Overview

Siren Gold (ASX:SNG) is an exploration and growth firm specializing in gold belongings at its 1,100-square-kilometer tenement bundle positioned on the historic, high-grade Reefton, Lyell and Sams Creek goldfields in New Zealand.

Reefton Goldfield was first found in 1866 with complete present recorded manufacturing of 11 million ounces (Moz) of gold, consisting of two Moz @ 16 grams per ton (g/t) gold from underground, 0.7 Moz from open pit and ~8 Moz gold from alluvial mining.

Mining and the native communities thrived within the area throughout the early 1900s, however many of the 94 underground mines closed by 1942 throughout WWII, and the Blackwater mine, which produced 740 koz @ 19 g/t all the way down to greater than 700 meters beneath the floor, lastly shut down in 1951 bringing the whole subject to a detailed. The gold worth in 1951 was US$35 per ounce.

The district is extensively identified for producing gold, antimony and coal. A vital side of the Reefton Goldfield is the numerous incidence of antimony, a uncommon thermal-resistant steel and a poor conductor of electrical energy. These attributes make it best for flame retardants, paints and varied industrial purposes to enhance thermal tolerance. Moreover, antimony is a important factor in lithium-ion batteries and next-generation liquid steel batteries utilized for vitality storage programs. The presence of antimony within the goldfield creates further worth for Siren’s tasks as exploration continues.

Siren at present has seven tasks, lots of which have been lively websites that have been closed throughout WWII regardless of encouraging exploration or manufacturing. Now, the corporate has constructed an expansive portfolio of tasks and can endure systematic exploration of its belongings utilizing modern applied sciences and methods.

With seven tasks beneath its belt, Siren is primarily targeted on Sams Creek, Alexander River, Huge River and Auld Creek. These 4 tasks are slated for future exploration and potential growth to enhance the belongings’ worth.

A talented administration workforce leads the corporate in the direction of absolutely exploring its promising portfolio, with numerous experience in geology, company administration and finance.

Firm Highlights

- Siren Gold is an exploration and growth firm specializing in gold belongings within the high-grade, historic Reefton Goldfield and Sams Creek in New Zealand.

- Siren owns seven extremely potential tasks all through the area, every with the potential for gold and antimony, a uncommon steel utilized in varied thermal-resistant purposes.

- The corporate’s international mineral useful resource is at present at 1.33 million ounces at 3.3 g/t AuEq (gold equal), with important potential to extend as exploration continues.

- The Reefton Goldfield traditionally produced over 11 million ounces of gold earlier than the whole subject closed after WWII.

- Siren’s belongings inside the Reefton Goldfield are extremely potential however have but to be absolutely explored by way of trendy exploration methods, creating important blue-sky potential.

- A administration workforce with a variety of experience within the pure assets business leads the corporate in the direction of absolutely realizing the potential of its extremely potential portfolio.

Key Initiatives

Sams Creek Gold Undertaking

The Sams Creek Gold Undertaking is positioned 140 kilometers northeast of Reefton and 100 kilometers northeast of Lyell.

The Sams Creek porphyry dyke-style gold deposit is equal in geology deposits to the Australian Jap Lachlan fold belt that comprises very giant porphyry copper-gold and porphyry gold-style deposits like at Cadia and Ridgeway in New South Wales.

Siren believes there’s important potential at Sams Creek for a really giant underground mining operation because the orebody is over 60 meters thick, has a vertical extent of 1 kilometer and has been traced for greater than 7 kilometers alongside strike.

So far, round 127 diamond holes have been drilled at Sams Creek and the blue-sky venture already comprises a powerful useful resource estimate, with a lot of the asset remaining unexplored.

Undertaking Highlights:

- Prolific Useful resource Estimate: The asset’s newly up to date JORC (2012) mineral useful resource estimate (MRE) describes 8.9 million tonnes at 2.82 g/t gold for 808 koz of contained gold. Nevertheless, there’s nonetheless super potential for growth as work continues.

- The principle mineralization at Sams Creek is open at depth and can be additional drill-tested because the deposit is open in all instructions and has important potential for elevated gold assets from further exploration drilling.

- Siren has an entry settlement with the Division of Conservation that permits as much as 100 drill websites inside EP40338.

