pcess609

This month-to-month article collection experiences sector metrics within the S&P 500 index. It’s also a top-down evaluation of all ETFs primarily based on the S&P 500.

Quick Info on BBUS

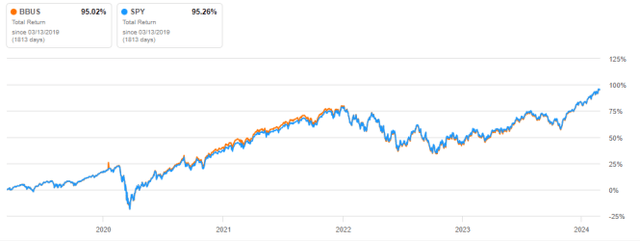

JPMorgan BetaBuilders U.S. Fairness ETF (BATS:BBUS) was listed on 03/12/2019 and tracks the Morningstar® US Goal Market Publicity Index. This massive and mid-cap index is just like the S&P 500. Since BBUS inception 5 years in the past, BBUS and SPDR® S&P 500® ETF Belief (SPY) have adopted the identical path, as plotted on the subsequent chart. The distinction in whole return is negligible.

BBUS vs SPY since inception (Searching for Alpha)

The highest 10 holdings are equivalent and their weights are shut, as reported beneath.

|

Ticker |

Identify |

BBUS |

SPY |

|

MICROSOFT CORP |

6.85% |

7.10% |

|

|

APPLE INC |

6.00% |

6.22% |

|

|

NVIDIA CORP |

4.18% |

4.50% |

|

|

AMAZON.COM INC |

3.65% |

3.69% |

|

|

META PLATFORMS INC CLASS A |

2.43% |

2.52% |

|

|

ALPHABET INC CL A |

1.83% |

1.89% |

|

|

BERKSHIRE HATHAWAY INC CL B |

1.69% |

1.76% |

|

|

ALPHABET INC CL C |

1.55% |

1.60% |

|

|

ELI LILLY + CO |

1.45% |

1.42% |

|

|

BROADCOM INC |

1.28% |

1.33% |

The following desk compares numerous traits of the 2 funds:

|

BBUS |

SPY |

|

|

Inception |

3/12/2019 |

1/22/1993 |

|

Expense Ratio |

0.02% |

0.09% |

|

AUM |

$2.98B |

$497.11B |

|

Avg Every day Quantity |

$14.63M |

$39.22B |

|

Holdings |

573 |

503 |

|

Belongings in High 10 |

30.91% |

32.03% |

|

Turnover |

3.00% |

2.00% |

|

P/E ttm |

24.02 |

24.15 |

A budget charge of the JPMorgan ETF is enticing for long-term buyers. Nevertheless, a lot larger buying and selling volumes make SPY a greater instrument for merchants.

Shortcut

The following two paragraphs in italic describe the dashboard methodology. They’re vital for brand spanking new readers to grasp the metrics. In case you are used to this collection or in case you are wanting time, you may skip them and go to the charts.

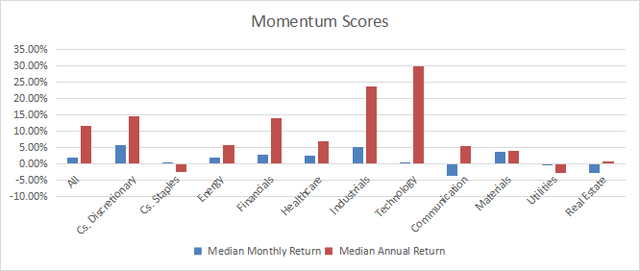

Base Metrics

I calculate the median worth of 5 basic ratios in each sector: Earnings Yield (“EY”), Gross sales Yield (“SY”), Free Money Stream Yield (“FY”), Return on Fairness (“ROE”), Gross Margin (“GM”). All are calculated on trailing 12 months. For all these ratios, larger is healthier and detrimental is unhealthy. EY, SY and FY are medians of the inverse of Worth/Earnings, Worth/Gross sales and Worth/Free Money Stream. They’re higher for statistical research than price-to-something ratios, that are unusable when the “one thing” is near zero or detrimental (for instance, firms with detrimental earnings). I additionally calculate two momentum metrics for every group: the median month-to-month return (RetM) and the median annual return (RetY).

