bjdlzx

Benefit Vitality (OTCPK:AAVVF) not too long ago acquired about 33,643 acres of land often called the Conroy acquisition. This allows extra liquids publicity ought to administration want that publicity. Administration mentions that this set of leases has no extra upkeep necessities till 2029. This offers administration time to determine methods to develop this acreage because the export LNG enterprise develops in Canada. Within the meantime, the Entropy subsidiary is progressing alongside. Though Entropy has quite a lot of speculative future hopes. The primary enterprise although is plagued with low pure gasoline costs. That makes the transformation to extra liquids manufacturing all of the extra essential to the close to future.

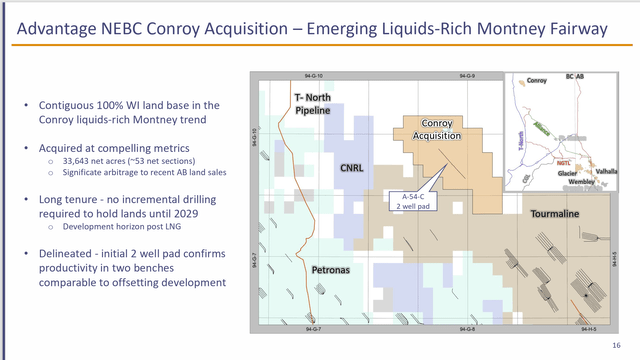

Conroy Acquisition

Administration spent about C$10 million for about 53 sections that complete a good quantity of acreage as famous earlier than. Acreage in Canada in even good areas is filth low-cost when in comparison with the US.

Benefit Vitality Conroy Liquids -Wealthy Acquisition (Benefit Vitality Fourth Quarter 2023, Earnings Convention Name Slides)

This acreage is situated close to the remainder of the corporate acreage in Canada. The corporate has lengthy been slowly constructing liquids manufacturing into the manufacturing combine so as to add worth whereas holding prices to the low dry gasoline stage the place attainable. On this approach, administration hopes to increase the manufacturing margin over time.

This administration additionally intends to develop manufacturing about 10% a yr. Nonetheless, pure gasoline costs are so low proper now that persevering with weak spot might revise that aim for the present fiscal yr.

This administration, like many, is properly conscious of the development of quite a lot of LNG exporting skill that may come on-line over the following roughly two years or so. However because the saying goes, “you must get there” and get there with out breaking the corporate within the course of. To that extent, liquids manufacturing has an outsized worth to the corporate proper now.

Entropy

This subsidiary acquired extra funding from Canada’s Development Fund along with earlier funding from Brookfield. Particulars are within the annual Administration Dialogue and Evaluation beforehand referenced.

Entropy doesn’t have materials outcomes on the corporate reported outcomes on the present time. Simply getting this subsidiary to an preliminary public providing is a serious endeavor that’s in all probability years away, with a good quantity to perform earlier than then. Many good concepts don’t make it that far. But when this subsidiary does, then the corporate would at that time sooner or later possible make a revenue on the general public providing.

In all probability the largest threat is that lots of people have the identical concept. So, by the point this firm goes public, there may be more likely to be quite a lot of competitors and even an overcrowded market. Let’s have a look at what occurs. However the odds towards anyone concept succeeding first to an IPO after which additional alongside are usually not good.

The Enterprise

The enterprise itself had a great yr. Not too long ago, administration started inventory repurchases. The possibilities of a dividend listed here are small and smaller. Due to this fact, earnings buyers can look elsewhere.

(Notice: Benefit Vitality Is A Canadian Firm That Studies In Canadian {Dollars} Until In any other case Famous.)

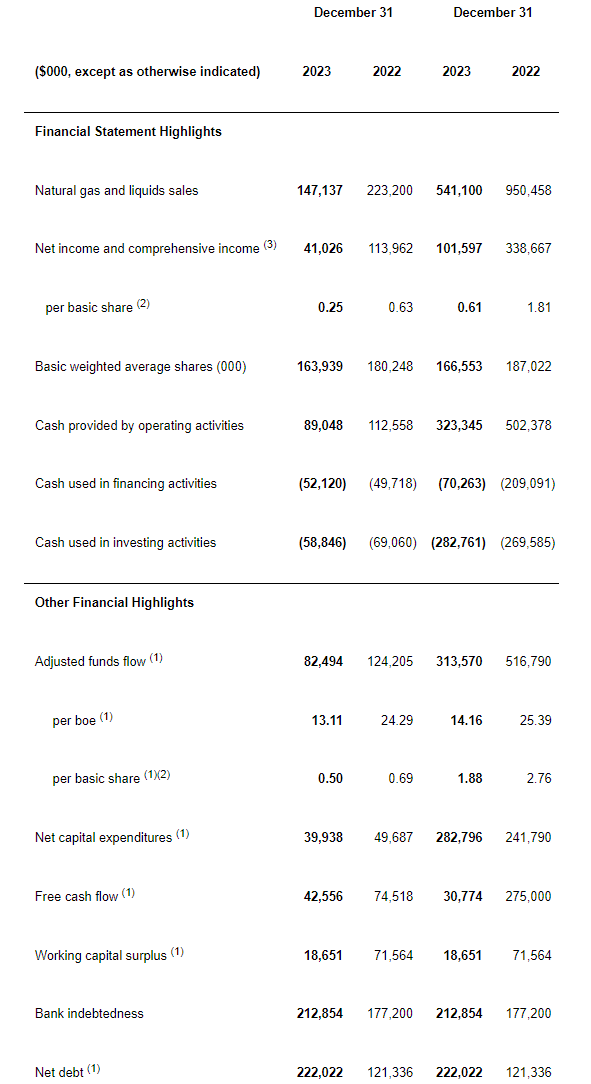

Benefit Vitality Abstract Of 2023 Monetary Outcomes (Benefit Vitality Fourth Quarter 2023, Earnings Press Launch)

