Ralf Hahn

Proper now there’s important competitors in your {dollars} on the subject of yield. Not that way back, when you had some money it will mainly earn zilch if it was in your checking account or if it was in a cash market. Nonetheless, that has all modified and most cash market funds at the moment are yielding over 5% and banks are even providing a significant yield on CD’s and financial savings accounts. However simply as we should always not have been taking a zero rate of interest coverage or “ZIRP” with no consideration, we must also notice that the times of parking money in cash market funds that earn over 5% (presently) are additionally numbered. It already seems that many traders are getting complacent with the usage of cash market funds as a result of there’s now roughly $6 trillion in money sitting in these funds.

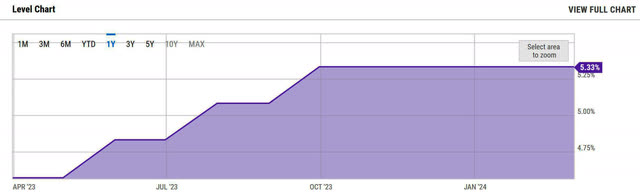

When rates of interest decline, the yield on these cash market funds might plunge and spark a mass exodus into different income-producing belongings. Simply as just lately as 2022, cash market funds have been yielding lower than half a %. It is a stark reminder of how far and how briskly rates of interest have climbed, and it must also serve to level out that cash market fund yields might get lower in half from present ranges and nonetheless be yielding many multiples of what the yield was in 2022. That is simply to level out that there’s a lot of room for charges to fall with out going again to the insanely low charges we noticed throughout the pandemic. The chart under exhibits how charges went from nearly nothing, and now are over 5%:

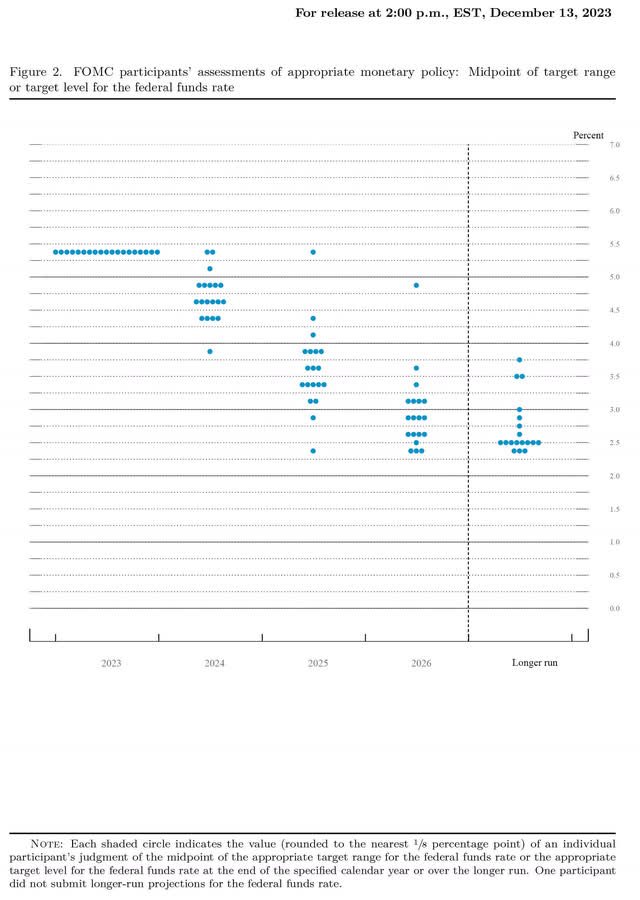

We aren’t there but, however in some unspecified time in the future within the not too distant future, we might see a mass exodus out of cash market funds. When trying on the “dot plot” projections for the Fed Funds Charge from the FOMC, it exhibits that charges might go from what’s presently over 5%, and plunge all the way down to as little as round 2.25% by 2026.

This exhibits what charges might seem like within the not too distant future, so it is smart for traders to begin making some strategic strikes, earlier than it will get to the purpose the place cash market funds are doubtlessly incomes simply 2.5% or much less. Everyone knows what occurs when an organization cuts the dividend: many traders promote, and we’re more likely to see cash market funds lower the “dividend” by 50% between now and 2026. When cash market fund charges are all the way down to this degree of two.5%, or possibly even decrease, many traders are going to be dissatisfied incomes so little, and can possible be inclined to money out of cash market funds and pay extra normally for dividend shares than they might be prepared to pay when charges are as excessive as they’re as we speak.