I want medians relatively than averages as a result of a median splits a set in an excellent half and a foul half. Capital-weighted averages are skewed by excessive values and the most important firms. As a consequence, these metrics are designed for stock-picking relatively than index investing.

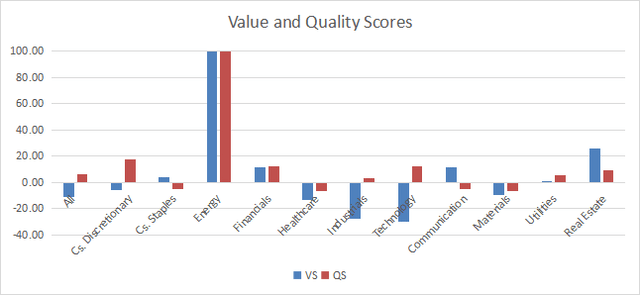

Worth and High quality Scores

Historic baselines are calculated because the averages on a look-back interval of 11 years for all metrics. They’re famous respectively EYh, SYh, FYh, ROEh, GMh. For instance, the worth of EYh for expertise within the desk beneath is the 11-year common of the median Earnings Yield of S&P 500 tech firms.

The Worth Rating “VS” is the common distinction in % between the three valuation ratios (EY, SY, FY) and their baselines (EYh, SYh, FYh). The identical approach, the High quality Rating “QS” is the common distinction between the 2 high quality ratios (ROE, GM) and their baselines (ROEh, GMh).

VS could also be interpreted as the share of undervaluation or overvaluation relative to the baseline (optimistic is nice, detrimental is unhealthy). This interpretation have to be taken with warning: the baseline is an arbitrary reference, not a supposed truthful worth. The components assumes that the three valuation metrics are of equal significance, besides in vitality and utilities the place the Free Money Stream Yield is ignored to keep away from some inconsistencies. VS and QS are capped between -100 and +100 when the calculation goes past these worths.

Present Knowledge

The following desk reveals the metrics and scores as of the final every day closing. Columns stand for all the info outlined above.

