We Are

Opener

I make investments actively within the inventory marketplace for two main causes. Firstly, and maybe most clearly, I search to beat the market and create wealth over the long run. Secondly, I genuinely get pleasure from selecting shares. I derive satisfaction from estimating my odds, studying about nice companies, and sharing my insights right here.

Certainly, there are quite a few methods to revenue available in the market. Buying and selling, for instance, provides potential returns, albeit with unfavorable odds – although it is not a path I pursue. Traditional worth investing entails shopping for undervalued shares, requiring a eager eye to discern that their present points aren’t vital. This method calls for excessive ability and expertise. Then there’s high quality development investing, or GARP (development at an inexpensive value), which, in my view, is the optimum method for personal traders because of the benefits they possess over giant funds, akin to persistence, freedom to speculate with out restrictions, and an countless time horizon. For my part, worth performs require larger technical expertise that I am undecided each retail investor has. Whenever you purchase a top quality firm, you get rid of enterprise danger to a a lot better extent, in distinction to a worth play the place the enterprise could possibly be poor, however the value is superb.

Whereas my predominant focus lies in high quality GARP investing, I sometimes delve into worth performs, notably in high-quality companies. Right now, I am going to share two GARP alternatives I’ve just lately invested in, however one might describe them as a worth play if they like.

Oddity Tech

That is the biggest holding in my portfolio. I just lately added a big quantity in the course of the drawdowns, which I view as merely background noise for the long-term thesis and alternatives to decrease my common price. My goal is to spend money on long-lasting compounders. I do not essentially must discover a firm that can return 100 instances the cash I invested, however I do wish to discover companies that may compound at the next price than the market over the long run. Nevertheless, Oddity (ODD) is an organization I can see returning ten instances my cash in a decade. To see this firm at a $20 billion valuation in 2034 would not be an unrealistic dream, though very optimistic.

Let me provide you with a brief pitch: Oddity is a founder-led, high-growth enterprise aiming to disrupt the wonder business. Their technique primarily revolves round leveraging expertise, using a differentiated promoting method, and providing high-quality merchandise. At the moment, it has two profitable manufacturers, IL Makiage, and SpoiledChild, with two extra on the way in which. Should you seek for IL Makiage/SpoiledChild on Google and discover the web sites, you may encounter a complete completely different expertise than with different magnificence manufacturers. At Oddity, a lot of the main target is on the tech aspect – promote you the most effective product by means of machine studying and algorithms. You do not simply purchase merchandise blindly; you’ll be able to even attempt before you purchase.

Now, you may say these are simply advertising gimmicks, however the merchandise themselves are fairly good, with nice evaluations on each manufacturers on Trustpilot. You possibly can see it in Oddity’s numbers – the corporate is rising like a weed, and the CEO, Holtzman, is consistently speaking about slowing down development to a 20% annual tempo. What number of firms have you ever heard of making an attempt to gradual development?

Turning to the primary quarter. As we mentioned final 12 months, we intentionally slowed the enterprise down within the again half of 2023 with a purpose to tempo our development, whereas our groups centered on big preparations for 2024.

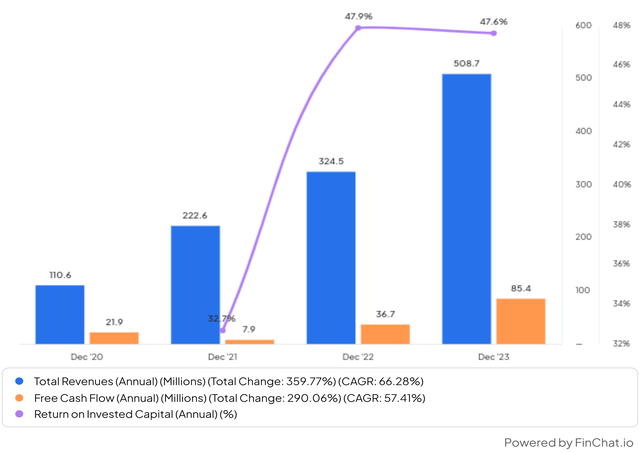

ODD is rising (finchat)

The distinctive half right here is that the corporate is tremendous worthwhile, with a 20% EBITDA margin goal which they’ve exceeded, and a 47% ROIC (!). The mixture of stable top-line development and excessive ROIC is a successful one in lots of instances. The bonus is that Oddity remains to be small, and the wonder market is large. I see plenty of development forward for Oddity, with plenty of income.

