dem10/iStock through Getty Pictures

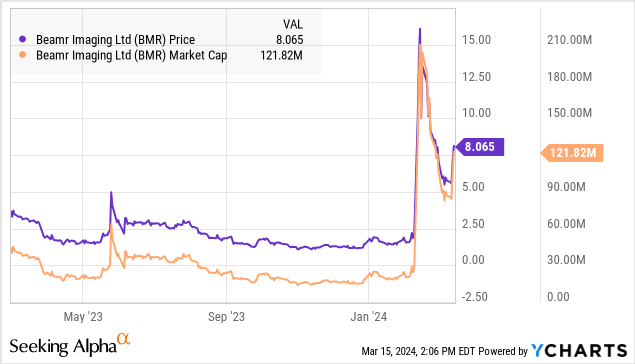

Beamr Imaging Ltd. (NASDAQ:BMR) has flashed throughout our radar with a spectacular 450% rally year-to-date. The Israel-based software program firm gives options that optimize video encoding and picture compression, decreasing digital file storage dimension whereas sustaining high-resolution high quality. Integration of synthetic intelligence (AI) instruments and collaboration with NVIDIA Company (NVDA) helps clarify the optimism in direction of the inventory.

That mentioned, the truth is that Beamr with a market cap sitting round $120 million is on the border of “penny inventory” territory in our guide. We’ll maintain BMR within the class of speculative and excessive threat however really feel it is price keeping track of with 2024 shaping as much as be a transformative 12 months within the firm’s development technique.

BMR Earnings Recap

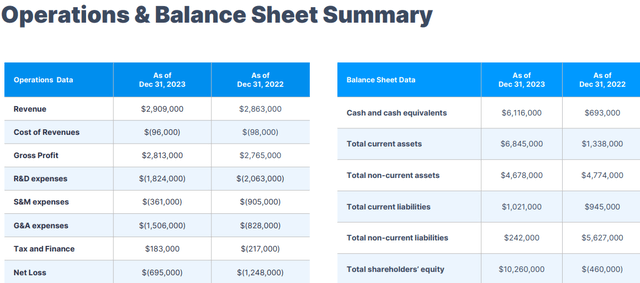

Beamer reported its This fall outcomes with full-year income of $2.9 million, up 2% from 2022. This included the increase from new contracts balancing different transactions that have been terminated. Following the corporate’s IPO final 12 months, efforts to rationalize prices together with a drop in gross sales and advertising and marketing saved complete bills underneath management. Accounting adjustment narrowed the web loss to -$700k narrowed in comparison with -$1.25 million in 2022.

The corporate ended the 12 months with $6.1 million in money and money equivalents, whereas a latest secondary providing into 2024 added one other $13.8 million in gross proceeds. Favorably, the extent of long-term debt at $242k is low.

supply: firm IR

What Does BMR Do?

By way of financials, there’s not a lot to get enthusiastic about with the corporate drawing parallels to a tech startup. Nonetheless, the attraction right here is the propriety expertise and portfolio of patents which have positioned Beamr because the market chief on this area of interest of video compression.

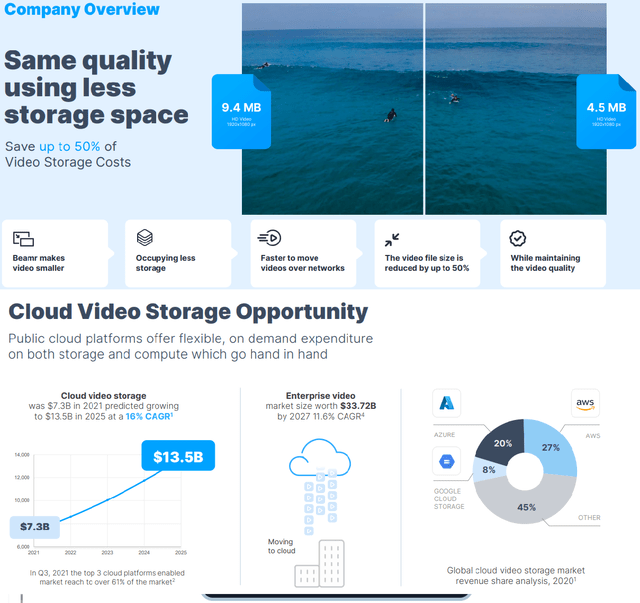

The thought right here captures explosive development in cloud video media with a value related to the required file storage. That is important for content material distributors, streaming platforms, and film studios which might be importing petabyte ranges of information.

