect of dropping 100% of your funding if the inventory closes under its strike worth on expiration.

Bare put technique

You possibly can think about a bare put technique, also called promoting or shorting a put. Whereas this bullish directional commerce can reap upside income and is Theta pleasant as you revenue on the time decay, the danger of being assigned if the inventory closes underneath the strike worth could be pricey. Until you wish to personal the inventory on the chosen strike worth. Moreover, most brokers require greater choices authorization approval to qualify to commerce bare places.

Name debit unfold technique

Take into account a name debit unfold technique the place you concurrently purchase a name choice and promote/quick the next strike worth name choice. It is referred to as a debit unfold since you pay the premium distinction between lengthy and short-call choice costs. This lets you pay much less for the lengthy directional place than simply shopping for the calls. Nonetheless, your upside is capped as much as the upper strike worth of the short-call choice. In alternate, your draw back can also be restricted to the price of the unfold, which remains to be lower than dropping 100% of the lengthy name choice. Theta shouldn’t be your buddy on debit spreads. Debit spreads are most well-liked when the implied volatility (IV) is low.

Put credit score unfold technique

Another choice technique known as a put credit score unfold, also called a bull put credit score unfold or a brief put unfold. That is much like the debit unfold technique however with some variations. On this commerce, you’ll concurrently promote a put at a strike worth that you simply really feel is a help stage and purchase a put at a decrease strike worth. It is referred to as a credit score unfold as a result of it pays you the premium first, which means you obtain a credit score up entrance.

The utmost revenue is the credit score premium you obtain. You retain the online credit score premium if the inventory stays above the upper strike worth on expiration.

Theta is your buddy on put credit score spreads as a result of while you promote places, you’re the one accumulating on the time decay. Credit score spreads are favorable when implied volatility (IV) is excessive. The max loss is hit if the underlying shares fall underneath the decrease lengthy put strike worth stage. Your loss can be the distinction between the put strike costs minus the premium acquired. The advantage of a credit score unfold is that you simply receives a commission your max acquire up entrance versus a debit unfold the place you pay to max loss up entrance to amass the unfold.

