Adam Smigielski

Every month I characteristic a number of dividend paying shares that I do not assume supply any margin of security based mostly on their enterprise and present inventory worth. This theme irritates some dividend yield chasers, so I encourage you to vent within the feedback.

When investing, your purpose should be to have a “margin of security” on each funding you make. Margin of security is the distinction between an organization’s present share worth and its intrinsic worth. Take into account this text sequence an early warning siren.

These shares may not plunge in worth tomorrow, however based mostly on my 3 to five yr outlooks for the businesses in comparison with their present share worth, I do not see a lot margin of security, however do see restricted upside and appreciable danger. I recommend upgrading in the event you personal these into higher positions. Promote these shares and purchase higher dividend shares with greater margins of security.

Client Staples Shares To Promote

This month I am taking a look at shopper staple shares which frequently profit from a flight to security proper earlier than a inventory market correction. All 3 of the shares I cowl immediately have had latest rallies that I feel you must use to promote your holdings you probably have any.

I don’t like most shopper staples shares long-term as a result of challenged enterprise fashions of most. The low margins and low development are exhausting to beat. For dividend-paying firms, the dearth of rising earnings is also a possible problem for future dividend funds.

By promoting the coated shares into latest energy, if we get the correction I consider is coming, then you possibly can pivot to raised shares quickly.

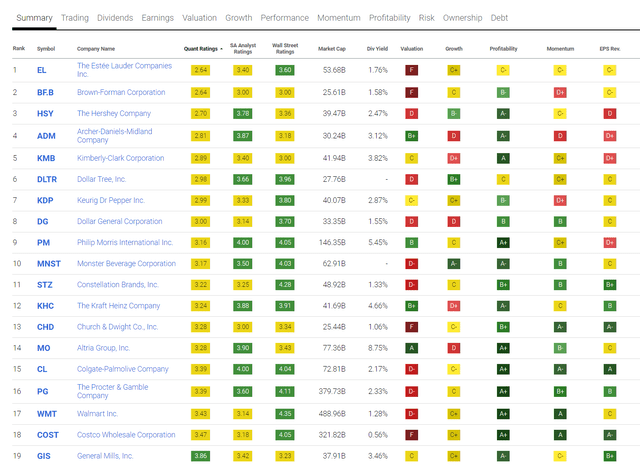

I used the Searching for Alpha Premium screener to seek out U.S. domiciled shopper staples firms with market caps over $25 billion that weren’t rated “sturdy purchase.” Here is what the checklist appears to be like like:

U.S. Client Staples $25b+ (Searching for Alpha Premium Screener)

I’ve numerous ranges of familiarity with the entire shares listed, and after reviewing most, I am updating my protection on the next with promote rankings.

Promote Altria Group (MO)

I final wrote about Altria in August 2017 and gave it a promote ranking: There’s Smoke Coming From This Dividend Champion And It is Time To Evacuate.

The value at publication was $65.15. Since then it is down 32% in share worth, however has eked out a 7% acquire based mostly on that tremendous attractive 8.9% dividend yield individuals like to speak about. For the file, the yield is just that top as a result of the share worth has fallen a lot.

From a complete return standpoint, Altria trailed the S&P 500 (SPX) significantly. Not precisely an amazing danger adjusted return.

I don’t see a lot purpose for Altria to show round. Their core smoking market continues to get snuffed out and administration’s development initiatives have been weak makes an attempt.

Altria sees its earnings at about $5 this yr. Their EPS ahead long-term development price (which you could find below the Development heading on the Searching for Alpha firm web page) is just forecast to be about 4%. That will imply EPS of perhaps a bit above $6 in 5 years.

If we take into account that PEG ratio ought to probably not exceed 2, then which means the P/E ought to solely be about 8 for Altria. That means intrinsic worth could possibly be as little as $48 adjusted for funds just a few {dollars} in both path.

Morningstar offers Altria a good worth of $52 on the one yr outlook. The StarMine from Refinitiv composite ranking of eight prime unbiased analyst corporations has Altria rated 5.1 or impartial. Worth Line offers a 3-5 yr appreciation vary of $60-90. I feel it might be a best case state of affairs to see $90/share within the subsequent 5 years and that $60 is much extra seemingly.

I feel a unfavorable shock is kind of potential for Altria given its challenged core enterprise and issue rising newer companies. To reenergize development, many firms have to chop their dividend. Dividend development has already fallen to about 5% the previous 5 years. The following step can be a minimize.

What would trigger a dividend minimize? Nicely, long-term debt has almost doubled since 2017 from about $13 billion to $25 billion. And the corporate has been paying it down slower than initially anticipated. What if financing charges in reality do keep greater for longer within the face of gradual development?

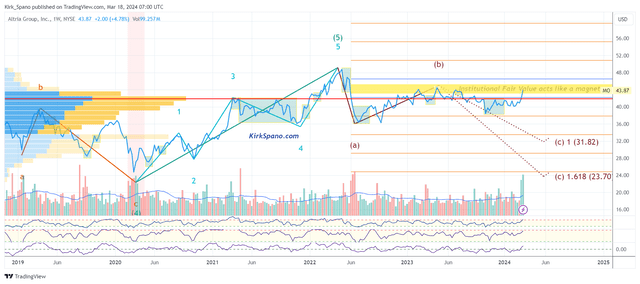

From a technical standpoint, the weekly measured RSI (vs. each day measured that merchants use) is sitting above 70 which is overbought on an prolonged timeframe. Which means a excessive danger for worth to fall quickly.