Merely put, Beamr’s content-adaptive bitrate (CABR) system maximizes compression of video information whereas sustaining decision, format, and visible high quality. Prospects can save as much as 50% on video storage prices which might signify thousands and thousands of {dollars} as a part of the value-added proposition.

Notably, teams like Netflix, Inc. (NFLX), Paramount World (PARA), Vimeo, Inc. (VMEO), and Walmart Inc. (WMT) have been cited by Beamer as amongst over 50 present enterprise prospects.

supply: firm IR

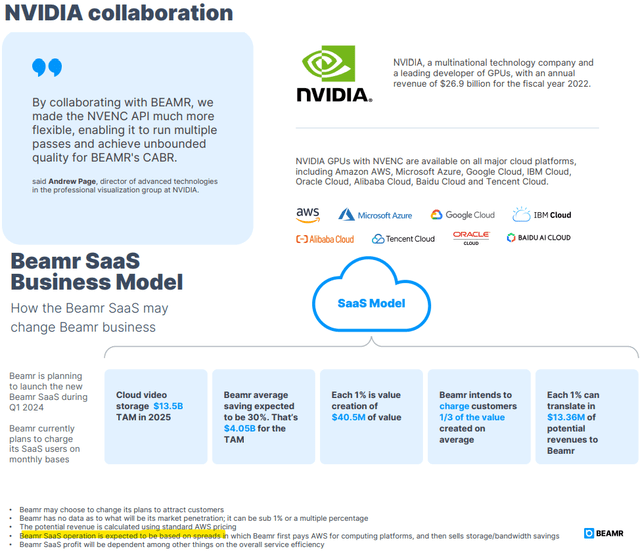

The most recent improvement into Q1 2024 is the launch of Beamr SaaS, which contains an API powered by Nvidia’s NVENC GPU-based accelerated {hardware} video encoding.

Customers are charged as a proportion of the worth in financial savings in comparison with normal Amazon.com (AMZN) cloud AWS storage pricing. In different phrases, Beamer is reselling the storage, by working the information via its optimization service and retaining a ramification as earnings.

From the cloud video storage market anticipated to succeed in $13.5 billion in 2025, the potential that Beamr captures simply 1% of that bandwidth may translate into $13.4 million in income as a baseline goal from this operation.

By way of the collaboration with Nvidia, there’s additionally an effort to advance the adoption of the rising video format (AV1). Beamer has an automatic course of to switch movies as an answer for corporations to maneuver ahead with AV1 which might signify a separate development driver going ahead.

Different enterprise alternatives embody an enlargement into segments like Web-of-Issues, user-generated content material, and generative AI the place video file compression has a wide range of purposes.

supply: firm IR

What’s Subsequent For BMR?

The understanding is that 2024 will probably be a important 12 months for the corporate to substantiate the business viability of its expertise and in the end ship sturdy development. The collaborations with massive tech gamers and a protracted checklist of main firms as present prospects present Beamr some speedy credibility.

The excellent news right here is that coming from simply $3 million in income for all of 2023, it will not take a lot to maneuver the needle with any new enterprise making an incremental impression. If Beamr’s CABR resolution is able to delivering the promised price financial savings to customers, there is a good case to be made that the service ought to promote itself.

Alternatively, we will not overlook what are critical questions concerning the precise addressable market and long-term monetary roadmap. There’s a threat that cloud service suppliers like Amazon’s AWS may shift pricing for video storage down the road, limiting the enchantment of the video compression expertise.

We’ll have to see extra to get an thought if it is doable for the corporate to succeed in a milestone of producing +$10 million in annual income earlier than starting to justify a $150 million valuation and the present 40x gross sales a number of on 2023 income.

Remaining Ideas

We charge BMR as a maintain, implying an in any other case impartial view of the inventory value from the present degree. With the latest momentum, we can’t be stunned if the inventory continues increased fueled by some layer of AI optimism, though assigning an intrinsic worth could be very troublesome.

As-is, BMR has an fascinating story however loads to show and we anticipate shares to stay extraordinarily risky reflecting its micro-cap standing and in any other case restricted earnings potential.

Over the following few quarters, we might prefer to see administration present monetary steerage with measures just like the gross margin and adjusted EBITDA market goal as key monitoring factors.