Olemedia

In mid-July 2023, in a In search of Alpha article on the VanEck Uncommon Earth/Strategic Metals ETF (REMX), I wrote:

VanEck Uncommon Earth/Strategic Metals ETF is a fund that may profit from the world’s growing urge for food for uncommon earth and strategic metals and minerals.

In the meantime, as Macrotips Buying and selling identified in a December 2023 In search of Alpha article, REMX’s asset combine was mild on uncommon earths and heavy on lithium. REMX was buying and selling at $88.25 per share in July 2023. At $54.14 per share on April 11, the ETF was 38.7% decrease.

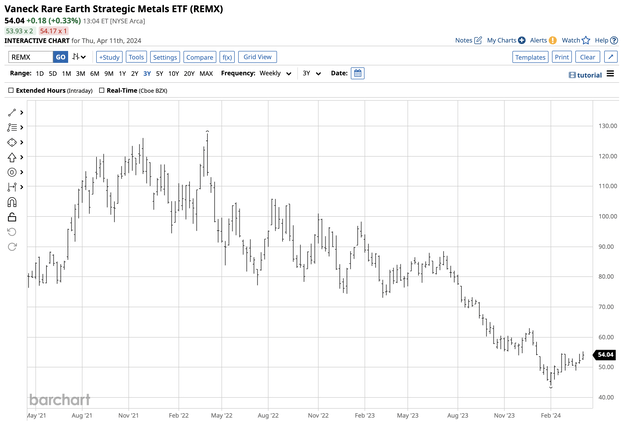

A bearish development within the uncommon metals ETF

Whereas it’s difficult to seek out any inventory market index, many particular person shares, or commodities which have moved decrease since July 2023, the VanEck Uncommon Earth/Strategic Metals ETF has been a lonely member of the bearish membership.

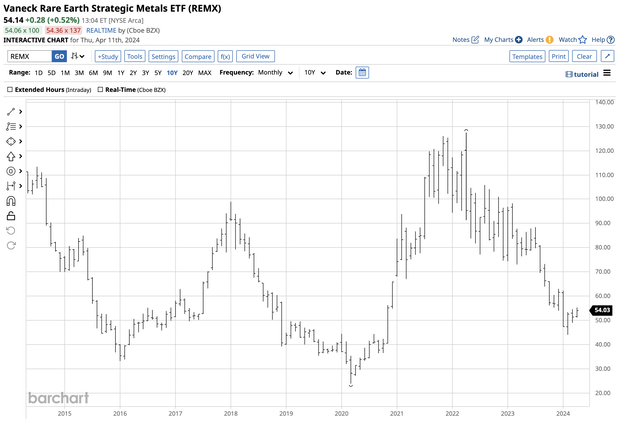

Ten-12 months Chart of the REMX ETF Product (Barchart)

The chart exhibits that REMX fell to a pandemic-inspired $23.91 low in March 2020 earlier than exploding 433.25% to a $127.50 per share excessive in April 2022 when the ETF ran out of upside steam. REMX fell 65.5% to $44.02 in February 2024, and was beneath the $55 stage on April 11. REMX stays in a bearish development, because it has not challenged a decrease excessive over the previous two years.

Weighted in direction of lithium- Costs have dropped

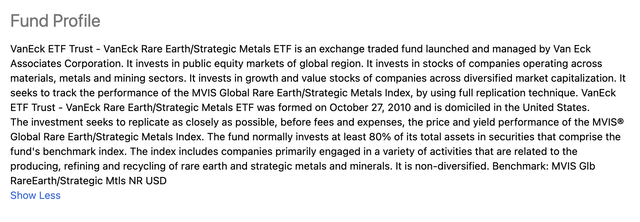

REMX’s fund abstract states:

Fund Profile for the REMX ETF Product (In search of Alpha)

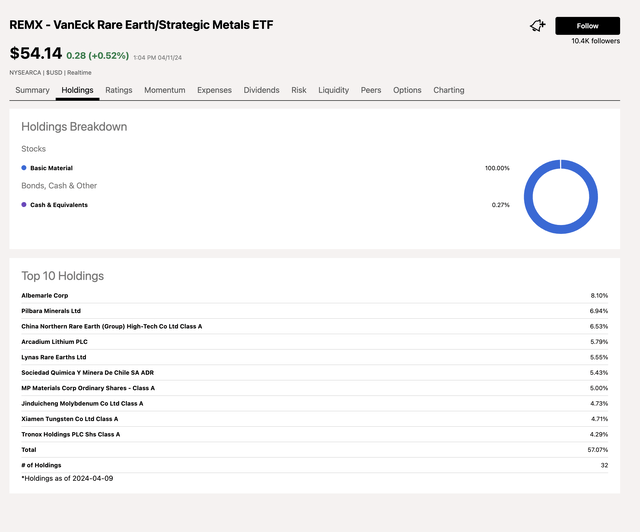

REMX’s high holdings embody:

