Sundry Images

Over a yr in the past, I printed “U.S. Bancorp: Internet Curiosity Margin Compression Might Shortly Erase Income This 12 months.” At the moment, I had a bearish view on U.S. Bancorp (NYSE:USB) below the view that its reasonably excessive leverage mixed with rising deposit charges would trigger its NIM to compress, inflicting the corporate to lose most of its internet earnings. At the moment, most, however not all, analysts had been bullish on USB as a result of its dividend seemed sturdy, doubtlessly overlooking the unfavourable outlook creating in its earnings.

Since then, USB has seen its EPS collapse as anticipated. Its quarterly EPS was $0.49 in This autumn, exhibiting a comparatively vital drop in its earnings, giving it an identical internet earnings to its 2020 lows. The inventory has misplaced roughly 7.5% of its worth since then, regardless of a big rally over current months. From the date the article was printed to its October trough, USB had misplaced round 32% of its worth. That mentioned, it recovered most of these losses over This autumn as just about all shares skilled a “Santa Claus” rally.

As we speak, U.S. Bancorp is in a precarious place once more. It’s almost again to its pre-correction value and exhibits technical resistance across the $45 stage. Additional, the economic system is now exhibiting extra fascinating indicators concerning the potential for elevated financial institution liquidity points later this yr related to developments within the financial market. Moreover, some elements of U.S. Bancorp’s enterprise have modified. Mixed with its leverage and renewed focus, I imagine USB requires one other deep-dive look to think about the way it could fare in the remainder of 2024 and whether or not it might present buyers with optimistic worth.

The Battle For Deposits Is Sluggish However Rising

One of many core points in banks at present is the overall lack of deposit progress throughout the economic system. U.S. Bancorp is a big financial institution, however it’s not essentially so massive that it doesn’t want to fret about shedding depositors. Many smaller banks are shedding deposits at present and may solely cease the bleeding by elevating financial savings account charges by almost 5%, which causes most to lose internet curiosity earnings until they shift towards even much less safe belongings.

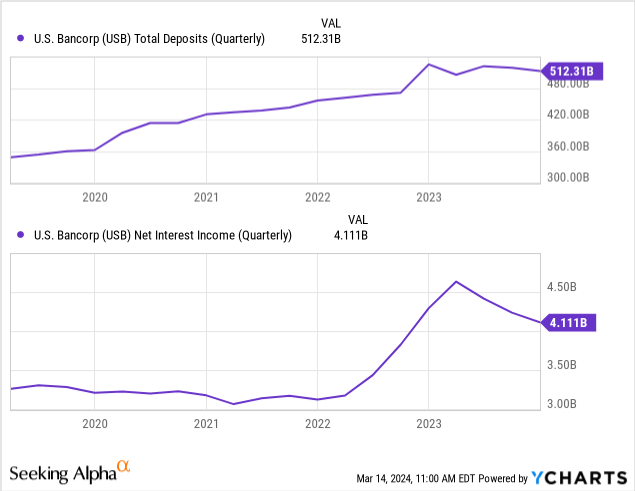

After I lined USB final, I believed the corporate would look to take care of deposits by elevating financial savings account charges, inflicting its NIM to say no. Nonetheless, that didn’t completely happen, because the financial institution was initially capable of maintain deposits with out shedding internet curiosity earnings. Since 2023, its deposits have barely declined, whereas its internet curiosity earnings is now beginning to slip at a sooner tempo. See beneath:

U.S. Bancorp continues to keep away from paying a lot for deposits. Personally, I’m stunned to see how little deposit losses most massive banks have confronted regardless of not paying any curiosity on financial savings. Individuals with financial savings can simply get 5%+ FDIC-insured financial savings by means of smaller banks or the cash market at zero technical threat. Regardless of that, most individuals (who aren’t rich or companies) with vital financial savings proceed to stick with near-zero charge banks, primarily giving them a considerable ROI on their money. This phenomenon is notable as it’s the main cause why many bigger banks have extra steady internet earnings at present in comparison with the regional banks, most of that are vulnerable to failing resulting from their collapsing NIMs and excessive leverage.

