littleclie

ETF Profile

Traders on the lookout for cost-efficient publicity to a diversified pool of European securities could take into account trying on the Vanguard FTSE Europe ETF (NYSEARCA:VGK). VGK is one thing of a tried-and-tested product, having been round for near twenty years now, and through this time, it has additionally managed to build up essentially the most AUM amongst all its friends, at almost $20bn.

At the moment, VGK covers over 1300 shares from 16 totally different European markets, and it does so at a particularly compelling expense ratio of simply 0.09% (for context, the typical expense ratio for comparable merchandise works out to round 0.97%- Supply: Morningstar). It isn’t simply that; there’s additionally a level of consistency with the portfolio holdings, as exemplified by an inordinately low portfolio turnover price (annual) of simply 4%. Sometimes, most different ETFs see annual turnover charges which can be near 6x VGK’s determine.

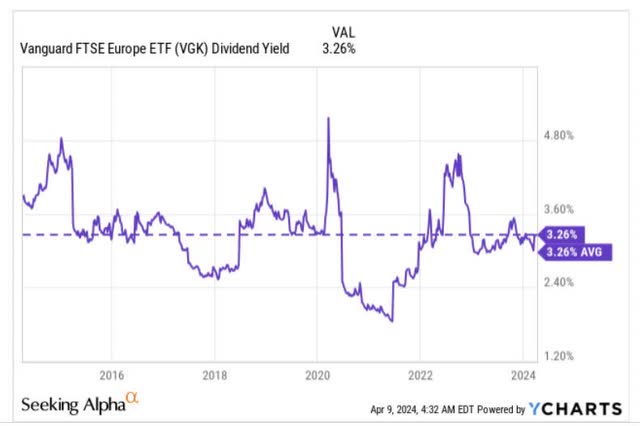

Traders on the lookout for some earnings will not be too disillusioned as VGK has been paying quarterly dividends since 2012 (previous to that distributions used to happen yearly), and at present costs, you possibly can lock in a wholesome yield of over 3.25%, which is curiously, bang in keeping with the ETF’s 10-year common determine.

YCharts

Macro Commentary

Should you’re on the lookout for progress, Europe and VGK aren’t one of the best candidates. The IMF’s quarterly report, encompassing GDP progress forecasts for various areas the world over, already pointed to an unappealing actual GDP progress outlook of simply 0.9% for Europe this yr. That quantity already marks the area because the slowest rising terrain (for context, the globe is poised to develop at 3.1% this yr), however these expectations will possible be dialed down even additional when the IMF comes out with its newest forecast subsequent week. Be aware that the ECB, which was beforehand anticipating 0.8% progress for FY24 in December, just lately compressed its expectations for the yr to 0.6%.

Now VGK’s main geographical publicity is the UK which accounts for near one-fourth of the full holdings, and right here too situations are hardly totally different with anticipated GDP progress of 0.8%.

These underwhelming progress projections also needs to enhance the prospect of price cuts quickly sufficient. Wage pressures look like abating, and within the UK progress of beginning salaries for everlasting workers has now dropped to their lowest stage in three years, offering assist that inflation could possibly be heading nearer to the two% goal, which it’s prone to hit in the summertime.

So far as the ECB is worried, there are unlikely to be any large modifications in price expectations throughout its coverage assembly this week even when inflation seems to be dropping nearer to goal, however in June, prospects of a 25bps minimize look more and more possible. Conversely, within the US, the speed pivot prospects have gotten much less apparent, with final week’s nonfarm payroll readings reiterating the energy within the labor market. It was initially anticipated that the US Fed would pivot earlier than the ECB, however these expectations have now light. If the ECB begins slicing charges earlier than the US Fed, that is not going to mirror properly on the Euro.

This shift to a rate-cutting stance can be going to mirror moderately poorly on the web curiosity earnings (NII) trajectory of European banks who’ve already loved their time within the solar, with the STOXX Europe 600 banks index hitting its highest level in shut to 6 years. (notice that the highest sector publicity of VGK is in the direction of the monetary sector). After delivering 23% NII progress final yr, this yr’s NII progress is anticipated to be flat, adopted by a -3% decline in FY25.

Valuation and Technical Commentary

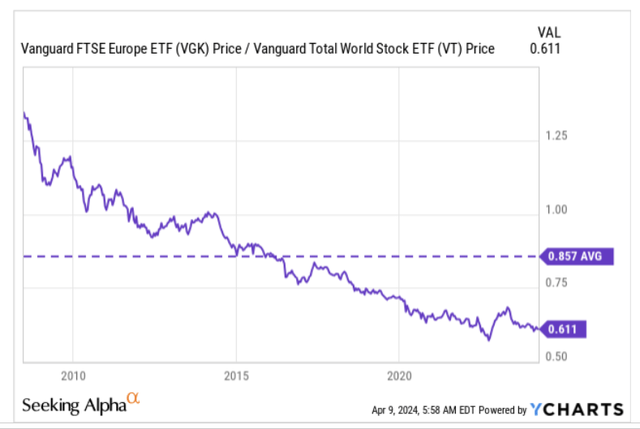

From a valuation angle, VGK appears to be like like fairly a compelling wager. Morningstar knowledge reveals that the ETF may be picked up at a P/E of lower than 13x, which makes it one of many cheaper environments on this planet. For perspective, a portfolio that covers international shares – the Vanguard Complete World Inventory Index Fund ETF Shares (VT) is priced at a premium of roughly 33%.

Graphically, it additionally appears to be like like European shares appear like some of the beaten-down terrains across the globe, and provide good promise as mean-reversion candidates. At the moment, VGK’s relative energy ratio versus VT interprets to a 29% low cost versus its long-term common.

YCharts

Nonetheless, buyers ought to pay attention to the anemic progress prospects and sub-par earnings progress of this area. Morningstar knowledge means that VGK’s 1,300-odd shares will possible solely ship long-term earnings of lower than 8%. In distinction, international shares might see a greater threshold of double-digit earnings progress.

Investing

Lastly, if we assessment VGK’s long-term worth imprints for the reason that GFC period, it is fairly evident that this product has been transferring up over time within the form of an ascending channel. Timing your entries and exits inside this channel has confirmed to be a moderately rewarding technique.

Now, in case you take a look at the place the worth is at the moment perched ($67), and measure the respective distances between the higher and decrease boundaries, we get a moderately unappealing reward-to-risk equation of simply 0.35x. In gentle of this, we do not imagine VGK would make a terrific purchase right here, and would favor to see a pullback nearer to the decrease boundary of its channel, or when the reward-to-risk equation exceeds 1x.