This implies it’s time to begin locking in among the excessive yields which can be obtainable by shopping for dividend shares now. The concept is that not solely will we lock in a beneficiant yield, however we will even be arrange for doubtlessly important capital positive aspects by 2026, since these shares will possible rise and be value extra in a a lot decrease fee atmosphere. I feel all of us want to consider the truth that cash market funds are an especially crowded commerce proper now and we should always begin getting out, forward of the group.

As a result of investing in particular person shares entails important dangers that might derail your portfolio, I feel it is smart to make use of ETFs with a purpose to diversify. I exploit ETFs if I’m desirous to commit a really massive sum of money to a sure asset class, particularly if I’m investing for the long run. I usually will purchase a inventory in an organization after I see a doubtlessly very compelling alternative that may give me the extra upside I must compensate for the additional threat that comes with shopping for single shares.

Schwab U.S. Dividend Fairness ETF (NYSEARCA:SCHD) is a perfect manner to purchase a basket of dividend paying shares. This fund pays a dividend of $2.66 per share, which gives a yield of about 3.4%. A number of the prime holdings for this fund embrace: Texas Devices (TXN), Chevron (CVX), Verizon (VZ), Cisco Methods (CSCO), Coca-Cola (KO), Broadcom (AVGO) and lots of extra. This ETF was launched in 2011, and it has generated annual returns of about 13%, since inception. It is a excellent monitor file.

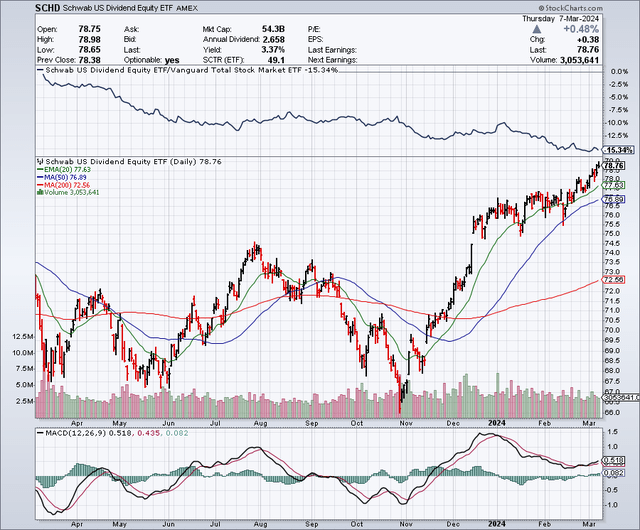

This ETF has been rising in worth over the previous few months however in late 2023, there was a pointy selloff for the inventory market which took this ETF all the way down to about $66. This ETF now appears to be like a bit overextended after a latest rally. Due to this, I might look ahead to pullbacks earlier than beginning a brand new place or including to an current place.

Because the chart under exhibits, this ETF bottomed out in October of 2023, and has since been steadily rising. With the ETF presently buying and selling for over $78 per share, I feel it is smart to attend for some pullbacks earlier than committing any main sums to this funding. The 50-day shifting common is $77.67, so we might simply see a pullback to this degree. The 200-day shifting common is round $72.50, which might be a much more perfect degree to purchase shares and we might get to this key help degree if the market experiences even a small 5% correction.

Whereas the Schwab U.S. Dividend Fairness ETF won’t appear to be an thrilling alternative, it does get thrilling when you think about the monitor file it has of offering shareholders with annual returns of practically 13%. I feel it might be poised to supply most of these returns for the following couple of years, as a result of dividend shares might be re-rated to larger ranges when charges fall. For instance, if cash market fund charges drop to 2.5%, it will not be unrealistic for the yield on this ETF to drop to three% or much less. A drop from a 3.4% yield to a 3% yield for this ETF would point out a few 15% achieve for the share value. This instance could be too conservative as a result of the yield on this fund might even go to 2.5%, which might indicate a good larger achieve within the share value. However even when it solely positive aspects 15% over the following 2 years, this might result in complete shareholder returns of roughly 22% (a 15% capital achieve, mixed with 2 years of dividends totaling 3.4% for annually equaling nearly 7%). Nonetheless, as I mentioned earlier, I might look ahead to pullbacks which might improve each the upside from capital positive aspects and from the dividend yield.

One other ETF that might make sense could be the Vanguard Actual Property Index Fund (VNQ). This fund focuses on REITs and yields simply over 4%, and can be poised to profit from decrease charges. Nonetheless, I wished to concentrate on SCHD as a result of it provides extra diversification by way of publicity to a variety of industries and for that motive I really feel it deserves a bigger portfolio allocation. Whereas it is smart to make use of a extremely liquid ETF for a bigger portfolio allocation, I feel it is usually good so as to add some even larger yielding shares to combine with a purpose to enhance the general yield out of your portfolio, this is one instance:

British American Tobacco (BTI) is a number one world tobacco firm with well-known manufacturers akin to Kent, Dunhill, Fortunate Strike, Rothmans, Pall Mall. It additionally has U.S. particular manufacturers akin to Camel, Pure American Spirit and Newport. Additionally it is promoting non-combustible merchandise.