- Extra drilling will even be targeted on infilling any new mineralized zones found, so an up to date MRE could be accomplished, feasibility research could be commenced, and a mining allow utility could be superior in 2024

Alexander River Gold Undertaking

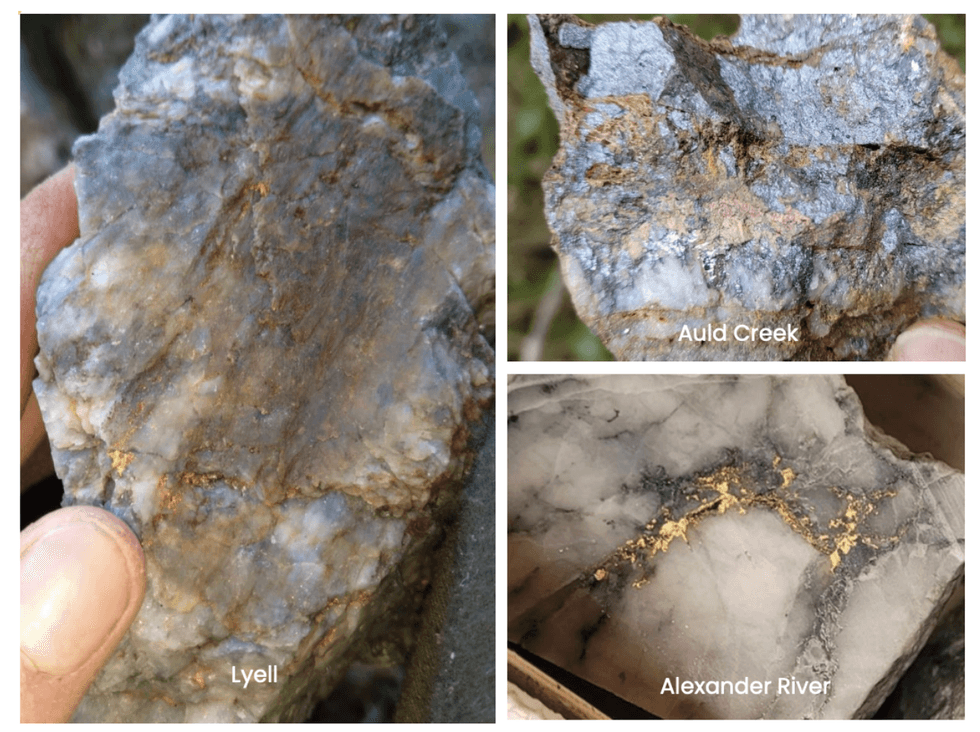

The Alexander River venture covers 16.75 sq. kilometers and is 100% owned by Siren Gold. The asset is positioned 15 kilometers away from the prolific Blackwater Mine, an important signal of what’s doable at Alexander River.

Undertaking Highlights:

- Encouraging Useful resource Estimate: The venture’s inferred mineral useful resource estimate is at present 1.07 million tonnes at 5 g/t gold for 170 koz at a 1.5 g/t cut-off. Encouragingly, this can be a substantial enhance of 30 % and a grade enhance of twenty-two % from earlier estimates.

- Previous-producing Undertaking: Operations on the venture closed in 1942; earlier than shuttering, that they had historic manufacturing of 41 koz at 24.6 g/t gold at a cut-off grade of 15 g/t gold. Now, Siren is utilizing trendy methods to discover and develop the venture additional.

- Exploration Targets: At present, the corporate focuses on a 1.2-kilometer-long outcropping quartz reef with mineralization outlined by floor trenching over 800 meters lengthy and 4 meters broad at 8g/t gold. The width of the outcropping is well-suited for environment friendly mechanized mining.

Huge River Gold Undertaking

The Huge River venture covers 44.87 sq. kilometers and is taken into account a extremely potential exploration goal of 100 to 125 koz at 7 to 9 g/t gold. The corporate will proceed exploring to find out the asset’s depth and gold grade.

Undertaking Highlights:

- 4-kilometer Anomalous Strike Size: The Huge River venture comprises a major 4-kilometer strike size. Sampling alongside this strike hosts huge stibnite veins with high-grade gold deposits, with outcomes as much as 82 g/t gold.

- Encouraging Drill Outcomes: Accomplished drill campaigns have produced high-grade near-surface assays, with the perfect drill holes together with:

- 6.6 meters at 21.4 g/t gold

- 3 meters at 18.5 g/t gold

- 6 meters at 5.1 g/t gold

- 5.2 meters at 6.3 g/t gold

- Maiden Mineral Useful resource Estimate: Siren lately introduced the asset’s Maiden JORC (2012) mineral useful resource estimate with a complete indicated and inferred estimate of 11 million tonnes at 3.11 g/t with a cut-off of 1.5 g/t.

Auld Creek

The Auld Creek venture comprises an epizonal mineralization that extends over 2 kilometers and comprises high-grade gold and big stibnite veins. Close by mines have produced over 400 koz of high-grade gold, which signifies what’s doable on the firm’s asset.

5 diamond holes have been accomplished at Auld Creek with all 5 holes intersecting important mineralisation within the Bonanza East Shoot.

