Spencer Platt/Getty Photographs Information

Over the previous few years now, the journey embarked upon by shareholders of business conglomerate Basic Electrical has been fascinating. It has been a bumpy experience and lots of market watchers and buyers believed that the long-term image for the corporate was unfavourable. I used to be one of many few analysts to imagine that shareholders can be rewarded somewhat handsomely by retaining maintain of their shares for a very good portion of the time. I used to be finally rewarded when Basic Electrical spun off its healthcare operations into GE HealthCare Applied sciences (GEHC). Between the run-up scene and the share value of the conglomerate main as much as that time, and the continued upside seen by the businesses following the break up, I made fairly a hefty return.

Finally, I did find yourself promoting my inventory in each corporations. I felt as if upside from that time on can be extra restricted and that there can be higher alternatives available. Sadly, that did result in me lacking out on some somewhat significant further upside. I did not assume, heading into the ultimate leg of the journey, that shares had been low-cost sufficient to warrant additional appreciation. However clearly, I used to be mistaken.

Quick ahead to right now, and we now have lastly accomplished that remaining separation, turning Basic Electrical into GE Aerospace (GE) and spinning off the corporate’s energy and different vitality operations right into a separate agency referred to as GE Vernova LLC (NYSE:GEV).

Given this somewhat vital growth, I figured it could be a clever concept to try GE Vernova with a view to see whether or not now is perhaps a very good time for buyers to purchase in in the event that they have not already or to see if it is sensible to carry onto shares obtained as a part of the spinoff. Based mostly by myself evaluation of the corporate, I might argue that, if one holds lengthy sufficient, GE Vernova may very nicely grow to be a good prospect. Nevertheless, given how shares are presently priced, I might say that there most likely are higher alternatives that may be had right now.

Looking at GE Vernova

On April 2nd of this 12 months, GE Vernova and GE Aerospace started buying and selling as separate publicly traded entities. Technically, GE Aerospace simply assumed the mantle held by Basic Electrical itself. Which means when you had 100 shares of Basic Electrical, you saved these they usually had been primarily renamed as GE Aerospace. In the meantime, for every share of the enterprise that you simply owned, it is best to have obtained 4 shares of the newly unbiased GE Vernova. Within the occasion that you simply ended up proudly owning numerous shares of Basic Electrical that may outcome within the possession of partial shares of GE Vernova, it is best to obtain money in lieu of inventory. Relying in your dealer, it might take a couple of days for every little thing to actually settle into place.

GE Vernova

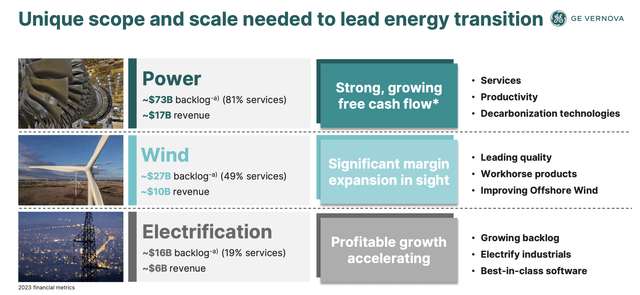

Operationally talking, GE Vernova actually facilities round two major companies beforehand owned by Basic Electrical. The first of those is the ability section of the conglomerate. That is the a part of the corporate that focuses on the manufacturing and set up of gasoline generators and related applied sciences. The aim is to make use of pure gasoline with a view to generate electrical energy. These can be utilized for a wide range of functions, together with transportation and industrial energy. In keeping with administration, the corporate has over 800GW of put in capability. That makes it roughly twice the dimensions of its largest competitor. These operations contact on all kinds of alternatives, together with energy technology via steam, hydropower, and even nuclear.

It additionally occurs to be the biggest a part of the agency, answerable for $17 billion of the $33 billion in income GE Vernova generated in 2023. It accounts for roughly $73 billion of the $116 billion of backlog that the enterprise has. And what’s actually thrilling about that is that roughly 81% of that backlog is within the type of providers. Typically talking, providers convey with them increased margins than tools gross sales due. So to see such a big quantity of income sooner or later coming from these actions is certainly promising.

Sadly, issues haven’t at all times been good for this specific section. For years, the ability portion of Basic Electrical suffered due to elevated prices and trade weak spot. However these days gave the impression to be largely gone. Whereas the section generated $17.4 billion in income final 12 months, administration is forecasting natural progress this 12 months that’s within the mid single digit vary. That needs to be someplace between 4% and 6%, give or take some.

On the underside line, the image can be supposed to enhance somewhat markedly. Final 12 months, the section generated EBITDA of $1.7 billion. However there’s the expectation that the shift in the direction of providers, mixed with increased costs geared toward offsetting inflation and investments which are being made into decarbonization applied sciences ought to lead to a roughly 100 foundation level natural margin enlargement. Assuming income progress for the section of 5%, that ought to translate to roughly $2 billion in EBITDA this 12 months.

GE Vernova

The opposite massive portion of the corporate falls beneath the renewable vitality house, notably the development and sale of wind generators. This is part of the corporate that, regardless of producing round $9.8 billion in income for the corporate, nonetheless struggles from a revenue perspective. A part of this probably stems from the truth that, of the $27 billion in backlog the section brings to the desk, 49% is within the type of providers.