|

VS |

QS |

EY |

SY |

FY |

ROE |

GM |

EYh |

SYh |

FYh |

ROEh |

GMh |

RetM |

RetY |

|

|

All |

-11.20 |

6.44 |

0.0380 |

0.3611 |

0.0255 |

16.41 |

48.32 |

0.0432 |

0.4181 |

0.0277 |

15.14 |

46.27 |

1.98% |

11.50% |

|

Cs. Discretionary |

-5.91 |

17.40 |

0.0428 |

0.5378 |

0.0313 |

28.58 |

36.93 |

0.0451 |

0.6424 |

0.0302 |

21.51 |

36.24 |

5.67% |

14.49% |

|

Cs. Staples |

4.23 |

-4.81 |

0.0467 |

0.4955 |

0.0204 |

21.32 |

40.40 |

0.0420 |

0.4727 |

0.0211 |

23.48 |

40.57 |

0.47% |

-2.54% |

|

Vitality |

100 |

100 |

0.0830 |

0.4968 |

0.0421 |

21.71 |

48.09 |

0.0242 |

0.5488 |

-0.0059 |

7.14 |

43.23 |

1.92% |

5.56% |

|

Financials |

11.30 |

11.95 |

0.0637 |

0.5435 |

0.0778 |

12.77 |

80.93 |

0.0687 |

0.4346 |

0.0670 |

11.09 |

74.42 |

2.68% |

13.93% |

|

Healthcare |

-13.32 |

-6.57 |

0.0297 |

0.2645 |

0.0262 |

13.93 |

62.87 |

0.0347 |

0.2769 |

0.0332 |

15.90 |

63.35 |

2.56% |

7.00% |

|

Industrials |

-27.62 |

2.98 |

0.0328 |

0.2793 |

0.0243 |

21.17 |

39.57 |

0.0440 |

0.5244 |

0.0272 |

21.28 |

37.16 |

5.09% |

23.72% |

|

Know-how |

-29.84 |

12.17 |

0.0276 |

0.1640 |

0.0249 |

27.42 |

63.08 |

0.0373 |

0.2593 |

0.0340 |

22.06 |

63.07 |

0.48% |

30.05% |

|

Communication |

11.20 |

-5.23 |

0.0413 |

0.6879 |

0.0402 |

14.31 |

56.12 |

0.0461 |

0.5273 |

0.0354 |

16.50 |

54.57 |

-3.67% |

5.33% |

|

Supplies |

-9.42 |

-6.52 |

0.0340 |

0.5975 |

0.0226 |

16.36 |

33.64 |

0.0439 |

0.6015 |

0.0238 |

17.42 |

36.15 |

3.74% |

3.95% |

|

Utilities |

0.89 |

5.77 |

0.0538 |

0.4630 |

-0.0995 |

9.96 |

42.75 |

0.0494 |

0.4985 |

-0.0557 |

9.59 |

39.71 |

-0.37% |

-2.92% |

|

Actual Property |

26.08 |

9.21 |

0.0326 |

0.1273 |

0.0092 |

8.08 |

64.90 |

0.0231 |

0.1146 |

0.0073 |

6.76 |

65.62 |

-2.77% |

0.58% |

Rating Charts

The following chart plots the Worth and High quality Scores by sector (larger is healthier).

Worth and high quality within the S&P 500 (Chart: creator; knowledge: Portfolio123)

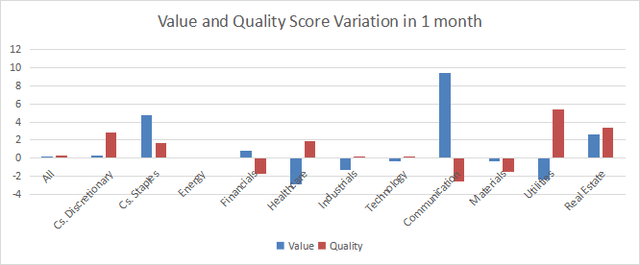

Rating variation since final month:

Variations in worth and high quality (Chart: creator; knowledge: Portfolio123)

The following chart plots momentum scores primarily based on median returns by sector.

Momentum within the S&P 500 (Chart: creator; knowledge: Portfolio123)

Interpretation

A hypothetical S&P 500 “median” firm is overvalued by 11.2% relative to common valuation metrics since 2012. The standard rating is barely above the historic baseline. We will translate median yields of their inverse ratios:

Worth/Earnings: 26.32 – Worth/Gross sales: 2.77 – Worth/Free Money Stream: 39.22

Vitality has been displaying the very best worth and high quality scores amongst GICS sectors for two years. Actual property is undervalued by about 26% relative to 11-year averages, and likewise has an excellent high quality rating. Financials, communication, and shopper staples are undervalued by 4% to 11%. Utilities are simply on the historic baseline in valuation and shut above it in high quality. Supplies, healthcare and shopper discretionary are overvalued by 6% to 13% relative to their baseline. It could be justified by an excellent high quality rating for shopper discretionary. Know-how and industrials are overvalued by nearly 30%.

SPY has gained 30.2% in 12 months (whole return), whereas the median return of the S&P 500 is 11.5% (reported within the desk above) and the equal-weight return (measured on RSP) is 12.8% . It means the capital-weighted index has been massively skewed to the upside by mega-cap firms over the past 12 months.

We use the desk above to calculate worth and high quality scores. It could even be utilized in a stock-picking course of to test how firms stand amongst their friends. For instance, the EY column tells that a big shopper staples firm with an Earnings Yield above 0.0467 (or value/earnings beneath 21.41) is within the higher half of the sector concerning this metric. A Dashboard Record is shipped each month to Quantitative Danger & Worth subscribers with probably the most worthwhile firms standing within the higher half amongst their friends concerning the three valuation metrics on the similar time. The 9 shares listed beneath are an excerpt of the record of 75 firms despatched to subscribers for the March 2024 replace.

|

Polaris Inc. |

|

|

Valero Vitality Corp. |

|

|

Synchrony Monetary |

|

|

Tenet Healthcare Corp. |

|

|

Lockheed Martin Corp. |

|

|

Apogee Enterprises, Inc. |

|

|

Bunge International SA |

|

|

InterDigital, Inc. |

|

|

SJW Group |

It’s a rotational mannequin with a statistical bias towards extra returns on the long-term, not the results of an evaluation of every inventory.