The corporate supplied a maiden mineral useful resource estimate (MRE) for the Auld Creek Prospect which incorporates 132 koz @ 7.1 g/t gold equal (AuEq) containing @ 3.5 g/t gold and eight,700 tons of antimony @ 1.5 % antimony. The MRE consists of the next important intersections;

- 35 meters @ 4.1 g/t gold, 2.9 % antimony or 35 meters @ 11 g/t AuEq

- 6 meters @ 4.1 g/t gold, 4.1 % antimony or 6 meters @ 13.8 g/t AuEq

- 34 meters @ 1.6 g/t gold, 0.7 % antimony or 34 meters @ 3.3 g/t AuEq

- 20.7 meters @ 5.9 g/t gold, 2.6 % antimony or 20.7 meters @ 12 g/t AuEq

With a world MRE of above 1.3 Moz, Siren is on observe to realize its imaginative and prescient of being a multiple-million-ounce, high-grade gold and antimony producer.

Extra Initiatives

Siren owns further gold belongings which might be being systematically explored to extend shareholder worth additional.

-

Undertaking Highlights:

- Lyell Goldfield: The 100-percent owned venture spans 54.25 sq. kilometers north of the Alpine United Mine. The venture has historic manufacturing of 91 koz at 1.84 g/t gold with a cut-off grade of 15 g/t gold. Early trenching signifies grades as much as 13.8 g/t gold.

- Cumberland: The corporate’s Cumberland tenement bundle is within the heart of a 35-kilometer-long construction hall that hosts a few of the most important tasks within the Reefton Goldfield. The venture has historic manufacturing of 45 koz at 14.2 g/t.

- Reefton South: The Reefton South asset covers 333 sq. kilometers and is taken into account a 20-kilometer extension of the Reefton Goldfield. The underground nature of doable deposits hid them from previous explorers however created important potential for making use of trendy applied sciences.

Administration Staff

Brian Rodan – Chairman

Brian Rodan is a fellow of the Australian Institute of Mining and Metallurgy with 45 years of expertise. He’s the managing director and proprietor of Australian Contract Mining, a mid-tier contracting firm that efficiently accomplished $1.5 billion price of labor over 20 years. ACM was offered to an ASX-listed gold mining firm in 2017. Rodan is the founding director of Dacian Gold, which bought the Mt Morgans Gold Mine from the Administrator of Vary River Gold. After itemizing on the ASX in 2012, Rodan turned Dacian’s largest shareholder. He had a 15-year tenure with Australia’s largest full-service ASX-listed contract mining firm with an annual turnover of greater than $850 million.

Paul Angus – Government Technical Director

Paul Angus is a New Zealand-based exploration geologist with greater than 30 years of mining and geology expertise in New Zealand. He graduated from Otago College and has held senior administration roles with OceanaGold. Whereas he was an exploration supervisor, Angus found greater than 3 Moz at Macraes, Reefton and Sams Creek.

Keith Murray – Non-executive Director

Keith Murray is a chartered accountant with 40 years of expertise on the normal supervisor degree in audit, accounting, tax, finance, treasury and company governance. Throughout the Nineties, Murray was group accounting supervisor, company and taxation joint firm secretary for Eltin Restricted, a number one Australian-based worldwide mining providers firm. Murray is at present normal supervisor company and firm secretary for the Heytesbury Group.

Victor Rajasooriar – Non-executive Director

Victor Rajasooriar is a extremely skilled Australian mining govt and board director who has greater than 25 years of operational and technical expertise throughout each underground and open pit mining operations. Rajasooriar’s distinguished profession has seen him maintain senior roles with main useful resource firms, together with managing director and CEO of Echo Assets (ASX:EAR) till the completion of a takeover by Northern Star Assets (ASX:NST). Previous to becoming a member of Echo, Rajasooriar held the function of chief working officer for main underground mining contractor Barminco and has held senior technical roles with Gold Fields and Newmont Mining. At Newmont, this included operational accountability for the Waihi Gold Operation within the North Island of New Zealand between 2006 – 2008. He holds a bachelor of engineering (mining) from the WA Faculty of Mines and is a member of each the Australian Institute of Firm Administrators and the Australasian Institute of Mining and Metallurgy.

Sebastian Andre – Firm Secretary

Sebastian Andre is a chartered secretary with over 10 years of expertise in company advisory, governance and threat providers. He has beforehand acted as an adviser on the ASX and has an intensive understanding of the ASX Itemizing Guidelines, specializing in offering recommendation to firms and their boards for capital raisings, IPOs, backdoor listings, company compliance and governance issues. Andre holds accounting, finance, and company governance {qualifications} and is a member of the Governance Institute of Australia.