pepifoto

There’s the person, after which there’s the index. There’s the index, after which there’s the ETF. Lots of people are acquainted with media persona Joe Terranova. He is obtained an index and a fund that seeks to trace that index which is rules-based. The methodology is value looking at impartial of Mr. Terranova himself.

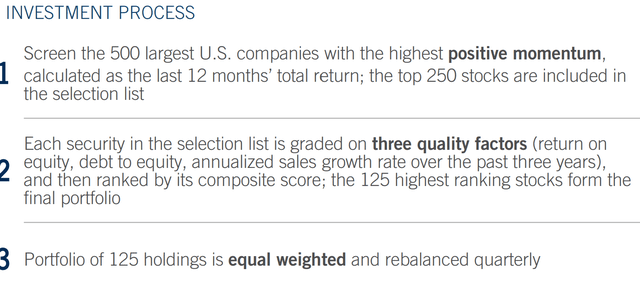

The Virtus Terranova U.S. High quality Momentum ETF (NYSEARCA:JOET) is primarily designed to supply publicity to U.S.-listed large-cap corporations that exhibit robust high quality fundamentals together with constructive momentum technical traits. The ETF seeks to imitate the efficiency of the Terranova U.S. High quality Momentum Index, earlier than charges and bills. This index focuses on the five hundred largest U.S. corporations and filters them primarily based on constructive technical momentum, subsequently rating them by measures of elementary high quality. Consequently, this leads to an equally weighted portfolio of 125 well-established U.S. securities.

The screening course of has stable elementary underpinnings, which I am a fan of as a result of it removes the chance of getting a portfolio with so-called “zombie corporations” which have excessive debt and which basically are ranked by Return on Fairness and progress. While you then mix the momentum technical filter, it enhances the attraction relative to passive market-cap weighted averages.

virtus.com

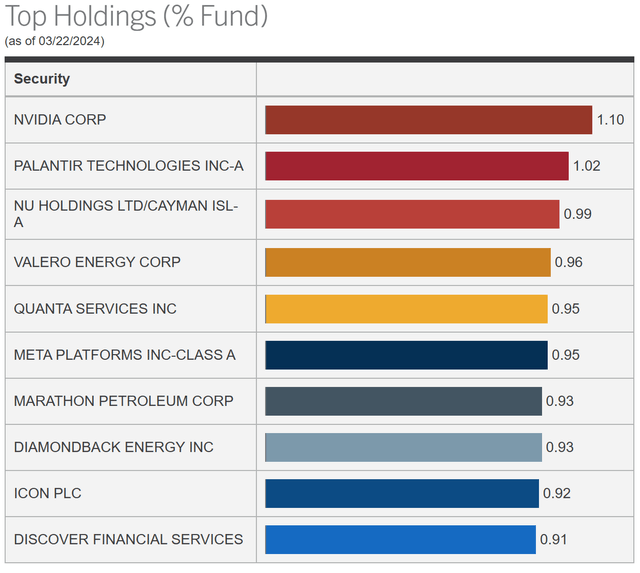

Unraveling the Key Holdings of JOET

A more in-depth examination of the ETF’s holdings gives a clearer image of the fund’s funding technique and the potential dangers and rewards related to it. The fund’s holdings embody the under. Be aware that as a result of that is equal weight, no single inventory is a giant driver of efficiency total.

virtus.com

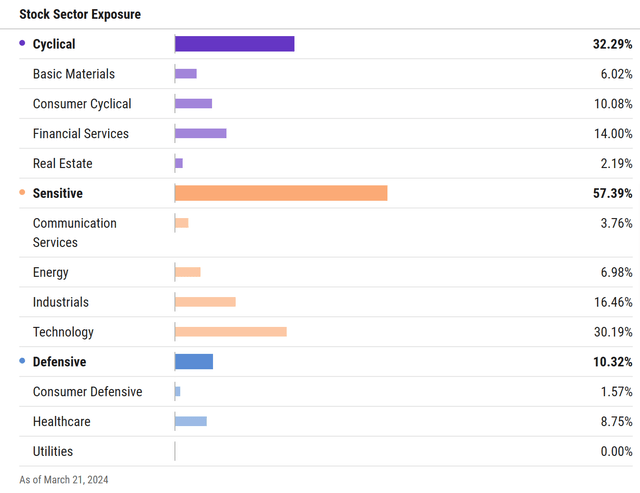

JOET is well-diversified throughout quite a lot of sectors. Its largest publicity is within the Info Know-how sector, accounting for roughly 30.19% of the fund’s portfolio. That is adopted by Industrials (16.46%), Financials (14%), Shopper Cyclical (10.08%), Healthcare (8.75%), and Power (6.98%).