Now, guess the valuation – you assume it is in all probability uninvestable with a sky-high valuation, proper? Not fairly. Since Oddity is a small Israeli firm, I assume Individuals aren’t comfy shopping for it with out a huge margin of security, particularly with the latest tensions with Iran that additional dropped the inventory. The actual fact is, as an Israeli, there will likely be no impact on Oddity. The overwhelming majority of gross sales are in North America, and the Israeli employees are within the R&D phase and may make money working from home in case of an enormous conflict right here, plus their places of work are within the comparatively secure Tel Aviv.

Again to valuation, the truth that a affected person investor can now purchase the inventory at 23 instances NTM earnings is absurd to me. Remember the fact that gross sales grew 44% final quarter. If I assume 20% top-line development wanting ahead, which is definitely a lot decrease than the expansion Oddity has introduced, with this NTM PE I get a 1.1 PEG. Sure, it is not the low value we noticed in November, which I nonetheless remorse not figuring out concerning the inventory again then, however in my opinion, it’s low-cost for a enterprise that may develop profitably with an enormous TAM forward.

For my part, there are twin engines right here – a number of growth in addition to earnings development that may final. Only for comparability, it has the bottom a number of amongst friends like L’Oréal, ELF, and Estée Lauder, regardless of rising with the very best ROC and probably the most room for development. Perhaps I sound too bullish, however there are dangers, primarily within the lack of model relevance, shopper style, and competitors.

EV/EBITDA (in search of alpha)

You possibly can additional dig into the corporate within the following article I wrote in January.

Lululemon

Nicely, within the case of Lululemon (LULU), after all, I do not anticipate a 10X return, however I do assume it would outperform over the long run. Right here, it’s cheap to imagine that the market will stabilize after the latest drop because the report, and can perceive that there’s a possibility for dual-engine development, each in multiples and earnings. I consider the market will finally right itself, because it’s the character of Mr. Market to initially punish, then reassess, and doubtlessly right misjudgments. This adjustment may happen inside a month and even six months, but when the enterprise performs nicely, it is sure to occur. When it does, the turnaround may be swift. For example, after the report, Oddity skilled a 12% decline, however inside a number of days, all losses had been recouped as rational traders acknowledged the optimistic facets of the report (this was earlier than the tensions with Iran). I anticipate that quickly the market will acknowledge Lulu’s potential, maybe spurred by a catalyst.

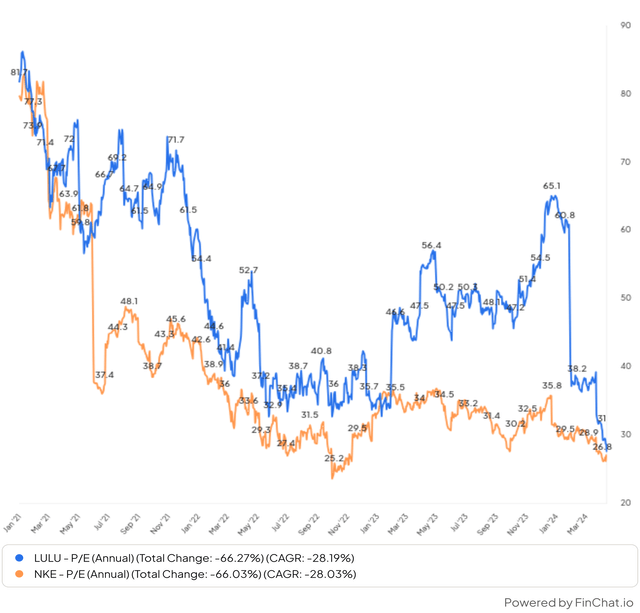

Lululemon is a high-quality firm and a uncommon, long-lasting winner within the vogue area. The market punished it within the final earnings report because the steerage was weak. Nicely, Lulu’s valuation has been stretched for some time now, and the inventory hasn’t climbed for 3 years. Nevertheless, the valuation has been stretched for an excellent purpose. There aren’t plenty of companies on this business which have managed to take care of a powerful model with excessive returns on capital and development for such a very long time, like Lululemon. In fact, the massive mannequin is Nike (NKE), which has a powerful model that doesn’t deteriorate for many years. I believe the market is a bit pessimistic about Lulu’s future. Sure, the expansion in all probability will not be on the 20% CAGR as we have now seen in the previous couple of years. However at a 15% bottom-line CAGR, together with buybacks, it will likely be above market expectations and can seemingly result in a number of growth or a return to its imply.

