Preserving monitor of enterprise bills is one factor. However then there’s the query of tips on how to handle these private funds, too.

Now, as a substitute of 1, you may have two budgets to stability.

So the place ought to an entrepreneur look when attempting to control their private spending habits?

We have pulled collectively a listing of nice assets that may enable you just do that.

7 Instruments for Private Monetary Administration

1. Mint

This fashionable free software helps you intend your price range, monitor bills, and even sends alerts once you’re near overstepping your set price range limitations. It additionally gives ideas for higher saving, a free credit score rating, and is 100% safe.

Good for: The entrepreneur who desires to see the large image of his/her private funds.

2. Spendee

This app is all about exhibiting you the place your cash goes. Whether or not it is gasoline, eating out, or procuring, you can see the place you might in the reduction of.

Good for: Getting a sensible image of your spending habits. You could be stunned to search out you are spending greater than you suppose.

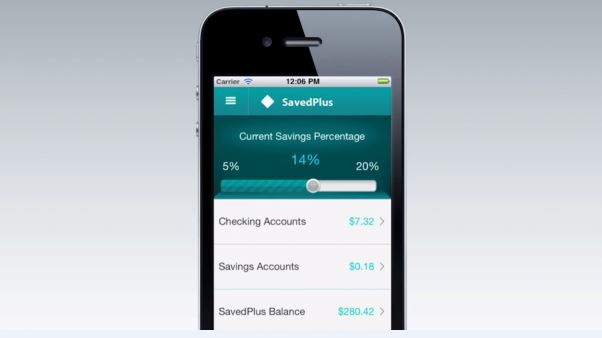

3. SavedPlus

If you would like to focus extra on saving, SavedPlus helps you to put aside a proportion of every buy you make. Then, that proportion quantity is distributed to your financial savings account in a lump sum by way of weekly deposit.

Good for: In the event you wrestle with saving cash, that is one technique to do it with out having to consider it a lot.

4. Degree Cash

This app helps you see the place you are at in actual time along with your spending. Based mostly in your revenue stage, it tells you ways a lot you may have obtainable to spend every month (with out all of the charts and graphs.)

Good for: Entrepreneurs who’re much less anxious a few price range and actually simply need to know the place they stand on a day-to-day foundation with their funds.

5. Day by day Value

Need to handle private funds with out the frills? Dailycost is constructed that can assist you enter and monitor your bills in three seconds or much less. With a clear design and easy information, there is no digging required to get straight to the numbers.

Good for: Easy price range monitoring on the go.

6. YouNeedABudget (YNAB)

A way more sturdy software, YNAB helps you are taking a deeper take a look at your funds and plan your price range primarily based on the small print of the place you may in the reduction of. There’s a $60 one-time charge, but it surely additionally grants you entry to dwell on-line courses and help.

Good for: The entrepreneur who actually desires to get severe about budgeting and saving.

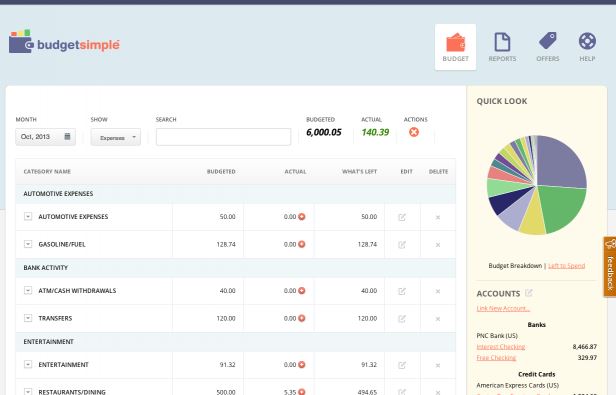

7. BudgetSimple

In the event you’re unsure tips on how to be a greater budgeter, BudgetSimple helps by offering concepts on the place particularly it’s best to cut back spending. It connects along with your financial institution and bank cards to maintain monitor of the place your cash goes, after which helps you intend a better price range every month. There’s each a free and a $4.99/mo possibility with extra options.

Good for: Making and sustaining a price range that works along with your way of life.

Get Recommendation

In the event you’re not all about apps and need a totally different technique to plan your private funds, there are many books, courses, and instruments obtainable from private finance consultants like Nicole Lapin, Suze Orman, Dave Ramsey, and Clark Howard.

These consultants supply all types of coursework and assets that may just do as a lot (or extra) that can assist you get your private price range in verify.

The underside line: No matter software you employ, the key to correctly managing your private funds is to discover a price range that works for you–and stick with it.

Your flip: Have you ever tried any of those instruments? What would you add to this listing?