Inflation within the US in all probability abated solely step by step final month and retail gross sales rebounded, illustrating why the Federal Reserve is in no rush to decrease rates of interest.

Article content material

(Bloomberg) — Inflation within the US in all probability abated solely step by step final month and retail gross sales rebounded, illustrating why the Federal Reserve is in no rush to decrease rates of interest.

The core shopper value index, a measure that excludes meals and gas for a greater image of underlying inflation, is seen rising 0.3% in February from a month earlier after a 0.4% advance to begin the yr. The Labor Division will concern its CPI report on Tuesday.

Commercial 2

Article content material

Article content material

The value gauge is projected to have risen 3.7% from a yr in the past, which might mark the smallest annual advance since April 2021. Whereas the year-over-year determine is properly under the 6.6% peak reached in 2022, the tempo of progress extra not too long ago has been modest.

That squares with congressional testimony from Fed Chair Jerome Powell prior to now week, who mentioned that whereas it could probably be acceptable to chop charges “sooner or later this yr,” he and his colleagues aren’t prepared but.

Learn extra: Powell Says Fed ‘Not Far’ From Confidence Wanted to Lower Charges

That’s as a result of the Fed desires convincing indicators that inflation is nearing their 2% goal, primarily based on a separate gauge — the private consumption expenditures value index. Along with the CPI, the federal government’s producer value index on Thursday will assist inform the PCE index, which can be launched after the US central financial institution’s March 19-20 coverage assembly.

Fed officers will observe a blackout interval for talking engagements forward of that assembly.

Away from inflation, there are scant indicators of stress within the financial system. The most recent jobs report pointed to moderating but wholesome employment progress that may hold shopper spending afloat.

Article content material

Commercial 3

Article content material

Authorities figures on Thursday are anticipated to point out a 0.8% advance in February retail gross sales following a drop of the identical magnitude a month earlier. Such an consequence would point out a return of buyers who took a breather after a robust holiday-shopping season.

Different US information within the coming week embody February industrial manufacturing and the College of Michigan’s preliminary March shopper sentiment index.

- For extra, learn Bloomberg Economics’ full Week Forward for the US

Turning north, nationwide steadiness sheet information from Canada will supply a have a look at family funds as excessive rates of interest weigh on closely indebted mortgage-holders.

What Bloomberg Economics Says:

“February’s CPI report is unlikely to supply the reassurance Powell must undertake a firmly dovish stance. Seasonal tendencies noticed within the January report, which drove up core CPI, are anticipated to persist in February. We predict it’s a detailed name between Might or June for the Fed’s first charge lower.”

—Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For full evaluation, click on right here

Elsewhere, wages in Japan and the UK, plus a flurry of inflation numbers from Sweden to Brazil, will hold buyers busy.

Commercial 4

Article content material

Click on right here for what occurred final week and under is our wrap of what’s developing within the world financial system.

Asia

Japan’s intently watched annual wage negotiations attain a milestone with the discharge on Friday of the outcomes from the primary union group, Rengo.

The numbers are anticipated to high final yr’s outcomes, which have been already the perfect in many years, paving the way in which for the Financial institution of Japan to finish its detrimental charge both this month or subsequent.

Additionally feeding into that rubric can be Japan’s closing fourth-quarter gross home product statistics on Monday. They’re more likely to be revised increased to probably pull the nation out of a technical recession, in what could be one other inexperienced mild for the BOJ.

Elsewhere, India’s industrial output could have elevated at a sooner clip in January, whereas February inflation is seen cooling a tad.

India, Indonesia and the Philippines get commerce information within the coming week, and Australia will get the February NAB Enterprise Situations gauge and family spending numbers.

- For extra, learn Bloomberg Economics’ full Week Forward for Asia

Europe, Center East, Africa

Commercial 5

Article content material

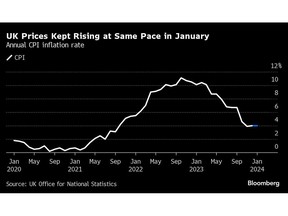

The UK will take middle stage within the area, with wage information on Monday more likely to present a still-robust tempo of enhance that may hold the Financial institution of England cautious. In a touch of the labor market’s tightness, the central financial institution itself has simply been compelled to grant raises to its employees that match inflation.

On Tuesday, month-to-month GDP numbers for the UK are anticipated to point out a small enhance after a drop in December, underscoring how the financial system continues to be struggling. The BOE will launch its personal survey of shopper inflation expectations on Friday.

Turning to the euro zone, the primary report can be industrial manufacturing, which is anticipated to point out that 2024 started with a month-to-month drop.

In the meantime, following final week’s European Central Financial institution determination signaling a charge lower in June, a number of officers are on account of converse, together with chief economist Philip Lane. The establishment could unveil a revamp of its financial coverage framework on Wednesday.

A number of European international locations will launch inflation numbers, together with Denmark, Norway, Sweden, Serbia and Romania. And Ukraine’s central financial institution will announce its newest charge determination on Thursday amid uncertainty over US navy assist.

Commercial 6

Article content material

Turning south, buyers will watch Egypt’s inflation quantity on Sunday, with some anticipating it to have slowed considerably from January’s 29.8%. The info will comply with the central financial institution’s jumbo charge hike of 600 foundation factors and forex devaluation on Wednesday.

In Nigeria, in contrast, information on Friday will probably present value progress previous 30% because it struggles within the aftermath of a forex devaluation.

On the identical day, Angola is anticipated to extend its key charge to stem upward stress on inflation from hostile climate situations and a weaker trade charge.

Additionally on Friday, Israel will report inflation. Worth progress has slowed sharply prior to now yr to 2.6%, even with the onset of the battle towards Hamas in October. The Financial institution of Israel has nonetheless prevented charge cuts amid uncertainty in regards to the length of the battle, already into its sixth month, and its affect on costs.

- For extra, learn Bloomberg Economics’ full Week Forward for EMEA

Latin America

The Brazilian central financial institution’s survey of economists will get the week rolling on Monday. Inflation expectations for year-end 2024 have been inching down however these for the next three years stay unmoored.

Commercial 7

Article content material

Native economists see shopper value will increase slowing to three.76% by year-end, a shade under estimates from economists surveyed by Bloomberg. Knowledge posted Tuesday will probably present that annual inflation slowed again to inside policymakers’ 1.5% to 4.5% goal vary.

Retail gross sales in Brazil dissatisfied in December amid an prolonged softening of shopper confidence that will additionally weigh on January figures due Thursday.

Mexico posts January industrial manufacturing information after the year-on-year studying flatlined in December. In opposition to that detrimental, manufacturing and manufacturing pattern indicators rose for a 3rd month in February to a three-year excessive.

Peru’s GDP-proxy information for January will probably present the Andean financial system leaving 2023 and its second-worst contraction in additional than 30 years behind. Nonetheless, many analysts see a protracted stretch of mediocre progress forward.

In Argentina, inflation probably confirmed for a second month in February from December’s 25.5% studying, although the implied annual charge is forecast to have pushed up over 280%.

Whereas the mix of recession and President Javier Milei’s fiscal changes are cooling value pressures, most analysts see triple-digit annual prints extending properly into subsequent yr.

- For extra, learn Bloomberg Economics’ full Week Forward for Latin America

—With help from Brian Fowler, Piotr Skolimowski, Robert Jameson, Laura Dhillon Kane, Paul Wallace and Monique Vanek.

Article content material