Cash stuff may be overwhelming and scary.

If you’re an entrepreneur, you have got the powerful process of managing two units of funds: your corporation’ and your personal.

Nicole Lapin, private finance knowledgeable, is aware of how powerful it may be, and needs that can assist you navigate budgeting, saving cash, and making ready for retirement.

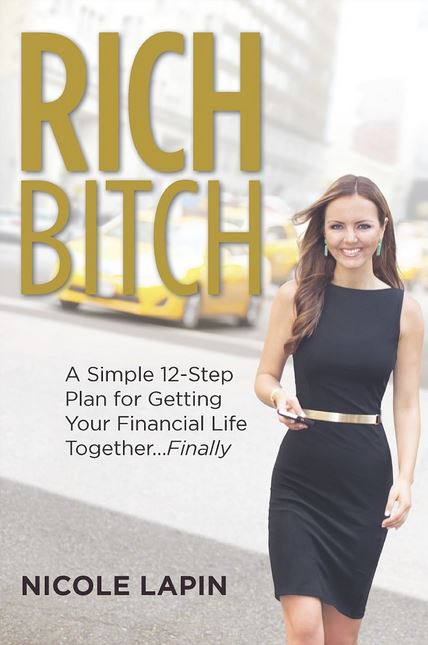

We picked her mind about private finance and her new guide, Wealthy Bitch: A Easy 12-Step Plan for Getting Your Monetary Life Collectively…Lastly.

Nicole’s recommendation is efficacious to any entrepreneur, however particularly ladies, attempting to get wealthy and type out their funds.

Cash isn’t one thing lots of people like to speak about, not to mention write an entire guide about! What bought you so excited by private finance?

Cash is the story of our present occasions, and it’s part of our zeitgeist. Simply have a look at reveals like Shark Tank, Tabitha’s Salon Takeover, even Cake Boss. They’re all about enterprise, and making small companies work. We’ve a nationwide entrepreneurial spirit going, the place everybody needs to be the subsequent Mark Zuckerberg. However we even have a nationwide private debt epidemic. So I’m excited by serving to ladies and younger individuals get their monetary homes so as to allow them to make their cash and enterprise desires develop.

How is your strategy to private finance completely different than a few of the different gurus on the market?

We live in a ‘new regular.’ What may need been true about private finance 10, 5, even simply 2 years in the past is wildly completely different in our post-recession financial panorama. I’m excited to be the primary private finance knowledgeable to deal with these new points, and debunk loads of the standing “typical” knowledge. Do you want a 401(ok)? Perhaps. However perhaps not. Do you have to purchase a home? I say, for most individuals renting is the higher approach to go. Are you able to deal with your self to small indulgences like your morning latte? YES! The concept of the ‘American Dream’ is useless. It is your dream. Your future. And, I’m thrilled to be part of that monetary paradigm shift.

Why do you suppose it’s necessary for ladies to take cost of their monetary well-being?

With regards to our cash and our careers, it’s time for ladies to cease smiling and nodding and be a part of the dialog. We’ve gotten so used to data overload that always as a substitute of asking the pertinent questions and sifting by means of the knowledge to seek out the truisms that work for us, we simply take them at face worth. I’m on a mission to get younger individuals, particularly ladies, to talk the language of finance. It’s simply not that scary, and it’s time to take management of our monetary destinies.

Who or what impressed you to write down this guide?

Actually, my former self. I didn’t develop up with _The Wall Avenue Journal _on the kitchen desk. There was no discuss shares or bonds in my household…ever. As a part of an immigrant household, I used to be raised pondering that stashing your money below your mattress was the perfect place to maintain your cash. I by no means discovered or thought of the right way to develop that cash by means of investing, and the right way to make my cash work for me. I discovered every part I find out about cash and finance not by means of an MBA, however the college of Arduous Knocks. And now I’m writing for her—my former self who couldn’t but communicate the language of finance. I’m her Rosetta Stone, and I hope to play that function for a lot of different ladies, too.

What’s your finest piece of recommendation for ladies with regards to their funds?

Get going…now!! Don’t wait round and let your life, and your funds, move you by. It’s so necessary to put basis for your self in your 20s and 30s; your peak incomes years, particularly earlier than youngsters. I speak on a regular basis a couple of magical factor often known as “compounding curiosity.” It primarily implies that you’re incomes curiosity _on _your curiosity, and that implies that whether or not you’re saving for retirement or a brand new home or your youngsters to go to school, the earlier you dump some cash right into a stable financial savings car, like a Roth IRA, the extra that cash grows over time. It’s actually the distinction between creating wealth and making a fortune.

_Nicole Lapin is a veteran monetary journalist, serving as an anchor on CNN, CNBC, and Bloomberg. Her first guide Wealthy Bitch: A Easy 12-Step Plan for Getting Your Monetary Life Collectively…Lastly was printed in 2015. __You can comply with Nicole on Fb, Instagram, _Twitter _and at _NicoleLapin.com _for sensible monetary recommendation and unconventional cash ideas. _