ycharts.com

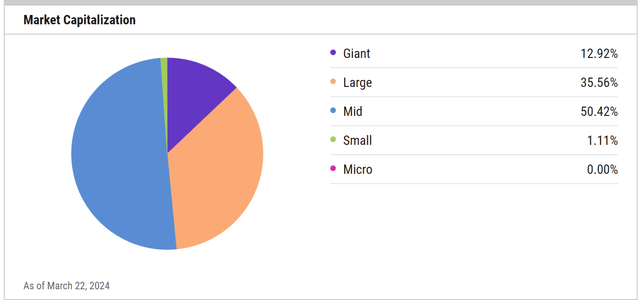

One of many issues I like in regards to the fund is that it is obtained a heavy mid-cap allocation. About half is mid with the remaining being within the large-to-mega-cap vary. Given my total issues round large-cap dominance at this level within the cycle, it is good to have a fund like this which tilts smaller with out essentially taking over the chance of small-cap shares.

ycharts.com

Comparability With Peer ETFs

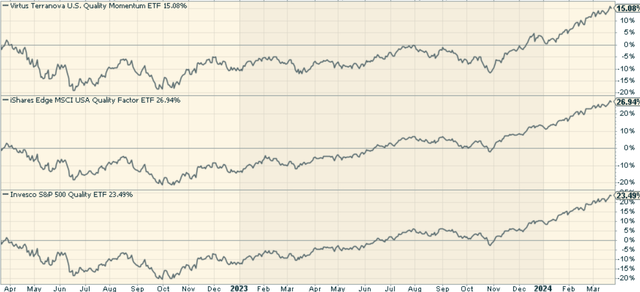

The Virtus Terranova U.S. High quality Momentum ETF (JOET) is distinct from the iShares MSCI USA High quality Issue ETF (QUAL) and the Invesco S&P 500 High quality ETF (SPHQ) in its funding method and methodology. QUAL is designed to trace the MSCI USA High quality Index, focusing solely on high quality issue with out the momentum facet, whereas SPHQ tracks the S&P 500 Excessive High quality Rankings Index, additionally concentrating on high quality metrics of large-cap U.S. shares. Each QUAL and SPHQ are passively managed and try to copy their respective indices carefully.

When it comes to portfolio traits, JOET employs an equal-weighted method at every quarterly index rebalance, which is meant to make sure stability and diversification, and to mitigate the dangers of over-concentration specifically shares or sectors. This may be contrasted with the market cap-weighted methods that sometimes govern passively managed funds like QUAL and SPHQ. Clearly this explains a big portion of why JOET has underperformed QUAL and SPHQ over the previous two years.

stockcharts.com

Professionals and Cons of Investing in JOET

Like every funding, JOET comes with its personal set of benefits and downsides. On the constructive facet, its high quality and momentum-based technique might provide engaging risk-adjusted returns over the lengthy haul. It gives publicity to a various vary of large-cap U.S. corporations with sturdy fundamentals, probably decreasing the chance of over-concentration in a single sector or firm.

Nevertheless, on the draw back, the ETF’s technique is basically technical and retrospective, probably overlooking the significance of idiosyncratic and qualitative threat components. Moreover, the ETF might not be your best option for income-focused traders.

Concluding Ideas: To Make investments or To not Make investments?

The Virtus Terranova U.S. High quality Momentum ETF presents a singular funding technique combining high quality and momentum components. It gives publicity to a diversified portfolio of U.S.-listed large-cap corporations and has demonstrated a stable threat administration method. Nevertheless, like all investments, it comes with its personal set of dangers and issues. I just like the filtering methodology total and the equal weight method, so regardless that efficiency has been underwhelming given the cycle now we have been in, I nonetheless suppose it is value contemplating in a portfolio.