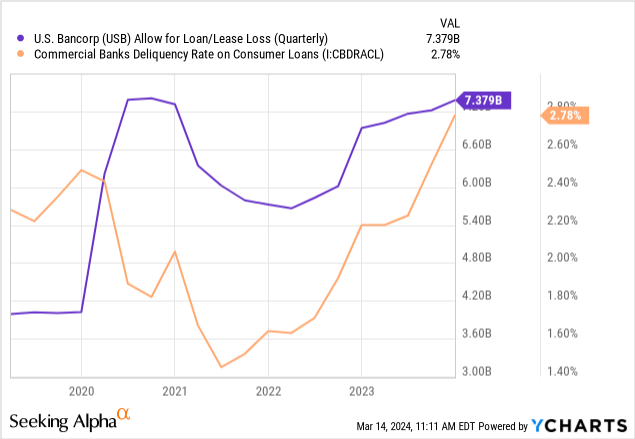

Regardless of my view that U.S. Bancorp would see vital NIM declines, it has usually maintained a 3% stage over the previous yr. It has probably achieved this by shifting some belongings into barely increased credit score loss threat belongings. Like many banks, U.S. Bancorp’s allowance for credit score losses has elevated markedly, rebounding to the 2021 peak stage (a lot of which was not misplaced), coinciding with the numerous enhance in shopper mortgage delinquency charges throughout the US. See beneath:

U.S. Bancorp’s mortgage portfolio is unfold out between every vital section. On the finish of This autumn, over a 3rd was in industrial loans, 14% in industrial actual property (a very troublesome section at present), 31% was in residential mortgages (that are low threat however have misplaced super honest worth), and the remaining break up between bank cards and different retail. This provides USB satisfactory publicity to the dangers within the US financial system and economic system, significantly its excessive CRE mortgage publicity as a result of monumental losses within the sector. In This autumn 22, 0.61% of USB’s CRE loans had been nonperforming, rising to 1.45% in This autumn 23 and certain rising increased as CRE costs dipped once more over This autumn resulting from increased mortgage charges.

Observe U.S. Bancorp’s Excessive Unrealized Losses

U.S. Bancorp can be extra leveraged than many could imagine if we take into account its belongings’ honest worth. It is a large subject that triggered the failure of many regional banks over the previous yr. Whereas many buyers nonetheless imagine that unrealized losses don’t matter, that’s solely true within the occasion of very steady liquidity. In actuality, liquidity isn’t steady, significantly for extra leveraged banks in a Fed-driven financial system. So, buyers should account for the danger that held-to-maturity belongings can be moved to available-for-sale, creating vital loss realization.

On the finish of final quarter, USB had funding securities at an amortized value of $84B, with a good worth of $74B and weighted common maturity of 8.7 years. Thus, promoting these belongings earlier than 8.7 years could trigger as much as $10B in loss realization. As generally, most of these securities are company MBS, providing <3% mortgages round 2020, which at the moment are value little since inflation is increased than that.

Buyers often rely for securities, however not all the time fixed-rate loans, which carry comparable or extra vital unrealized losses. Nonetheless, these will not be thought-about a “honest worth” measure since they are not liquid belongings. From its annual report mortgage portfolio breakdown, USB carries ~$107B in residential mortgage loans over fifteen years to maturity. We will additionally see that ~55% of its whole mortgage loans (~$115B) are fixed-rate, giving me a $59B “excessive period threat” residential mortgage mortgage publicity estimate. Its every day common steadiness sheet notes these residential mortgage loans (mounted and variable) carry a median yield of three.71%.