Placing on the commerce

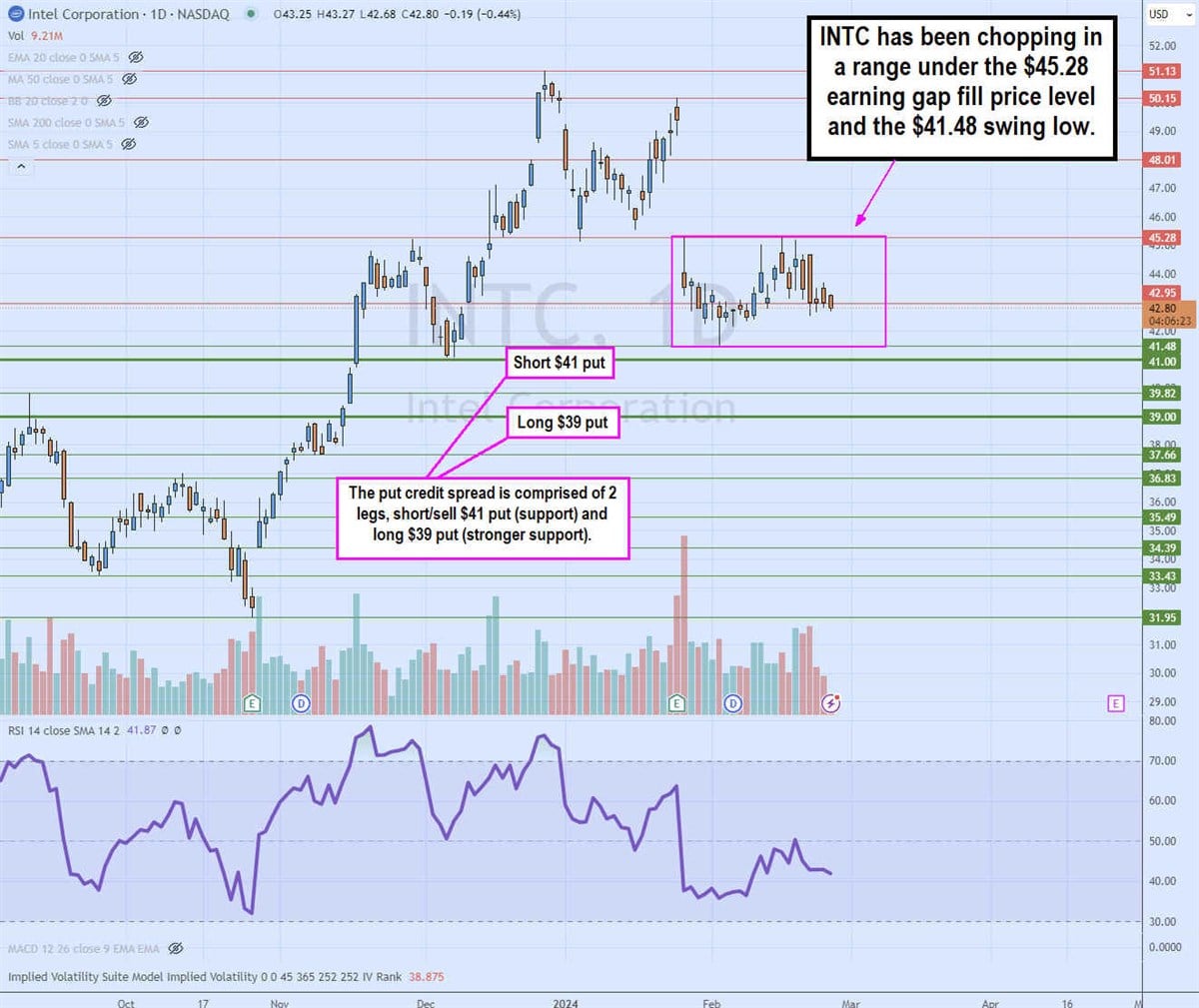

Let’s use Intel Co. NASDAQ: INTC on the day by day candlestick chart.

INTC is buying and selling at $42.85 on February 27, 2024. The $45.28 has been a gap-fill resistance stage because it gapped down on its This fall 2023 earnings miss and lowered steerage. There are two comparatively robust help ranges at $41.38 and $39.00. The day by day relative energy index (RSI) is beginning to lose steam once more sliding down in the direction of the 40-band. If we really feel bullish on INTC, then we will think about a put credit score unfold across the help ranges to gather premiums.

