gguy44

Final week we wrote about how M&A exercise has been gentle to date for 2024, properly the identical holds for IPO exercise. Nonetheless, this week brings two extremely anticipated public debuts that might reignite hopes for an upswing in IPOs.

Astera Labs and Reddit Going Public

Astera Labs (ALAB), a semiconductor firm that builds connectivity options to assist with AI and Machine Studying workloads, is about to IPO on Wednesday, March 20.

The Intel-backed firm will make their public debut by providing 17.8M shares in a share worth vary of $27-30, placing their IPO elevate at as a lot as $534M, with a valuation of $5B.

This can mark the primary massive semiconductor debut since Arm Holdings (ARM) again in September. Talking of ARM, their IPO lockup interval ended on Tuesday, March 13 and was met with elevated buying and selling exercise, however finally share costs have remained flat since then.

Reddit (RDDT) will make its long-awaited public debut on Thursday, March 21. The debut providing will function 22M shares, in a worth vary of $31-34, making for a complete elevate quantity of $715M on the excessive finish, and a valuation of near $6.5B.

IPO Exercise Mild 12 months-to-Date

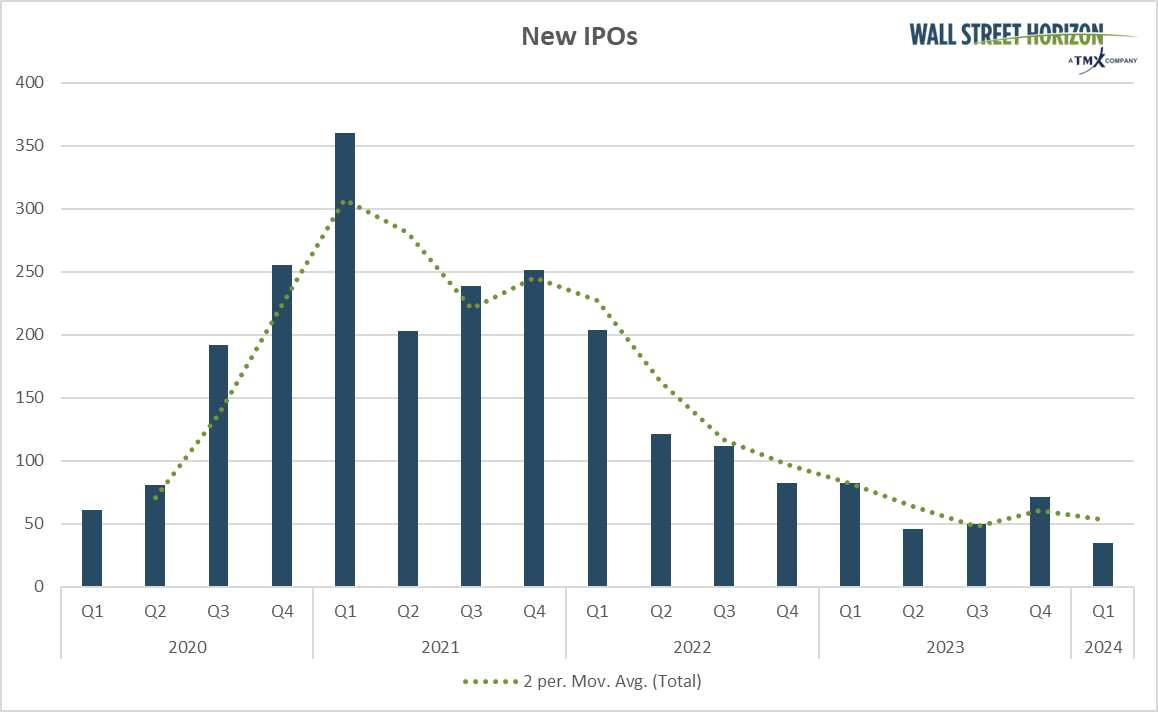

Regardless of these two high-profile debuts, YTD has in any other case been gentle for IPOs that are nonetheless going through headwinds from larger rates of interest making personal corporations hesitant to return to market.

In January and February, there have been solely 34 IPOs, vs. a 5-year common of 93. Thus far in March, solely NeOnc Applied sciences Holdings (NTHI) has filed for an IPO.

Supply: Wall Avenue Horizon

Supply: Wall Avenue Horizon

Trying Forward

How Astera Labs and Reddit carry out this week and within the weeks following their public entrance will probably impression how assured different personal corporations are in IPOing in 2024.

Final 12 months’s IPO glut was partly because of the worse-than-expected efficiency of many newly public corporations.1 Poor enterprise situations induced corporations corresponding to Reddit to delay their plans to go public.

With rates of interest anticipated to fall later this 12 months and the continued path to a smooth touchdown,2 this might be simply the recipe wanted for a resurgence in IPO exercise.

1 EY International IPO Traits 2023, December 13, 2023

2 Semiannual Financial Coverage Report to the Congress, Chair Jerome Powell, March 6, 2024

Editor’s Word: The abstract bullets for this text have been chosen by In search of Alpha editors.