Federal Reserve Chair Jerome Powell reiterated to lawmakers that the US central financial institution is in no rush to chop rates of interest till policymakers are satisfied they’ve gained their battle over inflation.

In ready testimony to a Home panel Wednesday, the Fed chief stated it should probably be acceptable to start decrease borrowing prices “sooner or later this 12 months,” however made clear they’re not prepared but.

ADVERTISEMENT

CONTINUE READING BELOW

The remarks echoed a constant message from almost each Fed official in latest weeks: The economic system and labor market are robust, which means policymakers have time to attend for extra proof that inflation is headed again to their purpose earlier than slicing rates of interest.

“The committee doesn’t anticipate that will probably be acceptable to cut back the goal vary till it has gained higher confidence that inflation is transferring sustainably towards 2%,” Powell stated in short ready remarks to the Home Monetary Providers Committee, the place he’s set to testify at 10 a.m. Wednesday.

The Fed chief is on Capitol Hill for the primary of two days of his semiannual financial coverage testimony, and is scheduled to look earlier than the Senate Banking Committee on Thursday.

Fed officers are within the final rounds of an aggressive combat to include inflation. After elevating their benchmark federal funds charge greater than 5 share factors beginning in March 2022, they’ve held charges regular since July amid easing worth pressures.

Central bankers are actually grappling with how quickly and the way far they need to decrease charges. Minimize too early, and officers fear they may gas a pick-up in financial exercise that retains inflation above 2% — the speed they see as acceptable for a wholesome economic system. Preserve borrowing prices elevated for too lengthy and so they danger tipping the economic system right into a recession.

“We consider that our coverage charge is probably going at its peak for this tightening cycle,” Powell stated in his ready remarks, repeating language used at his final press convention on Jan. 31. “If the economic system evolves broadly as anticipated, it should probably be acceptable to start dialing again coverage restraint sooner or later this 12 months. However the financial outlook is unsure, and ongoing progress towards our 2% inflation goal is just not assured.”

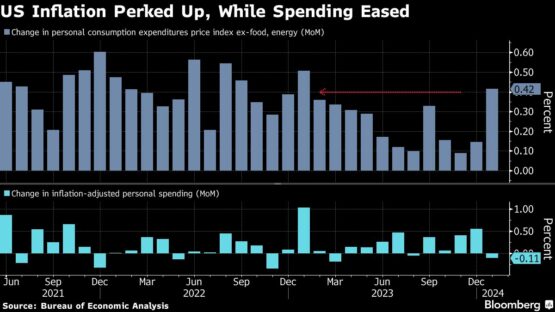

Inflation slowed to a 2.4% charge for the 12 months ending in January, down from a peak of seven.1% in June 2022. However worth pressures accelerated from December, and an underlying measure usually cited by Powell — companies costs excluding shelter and power — remains to be monitoring larger than its pre-pandemic pattern.

ADVERTISEMENT

CONTINUE READING BELOW

On the similar time, demand for staff has remained robust, with employers including 353 000 jobs in January and economists forecasting one other 200,000 added in February.

Fed officers have stated excessive rates of interest ought to proceed to ripple via the economic system and finally sluggish progress, which has been surprisingly sturdy over the previous 12 months. Nonetheless, some forecasters have lifted their estimates for financial output within the first quarter, on account of expectations for larger shopper spending.

Policymakers have responded to the economic system’s stunning power by indicating that they’ll maintain charges at a excessive stage and, as soon as they start slicing, will most likely decrease them at a slower and doubtlessly much less common tempo than prior to now.

Since their January assembly, officers have pushed again aggressively on expectations that they are going to reduce charges once they meet on March 19-20. Buyers are actually betting the primary charge reduce will are available in June. Additionally they anticipate between three and 4 charge cuts this 12 months, in keeping with Fed officers’ median forecast in December. Policymakers will launch up to date charge projections at their assembly this month.

In the meantime, Democratic lawmakers are rising impatient with the US central financial institution forward of the November elections. Sherrod Brown, the Senate Banking Committee chair who’s in a troublesome reelection battle in Ohio, urged the Fed to chop charges “early this 12 months” in a January 30 letter to Powell, arguing that top charges are hurting small companies and placing homeownership out of attain for a lot of People.

© 2024 Bloomberg