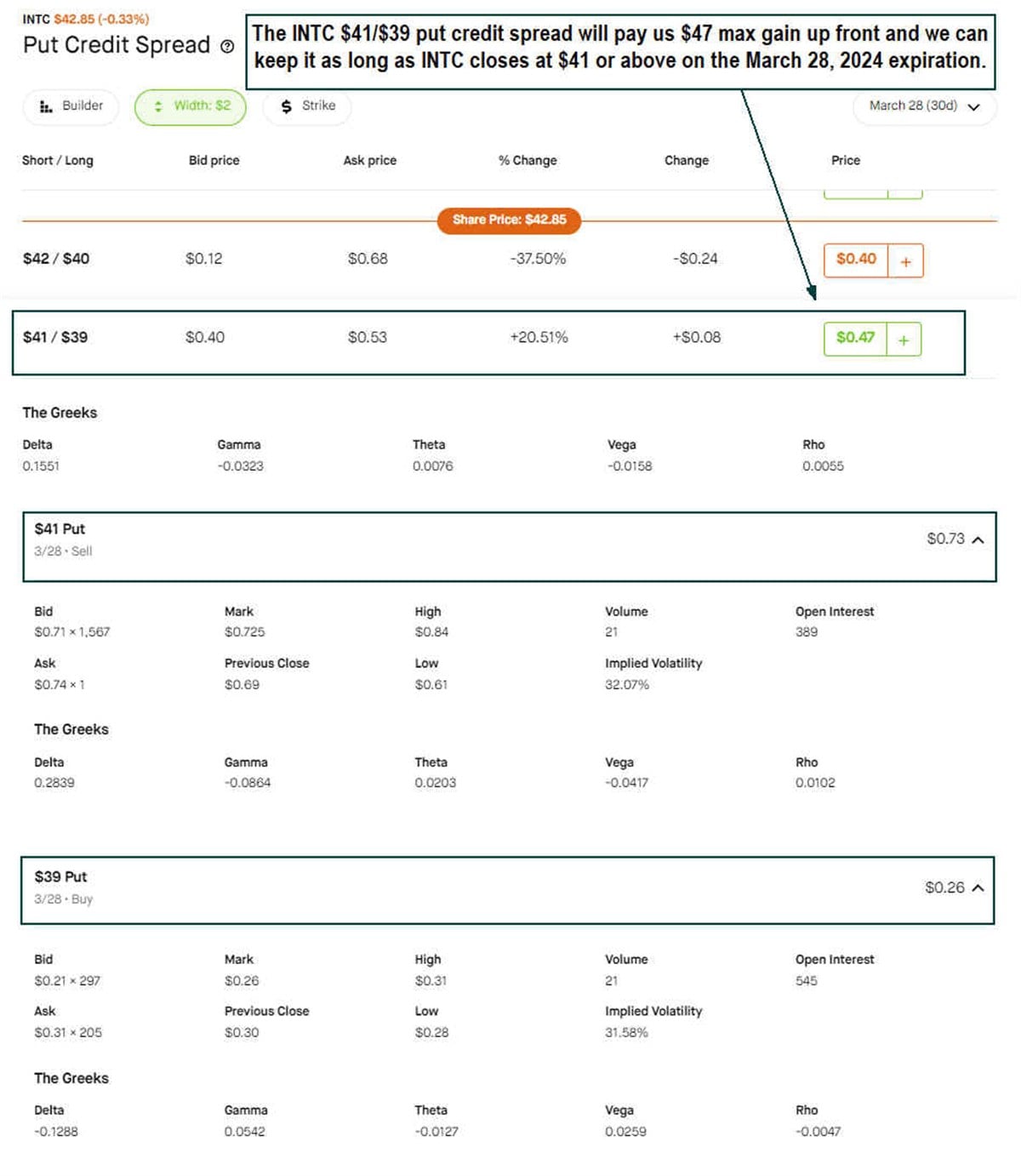

The put credit score unfold is a vertical choices commerce comprised of promoting/shorting a $41 put and shopping for a $39 put choice, each expiring on March 28, 2024, in 30 days. Many brokerage platforms have already got credit score spreads accessible, so you possibly can execute a single commerce somewhat than manually placing in 2 trades. The price of the INTC $41/$39 put credit score unfold is 47 cents or a credit score of $47 given to us. There’s a 73% chance of a revenue.

Each strike costs signify worth help ranges for INTC. The unfold is $2 between the strike costs. Since we’re bullish on INTC, we predict INTC to commerce above the $41 worth stage help on expiration in 30 days on March 28, 2024.

Potential outcomes

Upon expiration, if INTC closes at $41.00 or greater, then we maintain the 47-cent premium x 100 shares for a $47 revenue. The $41 represents the very best strike worth. There’s a 70% chance of a revenue. It is a 30.7% max return on the danger.

If INTC closes at $40.53, the commerce is breakeven.

IF INTC closes under $39.00, then we’d lose the distinction between the strikes of $2.00 minus the 47-cent premium acquired for a max lack of $1.53 or $153.00. The $39 represents the bottom put strike worth.

Managing the commerce

As with all choices trades, you are not required to carry by means of expiration. At any level, you may make changes or shut out the place. Since it is a credit score unfold, the place features day by day from the time decay. The commerce is worthwhile if INTC trades between $40.54 or greater with a max revenue above $41.00. The commerce loses cash when INTC trades under $40.53, with max loss triggering underneath $39.00. We are going to cowl methods to mitigate losses in future choices articles.

Earlier than you think about Intel, you may wish to hear this.

MarketBeat retains observe of Wall Avenue’s top-rated and finest performing analysis analysts and the shares they suggest to their purchasers every day. MarketBeat has recognized the 5 shares that high analysts are quietly whispering to their purchasers to purchase now earlier than the broader market catches on… and Intel wasn’t on the listing.

Whereas Intel at the moment has a “Maintain” ranking amongst analysts, top-rated analysts consider these 5 shares are higher buys.

Questioning what the following shares will probably be that hit it massive, with stable fundamentals? Click on the hyperlink under to study extra about how your portfolio may bloom.