For the reason that floating charge ones will all be properly over 3% at present, that means the fixed-rate ones are probably close to or below 3% the place they’re vulnerable to very excessive period threat losses. Of the estimated $59B in mortgage lengthy maturity, low charge, residential mortgage mortgage belongings, I estimate their honest worth is probably going nearer to $47B on the finish of Q3, given their period threat losses must be increased than that of the MBS securities resulting from their longer maturity size (over fifteen years). This provides an estimated -$12B honest worth adjustment to USB’s fairness worth, on prime of the -$10B from its securities place.

Crucially, most analysts is not going to account for honest worth losses on illiquid loans, believing that they are going to get better their worth after being held to maturity. These unrealized losses are additionally considerably troublesome to calculate as a result of we lack all the required knowledge. Nonetheless, provided that these loans is not going to mature for fifteen years or extra (probably near thirty), the unrealized losses must be thought-about a significant add-on threat to USB’s liquidity.

In different phrases, unrealized loans and securities losses are the non-issue until liquidity turns into wanted. If U.S. Bancorp wants liquidity resulting from declining deposits and must promote its securities or residential mortgage loans, it’ll mark large losses. Once more, that’s primarily what occurred in many of the 2023 financial institution failures, so buyers mustn’t write it off. Additional, unrealized losses will not be accounted for in fairness ratios like CET1. Therefore, many failed banks had “sturdy” CET1 ratios earlier than failure, just because buyers and regulators neglected this materials issue.

U.S. Bancorp had a tangible ebook worth of ~$30B on the finish of This autumn. Subtracting unrealized securities losses, that drop to $20B. Eradicating unrealized residential mortgage worth losses (an estimated determine), its NAV estimate falls to ~$8B. Technically, I might undergo its different loans and belongings and low cost the worth of different fixed-rate loans. Realistically, I don’t suppose its unrealized losses can be too notable in its completely different segments as a result of most of its long-term maturity belongings are residential loans. Nonetheless, the opposite segments, significantly its $135B in CRE loans, have such a pointy rise in threat and nonperformance that I might simply foresee a situation the place USB would have unfavourable tangible fairness at honest worth.

Additional, its market cap is $68B, vastly above my NAV estimate and its tangible ebook worth, indicating buyers largely overlook its steadiness sheet dangers. In fact, regardless of the comparatively vital steadiness sheet threat, USB has maintained its internet curiosity earnings as a result of depositors haven’t reacted negatively to its meager financial savings account charges. That’s one key space the place my earlier evaluation was not but appropriate, justifying its lack of tangible internet fairness worth with excessive internet earnings. Nonetheless, because the financial surroundings shifts, I imagine U.S. Bancorp will unlikely keep this profit.

Massive Banks “Free Cash Period” Is Ending

Previous to 2022, the US (and Western) monetary system was in a really low-cost cash period that lasted from the 2008 recession and was exacerbated by the 2020 stimulus packages. Since 2022, the direct value of cash has risen considerably, as all of the 2020 stimulus packages resulted in a big inflation spike.

Smaller banks, with much less steady depositors, felt the upper cash prices in a short time as companies and really rich people know higher than to park cash in a 0% APR financial institution. There’s, to me, no good thing about a 0% APR financial institution over a 5% APR financial institution, contemplating each are FDIC insured. Nonetheless, massive banks like U.S. Bancorp have many retail prospects that keep it up regardless of its lack of financial savings funds. Thus, the inflation value for savers in USB is a substantial earnings driver for the financial institution, as prospects primarily give away a 5% risk-free return.

This development has been an enigma to many economists, who count on savers to be a bit wiser, however the lengthy period of <1% APR charges has probably triggered many retail savers to neglect they need to usually be paid for financial savings. Thus, I nonetheless imagine it’s unlikely that USB will proceed to maintain depositors with out seeing its borrowing prices rise. Certainly, that might not be brought on by sensible decisions for retail purchasers however as an alternative by a Fed-driven liquidity decline.