Clearly, the yr was inferior to fiscal yr 2022. However we’ve all seen worse when pure gasoline costs get the place they’re now. Administration talked about through the convention name that liquids are actually 40% (roughly) of gross sales. When pure gasoline costs sag as a lot as they’ve recently, the extra liquids produced, the higher.

Whereas the online debt is larger than it has been prior to now, it’s nonetheless pretty conservative when in comparison with the annual funds circulate proven above. Both funds circulate determine can be utilized. The important thing concept is that with depressed pure gasoline costs this firm nonetheless has a conservative debt ratio. That’s simply what the debt market needs to see.

It Is All About Liquids

This administration is clearly going the additional mile on the subject of liquids manufacturing.

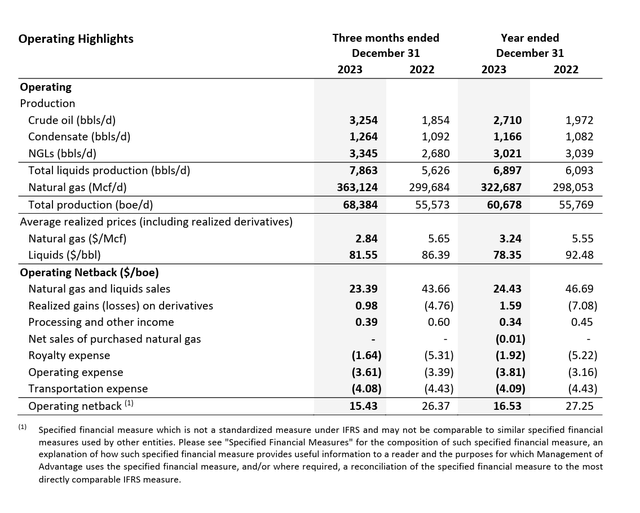

Benefit Vitality Realized Pricing And Manufacturing Abstract (Benefit Vitality Administration Dialogue And Evaluation Fourth Quarter 2023)

Discover that the typical liquids manufacturing is sort of worthwhile when in comparison with many different pure gasoline producers. This administration has clearly made the selection to develop the extra worthwhile liquids acreage in its possession. That makes the acquisition proven earlier than much more fascinating in mild of the gross sales progress proven above of excessive valued liquids.

Administration is getting that additional worth with out the bills materially altering. The growing proportion of liquids manufacturing considerably offsets the decline in oil and associated commodity costs all through fiscal yr 2023.

There are quite a lot of rivals which can be shutting in dry gasoline manufacturing. The presence of liquids within the gross sales combine helps to keep away from that consequence of unfavourable money circulate.

Now administration does have dry gasoline manufacturing. However that dry gasoline manufacturing is a number of the lowest value manufacturing in North America. Due to this fact, quite a lot of rivals may have unfavourable money circulate from their manufacturing earlier than this firm does.

Via the acquisition and the growth into liquids wealthy intervals on leases already owned, administration is giving itself the selection of growing acreage for extra liquids wealthy manufacturing when pure gasoline costs sag, as they’ve within the present fiscal yr. This administration can “milk” the dry gasoline manufacturing for money circulate whereas growing the extra worthwhile wealthy gasoline acreage as market situations point out.

There may be significantly extra flexibility right here than there may be with strictly dry gasoline producers.

Abstract

The conservative enterprise into liquids manufacturing is now proving to be a revenue enhance throughout a time of very weak pure gasoline costs. Administration has managed to pay attention the pure gasoline manufacturing on the extra worthwhile liquids manufacturing that features mild oil, condensate and even pentanes.

That reveals some element orientation on the a part of administration. There may be additionally the facet of trying to maintain the dry gasoline manufacturing prices the place attainable in order that as a lot of the advantages of the extra worthwhile liquids manufacturing heads to the underside line.

That makes earnings progress from margin growth as essential because the administration guided manufacturing progress. It additionally signifies that earnings are more likely to develop in extra of manufacturing progress for a while into the longer term.

Now, in fact there may be threat of commodity costs being extraordinarily unstable and never cooperating. However general, the enterprise into liquids manufacturing seems to be very profitable.

Notice that it is a small firm. Regardless that it’s thought of a robust purchase, there may be the danger of a lack of a cloth senior government setting again the corporate. Nonetheless, that is one very well-run small firm that ought to deal with shareholders properly over time as a capital beneficial properties car. The compounded charge of return ought to common within the teenagers, even accounting for the volatility of the commodities within the trade.

It also needs to be famous that that is one very low visibility trade. Business situations can change in a short time. Due to this fact, this firm might be greatest suited as a consideration as a part of a basket of shares. Diversification on the subject of small shares is crucial, as small shares generally tend to “flip left” whenever you least count on it. However the general basket, if chosen properly ought to nonetheless outperform.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.