What are the explanations that would propel such development? Firstly, it’s a premium, super-strong model with loads of development forward. It nonetheless has plenty of untapped markets it might develop into. Israel is an instance. They’ve just one retailer right here, in one of the vital well-known squares in Israel, which can be a manner of promoting. Curiously, the rising competitor, Alo, opened proper subsequent to it.

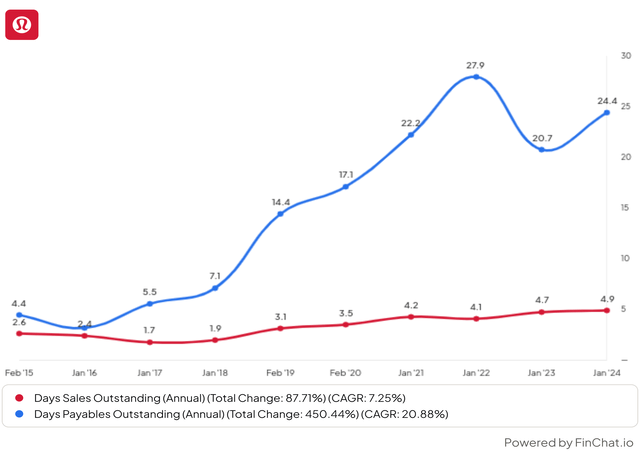

Lulu has a working capital benefit. It has adverse working capital, which signifies that like an excellent retailer, it’s amassing money earlier than paying suppliers, with a DSO of 5 and DPO of greater than 20. It’s a DTC vendor and is doing what Nike has been dreaming of and dealing on for years. It has greater than 40% of income by means of its e-commerce ventures. The vast majority of gross sales come from North America, so there may be plenty of international growth forward. Additionally it is increasing into different markets like males’s put on, mountain climbing, informal put on, and extra.

Damaging WC (finchat)

It’s the super-strong model energy main it ahead, together with premium costs. Premium is the center floor between mass-market manufacturers like Nike and luxurious manufacturers like Dior (OTCPK:LVMHF), and I believe Lululemon is the right model for it. I requested my girlfriend’s pals what they give thought to the model. First, the worth is just too excessive for them, but it surely additionally makes them need it due to the standard and standing image. One in all them moved to the US and acquired a pair. She says it is a standing image, and she or he needed to have it. Alternatively, some women respect Alo Yoga and assume it’s a reliable competitor, whereas some assume Alo has much less premium enchantment than Lululemon.

I believe {that a} TTM PE of 28, which is considerably beneath previous averages, makes Lulu fairly low-cost. Additionally, 23 instances NTM earnings for an organization that’s more likely to develop EPS within the mid-teens space together with greater than a 40% ROIC is certainly cheap, and you will not discover that loads within the American markets. On high of that, Nike is buying and selling at an identical a number of regardless of decrease development, decrease margins, and fewer effectivity.

Lowest a number of in years (finchat)

The primary danger, in my opinion, is the rising competitors. I do not wish to spend money on the attire business as a result of shopper preferences are altering quick, and types may be hit exhausting, as seen with Underneath Armour (UA).

The second danger, in my opinion, is that males in some markets will see the model as extra female. I believe it’s now like that in Israel. Lulu might want to make investments closely in advertising to alter males’s view of the model as a result of proper now, it appears many males see it as a sport-focused girls’s model. Such funding in advertising might have an effect on margins, that are already stretched excessive, and we should not anticipate extra from them.

You possibly can additional delve into my final articles on Lulu, right here and right here.

Conclusions

I consider that the risk-reward ratio right here is tilted in favor of long-term consumers, and at present costs, each shares might outperform the market. Moreover, I would like to emphasise that each shares are potential compounders, which means they could possibly be held for years. Even when they appear costly, these aren’t shares to dump after a double.

There are dangers, in my opinion, and I would not underestimate them. Nevertheless, I believe that affected person traders have an edge with these sorts of shares. Not like huge funds, they will maintain and watch for catalysts, as funds are scrutinized quarterly. Simply sit tight and watch for the compounding impact.

I hope you loved the article and look ahead to your feedback