As well as, two measures of institutional honest worth that act like a magnets for worth have been happy, that means any extra appreciation can be tougher to earn. And an algo-driven Elliott Wave sample recognizer is also seeing a correction within the not too distant future.

MO Chart (Kirk Spano)

General, there’s vital basic and technical danger with Altria. As you possibly can see, I am not forecasting Armageddon for Altria. I am now not a brief on this identify and have not been since March 2020.

I feel Altria inventory is about pretty valued. Going ahead, I see restricted upside that will likely be troublesome to achieve, excessive enterprise execution danger and virtually no margin of security based mostly on the inventory worth. I feel you are able to do higher, so promote it earlier than it corrects and improve accordingly.

Promote Archer-Daniels-Midland (ADM)

I even have a fuller evaluation of ADM popping out quickly and would possibly in reality provoke a brief on it if the worth runs too excessive.

ADM is a heavyweight within the agricultural commodities area, specializing within the acquisition, processing, and distribution of varied crops. They’re the middlemen between farmers and consumers within the meals, feed and power sectors, dealing with all the things from transportation to storage to processing. They would appear indispensable and supply a moat. However that is not true.

ADM’s business is cutthroat, with a variety of related services and products from opponents. In keeping with CSI Market they compete with dozens of firms together with:

Competitors results in a scarcity of pricing energy, which is compounded by the large capital investments required to maintain their operations working easily. The top result’s razor-thin revenue margins.

ADM runs the corporate on credit score and has web margins of barely 4%.

As I seek for market-leading investments, I am in search of one thing that is usually “asset gentle.” ADM is “asset heavy” and has all of the capex and upkeep bills.

Corporations which are “asset heavy” must have an particularly distinctive barrier to competitors so as to have the ability to generate greater margins that generate profitability. Clearly no such “moat” exists with ADM.

Soybeans and corn are the spine of ADM’s operations. So, whereas ADM advantages from the surge in Chinese language soybean consumption and authorities mandates for ethanol use in gasoline, in addition they face headwinds like fluctuating demand for high-fructose corn syrup and stiff competitors in commodity markets. In addition they should cope with the whims of the Chinese language communist social gathering.

Briefly, ADM is a capex heavy firm, with a variety of competitors, no discernible aggressive benefit and slowing development which end in little pricing energy. Consequently, ADM has no sturdy aggressive benefits and no moat. Analysts who don’t perceive this fundamental evaluation needs to be ignored.

Homeowners of ADM ought to familiarize themselves with the latest earnings restatements and Justice Division investigation. I consider they underlie a basic weak point in reporting and really challenged development.

Finally, ADM’s dividend is at risk of not rising a lot in coming years and will face a minimize if financing turns into tight for them. With little upside, appreciable danger and the latest rebound rally in worth, I consider buyers ought to promote ADM shares.

Promote Procter & Gamble (PG)

I’ve watched P&G for my complete profession. It has chopped greater for a really very long time. It most likely is the perfect firm I am saying to promote on this article. P&G has good administration and a slender moat by most evaluation. You realize lots of their manufacturers:

- Gillette

- Febreze

- Tide

- Previous Spice

- Daybreak

- Vicks

…and extra.

Everybody is aware of P&P and the inventory has rallied. The latest rally although has left the corporate with just about no upside the following 5 years.

In keeping with Valueline, the potential share worth appreciation for P&G is $175 to $215 the following 5 years based mostly on forecasted earnings and the standard vary on their worth to earnings ratio. Just about each backside up evaluation I discovered is in that vary.

Final yr, Warren Buffett’s Berkshire Hathaway (BRK.B) offered their remaining holdings in Procter & Gamble. Buffett is known for his ideas on “margin of security.” He has defined that we need to purchase firms whose shares are buying and selling at a reduction to their worth. Within the case of P&G that is not the case.

I might add that shares offered by Berkshire Hathaway usually have a downward worth trajectory quickly after.

My argument right here is just not in opposition to the corporate, it is purely a danger vs. reward argument based mostly on worth and the danger that every one firms include. We’re merely not getting sufficient margin of security to personal P&G inventory.

The longer term is unknown, so I am uncomfortable with the expansion outlook and the potential for black swans. I would wish a less expensive worth to personal P&G, and as such, would possibly take into account it on a deep correction for the suitable accounts.

For the reason that dividend is barely above that of the S&P 500 and there’s no worth based mostly margin of security, why personal the inventory individually when you possibly can absolutely personal a small quantity by way of your numerous ETFs and mutual funds?

Promote P&G and discover one thing with a much bigger margin of security and better dividend.

Investing Fast Ideas

For individuals who like fewer phrases, here is a fast take:

- Altria is navigating a really troublesome and costly enterprise transition and has offered virtually no whole return the previous seven years I anticipate that pattern to proceed for a very long time. Promote MO and discover a higher firm to take single inventory danger on.

- ADM is a asset heavy, excessive capex, working on credit score firm. The latest rally is unjustified and the share worth needs to be close to the place it fell to on the information of their alleged transgressions. Promote the rebound rally on ADM.

- P&G is a wonderful firm that is just too costly to supply any margin of security. I might purchase it after a 30% correction from right here if the enterprise remained good and the dividend yield have been greater. For now, it is not value proudly owning for single inventory danger and restricted upside. Promote PG as a tactical matter.

This has been a window of my interested by investments normally and these firms particularly. I hope you discover it helpful.