To place this in perspective, final 12 months, the wind operations of the corporate generated unfavourable EBITDA within the quantity of $1 billion. This 12 months, income is predicted to stay kind of flat. Nevertheless, increased volumes within the U.S., notably pertaining to on shore alternatives, ought to push the corporate near being worthwhile once more. Administration appears to imagine that profitability will finally are available 2025 someday.

Whereas the ability and wind operations of GE Vernova are the 2 largest, the corporate can be targeted on the electrification market. The agency’s efforts right here concentrate on a wide range of actions, comparable to grid transmission, grid distribution, grid orchestration, energy conversion and storage, and energy technology and manufacturing. All mixed, this unit was answerable for solely about $6.4 billion in income in 2023.

Sadly, EBITDA was solely round $0.2 billion. However administration forecasts low double digit natural income progress for the operations this 12 months, with mid single digit margins. In the long term, this a part of the corporate affords some significant upside. It’s because administration sees the electrification house increasing from about $75 billion in 2022 to $175 billion in 2030.

If all goes in response to plan, capturing a few of this upside ought to lead to no less than $1 billion of income for the enterprise coming from software program by as quickly as 2025. In fact, this is not the one progress alternative for the agency. The facility operations of the corporate are believed to be price round $110 billion right now. The wind operations, in the meantime, needs to be a market price someplace round $80 billion.

GE Vernova

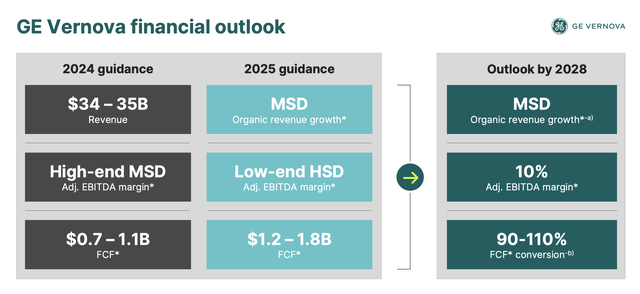

These alternatives ought to enable the corporate to develop its income, organically talking, on the mid single digit fee between now and the tip of 2028. Administration can be forecasting some margin enlargement. Utilizing the numbers administration supplied, mixed with some affordable assumptions of my very own, I calculated that, working money circulate needs to be round $1.7 billion this 12 months, with that quantity rising to $2.3 billion in 2025 and maybe $2.66 billion by 2028. In relation to EBITDA, we are able to anticipate related progress. We’re round $2.76 billion this 12 months, with that quantity probably rising to $4.19 billion by the tip of 2028.

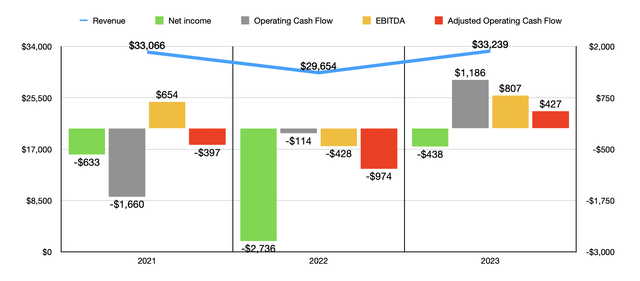

Writer – SEC EDGAR Knowledge

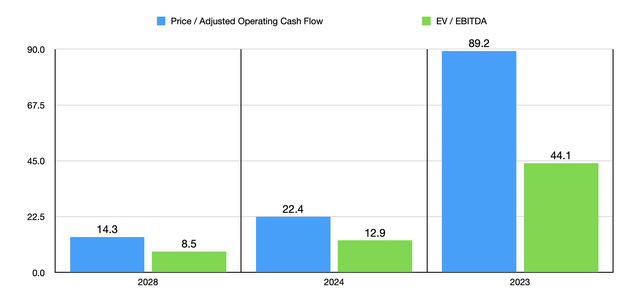

Utilizing the numbers administration supplied, mixed with the historic efficiency of the corporate as proven within the chart above, you possibly can see how shares are priced within the chart under. That is primarily based on the worth to adjusted working money circulate a number of and on the EV to EBITDA a number of. Due to the ache that the wind operations of the enterprise entailed, the buying and selling multiples for 2023 don’t look interesting in anyway. Nevertheless, the image for 2024 does not look terrible.

I undoubtedly would not name this a price alternative. However in some unspecified time in the future, as long as administration can obtain their targets, I feel that image might change. That is as a result of, because the chart reveals, the valuation for 2028 seems to be very interesting. Clearly, in terms of the EV to EBITDA strategy, the enterprise is aided by internet money of $3.47 billion.

Writer – SEC EDGAR Knowledge

Takeaway

To me, it seems to be as if GE Vernova LLC is on target. On a ahead foundation, although, the inventory seems to be to be kind of pretty valued at this time limit. That is not unhealthy, but it surely’s actually not nice for individuals who need further upside.

If administration can obtain their targets over the subsequent few years, the inventory may very well be fairly interesting by the tip of that window of time. However within the meantime, buyers who maintain on to it may very well be lacking out on higher alternatives elsewhere. Due to this, I imagine {that a} “maintain” ranking for GE Vernova LLC inventory is probably the most logical at this time limit. However that would change primarily based on future developments, comparable to the rise or lower of share costs and primarily based on backside line outcomes and expectations.