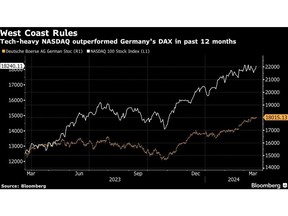

Germany’s economic system should still be within the doldrums, however buyers are beginning to change their tune.

Article content material

(Bloomberg) — Germany’s economic system should still be within the doldrums, however buyers are beginning to change their tune.

In accordance with Dan Dees, Goldman Sachs Group Inc.’s co-head of worldwide banking and markets, the situations for offers have began to enhance, German industrial firms are exploring choices to increase — albeit within the US — and the startup scene is about as vibrant as wherever else.

Commercial 2

Article content material

Article content material

“The temper amongst executives at German industrial firms is constructive, however positively extra sober in comparison with the optimism of friends within the US and particularly the West Coast,” Dees instructed Bloomberg Information in a current interview.

Dees, 53, simply returned from a go to to Goldman Sachs’s workplace in Frankfurt and its newly opened department in Munich, the place he stated a rising variety of tech startups — from synthetic intelligence to well being know-how and gaming — promise to spur deal stream and large investments in infrastructure.

“Each sovereign nation desires to construct and personal AI functionality, which can want chips, information facilities and associated infrastructure,” Dees stated.

Germany has been struggling to revive its economic system after the power disaster, softening international demand and long-simmering structural challenges like an outdated bureacracy and ageing workforce got here to the fore. The checklist of issues has raised questions concerning the nation’s potential to stay aggressive and appeal to funding.

Now, amid indicators that the European Central Financial institution could reduce rates of interest within the coming months, German investor confidence is again up, rising this month to the best in additional than two years. Decreasing borrowing prices could be a key catalyst for firms to scale up and increase tech spending on course of automation and AI — areas that Dees says German executives are eager to assist.

Article content material

Commercial 3

Article content material

With bettering sentiment and rates of interest, offers exercise is lastly beginning to choose up after a troublesome yr. World deal values are up 24% this yr to $651 billion, based on information compiled by Bloomberg. Offers involving firms from Europe, Center East and Africa are up 44%.

Dees cautioned, nonetheless, that it’s too early to inform whether or not deal making will proceed to enhance at this tempo. It “doesn’t take heroic assumptions to see that offers are choosing up after a 10-year low due to stabilizing rates of interest, financial stability and the mixture of dry powder and having property to promote on the aspect of the sponsor group.”

Analysts say Germany is within the midst of a recession after contracting within the remaining three months of final yr and, they predict, the primary quarter of 2024. The nation’s current poor financial efficiency — lagging all different G-7 industrial nations — has revived the moniker ‘Sick man of Europe,’ which was used to explain Germany’s anemic development across the flip of the century earlier than structural reforms have been pushed by.

Dees, although, rejected the label, saying the final sentiment amongst German executives, asset managers and startup founders “was higher than what I had anticipated.”

Commercial 4

Article content material

Throughout his journey to Europe, Dees additionally met tech business leaders in London this month and was inspired by the progress in a sector that’s dominated by US giants like Microsoft Corp. and Apple Inc.

“During the last decade now we have seen vital development within the European tech sector, with the variety of unicorns in Europe rising to a report 260,” he stated.

Dees expects various asset managers like infrastructure funds to contribute to the build-up of the associated know-how wanted for AI and different innovation on a big scale in coming years.

His feedback echoed these of Raj Agrawal, international head of infrastructure at KKR & Co., who stated in a Bloomberg Tv interview this week that investments in Europe’s know-how infrastructure poised to surge.

“Europe is likely one of the most superior when it comes to mobility, handsets, fiber connectivity — so the information utilization wants are there. We’re simply manner behind in europe,” Agrawal stated. “So there’s an incredible development story forward for Europe and information middle infrastructure.”

TSMC is presently constructing a chip manufacturing unit in Germany, and the federal authorities in Berlin can also be in superior talks to purchase the home enterprise of Dutch grid operator Tennet in a deal that might be valued at round €22 billion ($24 billion).

Moreover, Dees expects activist buyers to push for offers. “One out of six firms within the S&P 500 has an activist shareholder” and plenty of of those sometimes name for breaking apart conventional firm constructions to spice up efficiencies, he stated.

“We now have simply opened an workplace in Munich, which has a vibrant tech start-up scene that’s nearly as optimistic as their friends elsewhere,” he stated.

—With help from Anna Edwards.

Article content material