High Holdings of the REMX ETF Product (In search of Alpha)

Because the chart exhibits, REMX’s holdings are primarily in mining corporations producing lithium, because the ETF tracks the MVIX World Uncommon Earth/Strategic Metals Index. Whereas lithium is a strategic metallic, the uncommon earth holdings are mild. Due to this fact, the ETF’s title is deceptive.

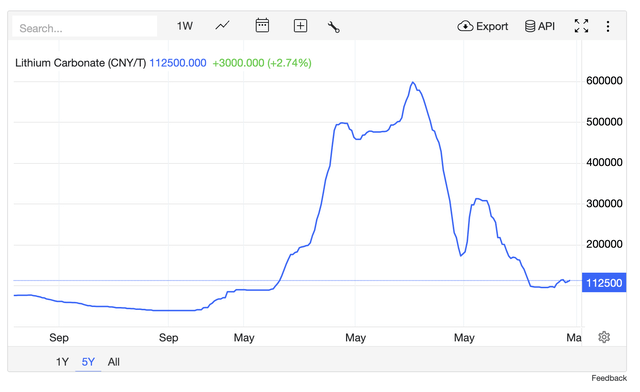

Lithium costs have declined sharply over the previous two years.

Chart of Lithium Costs (Tradingeconomics.com)

The chart highlights the decline in lithium costs because the 2022 excessive. Due to this fact, REMX is extra of a lithium ETF than a uncommon earth metals product. Uncommon earth metals are a set of metallic components on the periodic desk, possessing distinctive magnetic, optical, and catalytic properties. Uncommon earth metals are illiquid commodities, with China accounting for many worldwide manufacturing.

Commodity cyclicality- Lithium costs will possible backside out

Commodities are cyclical property which can be typically extra risky than shares or bonds. Volatility can result in irrational, illogical, and unreasonable costs on the up and drawbacks throughout rallies and declines. Costs are inclined to rise to ranges the place manufacturing will increase, inventories construct, and the demand declines, resulting in tops, as we witnessed within the lithium market in 2022.

Conversely, costs can decline to ranges the place manufacturing slows, inventories decline, and consumption will increase at decrease costs, resulting in vital value bottoms. Lithium is a crucial commodity with major purposes in heat-resistance glass and ceramics, lithium grease lubricants, flux components for iron, metal, and aluminum manufacturing, lithium metallic batteries, and lithium-ion batteries. Rising EV manufacturing elevated the demand for lithium, however the provides swelled to ranges that led to a value peak two years in the past.

Whereas it’s at all times harmful to select bottoms in any market, the slide in lithium costs may very well be a compelling alternative because the U.S. seeks to finish its reliance on Chinese language lithium. One startup government believes “the present bear market is one of the best time to spend money on provide chains.”

REMX may very well be a compelling alternative at beneath $55 per share

Over the previous two years, REMX has made decrease highs and decrease lows.

Three-12 months Chart of the REMX ETF Product (Barchart)

Whereas the technical development stays ugly in April 2024, the technical resistance ranges have been falling with the worth. The primary upside goal is on the late 2023 $62.97 excessive. Above that, the following resistance stage is on the mid-July 2023 $88.48 peak.

On April 11, REMX had property of $353.27 million and was beneath $55 per share. REMX trades a mean of 75,514 shares day by day and expenses a 0.54% administration charge. Because the 2020 lows, REMX has been a extremely risky ETF product, transferring over 5 instances larger in 2022 and greater than halving in worth because the 2022 peak. Volatility can present vital alternatives for merchants and buyers.

Depart loads of room so as to add on additional declines

Figuring out worth within the present inventory market, with the main indices close to document highs, is difficult. Nevertheless, if lithium costs get well over the approaching months and years, REMX may very well be a diamond within the tough.

I’m a scale-down purchaser of REMX beneath the $55 stage, leaving loads of room so as to add on additional declines. Technical help stays considerably beneath the present value stage on the 2020 $23.91 low. Nevertheless, commodity cyclicality might trigger lithium manufacturing to sluggish, inventories to say no, and shopper demand to extend on the present value stage, resulting in a restoration in lithium costs and the REMX ETF, which is known as a lithium ETF.