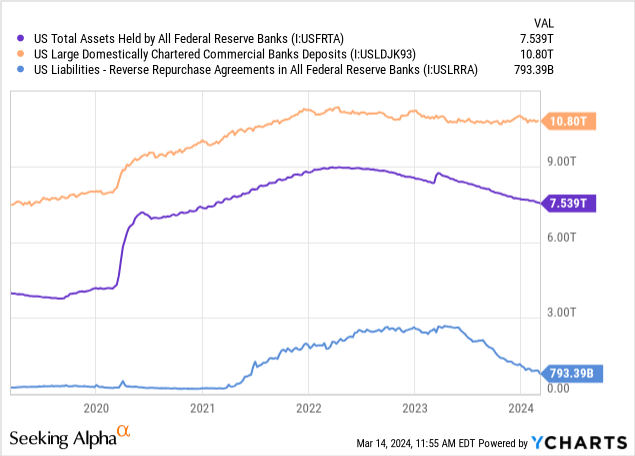

A good portion of “money” in massive banks at present was created throughout the stimulus program of 2020. As we speak, the Federal Reserve is slowly “deleting” that cash by permitting its belongings to mature, slowly pulling liquidity out of the economic system. Round 2021, as QE continued, many massive banks ultimately had an excessive amount of liquidity that they may not lend, inflicting them to lend again to the Federal Reserve by way of reverse repurchase agreements, that are a “legal responsibility” to the Fed and cash-like belongings for banks. This has been a direct supply of liquidity for giant banks, offsetting unfavourable broader financial liquidity developments.

In my opinion, because the Fed’s reverse repurchases “extra financial institution liquidity” determine falls towards zero, massive banks will see their deposits decline as they’ll not draw on extra liquidity. Essentially, all banks are related to the liquidity community, so a decline in broad extra liquidity will negatively impression the development of all massive banks. See these figures beneath:

The reverse repurchase settlement determine will attain zero across the mid-to-late summer time of this yr. Thus, I anticipate a decline in massive financial institution liquidity by then, leading to increased borrowing prices and/or decrease deposits for giant banks. Within the case of U.S. Bancorp, I count on it could want to maneuver extra belongings to be obtainable on the market, inflicting the belief of its vital reported and estimated unrealized losses. In that case, we might see its fairness ratio plummeting to a precarious stage. Add on the potential for increased CRE mortgage losses, and I don’t see how USB’s threat profile is any higher than that of regional banks at present.

The Backside Line

Total, I stay very bearish on U.S. Bancorp. I imagine it trades at a really extreme premium to its tangible fairness worth, primarily if its unrealized losses are accounted for. Moreover, each its tangible fairness worth and the “honest worth adjusted” determine are very low in comparison with its whole loans and belongings, making its fairness insecure within the occasion of a recession or a continued enhance in CRE mortgage losses.

That mentioned, I’d not short-sell USB at present. For one, my views concerning liquidity within the banking system stay speculative. U.S. Bancorp could proceed to earn a excessive earnings if it may possibly keep free (or very low-cost) deposits. Once more, that’s an space the place my outlook for giant banks has been incorrect. Massive banks could ultimately face the identical points as small banks, however that is dependent upon financial institution financial savings prospects being wiser about searching for higher financial savings yields. So far, many American savers seem tired of shifting cash for increased financial savings charges.

Lastly, I’d not short-sell USB as a result of it could obtain both direct or oblique stimulus within the occasion of a big monetary subject. Although I count on it’ll face vital monetary issues, I additionally know the US authorities, Fed, and different banks will tie themselves collectively to take care of basic stability. That might create super upside volatility, erasing potential positive aspects from betting in opposition to USB. Nonetheless, among the many massive banks, I imagine U.S. Bancorp is among the riskiest, so it could be greatest to observe over the approaching months because the reverse repurchase “extra liquidity” determine declines.