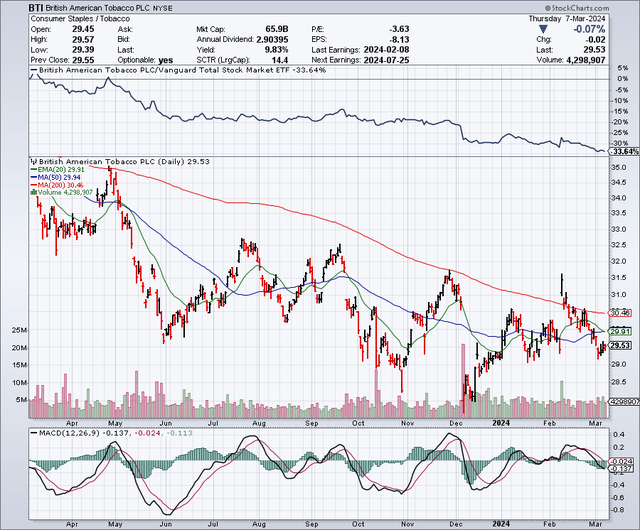

Because the chart under exhibits, this inventory dropped in December to across the $28 vary, and is buying and selling simply above that degree now. The 50-day shifting common is $29.92 and the 200-day shifting common is $30.47. With a little bit excellent news, this inventory might rebound again over the $30 vary pretty simply and create a bullish golden cross on the chart.

This firm pays a quarterly dividend which is round 74 cents per share, which is almost $3 per share on an annual foundation. The tobacco firms have very excessive regulatory dangers, and fewer persons are smoking annually, however they’ve had these challenges for years and are nonetheless rewarding shareholders with a beneficiant dividend. These firms have pricing energy, so they can elevate costs which preserve income up, despite decrease gross sales volumes. I feel the key tobacco firms are going to enter the hashish business as quickly as it’s legalized by the U.S. Authorities and this might carry income development again. If income development happens, the worth to earnings multiples might broaden considerably from present ranges.

Whereas I share some issues about this business, and the regulatory dangers, a lot of this seems to be priced in, I might say even overpriced in. This business is extra sturdy than the present PE ratio and dividend yield presently point out. Some analysts appear to agree with this view. JPMorgan (JPM) just lately launched a listing of European shares that they imagine supply a sustainable dividend and British American Tobacco made the listing.

Regardless of the bear case, when you have a look at earnings estimates, this does not look like a enterprise that’s going away anytime quickly. Analysts count on this firm to earn $4.64 in 2024, $4.97 in 2025, and $5.23 in 2026. This suggests a value to earnings ratio of simply round 6. Moreover, this degree of earnings exhibits that the dividend is extraordinarily well-covered, which suggests it seems secure and there’s room for dividend will increase.

After I put money into a excessive yield inventory, I all the time take into consideration the “Rule of 72”. That is utilized by traders to calculate how lengthy it’s going to take to double your cash. It really works by dividing 72 by the yield. With British American Tobacco presently yielding about 10%, if we divide 72 by 10, it exhibits it’s going to take round 7 years to double your cash with the dividend. Nonetheless, this inventory might be revalued larger when rates of interest decline and that might create capital positive aspects for shareholders.

Closing Ideas:

Along with these dividend concepts, I additionally like Whirlpool (WHR) which I just lately wrote about, as a result of I feel it is vitally undervalued with a 6.5% yield and a single digit value to earnings ratio. I feel Whirlpool goes to be a giant beneficiary of decrease rates of interest as a result of this might unfreeze the housing market and create a surge in main equipment upgrades.

It is clear that the cash market fund commerce might be near peaking and really overcrowded. It is time to accumulate dividend payers on pullbacks by means of ETF’s like SCHD, in addition to particular person shares. My technique is to maintain including publicity to dividend shares as a result of there’s an awesome alternative to lock in some beneficiant yields and possibly set portfolios up for capital positive aspects as charges drop over the following couple of years.

No ensures or representations are made. Hawkinvest is just not a registered funding advisor and doesn’t present particular funding recommendation. The knowledge is for informational functions solely. It’s best to all the time seek the advice of a monetary advisor.